The high number of new ETF launches is a clear example of the maturity and potential of this segment of the investment industry. According to data published by ETFGI, during the first eight months of the year, 1,192 new products were launched, surpassing the previous record of 1,140 new ETFs listed in the same period of 2021. “The new funds listed resulted in a net increase of 845 products after accounting for 347 closures,” noted ETFGI.

Assets invested in the global ETF industry reached a record $13.99 trillion by the end of August, experiencing 63 consecutive months of net capital inflows, accumulating a record $1.07 trillion in net inflows so far this year. As of the end of August, the global ETF industry had 12,677 products valued at $13.99 trillion, from 774 providers across 81 stock exchanges in 63 countries, according to ETFGI’s August 2024 global ETF industry outlook report.

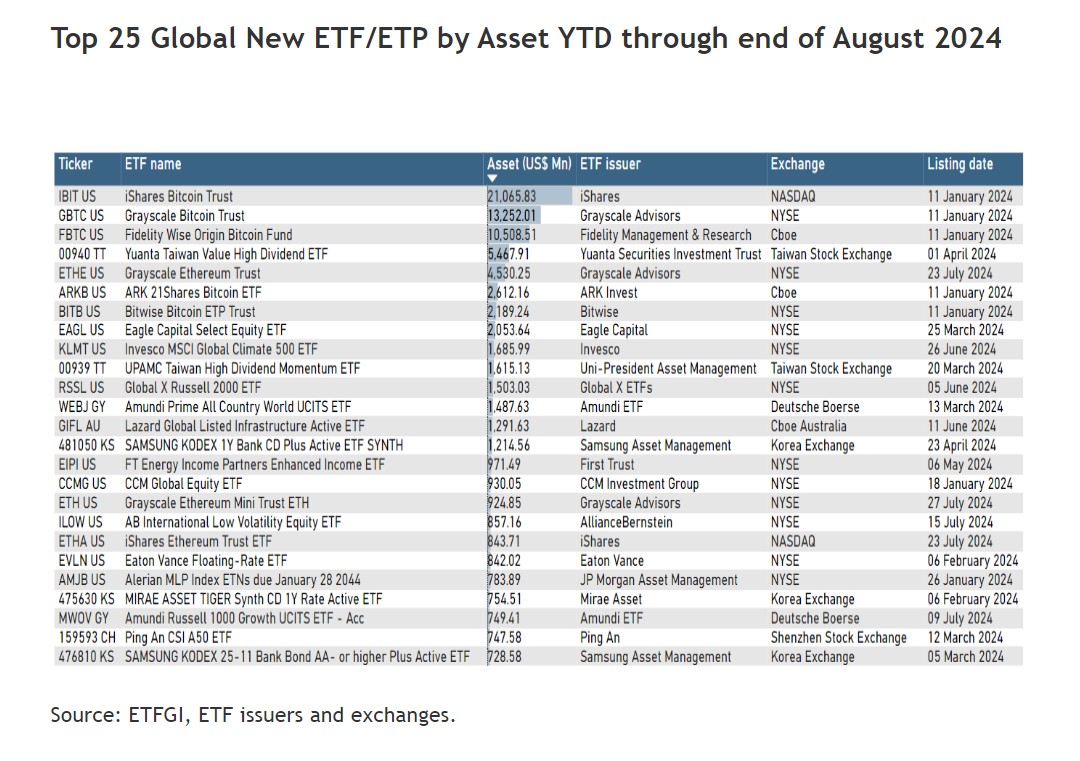

The report explains that until the end of August 2024, the ETF market has seen a notable increase, with a significant accumulation of assets by newly launched ETFs. In this context, the dominance of cryptocurrency ETFs stands out, with the iShares Bitcoin Trust (IBIT US) managing $21.07 billion in assets, followed by the Grayscale Bitcoin Trust (GBTC US) with $13.25 billion and the Fidelity Wise Origin Bitcoin Fund (FBTC US) with $10.51 billion.

“Reflecting the cryptocurrency investment boom since the approval of Bitcoin ETFs in the U.S. in January 2024, the SEC approved Ethereum ETFs for listing in July 2024. The Grayscale Ethereum Trust (ETHE US) reached fifth place in the Top 25 by assets with $4.53 billion, and the Grayscale Ethereum Mini Trust ETH (ETH US) ranked 17th with $924.85 million, both launched by Grayscale Advisors on the New York Stock Exchange (NYSE),” the ETFGI report points out.

In addition to cryptocurrency-focused ETFs, the Top 25 list includes ETFs across various sectors, such as high-dividend ETFs, equity, active, and climate-related ETFs, demonstrating the wide range of investment opportunities available to investors today.

The United States reported the highest number of closures with 115, followed by Asia-Pacific (excluding Japan) with 96, and Europe with 66. The 1,192 new products are managed by 299 different providers, distributed across 38 stock exchanges globally. iShares listed the largest number of new products, with 58, followed by Global X ETFs with 45 new launches, and First Trust and Innovator ETFs with 31 each.

From January to August

When reviewing the cumulative data for the first 8 months of the year from 2020 to 2024, the global ETF industry has experienced a significant increase in new launches, rising from 657 to 1,192. In 2024, the United States and Asia-Pacific (excluding Japan) registered the highest launches, reaching 403 and 390, respectively, while Latin America saw the fewest launches, with only 10.

“The United States, Asia-Pacific (excluding Japan), Canada, and Japan have reached their peak launches in 2024, with 403, 390, 136, and 32, respectively. Europe saw its highest number of launches in 2021, with 290; Latin America recorded 26 launches in 2021, while the Middle East and Africa reached 59 in 2021,” ETFGI reports.

However, the number of product closures accumulated by the end of August decreased across all regions compared to the same period in 2023. In 2024, the United States and Asia-Pacific (excluding Japan) registered the highest number of closures, with 115 and 96, respectively, while Latin America had the fewest, with only 2 closures. “Compared to the last five years of closures, the United States recorded its highest number of closures in 2020, with 174, while Europe had its highest number of closures with 108 in 2020. Asia-Pacific (excluding Japan) registered 116 closures in 2023, and Canada reported 52 in 2023,” the report concludes.