High yield bonds: An unprecedented contraction

| By Cecilia Prieto | 0 Comentarios

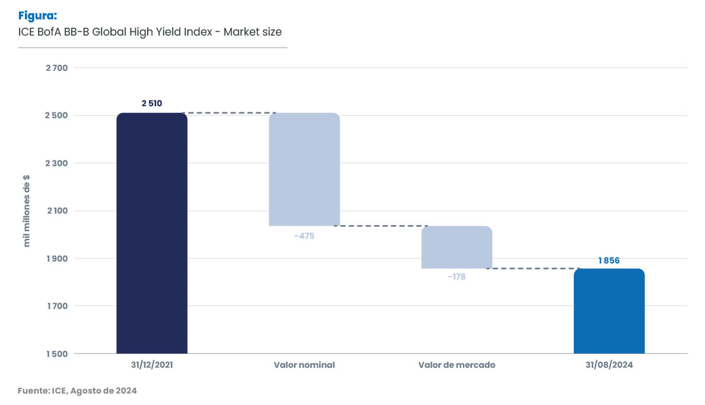

Since the end of 2021, the high yield bond markets have weathered an unprecedented storm. The sudden change in the interest rate regime left its mark, and the ICE BofA BB-B Global High Yield Index saw its value plummet by $654 billion, reducing its size by more than a quarter, from $2,510 billion to $1,856 billion[1].

Why such a contraction? There are three main factors that explain this earthquake in the high yield space.

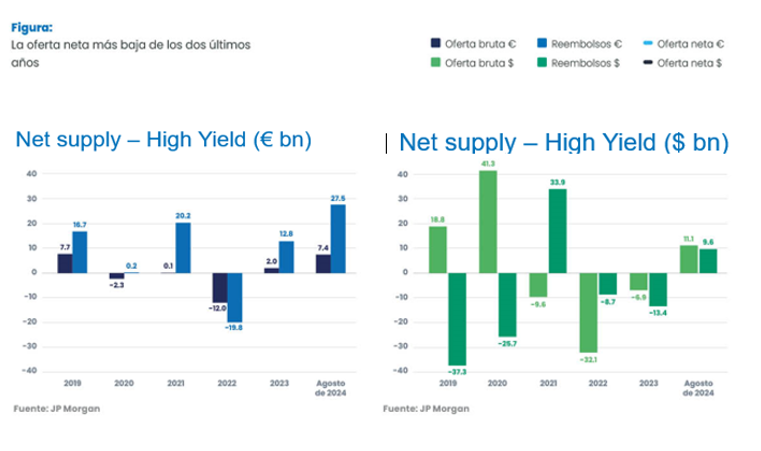

Firstly, rising interest rates have prompted many companies to reduce their debt levels, preferring to focus on stability rather than expansion through mergers and acquisitions or share buy-backs. This caution has led to a reduction in the supply of new bonds.

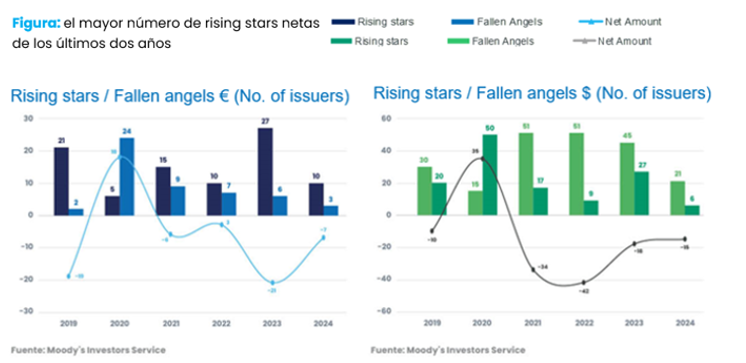

Secondly, the best-rated companies in the high yield segment have sought to improve their ratings in order to move into the investment-grade category and thus benefit from more advantageous debt costs.

Thirdly, rate hikes have increased default rates, as some indebted companies are no longer viable in the current environment.

Looking ahead, we expect this trend to continue, albeit at a slower pace. Businesses, though less inclined to take on debt, are beginning to adopt behaviors that could generate a positive net credit supply. However, private debt, offering higher rates, is increasingly competing with high yield bonds, exacerbating the scarcity of supply. In Europe, some companies shine like “rising stars”, but in the United States, opportunities are more limited, requiring greater selectivity. Default rates are likely to remain high, as companies face higher refinancing costs.

How can investors navigate this tumultuous environment? We recommend three rules:

- Focus on fundamentals: in an uncertain macroeconomic environment, it’s crucial to stay focused on fundamentals and prepare for greater dispersion.

- Move from beta to alpha: as credit spreads tighten, now is the time to focus on active, alpha-seeking strategies, rather than passive ones.

- Favoring a global approach: in a contracting market, investors should broaden their investment universe and favor a global approach, enabling greater diversification and more opportunities.

Candriam Bonds Global High Yield: Our tailor-made solution

Our fund, Candriam Bonds Global High Yield, is designed to exploit the unique opportunities offered by high yield bonds. Through sector and maturity diversification, this fund aims to outperform investment grade bonds. Faced with higher default rates, the expertise of our dedicated team of analysts is essential to navigate this complex market.

Our strategy is based on three pillars:

- Global vision: we cover the two largest markets (USA and Europe) and a wide range of instruments (high yield, investment grade, fixed and floating rate bonds, derivatives).

- Active management: our positions are actively managed, with strong convictions based on in-depth fundamental, legal and quantitative analysis.

- Prudent risk management: we apply rigorous risk management, closely monitoring liquidity, sovereign, extreme, volatility and credit risks. We also use asymmetrical products, such as options, to hedge our positions.

Our selection of issuers is based on rigorous fundamental research incorporating ESG factors. Each issuer receives an internal credit rating, enabling us to assess its creditworthiness and default risk, with particular attention paid to extra-financial criteria.

We go beyond traditional investor boundaries by exploring opportunities between the investment grade and high yield segments. This flexibility enables us to dynamically adjust the overall duration of our portfolio to suit different market conditions.

In times of uncertainty, our in-house legal expertise and understanding of the intricacies of contractual provisions are essential to managing risk. The important thing is not to take any ill-considered risks. The result of our risk approach is a zero default rate.

The world is increasingly dominated by key trends, such as digitalization, bipolarization and decarbonization, which are profoundly transforming economic relationships and are likely to significantly disrupt financial markets. Combined with the interventions of central banks that may be pursuing policies counter to the fiscal policies of governments, these trends are a source of concern for investors and are creating volatility in the money and bond markets.

In such a context, outperformance will depend on diversification, selectivity and active management to maintain a controlled and calibrated investment risk . We remain focused on finding promising opportunities, supported by rigorous fundamental research that integrates ESG factors. The harmonious collaboration between our portfolio managers, ESG analysts and credit analysts has been key to our success in managing high yield bond strategies over the past twenty years.

Opinion article by Nicolas Jullien,Head of High Yield & Credit Arbitrage at Candriam.

[1] Source: Bloomberg©, ICEBofA BB-B Global High Yield (HW40) index in USD. Data compared between the end of 2021 and August 2024, at market value.