Goldman Sachs Strengthens Its Bet on Active ETFs With the Acquisition of Innovator Capital Management

| By Amaya Uriarte | 0 Comentarios

The Goldman Sachs Group has signed an agreement to acquire Innovator Capital Management (Innovator), an ETF firm currently managing $28 billion in assets under management and specializing in income, targeted buffer, and growth strategies. According to the firm, the transaction will significantly expand Goldman Sachs Asset Management’s (Goldman Sachs AM) ETF range and future product roadmap, while strengthening its offering in one of the fastest-growing categories of active ETFs.

“Active ETFs are dynamic, transformative, and have been one of the fastest-growing segments in today’s public market investing landscape. With the acquisition of Innovator, Goldman Sachs will broaden access to modern, best-in-class investment products for investor portfolios. Innovator’s reputation for innovation and leadership in defined outcome solutions complements our mission to enhance the client experience with sophisticated strategies aimed at delivering specific, defined outcomes for investors,” said David Solomon, Chairman and CEO of Goldman Sachs.

For Bruce Bond, CEO of Innovator, this transaction marks a key milestone for the business. “Goldman Sachs has a long history of identifying emerging trends and significant directional shifts within the asset management industry. We are excited to bring top-tier investment solutions to clients within the ETF space and to expand our business in this leading, high-growth, and strategically important category. These synergies, among many others, make Goldman Sachs an ideal partner for us,” said Bond.

Defined Outcome Strategies

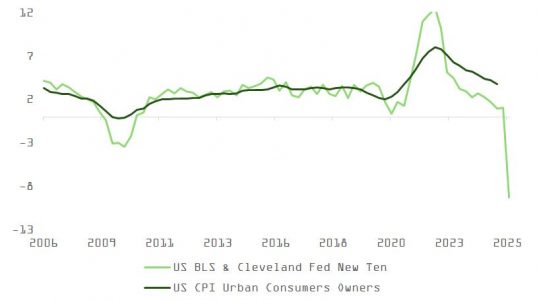

Global assets under management in active ETFs have reached $1.6 trillion, growing at a compound annual growth rate (CAGR) of 47% since 2020, as investors increasingly access public markets through the ETF wrapper.

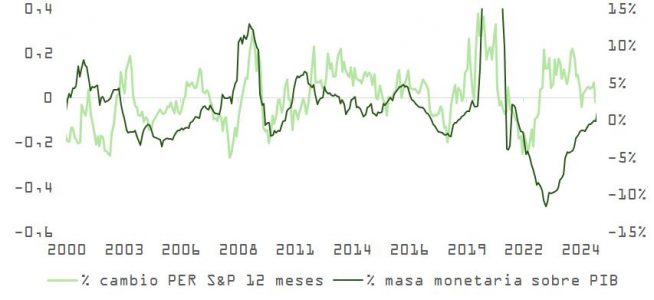

According to the firm, defined outcome ETFs — which have grown at a CAGR of 66% since 2020 — are a key component of the fast-growing active ETF market, driven by the goal of offering innovative structured strategies in accessible formats. Based on their experience, investors are increasingly using defined outcome ETFs to incorporate a broad and customizable range of objectives into their portfolios that address their risk management and return needs.

Defined outcome ETFs use derivatives and options-based strategies aimed at delivering specific objectives, such as downside protection, enhanced returns, and predefined outcomes when held for the full outcome period, enabling investors to build and customize portfolios through the ETF’s tax-efficient wrapper.

The Transaction

As of September 30, 2025, Goldman Sachs Asset Management and Innovator manage over 215 ETF strategies globally, representing more than $75 billion in total assets, placing Goldman Sachs AM among the top ten providers of active ETFs. According to the firm, the acquisition is part of Goldman Sachs AM’s broader strategy to grow its leadership in innovative and expanding investment categories, and to deliver compelling investment performance and service to clients. The firm offers sophisticated strategies to investors as an industry leader in direct indexing and separately managed accounts, as well as through access to alternative investment strategies via its evergreen G-Series funds and active ETFs.

Following the transaction, Bruce Bond, co-founder and CEO of Innovator; John Southard, co-founder and President; Graham Day, Executive Vice President and Chief Investment Officer (CIO); and Trevor Terrell, Senior Vice President and Head of Distribution, will join Goldman Sachs AM. Additionally, more than 60 Innovator employees are expected to join Goldman Sachs Asset Management’s Third-Party Wealth (TPW) and ETF teams. The business will be wholly owned by Goldman Sachs AM, and investment managers and service providers will remain unchanged.

The firm emphasizes that this acquisition strategically expands its more stable revenue base and reinforces its commitment to providing institutional and individual investors with comprehensive solutions. The transaction is expected to be valued at approximately $2 billion, payable in a combination of cash and stock, subject to the achievement of certain performance targets. The deal is anticipated to close in the second quarter of 2026, subject to regulatory approval and customary closing conditions.