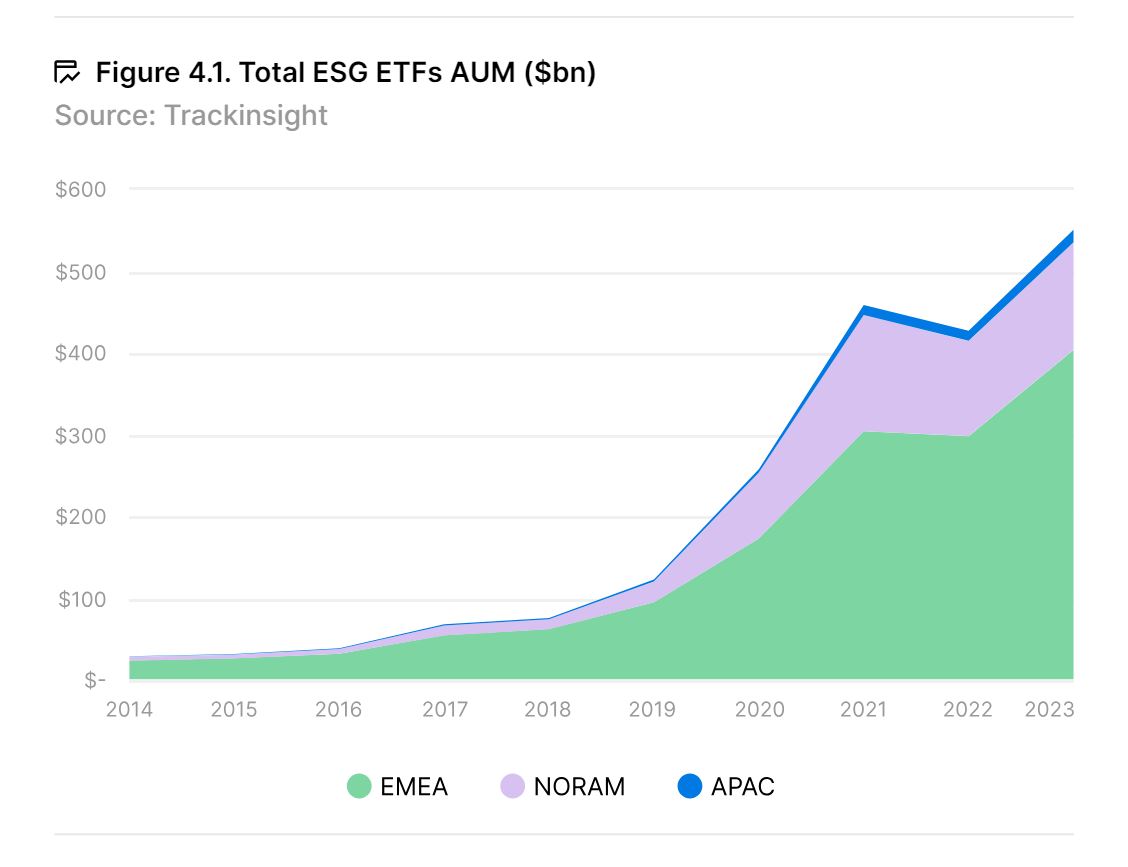

Sustainable ETFs have experienced extraordinary growth, reaching $550 billion in assets under management by the end of 2023, according to a report published by State Street and JP Morgan AM, which outlines the key trends in the passive management industry. One of the main conclusions of this document is the significant disparity between the situation and evolution of ESG ETFs on both sides of the Atlantic.

The report explains that ESG ETFs have undergone substantial development over the past decade. The most pronounced increase occurred during the pandemic years, 2020 and 2021, when assets under management grew by $335 billion, a 275% increase compared to 2019. “The COVID-19 pandemic greatly accelerated ESG investment, highlighting the importance of addressing global challenges such as pandemics, climate change, and biodiversity loss. This period emphasized the need for a more comprehensive investment strategy that integrates traditional financial analysis with a broader consideration of a company’s social and environmental impact,” the report explains.

Europe Reigns Supreme

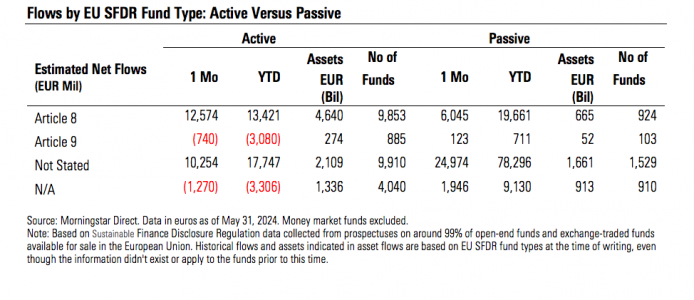

The growth and development of this segment of the industry have been uneven on both sides of the Atlantic. According to the report, European investors have consistently led the adoption of ESG ETFs, driven by strong legislative frameworks such as the SFDR (Sustainable Finance Disclosure Regulation) and a deeply ingrained cultural emphasis on sustainability.

As of 2023, the region maintains a dominant advantage, representing nearly three-quarters of the global ESG ETF market, with assets totaling $402 billion. While North America has slightly lagged behind Europe in the growth of ESG ETF assets, it has still maintained a strong presence, with total assets currently at $131 billion, just $10 billion less than its peak in 2021. The report indicates that this trend was supported by an increase in U.S. corporations adopting ESG standards and favorable changes in U.S. government policies, making ESG funds more attractive to retirement plans.

The Asia-Pacific region, while considerably smaller in scale compared to Europe and North America, has shown notable growth. From a modest start with $385 million in ESG ETF assets in 2014, the region expanded its portfolio to $15 billion by 2023.

According to the report’s data, from 2014 to 2023, the number of ESG ETFs globally skyrocketed from 148 to 1,826, highlighting a shift towards sustainable investment. “The EMEA region led this growth, with ESG ETFs expanding from 107 to 1,281, demonstrating a strong commitment to ESG principles. North American ESG ETFs grew from 34 to 430, reflecting an increasing interest in sustainable investment, although at a slower pace than in EMEA. The APAC region, starting from a smaller base, saw a steady increase from 7 to 115 ESG ETFs. The recent trend in ESG ETF launches, especially in North America, is quite distinctive. Despite a general slowdown in new ESG ETF introductions in 2023, the sharp decline in North America is particularly noteworthy,” the report adds.

After a period of robust growth culminating in 115 new funds in 2021, North America experienced a sharp decline to just 13 new launches in 2023. This drop starkly contrasts with the previously buoyant trend and reflects broader shifts in investment priorities.

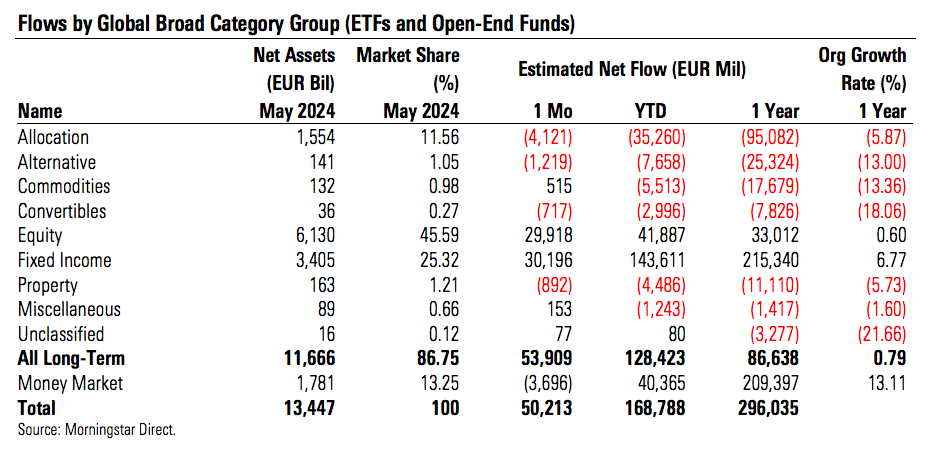

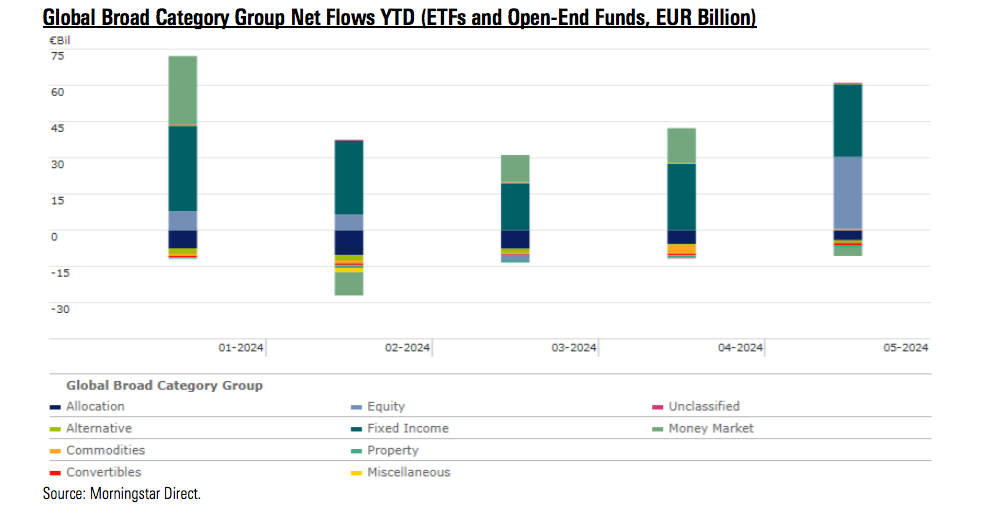

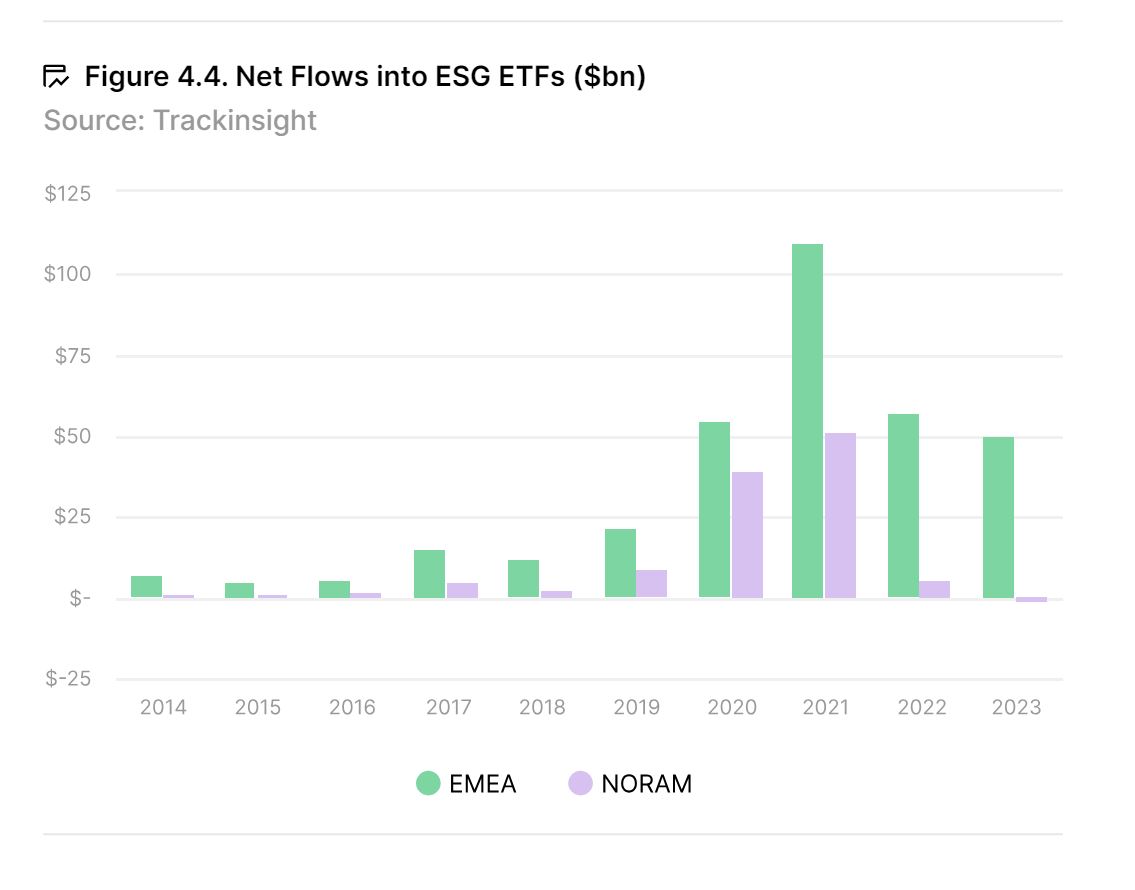

Flows Tell the Full Story

The full stance of North American (NORAM) investors on ESG, as the study shows, is clearly illustrated through ETF flow trends, highlighting a significant move away from ESG investments in the region. “In 2020, global net flows into ESG ETFs soared to $93 billion, reaching a peak of $165 billion in 2021. During this peak, the EMEA region contributed an impressive $109 billion in net flows, representing 65% of the total, while NORAM also saw a significant increase with approximately $51 billion,” the report indicates.

However, this upward trajectory in North America changed notably in the following years. By 2023, net flows in this region not only decreased but also turned negative. The report explains that this sharply contrasts with the steady growth in EMEA, which recorded nearly $50 billion in net flows during the same period. “This shift dispels the previous assumption that North America was rapidly scaling and poised to surpass Europe in the ESG ETF space. Current trends, according to the report, point to a reevaluation of NORAM investors’ strategies towards ESG investments, particularly in the United States,” the document states.

A key conclusion is that the decline in ESG investment, particularly in the U.S. in recent years, can be attributed to several factors, with a significant one being the rise in anti-ESG legislation driven mainly by political changes. This trend began gaining momentum in 2021 and reached new levels in 2023, with over 150 anti-ESG bills and resolutions introduced in 37 states. Although many of these proposals were rejected or stalled, by December 2023, at least 40 anti-ESG laws had been passed in 18 states, according to Harvard Law School. Conservative factions have also initiated boycotts against brands they consider overly progressive, resulting in considerable opposition to such brands and the ESG initiatives they support.

Investor dissatisfaction is another important factor in the declining interest in ESG initiatives. There is a growing preference for strategies that emphasize financial returns and a profit-centric approach, leading to less focus on social causes that do not produce immediate economic benefits.

According to the report, as a result of these dynamics, companies, including ETF issuers, have started to downplay ESG discussions, leading to a decrease in the promotion of related products and a subsequent decline in net flows into ESG ETFs compared to previous years. This divergence in investment philosophy has allowed ETF issuers to introduce Anti-ESG funds, which have seen increased interest over the past year. These Anti-ESG funds emphasize a more traditional profit-focused approach, attracting investors who prioritize financial returns over broader ESG goals.

While Europe, according to the report, exhibits a less polarized approach to ESG investment and has largely set a global example in ESG adoption, the past few years have seen a slight slowdown compared to the momentum of 2020 and 2021. Despite significant investment flows in 2022 and 2023, European interest in ESG has somewhat waned due to economic uncertainties, high interest rates, inflation, and geopolitical tensions, which may have led investors to shift towards other investments.

Moreover, the underperformance of certain ESG strategies, particularly in thematic areas like renewable energy, affected by rising financing costs, material inflation, and supply chain disruptions, among other factors, has played a role in fostering this cautious sentiment. Additional concerns about greenwashing and evolving regulations, covering issues such as fund reclassification and SFDR implementation, have created uncertainty for ESG investors, potentially causing them to temporarily pause investments until greater clarity emerges.

The Active Approach

The analysis of NORAM’s negative net flows in 2023 reveals a distinctive pattern: $6.6 billion in outflows predominantly came from passive funds, while active ESG ETFs were in demand, attracting $5.3 billion in new capital. This shift indicates a growing preference for active management in ESG investment. Investors, according to the study, appear to be moving towards strategies that offer greater flexibility and alignment with their specific investment goals, diverging from the constraints often associated with passive funds. For some investors, active ESG investment could offer a more dynamic approach, allowing them to have a potentially greater social impact and more direct influence over corporate behavior through activism.

According to the report, this involves deep analysis and engagement with companies in the form of activism, although it typically carries higher fees than passive strategies. By the end of 2023, the proportion of actively managed ETFs within the total AUM of ESG ETFs in NORAM had significantly increased to 13%, compared to just 3% in 2018. This notable growth underscores a substantial shift in investor preference towards active management in the ESG space over the past five years.

In Europe, passive ESG ETFs remain the predominant choice for investors, holding a significant 94% share of total ESG ETF assets. They also maintain a dominant position in terms of annual net flows. This trend persists despite a general decline in inflows into ESG ETFs on the continent that leads in ESG.

The acronym ESG stands for environmental, social, and corporate governance, introduced by the United Nations in the 2004 document titled “Who Cares Wins.” This document marked a crucial moment, advocating for the integration of these critical factors into financial analysis and decision-making. Over the subsequent 19 years, ESG has transformed from a niche concept into a central element of corporate strategy, permeating every sector of the industry, including financial instruments like ETFs.