Flexibility, Costs, and Above All, Innovation: The Weapons of ETFs to Gain Weight in Portfolios

| By Amaya Uriarte | 0 Comentarios

The advance of the ETF industry seems unstoppable. Increasingly, these products are detaching from the traditional conception of passive investment and are being considered management instruments with growing weight due to their efficiency. The question is whether, as an investment vehicle and thanks to their constant innovations and evolutions – including actively managed ETFs – they will ultimately displace traditional mutual funds in portfolios.

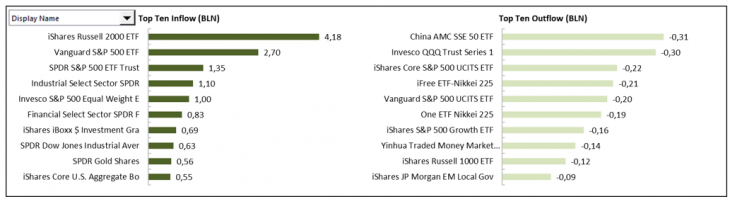

At the recent IMPower Incorporating Fund Forum held in Monte Carlo (Monaco), several experts shared their perspectives and participated in a debate analyzing the growth of ETFs and their potential and innovations. During a breakfast at the forum, Deborah Fuhr, Managing Partner and Co-founder of ETFGI, highlighted the multiple benefits of ETFs and their broad asset coverage, which has led them to reach record assets close to $13 trillion. Therefore, it is an industry to watch closely, analyzing its evolutions and opportunities.

Their acceleration has been enormous, partly supported by their flexibility and their advancement beyond pure passive investment: “They can also be active instruments. We have realized that ETFs are a very useful, extremely transparent, and flexible wrapper. Since their inception, ETFs have evolved from a market-capitalization-based vehicle to a very flexible one, and that is one of the reasons for their explosion. And, from a distribution standpoint, it is also seen much more simply than 10 years ago,” added Howie Li, Global Head and ETFs LGIM.

The Retail Investor’s Bet

“The ETF is a very transparent and efficient vehicle, ideal for making investment decisions and accessing different trends (AI, megatrends, sustainability, digital assets…), which explains its growth and adoption first by institutional investors and now by retail investors,” said Marie Dzanis, Former CEO, EMEA, Veteran CEO.

In fact, this is one of the major changes explaining their success: the adoption by retail investors, especially in the U.S., also due to the tax benefits in the country, but it is also happening in Europe, particularly in markets like Germany or the United Kingdom. “Retail investors are used to buying individual stocks, and that buying experience can extend to the purchase of a fund, which attracts the retail sector,” added Li.

Innovation and Actively Managed ETFs

This growing appetite has also led firms to move into a space they were not in a few years ago. “Many firms are entering the ETF industry, and one way to do this is by converting mutual funds into ETFs with index structures,” recalled Fuhr.

The development of proprietary indices to follow, or new active management structures based on indices, within an ETF wrapper – more transparent and cost-effective – is driving the ETF industry’s growth to unprecedented levels and reviving the debate not just between active and passive investment but about the best instrument for portfolios.

“The debate has gone beyond active versus passive management and is now focused on ETFs versus other investment vehicles,” said Philippe Uzan, Deputy CEO – CIO Asset Management at iM Global Partner.

“I would separate ETFs from the active vs. passive investment debate: ETFs are the result of industry innovation, the most efficient instrument for investing, for institutional and individual investors. If I have to choose between active or passive investment, it will all depend on the market context,” said Mussie Kidane, CIO, North America Advisors at Pictet.

The expert went further, noting that “in the United States, actively managed ETFs are leading market innovation and development, offering immediacy, transparency, and tax advantages. A traditional fund investor has to pay, but ETFs offer near-zero fees, and this is changing the industry’s playing field.” In his view, traditional funds represent a “dying industry in the U.S. while many investments are being built in ETF format” due to their efficiency. The expert argued that when there is a highly efficient instrument, supported by innovation, it can “kill” other instruments: “The amount of innovation happening in the U.S. in the world of ETFs is incredible,” he continued.

Controversial statements not all experts agreed with, especially professionals working on the European side: “I agree that ETFs have advantages in the U.S. that do not exist in Europe, but if they arrive, they could be a preferred instrument,” said Uzan. However, in his opinion, “the fund industry is changing, not dying. Those who do not change are the ones who die,” he defended.

Sustainability and Crypto

Debates at the forum also touched on ETFs as a way to access sustainable investments: “The issue of sustainability is stronger in Europe than in the U.S., but it cannot be denied. We have moved from an exclusion perspective to looking at companies’ behavior metrics and seeking ESG leaders, but in recent months, the focus has been on how this will work from a transition perspective, and the industry has realized it will take years and that the role of traditional companies cannot be denied. It will be acknowledged, and sustainable solutions will evolve,” commented Li.

Another significant innovation in this industry is ETFs that provide access to digital assets and cryptocurrencies through “solid and regulated structures.” Experts recalled that the launch of the first spot bitcoin ETF was the most successful in history.

Fixed Income Catch-up

The innovation in the ETF world is undeniable, but there are also advances regarding traditional assets: Tim Edwards, Managing Director and Global Head of Index Investment Strategy at S&P Dow Jones Indices (S&P DJI), provided a statistic: the majority of indexed funds are still in the equity space, and the total amount of equity worldwide invested through indices is about 20%, compared to 2% for fixed income. However, fixed income indexed vehicles are growing faster, he noted.

Uzan highlighted the difficulties managers have in beating the indices and yet defended that “fixed income is still a great territory for active management.” In his opinion, one of the keys for active managers is not to stick to or restrict themselves to a single investment category but to look at the entire investment universe. For other experts, vehicles that replicate indices have value in the most liquid areas of the asset, such as government or investment-grade corporate debt, while active management can apply to other segments of this market.

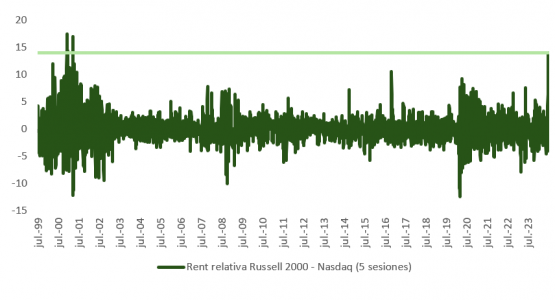

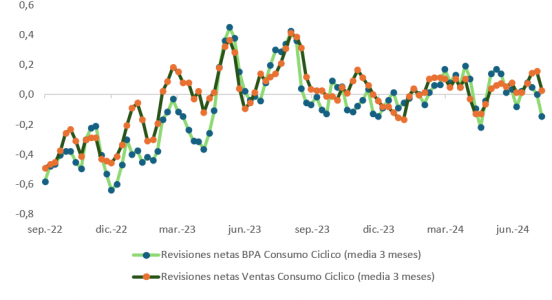

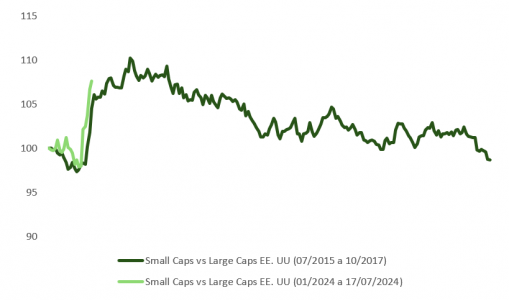

drive up inflation and benefit domestic demand (small caps), but it will eventually be a deflationary measure.

drive up inflation and benefit domestic demand (small caps), but it will eventually be a deflationary measure.