HSBC AM Advocates Real Diversification Amid Economic Fragmentation and Active Fiscal Policies

| By Amaya Uriarte | 0 Comentarios

In the opinion of Sefian Kasem, Global Head of ETF & Indexing Investment Specialists at HSBC AM, and paraphrasing William Shakespeare, the key to the outlook for the second half of the year lies in “cuts or no cuts (interest rates), that is the question.”

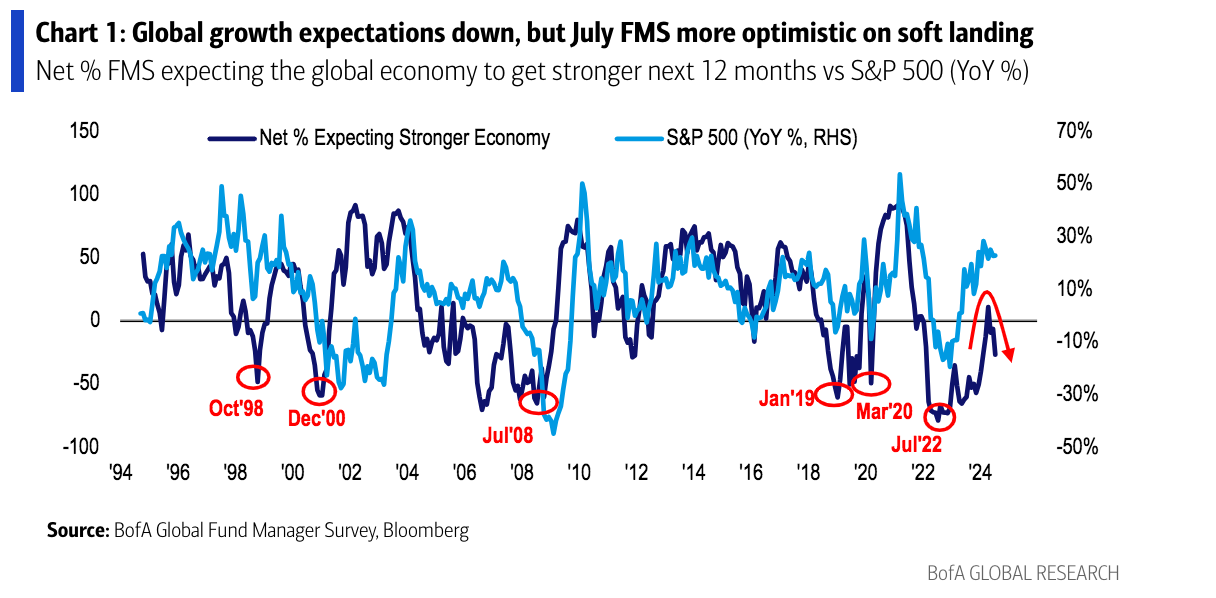

He explains, “Interest rate outlooks have changed significantly, especially concerning the U.S., and there is a greater consensus that they will be higher over the next 10 years; which creates a very different context from the last decade.” Additionally, he believes that the next six months should be approached with a clear change in mindset: “In 2023, we talked about a hard landing, but in 2024 we are already talking about a soft landing.”

This leads to his first reflection: we are facing a more fragmented environment in terms of monetary policy and geopolitics. For Kasem, although these two ideas—higher rates and greater fragmentation—will be present over the next ten years, they carry significant weight in the short term.

The HSBC AM head points out that the expectation has shifted from seven rate cuts to just two in the U.S. for this year. “Estimates of a more aggressive policy by banks continue. Their main driver will be inflation expectations, which is the primary element that monetary institutions are weighing to make monetary policy decisions,” he states.

According to his analysis, central banks in developed markets have been very focused on supporting the economic growth of their countries, but he believes it is better to use fiscal policy for that purpose. “Many of these countries will have to make decisions about their fiscal policy objectives and not rely as much on the measures we saw during the pandemic crisis to support the economies. Of course, they will have to do this in a context where inflation has moderated but is still high,” he adds.

Regarding the second fragmentation, geopolitics, Kasem warns that certain issues have gained relevance, such as infrastructure security and the resilience of supply chains. “Again, everything is connected. Greater attention will be paid to what is done with the economy and how fiscal policies are used because we are moving toward a more fragmented geopolitical environment,” he reiterates.

Implications for the Portfolio

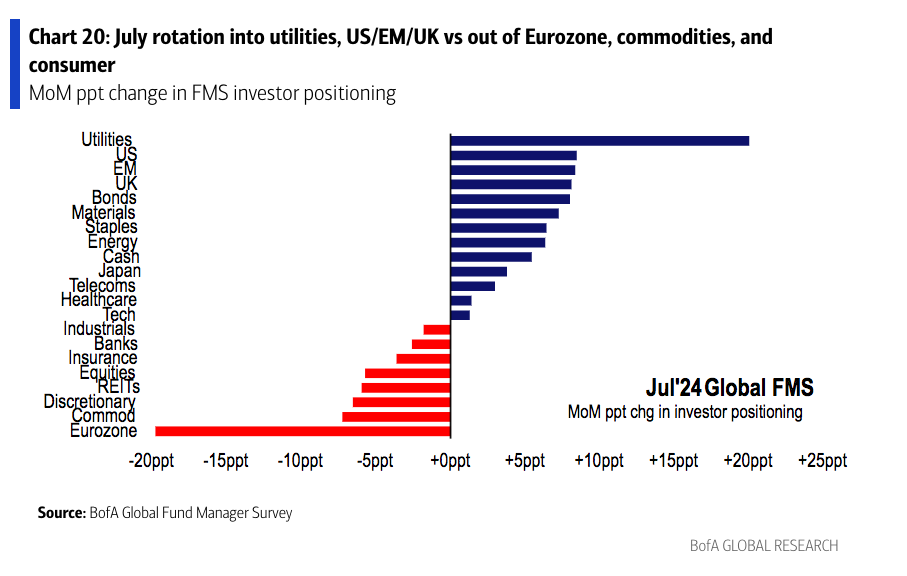

For the HSBC AM specialist, this latter idea is relevant when positioning portfolios. “This demonstrates that investors need to have real diversification in their portfolios, as well as thematic bets, maintaining a multi-asset approach. It could be said that the time has come for a new diversification because generating alpha will be complex,” he argues.

His first proposal for investors is to be more tactical and selective in fixed income positions. He particularly finds the yields provided by global high yield, US ABS, and the 60/40 portfolio very attractive. On the latter, he notes: “The 60/40 portfolios had a tough time in 2022, but they still work. It just needs to be reviewed because, with the changing context, we cannot expect it to perform the same way it did over the last ten years.”

Additionally, he shows a preference for reducing exposure to U.S. equities, as he believes that in the risk/reward relationship, there are fixed income assets that perform similarly and offer fewer risks.

He also maintains a positive view of emerging markets. He explains that they are now much more robust than they used to be thanks to the dynamics of their monetary policy. “We prefer to introduce emerging market risk into the portfolio because their valuations are more attractive. In particular, we prefer emerging countries that are less related to the U.S.,” Kasem adds.

Finally, the HSBC AM specialist focuses on alternative assets, particularly real assets. He warns that at first glance, they may seem less attractive than before, but they can play an interesting diversifying role in terms of asset type and source of return. “It is important to have flexibility to capitalize on opportunities in the private equity segment and also in private credit, always with a medium-to-long-term view. Having exposure to commodities, real estate, and infrastructure, both listed and unlisted, will generate very good diversification for the current fragmentation scenario,” Kasem concludes.