81% of Citizens Worldwide Believe That Funding Their Retirement Is Their Own Responsibility

| By Amaya Uriarte | 0 Comentarios

Are You Unsure if You Can Retire? Don’t Worry, the Global Retirement Index (GRI) by Natixis IM Shows Stability in Retirement Conditions Worldwide

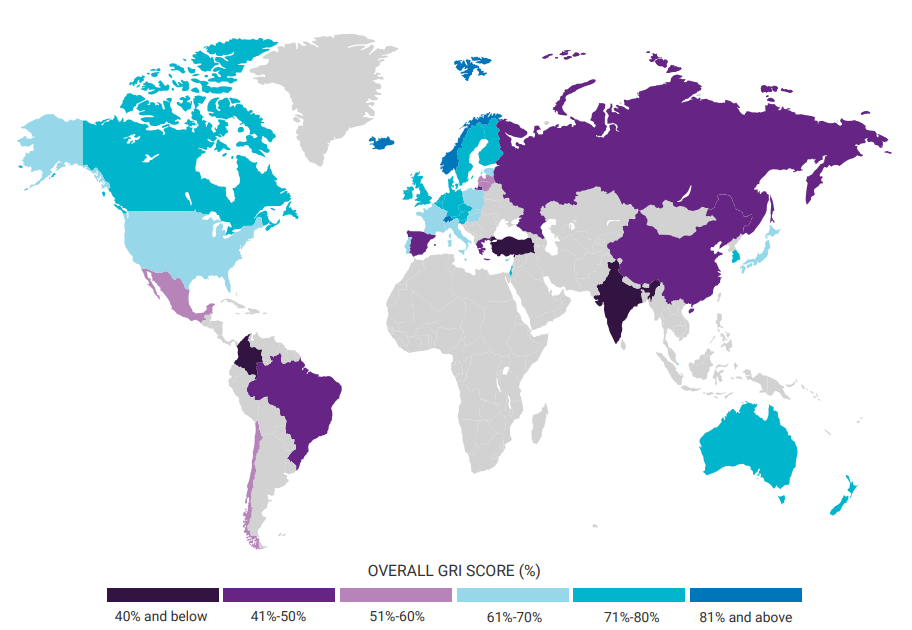

According to the latest edition of the Global Retirement Index (GRI) from Natixis Investment Managers, retirement conditions remain stable globally. After nearly all developed countries improved their scores last year, the latest findings suggest that retirement remains secure.

Countries that perform best in the GRI tend to show consistent results across all sub-indices, reflecting a stabilization of global retirement prospects. The top 10 ranked countries have remained the same for two consecutive years. However, individuals are feeling the pressure as more people realize that they are increasingly responsible for financing their retirement on their own.

In this year’s index, Switzerland overtook Norway to claim the top spot with an overall score of 82%, relegating Norway (81%) to second place. The top rankings have seen little change, with Iceland (3rd), Ireland (4th), and Australia (7th) maintaining their positions. Germany and Denmark each moved up one spot from last year, securing 8th and 9th places, while the Netherlands overtook Luxembourg to claim 5th place, pushing Luxembourg to 6th. However, New Zealand showed the most significant change among top-performing countries, dropping two spots to 10th.

Created in collaboration with Core Data Research, the GRI serves as a global benchmark that incorporates a wide range of essential factors for ensuring a healthy and secure retirement. These factors include important financial considerations as well as access to healthcare, its costs, climate conditions, governance, and overall population happiness. The GRI’s rankings are relative, not absolute, based on an aggregate of average scores ranging from 0% to 100% for 18 performance measures across four sub-indices (Finances in Retirement, Material Wellbeing, Health, and Quality of Life) that together offer a comprehensive picture of the retirement environment.

“It’s encouraging to see a consistent set of results in this year’s GRI, although there’s still room for improvement in most cases, within a broader environment characterized by rising debt levels, fiscal pressures, and higher interest rates. To prevent a future retirement crisis, a key step is to invest and work with a professional financial advisor to design a resilient, well-diversified portfolio, making the most of savings opportunities that align with individual retirement goals and the current environment. Fortunately, more people are taking responsibility for ensuring their financial security in retirement,” explains Javier García de Vinuesa, head of Natixis Investment Managers for Iberia, in relation to the survey results.

Key Index Movements

Manutara Ventures highlights that Switzerland, which tops this year’s GRI, achieved a perfect score in the unemployment indicator, reflecting the country’s impressive workforce participation rate. Despite declines in most sub-indices, Iceland retains its third position for the second year in a row. “Notably, Iceland dropped seven spots in the Health indicator (from the top 10 to 11th), despite a slight increase in its score,” they note. Meanwhile, Norway saw declines in both the Material Wellbeing sub-index, dropping from 1st to 6th, and in the Finances in Retirement sub-index, where it fell out of the top 10, landing in 12th place due to drops in the fiscal pressure, dependency ratio, and governance indicators.

Luxembourg, however, rose four percentage points to claim the top spot in the Health sub-index, driven by an increase in its life expectancy score, displacing Norway from its previous lead. Slovenia and Belgium also climbed four spots each: Belgium moved from 19th to 15th, and Slovenia just missed the top 10, moving from 15th to 11th.

Ireland leads the Finances in Retirement sub-index, improving its score by one percentage point to 74%, thanks to the continuous reduction of public debt. The United Kingdom also moved up two spots in this year’s GRI, ranking 14th due to improvements in the Health sub-index, while its scores in the other sub-indices remained unchanged.

Citizens Feel Increasingly Alone in Retirement

Despite generally positive global retirement security prospects, the Natixis Global Survey of Individual Investors in 2024 shows that the number of individuals who believe it is increasingly their responsibility to fund their retirement, rather than relying on public or private pensions, has grown from 67% in 2015 to 81% in 2023. Additionally, the number of people who believe a miracle is required to achieve retirement security rose from 40% in 2021 to 45% in 2023. One in five investors (19%) says that even if they could save $1 million, they still wouldn’t be able to afford retirement, including 18% of those who have already accumulated $1 million.

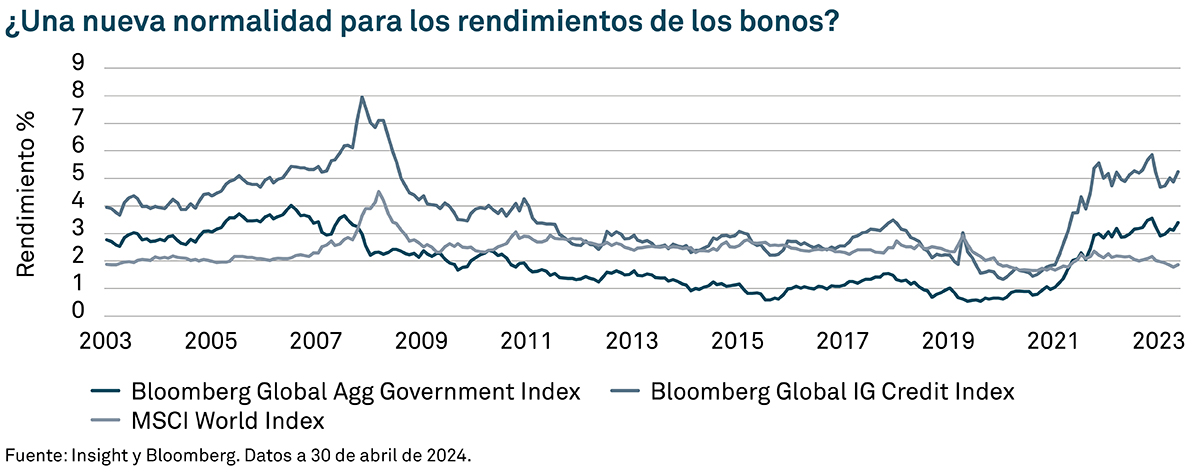

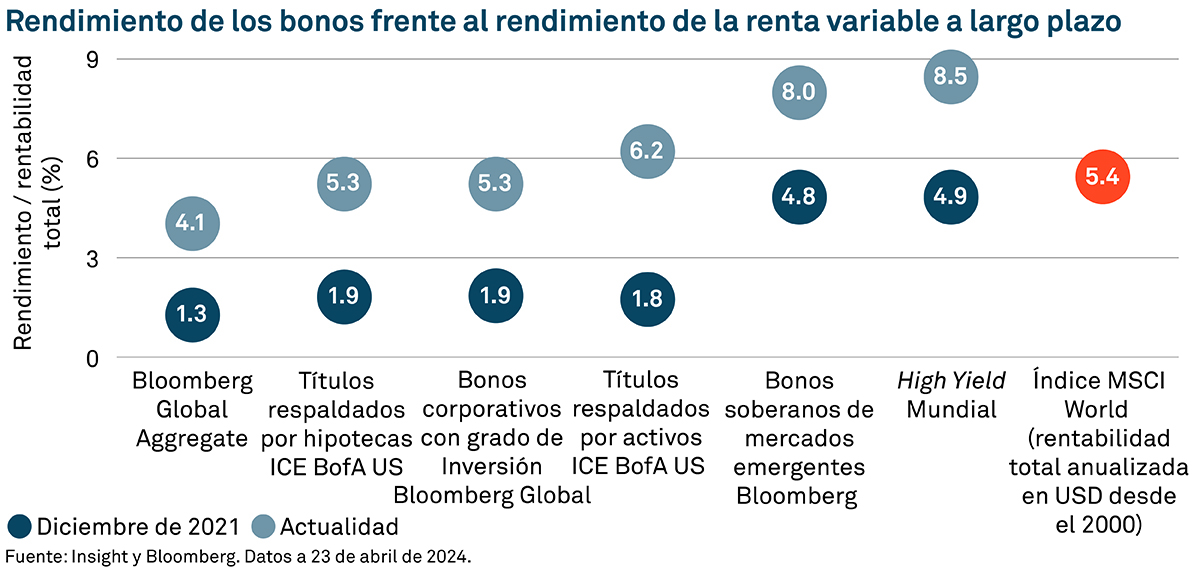

The report also identifies key risks individuals face, highlighting four in particular. First, they point to interest rates. “While low rates had been a key risk for retirees in the more than 15 years following the Global Financial Crisis, today’s higher rate environment presents new risks. Specifically, with more than $6 trillion invested in money market funds, deposits, and similar instruments, investors need to be aware of how the current cash trap could prevent them from meeting their need for a sustainable long-term income source,” they explain.

Second, they highlight inflation. While the worst may be over, as inflation slowly returns to central bank targets, the post-pandemic price surge serves as a stark reminder of how quickly and severely inflation can rise. Now, 83% of investors acknowledge that recent events have reminded them of the great threat inflation poses to their retirement security, and they must act accordingly to ensure they’re prepared for any future inflationary episodes.

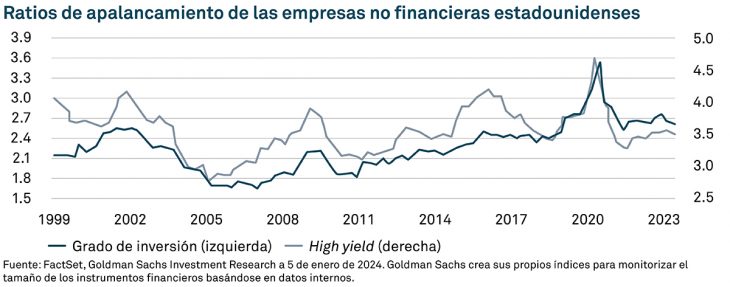

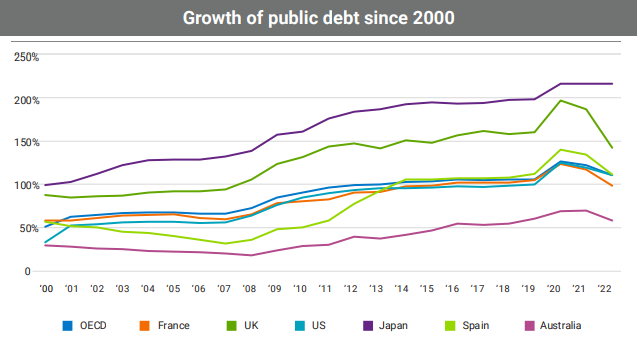

Another risk is public debt, which in OECD countries has more than doubled in the first quarter of the 21st century, as policymakers responded first to the Global Financial Crisis and then to the Covid-19 pandemic. While these measures were necessary to avoid short-term economic collapse, policymakers now face the long-term task of paying down this debt. A growing number of people are concerned that they’ll be asked to foot the bill, which could lead to cuts in public retirement benefits—the cornerstone of many retirement plans.

Lastly, they identify “people themselves” as a risk. “A secure retirement is a journey, not a destination. Success requires realistic expectations and significant individual commitment. While many may appreciate this in concept, not all investors set reasonable assumptions or establish realistic goals. GRI survey results show that investors lack a consistent view of what it takes to succeed,” the report concludes.