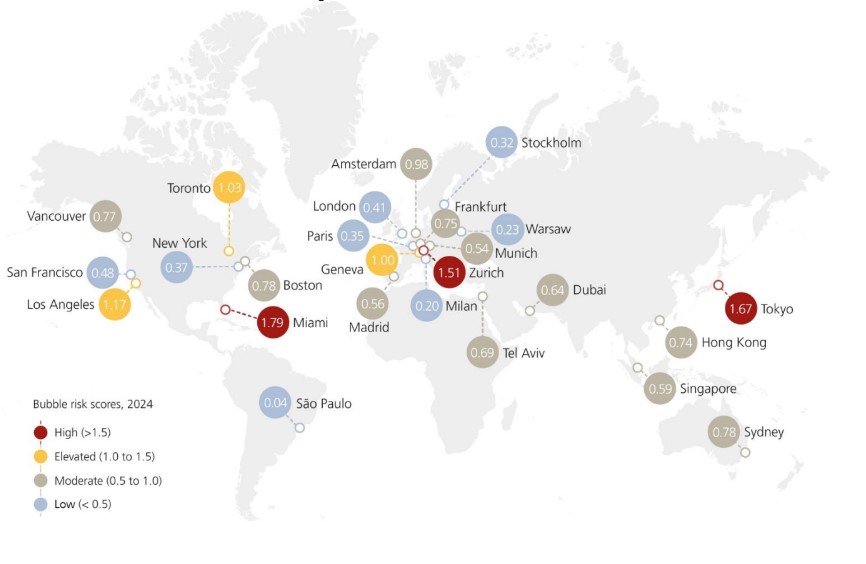

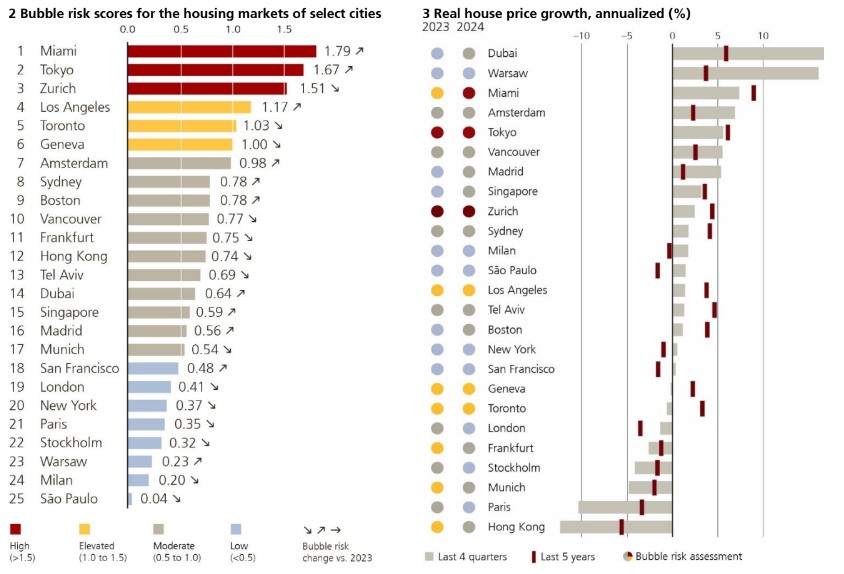

The risks of bubbles in the real estate sector of the cities analyzed in the UBS Global Real Estate Bubble Index have decreased, on average, for the second consecutive year. According to the index, there is little evident risk of a housing bubble in San Francisco, New York, and São Paulo, which shows the lowest bubble risk among the analyzed cities. In Europe, following new declines in the index score, London, Paris, Stockholm, and Milan also fall into this low-risk category. Likewise, the bubble risk in Warsaw remains low.

On the other hand, Miami shows the highest bubble risk among the cities in this study. There is also a high bubble risk in Tokyo and Zurich, although in these cases, the index score has dropped significantly compared to last year. Additionally, there is a clear elevated bubble risk in Los Angeles, Toronto, and Geneva.

In the middle, the index reveals moderate risk in Amsterdam, Sydney, and Boston. In the same risk category are Frankfurt, Munich, Tel Aviv, and Hong Kong, after significant reductions in imbalances. Vancouver, Singapore, and Madrid complete the group of cities with moderate bubble risk. Dubai, included in this group of cities with moderate bubble risk, recorded the highest increase in the risk score among all the analyzed cities.

Bubble Formation and Burst

Currently, inflation-adjusted housing prices in the analyzed cities are, on average, about 15% lower than in mid-2022, when global interest rates began to rise. Claudio Saputelli, head of the real estate division at UBS Global Wealth Management CIO, explains that the cities that saw the largest price corrections “are those that showed a high housing bubble risk in previous years.”

Real prices in Frankfurt, Munich, Stockholm, Hong Kong, and Paris are at least 20% below the peaks they reached after the pandemic. Vancouver, Toronto, and Amsterdam recorded significant price drops of around 10% in real terms.

Overall, the last four quarters were characterized by weak housing price growth. However, significant corrections continued to be recorded in Paris and Hong Kong. On the contrary, in the most sought-after areas of Dubai and Miami, housing prices continued to rise. Additionally, in some cities with a severe housing shortage, such as Vancouver, Sydney, and Madrid, real prices rose more than 5% compared to the previous year.

Housing Shortage as a Stabilizer

On average, a skilled employee in the services sector can afford 40% less living space than in 2021, before the global interest rate hikes. Current price levels do not seem sustainable given the prevailing interest rate levels, especially in markets with high homeownership rates.

However, a significant deterioration in affordability does not necessarily lead to price corrections. The growing housing shortage, reflected in rising rental prices, helped stabilize many urban housing markets. Real rental prices have increased by an average of 5% in the last two years, outpacing income growth in most cases. In most of the analyzed cities, rental price growth has even accelerated over the last four quarters.

The UBS study reveals that supply is offering no relief, as high interest rates and rising construction costs have been major burdens on housing construction. Building permits have declined in most cities over the past two years.

A Certain Relief in Sight

Housing market dynamics are set to improve. Rising rental prices support the demand for homeownership in urban areas. The fall in interest rates will make the cost advantage of ownership clearly lean toward buying. First-time buyers will return to the market as affordability improves. Matthias Holzhey, lead author of the study at UBS Global Wealth Management, concludes that real housing prices in many cities “have bottomed out” and adds that it is likely that “economic prospects will determine whether prices surge again or evolve more laterally.”

UBS Global Real Estate Bubble Index: Overview, 2024

Regional Outlook

In Europe, London’s real estate market has lost a quarter of its value since its all-time high in 2016. More interest rate cuts are expected from the Bank of England, which could rekindle housing demand, especially as rents are also rising. Forecasts for the prime market seem a bit bleaker, according to the study, as uncertainty over unfavorable tax regimes for the wealthy could undermine demand in this segment.

Real estate prices in Warsaw skyrocketed nearly 30% between 2012 and 2022. Solid employment prospects, metro expansions, and modern developments have kept the market attractive for new residents and buy-to-let investors. A new government subsidy program triggered another buying frenzy in 2023. However, the price dynamics are expected to slow down in the coming quarters, according to the study.

Both Frankfurt and Munich showed very high housing bubble risks back in 2022. Since then, the rise in mortgage rates has caused both markets to drop, with real estate prices falling by 20% from their respective peaks. The forecast for interest rate cuts, combined with supply shortages, should trigger a price recovery.

Backed by falling mortgage rates and strong international demand, real prices in Paris rose by 30% between 2015 and 2020. Emigration, lending restrictions, rising mortgage rates, and an increase in property taxes have curbed demand. With a 10% inflation-adjusted drop in the last four quarters, Paris was the weakest real estate market in Europe among all the cities analyzed in the study.

Regarding Switzerland, buying a home to live in Zurich now costs almost 25% more in real terms than it did five years ago. In the last four quarters, the Swiss city also experienced one of the largest rent increases among all the cities analyzed in the study. The proportion of owner-occupied homes is decreasing, as new buildings are often marketed as buy-to-let properties. Due to the very limited inventory of owner-occupied homes in Zurich, these will increasingly be seen as a luxury good.

Middle East

Driven by falling interest rates and the growing housing shortage, real estate prices in Tel Aviv tripled between 2002 and 2022. The rise in mortgage rates ended the boom two years ago, and demand shifted to the rental market. As a result, real prices fell by 10% by the end of 2023. However, housing transactions began to recover in 2024 due to the fear of missing out on the trend, despite security concerns.

After a seven-year price correction, the bubble risk signal in Dubai was low in 2020. Since then, transaction figures have set new records each year, and the oversupply has been absorbed. In the last four quarters, real estate prices increased by nearly 17% and are 40% higher than in 2020. The report states that a high proportion of unforeseen (likely speculative) transactions and the large volume of new supply could trigger a moderate price correction in the short term.

Asia-Pacific

In the last four quarters, real estate prices in Hong Kong registered a double-digit decline. Inflation-adjusted, housing prices are back to levels not seen since 2012. The number of transactions plummeted, and mortgage growth stalled. Strong economic growth and falling interest rates should support demand next year.

In Singapore, rental prices have outpaced housing prices over the past five years, driven by the influx of global talent and construction delays. Last year, however, real rents fell by 7%, while prices rose by 3%. High interest rates and the reduction of supply bottlenecks have increased unsold inventories, suggesting moderate price inflation in the future.

Due to high interest rates, Sydney is currently the second most unaffordable city in the study, surpassed only by Hong Kong. However, inflation-adjusted prices increased slightly over the last four quarters and are only about 10% below the 2022 peak in real terms. The resilience of prices is mainly due to the acute housing shortage.

Real estate prices in Tokyo have risen around 5% in recent quarters, continuing the trend of previous years. In the last five years, housing prices have risen more than 30% in inflation-adjusted terms, more than double the rate of rent increases. Tokyo has one of the highest price-to-income ratios among all the cities in the study.

Americas

High inflation over the past two years has significantly reduced imbalances in Canada’s housing market. Despite lower affordability, the housing market has held up well. In inflation-adjusted terms, purchase prices in both Toronto and Vancouver are only slightly below the levels of three years ago.

After a prolonged period of weakness, housing prices in São Paulo have risen slightly for the second consecutive year in inflation-adjusted terms. However, real prices are still more than 20% below the peak they reached at the end of 2014. Renting remains financially more attractive than homeownership due to very high interest rates. As a result, rents soared by nearly 10% in real terms over the last four quarters.

The homeownership market in the United States is becoming increasingly less affordable, as the monthly mortgage payment as a percentage of household income is much higher than it was during the peak of the 2006-2007 housing bubble. Despite its low affordability, housing prices in New York have not corrected drastically. They are only 4% below 2019 levels and have even risen slightly in the last four quarters.

Boston’s real estate market has seen a 20% price increase since 2019, outpacing both the local rental market and income growth. However, the local economy has recently suffered, with layoffs primarily in the tech and life sciences sectors, which could change this trend.

Driven by the luxury market boom, prices in Miami have increased by nearly 50% in real terms since late 2019, with 7% of that occurring in the last four quarters. In contrast, real housing prices in Los Angeles have barely risen since mid-2023. Due to declining economic competitiveness and the high cost of living, Los Angeles County’s population has been decreasing since 2016. Consequently, rents have not kept pace with consumer prices.

San Francisco’s real estate market is showing signs of a turnaround. After real prices corrected by 8% last year, they remained stable over the last four quarters. The stock market boom and falling interest rates have already begun to revitalize the luxury segment, and sales are increasing.