Active ETFs vs. Active Mutual Funds: What Is the Big Revolution?

| By Amaya Uriarte | 0 Comentarios

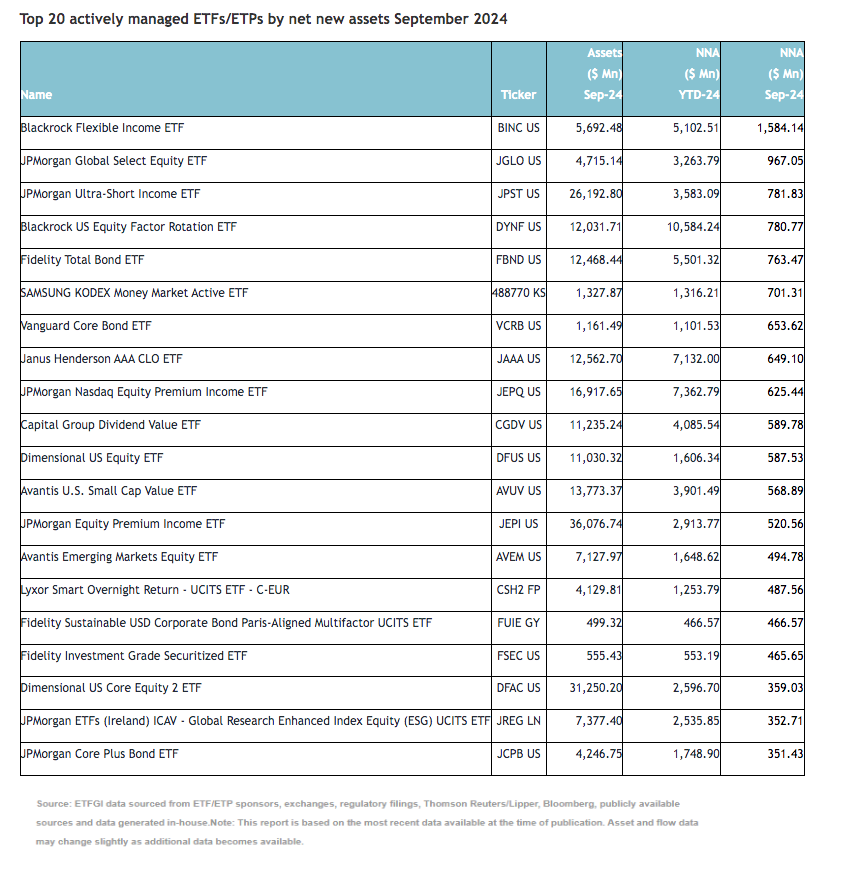

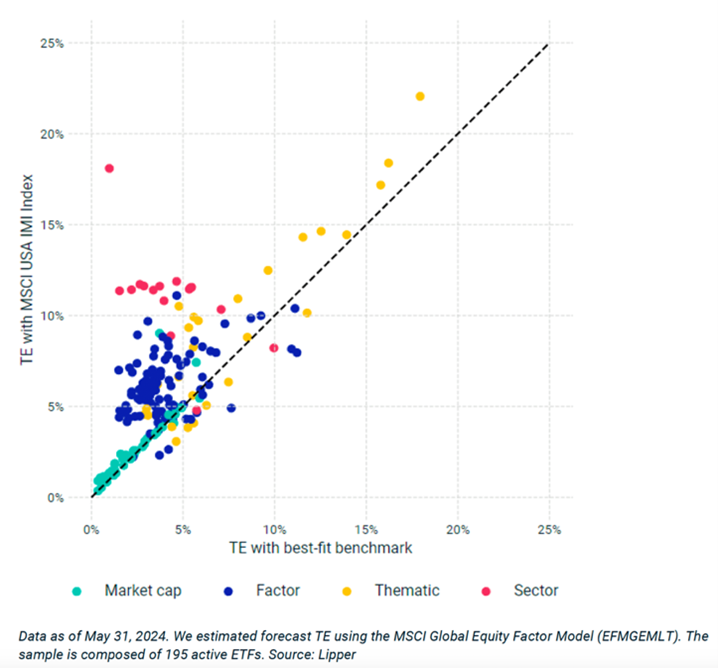

Active ETFs are rapidly growing in terms of assets under management (AUM), creating competition with established active mutual funds in the investment world. This article explores the concept of active ETFs, highlighting their advantages, disadvantages, and key differences from active mutual funds, to provide a comprehensive perspective on their role in investment portfolios.

Definition and Growth of Active ETFs

Active ETFs are a relatively recent innovation in the ETF market. Unlike passive ETFs, which track a benchmark index such as the S&P 500, active ETFs allow portfolio managers to actively select and manage a basket of securities in real time.

The goal is to outperform a benchmark index or achieve a specific investment objective rather than simply replicating market index returns. The flexibility of active ETFs enables managers to make adjustments based on market conditions or specific security information, similar to active mutual funds.

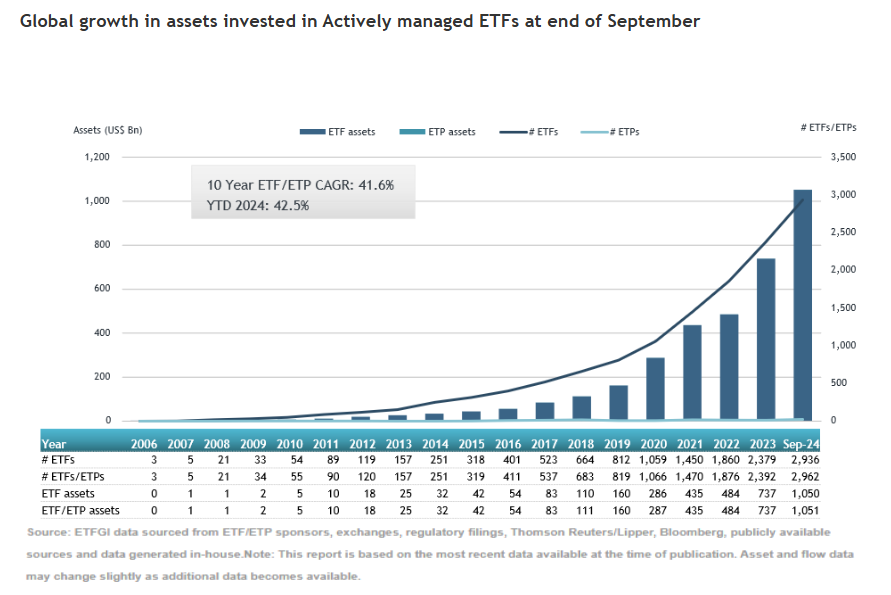

The growth of the active ETF market has been remarkable. According to data from TrackInsight and PwC, active ETFs have grown at a compound annual growth rate (CAGR) of 51% over the past decade, significantly outpacing passive ETFs in terms of capital inflows.

Advantages of Active ETFs

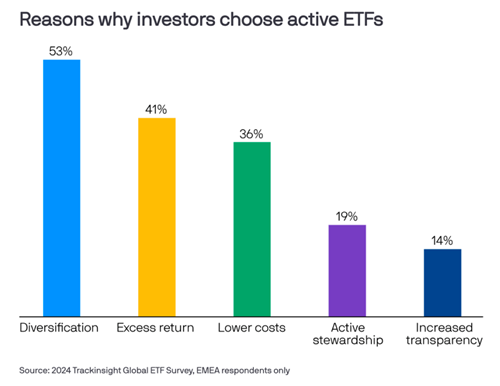

- Lower Costs Compared to Active Mutual Funds: One of the main advantages of active ETFs over active mutual funds is their lower cost ratio. Mutual funds often have management fees, 12b-1 fees, and other operational costs, while active ETFs offer lower overall costs to investors. According to JPMorgan research, this cost advantage is a key driver of active ETF popularity.

- Trading Flexibility: Active ETFs offer significant flexibility in trading. Unlike mutual funds, which are priced at the end of the trading day, ETFs trade on an exchange throughout the day, like stocks. This allows investors to react to market events in real-time, entering or exiting positions based on intraday price movements.

- Tax Efficiency: Active ETFs tend to be more tax-efficient than mutual funds due to their unique structure and the in-kind creation and redemption process. This process allows ETFs to avoid selling securities to meet redemption requests, often triggering capital gains taxes in mutual funds.

- Transparency: Most active ETFs are required to disclose their holdings daily, providing investors with full transparency into the fund’s portfolio. This level of transparency surpasses that of traditional active mutual funds, which typically disclose their holdings quarterly.

Disadvantages of Active ETFs

- Potential for Underperformance: Despite their flexibility and the potential for active management to outperform the market, active ETFs, like any actively managed product, carry the risk of underperformance. Fund managers may fail to generate alpha, particularly in volatile or highly efficient markets.

- Higher Costs than Passive ETFs: While active ETFs are generally more cost-effective than active mutual funds, they tend to have higher costs than passive ETFs. This is because active management requires more research, operations, and oversight.

- Limited History and Fewer Options: Compared to mutual funds and passive ETFs, the active ETF market is still relatively young. While there are now hundreds of active ETFs, they represent a small fraction of the broader ETF universe, and their track record of returns is significantly shorter than that of mutual funds.

- Due Diligence: Selecting a passive ETF requires a certain level of analysis to understand the tracking method used to replicate exposure to its respective index; however, the objective is relatively simple: a good replication technique seeks to minimize tracking error and reproduce the index’s performance.

For active ETFs, the objective is different: like active mutual funds, their goal is generally to outperform the benchmark, which involves a degree of tracking error (TE) and active participation, requiring investors to attain a high level of understanding of the algorithm behind it, its strengths, and, most importantly, its weaknesses.

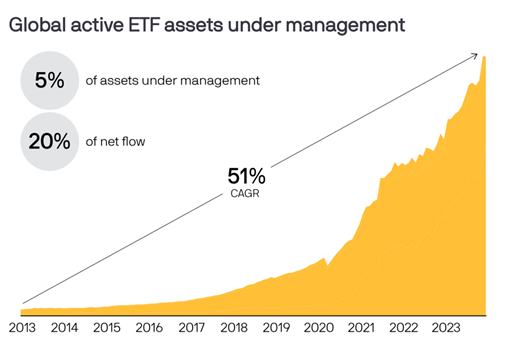

In the following chart, the Tracking Error (TE) is shown for a sample of 195 active ETFs domiciled in the U.S., organized by strategy (market capitalization, factors, thematic, and sector), with a clear differentiation in terms of active participation and TE: the majority of active ETFs referencing market capitalization were at the lower end of the TE spectrum (some below 2%).

Most factor-referenced ETFs had a TE in the 2% to 8% range. Thematic-referenced active ETFs showed the highest TEs. The generally high TE level of these active ETFs suggests that they provided active risk beyond their key investment style.

An additional consideration to keep in mind is the distribution of both product types (funds and active ETFs). Unlike mutual funds, active ETFs do not require a distribution agreement, reducing the time and cost from discovery to implementation in portfolios and generally do not provide kickbacks to advisors who use them. This can have indirect implications depending on the type of license the distributor chooses.

![]()

For U.S. Registered Investment Advisors (RIAs), assuming no advantages in risk-adjusted returns between comparable active ETFs and mutual funds, active ETFs may be preferred over mutual funds if they present lower management fees. This is due to the fact that compensation for managing clients’ portfolios under an RIA license is typically based on a percentage of assets under management (AUM) and additional fees or commissions, including kickbacks, cannot be charged. In contrast, under a brokerage model in the U.S., mutual fund formats may be preferred as this license allows for transaction-based commissions and kickbacks.

For non-resident clients (NRCs) in the U.S., unlike passive ETFs that may have dual registration and listing on different exchanges (e.g., Nasdaq and SIC), active ETFs currently do not permit dual registration, eliminating a key tax advantage compared to passive vehicles.

Smart Beta vs. Active Management: Key Differences

While active ETFs represent the intersection of traditional active management and the benefits of ETFs, smart beta strategies offer a hybrid approach distinct from both passive index tracking and full active management. Smart beta ETFs aim to capture the benefits of factor-based investing, targeting specific investment factors such as value, momentum, size, or quality.

These strategies seek to enhance returns or reduce risk by adjusting portfolio weights based on certain rules or criteria, rather than relying on typical market-cap weighting used by passive ETFs.

Rule-Based Approach vs. Manager Discretion

One of the main distinctions between smart beta and active management is the degree of human discretion involved. Smart beta strategies are typically rules-based, following a predetermined methodology that selects and weights securities based on factors such as volatility or dividend yield. While these strategies offer the potential for higher returns than traditional passive indices, they are not managed actively in the same way as active ETFs, where managers make discretionary decisions on what securities to buy or sell based on market conditions.

Cost Structure

Smart beta ETFs tend to be more cost-efficient than fully active ETFs, as they do not require the same level of active research, trading, and portfolio turnover. However, they are often more expensive than purely passive ETFs due to their sophisticated portfolio construction and factor analysis. In contrast, active ETFs generally have higher fees due to the need for ongoing management and oversight.

Transparency

Smart beta ETFs are highly transparent, as they follow a consistent set of rules for portfolio construction, making their positions and strategy predictable. Investors can easily understand the factors driving performance. On the other hand, active ETFs are less predictable, as the portfolio manager has the discretion to frequently change positions based on market conditions.

Potential to Outperform the Benchmark

Both smart beta and active ETFs aim to outperform a benchmark index, but their approaches differ. Smart beta strategies rely on biases toward certain factors to achieve higher returns, while active ETFs depend on the skill and judgment of the manager.

The potential for benchmark outperformance in active ETFs is greater if the manager can consistently identify undervalued assets or anticipate market trends. However, smart beta strategies offer a more systematic and disciplined approach to capturing excess returns.

Conclusion

Active ETFs and smart beta strategies offer innovative alternatives to both passive ETFs and traditional active mutual funds. Active ETFs provide the benefits of active management, liquidity, and tax efficiency, making them an attractive option for investors seeking flexibility and potential outperformance. However, they also come with higher costs and the risk of underperformance. On the other hand, smart beta represents a middle ground between active and passive investing, offering a rules-based approach targeting specific investment factors, while remaining more cost-effective than full active management.

When deciding between active ETFs, smart beta, and active mutual funds, investors should carefully consider their investment goals, risk tolerance, and preferences regarding costs, transparency, and flexibility. Each vehicle has its unique advantages and limitations, but the rise of active ETFs and smart beta strategies reflects the growing demand for customized and cost-effective investment solutions in today’s dynamic market environment.