The Biggest Innovations in ETFs Are Yet to Come

| By Amaya Uriarte | 0 Comentarios

In the past, ETFs were synonymous with equity tracking instruments. Ten years after WisdomTree’s launch in Europe, the adoption of this asset type (or wrapper) has opened a new frontier in investing for clients of all profiles. Over the decade since we entered the European market, the ETF landscape has radically changed in terms of available products, assets under management (AUM), and ETF users.

Many European clients who, years ago, were buying an ETF for the first time are now firm believers in this asset type. In fact, many have replaced their mutual fund holdings with ETFs due to the transparency, liquidity, and exposure they can access through this cost-effective wrapper.

ETFs have also moved past their reputation as passive vehicles. We never pigeonholed them that way because we always believed investors needed more innovative solutions than market capitalization-weighted indices. This led us to pioneer the launch of ETFs that invest in systematic strategies based on fundamentals.

Their ability to encompass all types of investment strategies is just one of the reasons why ETFs have done more to level the playing field for investors than any other innovation in asset management. One of their effects in recent years has been their adoption by retail clients, which has accelerated across the region. While there is still room to catch up with the U.S. market, this trend represents an exciting growth opportunity for ETF issuers in Europe.

And it’s not just individual investors benefiting from ETFs. Private banks, high-net-worth individuals, and financial advisory firms can also access institutional-quality products in a direct, cost-effective, transparent, and liquid manner, truly transforming their client offerings in ways previously unattainable.

ETF users today are more curious and open-minded than they were 10 years ago, when these products were mainly used for large-cap equity allocations. At that time, few believed that non-market-cap-weighted exposures could be viable investment options in an ETF. The world now understands that these products are highly efficient, which is another reason why, according to our latest survey of professional investors, nearly all of them invest in ETFs. This point is reinforced by the fact that nearly half expect to increase their allocations in the next 12 months.

The Potential of ETFs

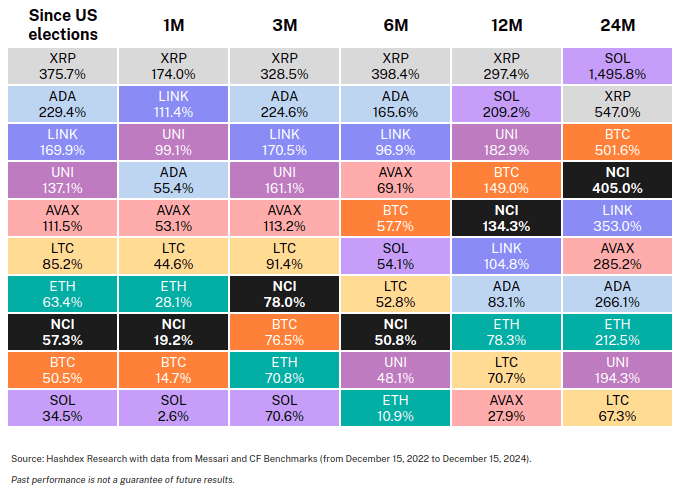

There is no doubt that ETFs have become essential for asset allocators. While most ETF assets are invested in products tracking traditional benchmark indices, investors are increasingly seeking access to a wider range of asset classes through these strategies. More than one-third (35%) of professional investors use ETFs to access alternative asset classes, including commodities and cryptocurrencies. This marks a significant shift from earlier skepticism about the viability of non-equity exposures in an ETF.

To understand the impact of these products, one must consider the global adoption of cryptocurrency ETPs. This innovation has bridged the gap between traditional finance and this emerging asset class, as evidenced by the $20 billion that has flowed into bitcoin ETPs this year. Turning bitcoin into an exchange-traded product democratized access to the world’s largest cryptocurrency. It has succeeded because bitcoin adds something different to portfolios, and there are fewer barriers to entry—most European investors can now buy a cryptocurrency ETP.

The Next Chapter: Smart Innovation in ETFs

The past decade has shown us that ETFs have a promising future. This will translate into greater adoption, more options for investors, and continuous innovation from issuers, who must adapt to evolving client needs. Failure to innovate can be costly. The future of ETFs is immensely promising, and I am confident that smart ETF innovation will shape a bright future for both the industry and investors.