Edouard Carmignac: “Donald Trump Can Be Criticized, but We Must Acknowledge That He Has a Formidable Instinct”

| By Amaya Uriarte | 0 Comentarios

Edouard Carmignac had the opportunity to have lunch with the now-president Donald Trump 20 years ago. It was a business lunch where the founder, president, and CIO of Carmignac Gestion gained a good understanding of the character of the then-businessman, which has helped him assess how his second, non-consecutive term as U.S. president might unfold: “Donald Trump, for his flaws, can be criticized, but we must acknowledge that he has a formidable instinct. In a world seeking growth but that is globalized and where traditional models no longer work, his approach has an impact.” Although the president and CIO admitted that some of Trump‘s promises “include extreme proposals that may sometimes seem radical,” he also stated that “boldness and leadership are needed because the old paradigms are no longer sustainable.”

These remarks were made by Carmignac at the annual forum organized by his firm in Paris for clients and the media, which this year also marked the 35th anniversary of the firm and its flagship fund, Carmignac Patrimoine.

One of the major investment-related topics Edouard Carmignac addressed in his speech was the shift in the global political order, where he was particularly critical of countries with left-wing governments: “The classic redistribution models, which worked well in the past, are now exhausted. Resources cannot continue to be redistributed if there is no way to generate them. That is why European models face resistance and need to reinvent themselves with efficient governance.” However, despite these challenges, Carmignac maintained an optimistic outlook, asserting that “there is potential” for greater growth in Europe, and expressed confidence that European governments would gradually shift towards more conservative and right-wing positions, beginning with Germany after the elections scheduled for February.

Carmignac cited another example of a global leader, Javier Milei, with whom he had a one-hour meeting. Among the topics they discussed were economics and their shared views on the Austrian School of Economics. “I was impressed by his intelligence and his knowledge of economics. He has an unwavering determination to change Argentina and move it forward, which will have an impact not only on his country but also on South America,” Carmignac emphasized.

Among the investment themes for 2025 that Carmignac Gestion is monitoring, Edouard Carmignac highlighted that “a technological revolution is underway,” though he preferred to call it “augmented intelligence” rather than artificial intelligence. “We are witnessing a transformation that is just beginning, and those who invest in it will find great opportunities.” Regarding cryptocurrencies, he took a more cautious stance, instead emphasizing the importance of “continuing to invest in projects with real value and long-term sustainability.”

Outlook for 2025

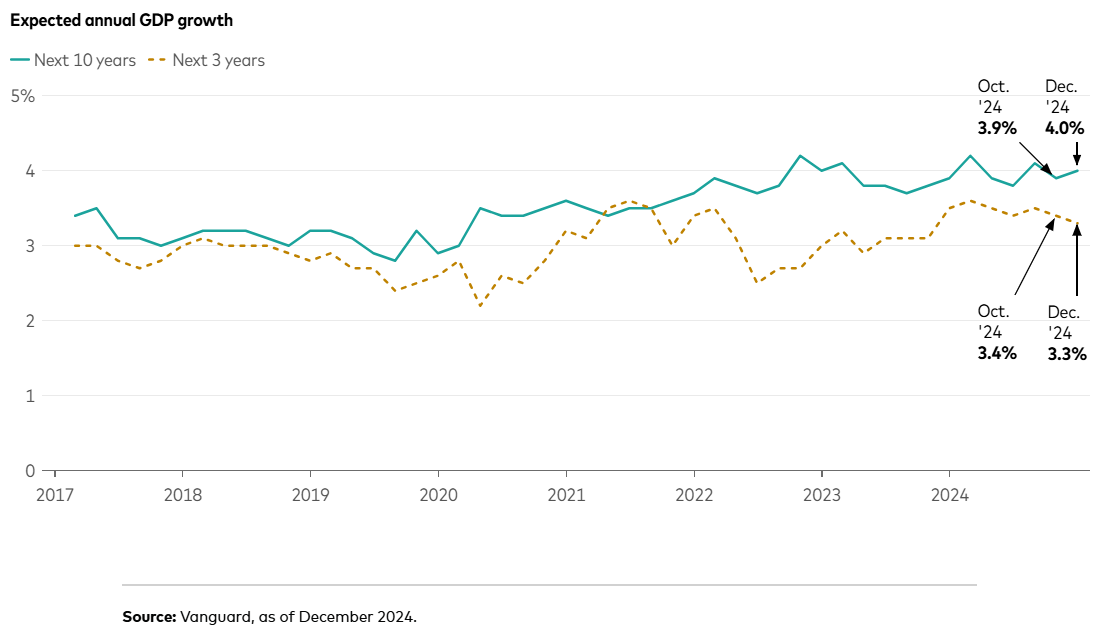

Raphaël Gallardo, chief economist at Carmignac Gestion, provided a more detailed and specific analysis of key themes the firm is monitoring this year, positioning their funds accordingly. He began by discussing the current situation in the U.S., particularly the difficult paradox facing the new Trump administration, which has promised continued economic growth while avoiding inflationary pressures.

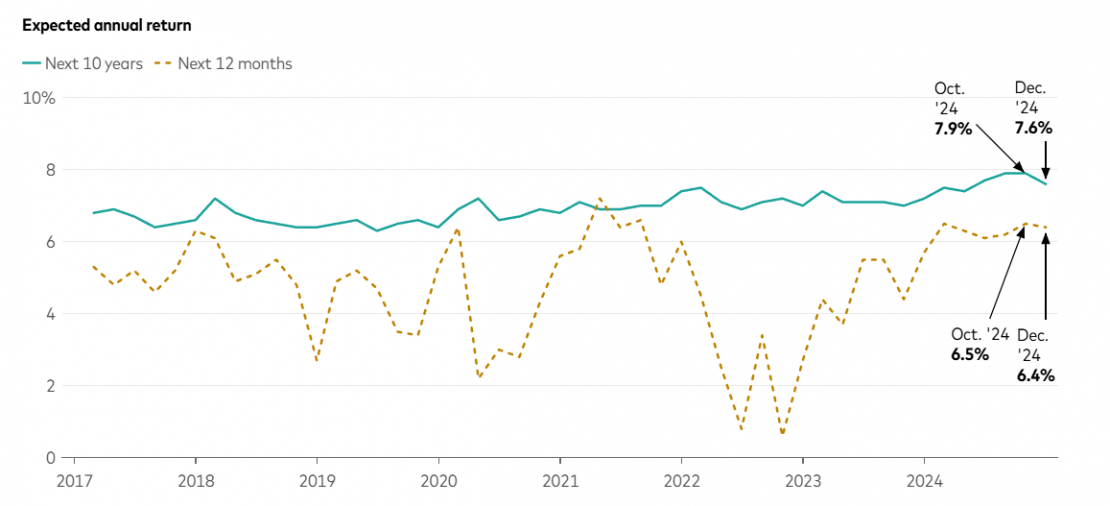

Specifically, Gallardo identified three factors affecting U.S. growth: the high deficit (above 6%), which will constrain budget decisions; the sustainability of the wealth effect experienced by households in recent years, driven by rising financial asset prices, which Gallardo questioned; and, related to the previous two, the evolution of interest rates, which he believes “will determine the budgetary margin,” as each movement in the cost of money directly impacts stock market valuations and real estate assets while also absorbing up to 20% of U.S. household incomes.

According to the chief economist, Trump has four key levers to navigate this challenge: reducing public spending through the newly created Department of Government Efficiency (DOGE), led by Elon Musk; promoting deregulation, particularly in artificial intelligence; implementing tariffs; and lowering oil prices by flooding the market with more barrels, which would require negotiations with Saudi Arabia and even Russian authorities, potentially leading to a resolution of the war in Ukraine.

On the other side of the world, Gallardo discussed China’s “obsession with trade surpluses,” arguing that its export figures are inflated due to the country ramping up shipments in 2024 ahead of new U.S. tariffs. Gallardo believes Xi Jinping‘s government is currently at an “impasse,” as it attempts to mitigate the negative impact of the real estate sector on the economy while trying to “set a consumption floor without altering the economic model.”

Regarding a potential new trade war between the U.S. and China, Gallardo sees multiple factors at play. He anticipates another shift in trade rules between the two nations—though he notes that Trump, unlike in 2018, is not being as aggressive with tariffs this time. He also cites other influences, such as the war in Ukraine and the ongoing fentanyl trade between the two countries.

Finally, Gallardo argues that the EU can play a key role in this historic rivalry in three ways: first, by becoming a better client for the U.S., particularly by increasing demand for American goods and services in the defense and gas sectors; second, by coordinating with the U.S. to decouple China’s technological advancement, creating a competitive advantage; and third, by leveraging deregulation within Europe to impact U.S. companies, such as enforcing stricter regulations on digital giants.