Shedding Light on the Sticky, Rigid, and Persistent Inflation

| By Amaya Uriarte | 0 Comentarios

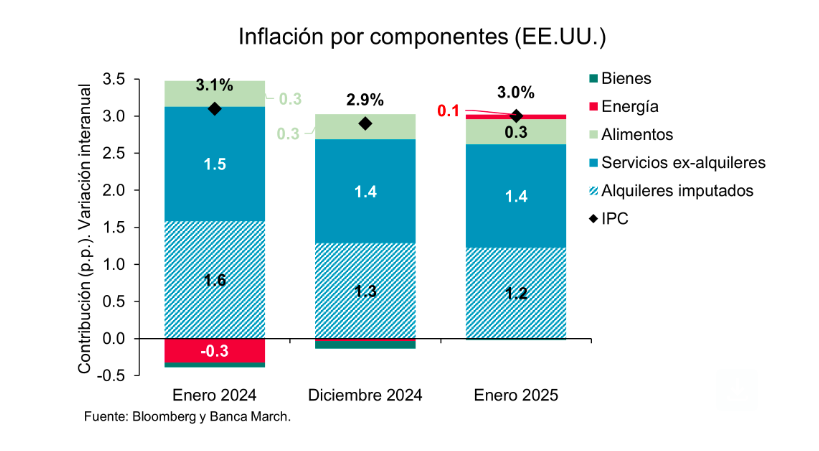

The latest report on the U.S. Consumer Price Index (CPI) showed that core inflation rose 0.4% month-over-month, surpassing consensus expectations. This pushed annual inflation to 3% in January 2025, up from 2.9% in December 2024. Additionally, the report detailed price spikes in categories that typically increase at the start of the year, including auto insurance, internet/TV subscriptions, and prescription drugs.

According to analysts at Banca March, the data presented a mixed picture: “The increase was mainly due to energy prices contributing to inflation (+0.06%) for the first time since last July, as well as a weaker downward drag from goods prices, which fell -0.13% year-over-year in January, marking their smallest decline since December 2023.”

They note that this shift in goods prices was driven largely by two components—used cars and prescription drugs—which together contributed +0.3% to January’s inflation, whereas in December, they had subtracted three-tenths from the CPI.

On a more positive note, service prices continued their gradual moderation trend, though not enough to prevent the inflation uptick. Service inflation rose at a 4.3% annual rate—one-tenth lower than in December—marking the slowest increase in service prices since January 2022. “Notably, the largest component, imputed rents, moderated to +4.4% year-over-year, down from +6% a year ago, supporting the gradual ‘normalization’ of inflation. However, upward pressure came from transportation services such as insurance and vehicle maintenance,” explain Banca March experts.

What Does This Mean?

According to Tiffany Wilding, U.S. economist at PIMCO, these figures do not change the broader narrative that the U.S. economy remained strong at the turn of the year while inflation progress stalled. “If anything, this reinforces the Federal Reserve’s (Fed) stance of keeping rates steady for some time. We believe inflation is likely to remain uncomfortably high through 2025 (with core CPI at 3%), despite growing risks of a more pronounced slowdown in the labor market and real GDP growth, stemming from Trump’s recent immigration policy announcements and broader political uncertainty,” explains Wilding.

She adds that Trump’s policies put the Fed in a difficult position: “Sticky inflation raises questions about whether the Fed will ultimately deliver the two 25-basis-point rate cuts implied in its December Summary of Economic Projections (SEP). At the same time, a more significant slowdown in real GDP growth and labor markets—both of which have been buoyed by strong immigration trends—could increase downside risks to the economy,” she says.

Uncertainty for Central Banks

Experts agree that this situation puts the spotlight on the Fed and other monetary institutions. “Central banks are no longer a source of stability, as they are caught between the need to control inflation and the desire to avoid an economic slowdown that may be necessary to bring inflation sustainably back in line with targets. This dilemma could worsen if the U.S. tariff threat materializes, as governments may have no choice but to loosen fiscal policies. Monetary policy decisions could take investors by surprise, as central banks may take very different paths,” note Marco Giordano, Chief Investment Officer at Wellington Management, and Martin Harvey, fixed income portfolio manager at Wellington Management.

Trump and Inflation

Benjamin Melman, Global CIO at Edmond de Rothschild AM, warns that global inflation no longer seems to be retreating, especially in the U.S. services sector, while rising oil, gas, commodity, and agricultural prices have added further inflationary pressures in recent months. In this context, he argues that Trump’s administration has introduced an additional layer of uncertainty regarding future inflation trends with its tariff and deportation policies.

“While it may be tempting to downplay these concerns by suggesting that tariffs are merely a negotiation tool to extract concessions from affected countries, and that large-scale deportations are technically difficult to implement, it would be a mistake to draw conclusions just one week into Trump’s second term,” Melman points out.

However, he clarifies that even if Trump does not fully implement these inflationary measures, or does so on a limited scale, the unleashing of so-called ‘animal spirits’ in the U.S.—driven by expectations of deregulation and tax cuts—cannot be ruled out. “This is likely to stimulate the economy and inflation through more traditional channels, particularly given that the output gap is already positive,” he concludes.