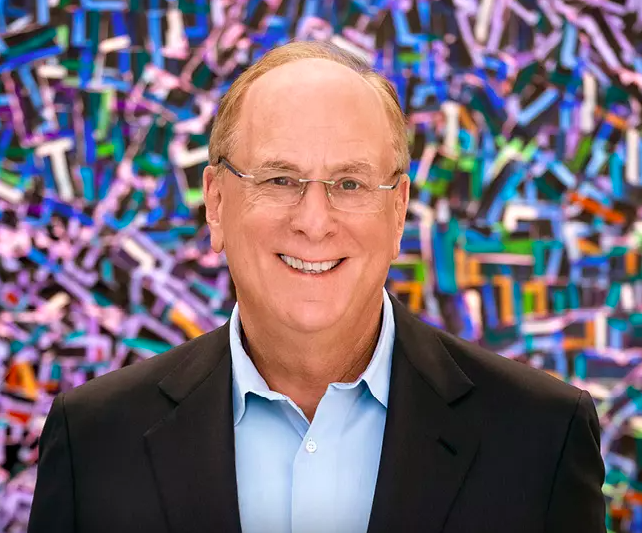

Democratization: Larry Fink’s Key Word for the Markets and for BlackRock

| By Beatriz Zúñiga | 0 Comentarios

As he does every year, Larry Fink, CEO of BlackRock, has published his annual letter to investors, in which he analyzes the long-term forces shaping the global economy and how BlackRock is helping its clients navigate these dynamics and seize emerging opportunities.

What stands out is that in the opening lines of his letter, he acknowledges that investors are nervous. “I hear it from nearly every client, nearly every leader, nearly every person I speak with: they’re more worried about the economy than at any time in recent memory. And I get it. But we’ve been through moments like this before. And somehow, over the long term, we find a way through,” he writes.

To explain how the asset manager is approaching today’s environment and its view of the world, the letter opens by highlighting a key principle of BlackRock’s business: that capital markets can help more people experience the growth and prosperity that capitalism can deliver.

“Of all the systems we’ve created, one of the most powerful — and especially suited for moments like this — began over 400 years ago. It’s the system we invented specifically to overcome contradictions like scarcity amid abundance and anxiety amid prosperity. We call this system the capital markets.”

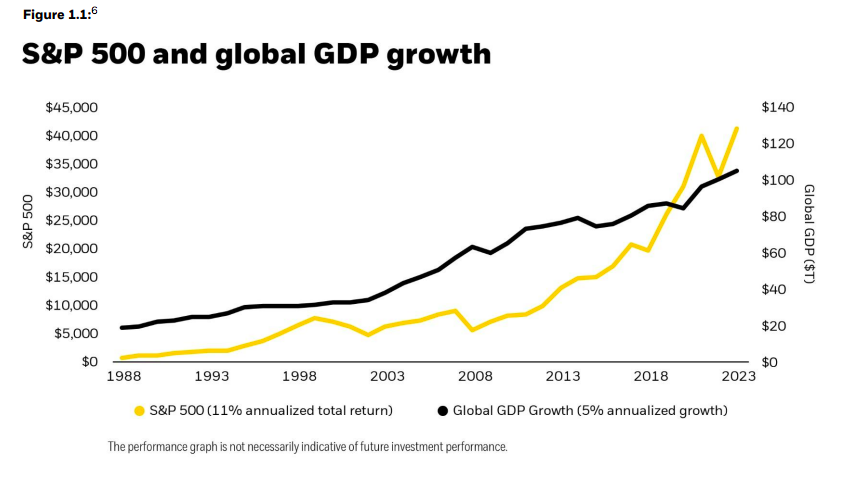

The CEO highlights that investors have benefited from the greatest period of wealth creation in human history, noting that in the last 40 years, global GDP has grown more than in the previous 2,000 years combined. He argues that this extraordinary growth — driven in part by historically low interest rates — has generated exceptional long-term returns. However, he acknowledges that not everyone has shared in this wealth.

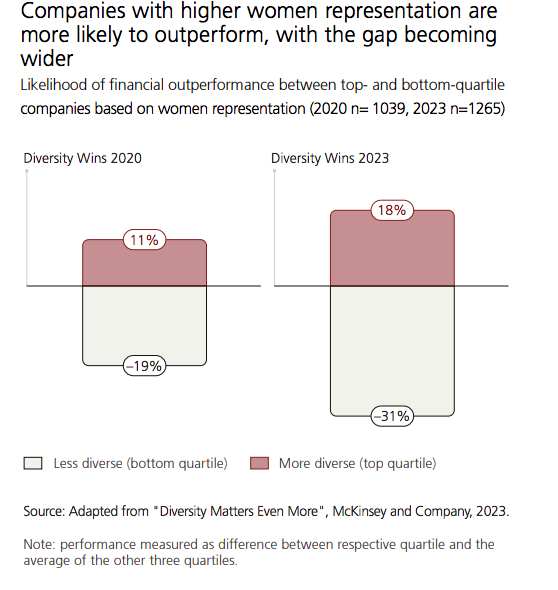

Fink concedes that capitalism has clearly not worked equally for everyone, and that markets are not perfect. To change this, he believes the answer is not to abandon the markets, but to expand them: “to complete the democratization of the market that began 400 years ago and enable more people to have meaningful participation in the growth happening around them.” How can investment continue to be democratized? In his view, there are two general ways: helping current investors access parts of the market that were previously out of reach, and enabling more people to become investors from the outset.

“More investment. More investors. That’s the answer. Since BlackRock is a fiduciary and the world’s largest asset manager, some readers might say I’m talking my book. That’s understandable. But it’s also the path we consciously chose, long before it was fashionable. From the beginning, we believed that when people can invest better, they can live better — and that’s exactly why we created BlackRock,” he states.

Unlocking Private Markets

In Fink’s view, the assets that will define the future — such as data centers, ports, power grids, and the world’s fastest-growing private companies — are not available to most investors. “They are in private markets, locked behind high walls, with doors that only open to the largest or wealthiest market participants. The reason for this exclusivity has always been risk. Illiquidity. Complexity. That’s why access is limited to certain investors. But nothing in finance is immutable. Private markets don’t have to be so risky, opaque, or out of reach — not if the investment industry is willing to innovate. And that’s exactly what we’ve been working on at BlackRock over the past year.”

In this vein, over the last fourteen months, BlackRock has acquired Global Infrastructure Partners (GIP) and Preqin, and announced the acquisition of HPS Investment Partners. According to the CEO, these moves enable broader access to private markets for more clients and provide investors with greater choice. “BlackRock is transforming the future of our industry to better serve today’s clients,” he adds.

The Big Retirement Question

For BlackRock, these strategic moves are driven by the mismatch between investment demand and capital available from traditional sources. Capital markets can help fill that gap. In this regard, the CEO explains how democratizing investment can help more people secure their financial future and that of their families.

In the letter, he outlines ideas such as helping people start investing earlier and giving retirees the peace of mind and security needed to spend in retirement. “A good retirement system acts as a safety net that protects people when they face hardship. But a great system also offers a path to build savings, accumulating wealth year after year,” he notes. More than half of the assets managed by BlackRock are for retirement funds. “It’s our core business, and that makes sense: for most people, retirement accounts are their first — and often only — experience with investing. So if we truly want to democratize investing, retirement is where the conversation has to start,” he adds.

Focusing on the U.S., he considers the situation there to be critical: “Public pension systems are facing massive shortfalls. Nationally, data shows they are only 80% funded — and that number is likely too optimistic. Meanwhile, one-third of the country has no retirement savings at all. As money becomes scarce, people are living longer. Today, if you’re married and both partners reach age 65, there’s a 50% chance that at least one of you will live to 90.”

In response, he highlights that last year, BlackRock launched LifePath Paycheck® to address this fear. “It offers people the option to convert 401(k) retirement savings into a steady, reliable monthly income. In just 12 months, LifePath Paycheck® has already attracted six plan sponsors representing 200,000 individual retirement savers,” he explains.

A Look at Europe

On major market trends, Fink also shared his views. Regarding Europe, he believes the continent is waking up and wonders if it’s time to turn bullish on the region. “The policymakers I speak with — and I speak with many — now recognize that regulatory barriers won’t disappear on their own. They must be addressed. And the potential is enormous. According to the IMF, reducing internal trade barriers within the EU to the level that exists among U.S. states could boost productivity by nearly 7%, adding a staggering $1.3 trillion to the economy — the equivalent of creating another Ireland and another Sweden,” he states.

He adds that the biggest economic challenge facing the continent is the aging workforce: “In 22 of the 27 EU member states, the working-age population is already shrinking. And since economic growth largely depends on the size of a country’s labor force, Europe faces the risk of a prolonged economic slowdown.” The letter highlights that BlackRock manages $2.7 trillion for European clients, including around 500 pension plans supporting millions of people.

It also notes that ETFs contribute to developing an investment culture in Europe, making it easier for more individuals to reach their financial goals by using capital markets: “When first-time investors start entering capital markets, they often do so through ETFs — and particularly iShares. We are working with established players, as well as several newcomers to Europe, such as Monzo, N26, Revolut, Scalable Capital, and Trade Republic, to lower investment barriers and build financial literacy in local markets.”

Tokenization: The Great Revolution of Democratization

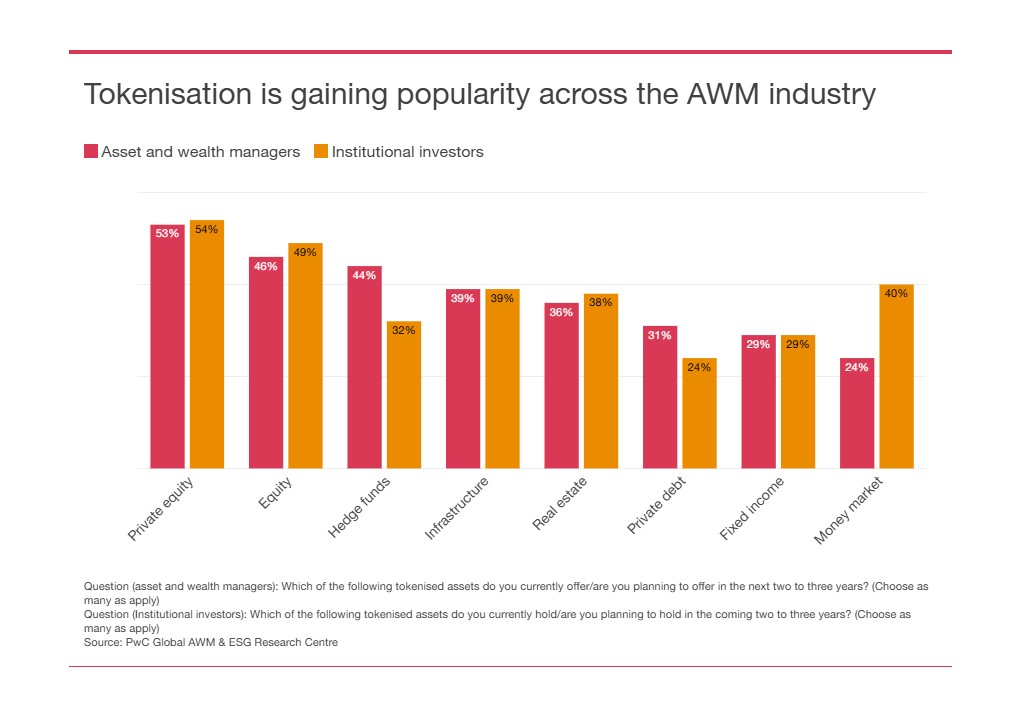

While expanding access to capital markets requires innovation and effort, Fink believes it’s not an insurmountable challenge. As an example of such innovation, he points to tokenization as a clear step toward democratization. In his view, if SWIFT is like postal mail, then tokenization is email: assets move directly and instantly, bypassing intermediaries.

“What exactly is tokenization? It’s the process of turning real-world assets (stocks, bonds, real estate) into digital tokens that can be traded online. Each token certifies your ownership of a specific asset, much like a digital deed. Unlike traditional paper certificates, these tokens live securely on a blockchain, enabling instant buying, selling, and transferring — without cumbersome paperwork or waiting periods. Every stock, every bond, every fund, every asset can be tokenized. If they are, it will revolutionize investing. Markets would no longer need to close. Transactions that now take days could settle in seconds. And billions of dollars currently trapped by settlement delays could be immediately reinvested into the economy, generating more growth,” he explains.

In his view, perhaps most importantly, tokenization makes investing far more democratic. “It can democratize access, shareholder voting, and returns. One day, I hope tokenized funds become as familiar to investors as ETFs — provided we solve one critical issue: identity verification,” Fink concludes.