U.S. Investors Go Big on Europe, Explaining Record Inflows into European ETFs in 2025

| By Amaya Uriarte | 0 Comentarios

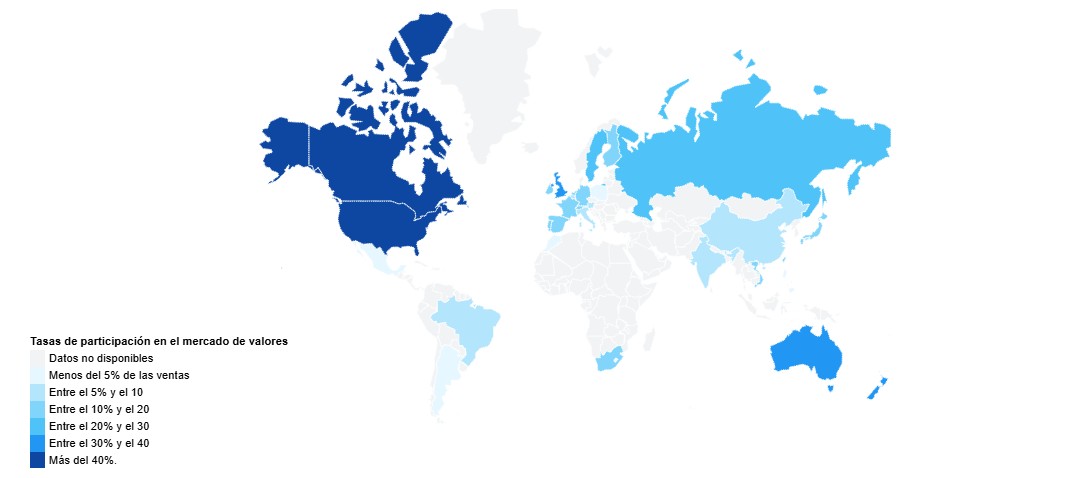

Analysts at Freedom24, the investment platform of European group Freedom Holding Corp., reveal a historic shift in capital flows: U.S. investors are making strong bets on Europe. In just the first quarter of 2025, they invested $10.6 billion in European exchange-traded funds (ETFs), a figure seven times greater than during the same period in 2024, driven by volatility in U.S. markets and Europe’s fiscal and regulatory revival.

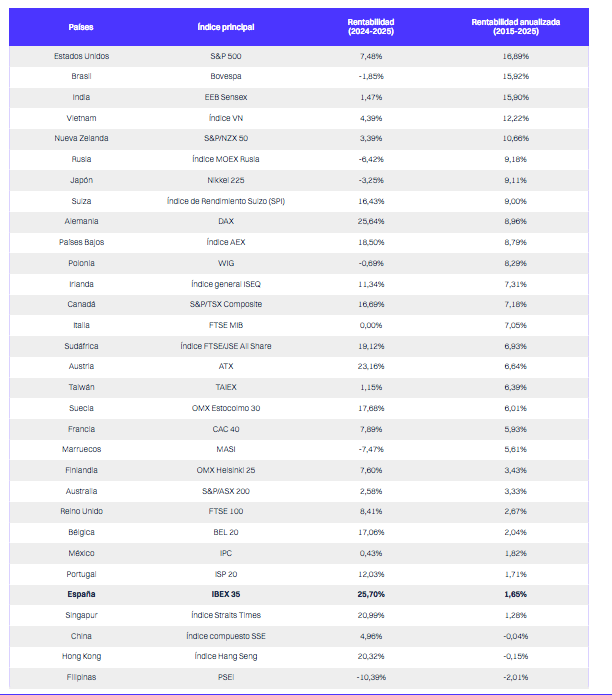

Since January, European equities have outperformed U.S. stocks by more than 10%, prompting a reassessment of where the best opportunities lie. Freedom24 analysts examine the European ETFs receiving the highest inflows in 2025, based on available data and trends as of April 3, 2025.

Historic Inflows of $10.6 Billion

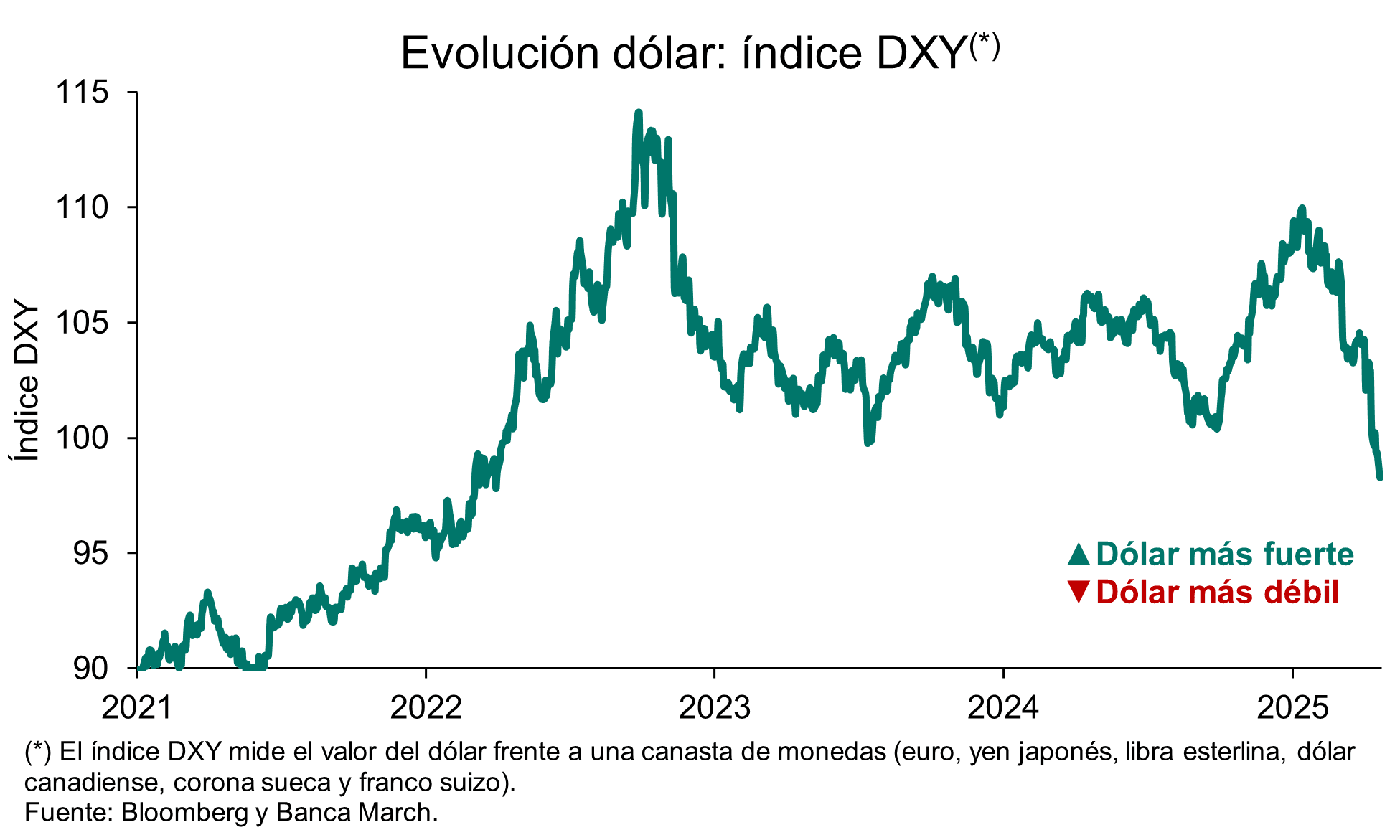

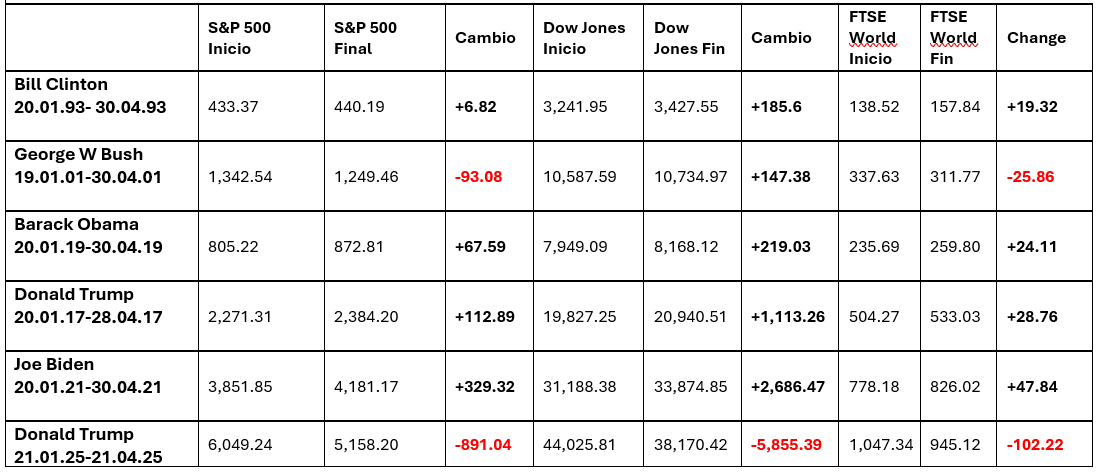

European ETFs recorded historic inflows of $10.6 billion in Q1 2025, marking a sharp turnaround from the $6.4 billion in net inflows accumulated since February 2022. This recovery comes at a time when U.S. markets are under pressure from new tariff threats — a factor that sharply contrasts with the performance of the Morningstar US Market Index. While the latter has seen a cumulative drop of about 8%-9% through mid-April 2025 due to these pressures, the Morningstar Europe Index has followed a different trajectory, showing much more restrained movement during the same period, after a notable rise at the start of the year.

This shift is also evident in European investor behavior: in February, they withdrew $510 million from U.S. equity ETFs. This contrasts with the strong global appetite seen just a few months earlier, when November 2023 saw $22.8 billion in inflows into such products, according to etf.com. In summary, MEGA-style operations (Make Europe Great Again) are quickly replacing MAGA (Make America Great Again) trades.

Defense: A Rising Star

Defense remains the crown jewel, driven by Europe’s €800 billion ($866 billion) rearmament and Germany’s fiscal expansion. The Select STOXX Europe Aerospace & Defence ETF (EUAD), launched in October 2024, had already raised $476 million by April 2025 — a sign of its appeal. European defense stocks have risen 33% this year, and valuations — such as Rheinmetall trading at 44 times future earnings — have surpassed their U.S. counterparts and even luxury brands like Ferrari.

Still, caution is warranted: although profit growth forecasts (e.g., 32% annually for Rheinmetall through 2028) are tempting, 78% of the EU’s arms spending since 2022 has occurred outside the bloc, mainly in the U.S. Nevertheless, EUAD remains a favorite for this long-term trend, along with supply chain players like Eutelsat (ETL.PA), which surged 260% this month amid Ukraine-related speculation.

European ETFs with the Largest Inflows in 2025

Based on early trends and reports, the funds attracting the most attention from U.S. and global investors include standout options for both their financial characteristics and macroeconomic backdrops.

One of the most notable is the iShares MSCI Germany ETF (EWG), which has received over $1 billion in inflows this year. The fund benefits from Germany’s fiscal push in areas such as infrastructure and climate, as well as the positive performance of the German stock market, which rose 9.04% in January.

The iShares MSCI Europe (IEV) is also drawing significant interest, partly due to its broad exposure to the European market and a low expense ratio of 0.59%, within an environment of $2.3 trillion in assets under management in European ETFs in 2024.

Meanwhile, the Vanguard FTSE Europe ETF (VGK) stands out among the leaders thanks to its competitive 0.07% expense ratio and $3.5 billion in inflows into Vanguard’s UCITS products this year.

Finally, the iShares Core MSCI Europe UCITS ETF (IMEU), although without specific 2025 data, has maintained strong momentum supported by a solid historical return and the $11.59 billion raised in January by iShares products.

What’s Driving the European ETF Boom?

According to Freedom24 analysts, the renewed appeal of European ETFs is due to several structural factors. First, Europe is moving faster than the U.S. in cutting red tape, creating opportunities in multiple sectors. Germany’s €500 billion infrastructure fund, expected to boost GDP by 1.4% annually, is a key example. This has directly benefited the iShares MSCI Germany ETF (EWG), which has doubled its assets after receiving $1 billion.

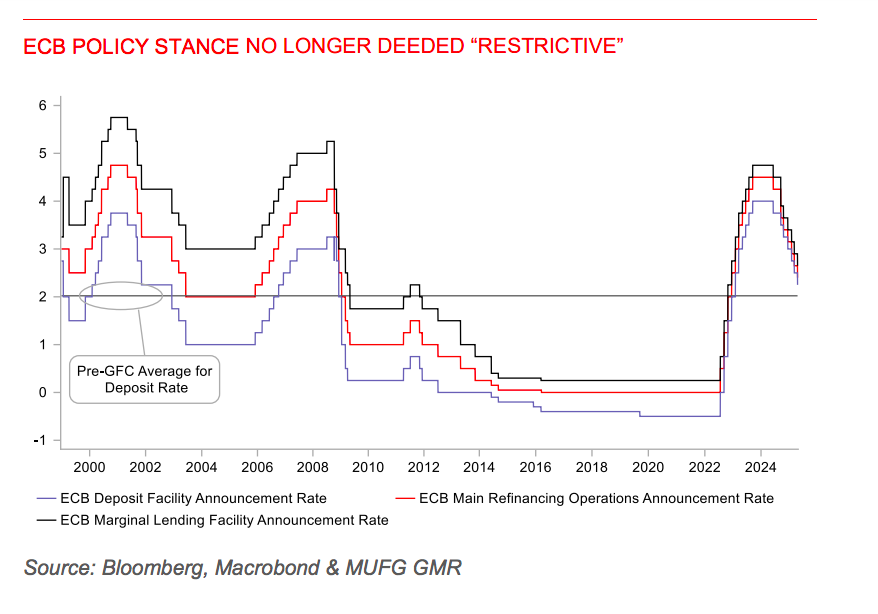

Another highlight is the expansion of the bond market. Rising German debt and the EU’s €150 billion SAFE program are increasing the supply of AAA-rated assets, boosting products like the First Trust Germany AlphaDEX Fund (FGM).

The European banking sector is up 26% in 2025 — its best quarter since 2020 — and markets like Spain and Italy are gaining prominence due to lower trade tensions and attractive valuations. In fixed income, bond ETFs attracted $9.3 billion in February, with funds like the iShares Core € Corp Bond UCITS ETF (IEAC) leading in inflows.

Lastly, the energy transition is solidifying as a key driver. With solar energy reaching 11% of Europe’s electricity mix, companies like Iberdrola and Enel — which have appreciated between 7% and 16% this year — are boosting interest in ETFs focused on renewables.

From Outflows to Opportunity: Europe’s New Paradigm

Since 2022, when Europe saw $6.4 billion in net outflows from ETFs, the landscape has radically changed. Germany’s strong climate investment and the EU’s push for renewables have restored the continent’s appeal. Logistics and communications firms like Scania (Traton) and Atlas Copco are also well positioned amid growth in defense and infrastructure.

Europe: A Long-Term Strategic Bet

According to Freedom24 analysts, the $10.6 billion surge into European ETFs in Q1 is not a passing trend but a sign of Europe’s “MEGA Moment.” Funds like the Select STOXX Europe Aerospace & Defence ETF (EUAD), iShares MSCI Germany ETF (EWG), and First Trust Germany AlphaDEX Fund (FGM) are leading the shift. At the same time, sectors like banking and renewables and regions like Southern Europe are solidifying their appeal.

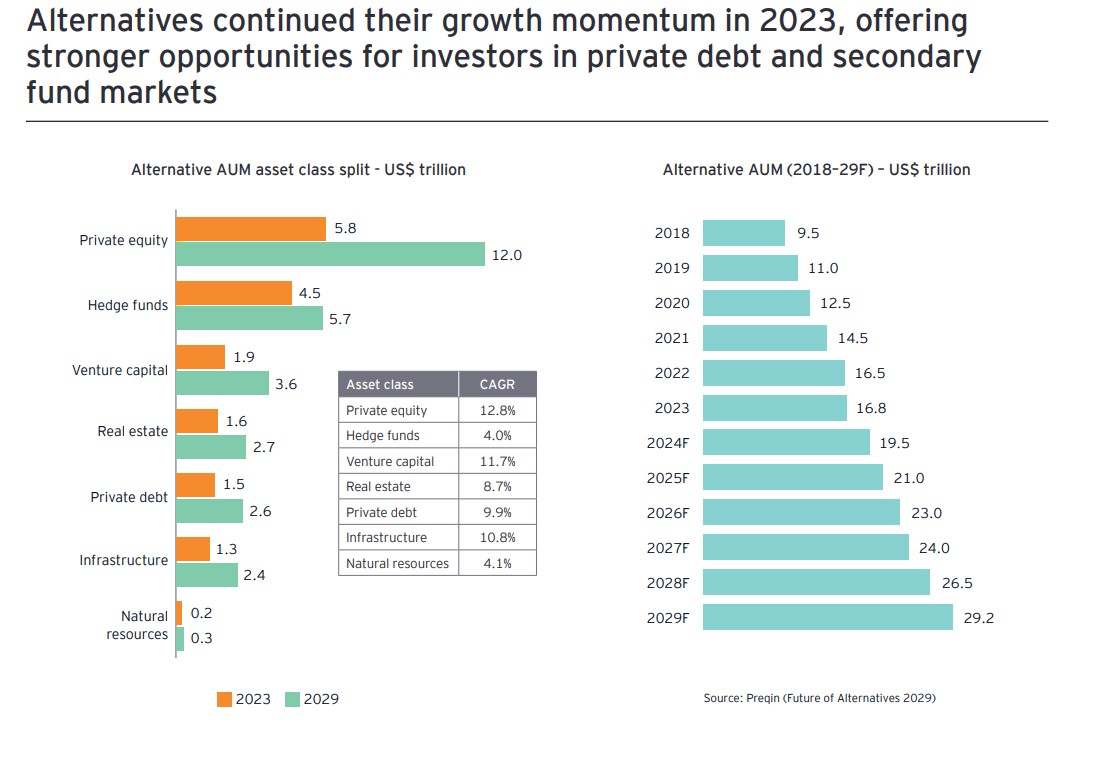

Despite strength on both sides of the Atlantic, European ETFs are growing at a faster pace. According to EY, assets under management in Europe reached $2.3 trillion at the end of 2024 and could rise to $4.5 trillion by 2030, driven by retail trading and the growth of individual savings.

In conclusion, say analysts at Freedom24, Europe is consolidating its position as an undervalued region with high potential. Its fiscal agenda, favorable regulation, and leadership in key sectors make it an increasingly present bet in global portfolios. In the long term, smart capital is clear: Europe is back at the center of the map.