Market Risks and Uncertainty Do Not Diminish the Appeal of Dividends

| By Amaya Uriarte | 0 Comentarios

According to forecasts from the latest Janus Henderson Global Dividend Index, dividends could grow by 5% in headline terms this year—a projection that would bring total payouts to a record high of $1.83 trillion. “Underlying growth is likely to be closer to 5.1% for the full year, as the strength of the U.S. dollar against numerous currencies slows overall growth,” the asset manager explains. However, the current environment of uncertainty and slower economic growth is prompting investment firms to reflect on what might happen with dividends this year.

BNY Investments notes that we are operating in a world undergoing deep structural changes, where inflation is likely to remain elevated and interest rates are no longer near zero. “Those ultra-low rates were a historical anomaly, a response to the financial crisis, but they do not represent the norm. As inflation persists, we should expect rates to stabilize around 3% to 5% in the long term,” says Ralph Elder, Managing Director for Iberia and Latam at BNY Investments.

In this regard, he believes this shift also has a geopolitical dimension: “We are moving from what we used to call the ‘peace dividend’ after the Cold War to a new era of rearmament. The global economy is fragmenting, shifting from globalization to regional blocs and from free trade to more protectionist policies. All of this contributes to greater uncertainty and structural inflation.”

The Role of Dividends

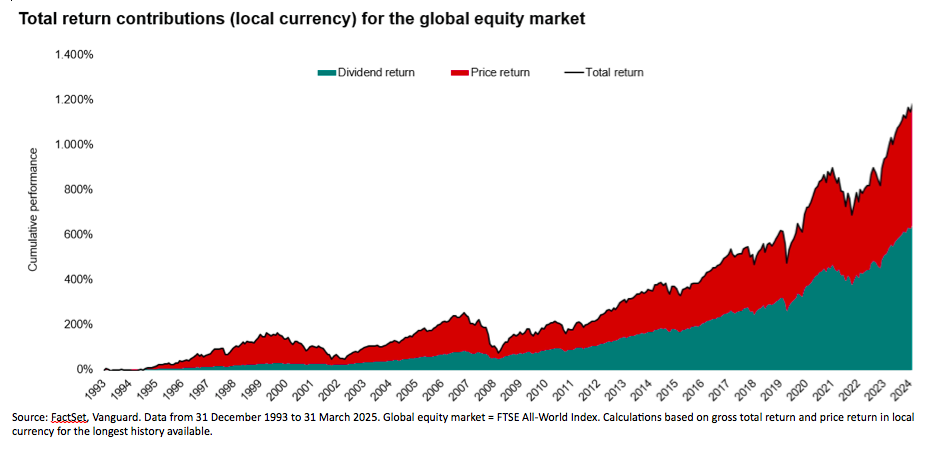

In this context, Elder recalls that dividend income has historically been the most consistent driver of total returns in equity markets, except during highly unusual periods such as quantitative easing, when artificially low interest rates distorted valuations.

“Looking at long-term data, dividend reinvestment dramatically improves outcomes. If you had invested $1 in 1900 and simply followed the market, today you would have approximately $575. But if you had reinvested dividends year after year, that figure would exceed $70,000. That is the power of the compounding effect of dividends over time,” Elder points out.

He argues that in a more volatile, inflationary world with higher interest rates, dividends can provide stability and act as a buffer. “They help smooth the investment journey and will continue to be an essential component of equity returns going forward,” he emphasizes.

This view is also shared by Viktor Nossek, Director of Investment and Product Analytics at Vanguard in Europe: “Dividends remain a fundamental component of long-term equity returns. Since 1993, the FTSE All-World Index has risen nearly 1,150%, with 586 percentage points of that increase attributable to reinvested dividends. It’s a trend that will likely gain importance, especially in a market environment with greater uncertainty and stagflationary tendencies.”

The Impact on Dividends

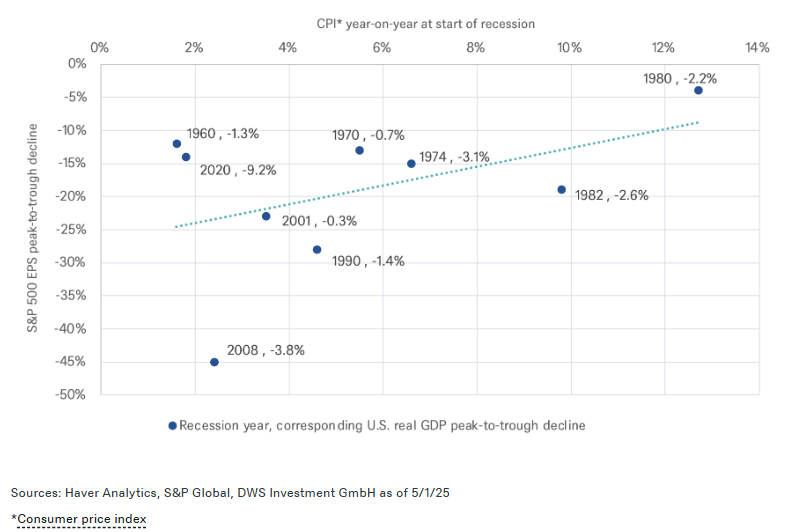

Now then, how do recession risks affect earnings per share (EPS)? According to DWS, recessions with higher inflation rates have historically had a smaller impact on the S&P 500’s earnings per share (EPS) than deflationary recessions. Their analysis shows that the average decline in S&P 500 EPS during recessions has been 20%, from the peak to the trough of earnings over a four-quarter period, with results since 1960 ranging between 4% and 45%. The asset manager notes that although deeper recessions tend to lead to more pronounced EPS declines, the inflationary environment also plays an important role.

David Bianco, Chief Investment Officer for the Americas at DWS, notes that in recessions with inflation above 4%, the impact on S&P EPS is smaller than what would be suggested by the contraction in real GDP. “This is due not only to high inflation driving nominal sales growth but, more importantly, to the fact that—unlike during severe disinflation or deflation—recessions with high inflation can help avoid rising financing costs for the financial sector; limit losses from corporate inventory liquidations; prevent consumers from further delaying purchases in anticipation of falling prices; support commodity prices and demand for related capital goods; enable large companies to implement price increases; and limit asset write-downs that negatively affect reported EPS,” explains Bianco.

In the long term, Bianco expects S&P 500 companies to absorb about one-third of the tariffs ultimately implemented by the Trump administration, which he estimates would impact S&P net earnings by 3.5%, or approximately $10 per share. “Our revised S&P EPS forecasts for 2025 and 2026 are $260 and $285, respectively, assuming slower growth and weak output, but no deep U.S. recession or sharp decline in the value of U.S. assets. We also include a $5 foreign exchange gain in the S&P EPS, as we expect a weakening of the U.S. dollar going forward,” he concludes.

Dividends in the First Quarter

In the first quarter of 2025, global dividend distribution volume reached $398 billion, representing a 9.4% increase compared to the same period the previous year. Although growth remains robust, it is significantly lower than the 15.3% rise recorded in Q4 2024.

According to Vanguard, these figures are an early indication that global uncertainties are increasingly weighing on corporate confidence, although the 12-month global dividend distribution volume remains at $2.2 trillion for the year.

“Dividend payouts in 2024 hit record levels. And although distributions continued to rise in Q1 2025, the early effects of potential tariffs are becoming evident. Declines were primarily observed in Asia-Pacific and emerging markets (excluding China); in addition, there were dividend cuts from consumer goods companies in the U.S. (down $5.8 billion year-on-year) and China (down $2.3 billion year-on-year). These losses were offset in the first quarter by dividend distributions from North American financial and technology stocks,” notes Nossek.

While Viktor Nossek, Director of Investment and Product Analytics at Vanguard in Europe, acknowledges that China will continue to drive dividend growth, North America remains the largest payer. “Globally, the dividend distribution landscape is uneven. Japan saw an 18% increase, North America 4%, the U.K. 1%, and Europe 0%. Emerging markets, excluding China, recorded growth nearly 7% lower than the previous year, while companies in the Pacific region, excluding Japan, reduced payouts by 14%. Despite China’s exceptional interim dividend, North America remains the largest dividend payer, with around $191 billion in Q1, followed by emerging markets ($74 billion), Europe ($51 billion), and China ($38 billion),” he concludes.