Pressure Is Mounting, but the Data Still Support the Fed’s Cautious Approach

| By Amaya Uriarte | 0 Comentarios

Although no new rate cuts are expected to be announced by the monetary authority, this meeting is marked by somewhat weaker preliminary data, pressure from the Trump administration making headlines, and the market watching closely.

“While no change to the benchmark interest rate is expected, recent comments from some voting members of the Federal Open Market Committee have shown support for a possible cut. Furthermore, the trade agreement between the EU and the U.S. could further reduce the need for short-term stimulus,” note analysts at Muzinich & Co.

The forecast is that the interest rate will remain in the range of 4.25% to 4.5%, as there have been no clear signs either in the last meeting or since then that a rate cut is being considered. Instead, what will matter most are Powell’s remarks, as the goal is to temper market expectations, which currently assign a 60% probability to a rate cut in September.

“The market’s reaction to the press conference will be interesting. A week before the FOMC meeting, the market was pricing in a 65% chance of a cut in September. That probability will approach either 0% or 100% as we get closer to September 17. Will we see signs of such a move after the July meeting?” asks Erik Weisman, Chief Economist at MFS Investment Management.

For Vincent Reinhart, Chief Economist at BNY Investment, Fed officials will have to work hard to do nothing at this FOMC meeting. “This isn’t chess or tic-tac-toe. For the Fed to cut rates, three conditions must align: some concern about employment, signs that inflation will return to target, and enough clarity about the economy to be confident in those two premises. For now, we anticipate a 25-basis-point cut in December, and less than a 50% chance of anything happening before then. Essentially, the Fed would correct course if economic data worsens, acknowledging they may have misjudged the economy’s strength and the impact of tariffs on inflation,” notes Reinhart.

The Data the Fed Watches

Growth and inflation outlooks support the central bank’s more cautious approach. It’s worth recalling that in terms of inflation, the Fed’s preferred indicator (core PCE inflation) remains above target, at 2.7% year-over-year, and there are signs that tariffs are beginning to pass through to core goods prices. “Consumer expectations have declined from multi-decade highs, but remain high enough for the Fed to be hesitant about rate cuts in July,” says Michael Krautzberger, CIO of Public Markets at Allianz Global Investors.

In this context, Kevin Thozet, a member of the investment committee at Carmignac, notes that the Fed does not expect inflation to return to its 2% target before 2027, representing a six-year “deviation.” “And the latest inflation data are not particularly encouraging. We’re starting to see signs of import cost pass-through due to tariffs. Core goods inflation has already ticked up modestly, and the FIFO model that dominates the U.S. retail sector indicates that more price increases will come once tariffs are more broadly applied,” explains Thozet.

According to David Kohl, Chief Economist at Julius Baer, the weakening of the U.S. economic outlook suggests that a more accommodative monetary policy is likely in the second half of the year. However, he warns that “uncertainty around inflation following the rise in tariffs prevents a rate cut in July, as does the political pressure from President Trump to lower rates.”

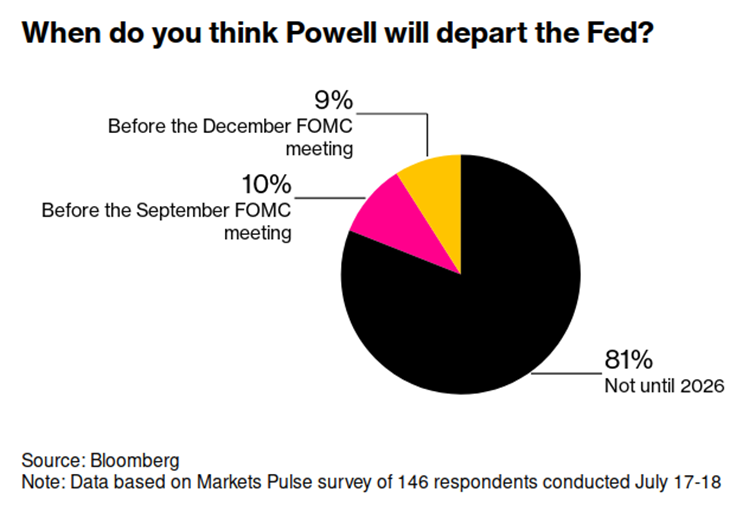

The Pressure Mounts

Even though the data still support the Fed’s “wait-and-see” stance, the pressure to cut rates is increasing, both from the Trump administration and from within the Fed itself. On the political front, Fed Chair Jerome Powell has faced growing pressure to cut rates immediately, with President Trump even suggesting the possibility of replacing him before his term expires in May 2026. According to Thozet’s analysis, Powell has been under increasing political pressure, but any speculation about his replacement should be treated cautiously. “President Trump has little to gain from reshuffling Fed leadership just six months before Powell’s term ends. Moreover, the risks of undermining the Fed’s credibility on the dollar, inflation expectations, and long-term bond yields are too great. The central bank’s credibility has played a key role in anchoring long-term inflation expectations since their sharp rebound in 2022. Any move toward fiscal dominance or premature easing could jeopardize that hard-won stability, with significant negative ripple effects,” he comments.

The pressure doesn’t come only from the White House—it also comes from within the institution itself. “The minutes from the June meeting showed that most committee members believe monetary policy is ‘well positioned’ as they wait for more clarity on growth and inflation outlooks. However, they also acknowledged the risk that tariffs could have more persistent effects. Still, internal divisions are starting to emerge within the Fed,” comments Krautzberger.

In recent weeks, Governor Waller called for a 25-basis-point cut in July, based on the following rationale: tariffs will cause an exceptional increase in prices; the economy has already been operating below potential during the first half of the year; and labor market risks are increasing. “Other Fed members, however, have expressed a desire not to cut rates preemptively, and Powell himself has suggested that it remains prudent to wait and see how macroeconomic conditions evolve,” adds the Public Markets CIO at Allianz GI.

Beyond July

Looking beyond July, the market anticipates no more than two rate cuts before year-end, depending on upcoming inflation data. However, heading into the Fed’s September meeting, political pressure to reduce rates could intensify, especially if consumer demand and the labor market weaken more than expected. “We believe current data support the Fed maintaining its monetary policy stance in July. However, unless there’s a significant inflation surprise, the September meeting could become an active turning point for resuming cuts, particularly if economic indicators weaken and political pressure reaches a level that forces the Fed to act,” says Krautzberger.

According to Julius Baer’s chief economist, the stagnation of private consumption and lower investment intentions, which point to reduced demand, would justify a less restrictive policy stance, even though inflation rates remain above target. “Political pressure makes it harder for the Fed to communicate rate cuts in upcoming meetings. We expect the Fed to resume its rate-cutting cycle at its September FOMC meeting,” states Kohl.

Experts agree that the overall data suggest the economy remains in good health, and there is a risk of an upward trend in inflation due to tariffs. According to Mauro Valle, Head of Fixed Income at Generali AM (part of Generali Investments), “the market expects the Fed to cut again between September and October, but no longer anticipates two cuts by year-end. Uncertainty about the economic outlook and the impact of tariffs is high, and the Fed will likely continue to take its time.”

In the view of Tiffany Wilding, Economist at PIMCO, interest rates could reach neutral next year. “Many investors are wondering about the direction of Fed policy, particularly in light of public dissatisfaction from Trump with recent decisions under Powell and the expiration next year of key Fed appointments. In our view, economic fundamentals and institutional dynamics point to a baseline policy outlook that is not significantly different from what would be expected under the current composition of FOMC participants—perhaps with a marginally faster return to a more neutral policy stance,” she concludes.