Commodities: Sector-Wide Rise Driven by Specific Geopolitical and Political Factors

| By Amaya Uriarte | 0 Comentarios

The Bloomberg Commodity Total Return Index rose 5.5% in the first half of the year, with most of the gains concentrated in just four contracts: gold, silver, copper, and live cattle. Additionally, outside of this index, platinum soared nearly 50%. According to experts, persistent forces such as deglobalization, decarbonization, increased defense spending, dedollarization, demographic shifts, urbanization, and climate change continue to lay the groundwork for a potential commodities bull market.

Kerstin Hottner, head of commodities and portfolio manager at Vontobel, takes a cautious view and considers that we are seeing isolated sectoral movements driven by very specific factors. “We have seen cyclical and geopolitical impulses that have raised the prices of certain assets, but the current dynamics are much more determined by supply and demand, speculative flows, and technical factors. In a global context marked by geopolitical tensions, uncertain monetary policies, and a transitioning economic cycle, I see commodities regaining a central role in investment strategies,” says Hottner.

Precious metals

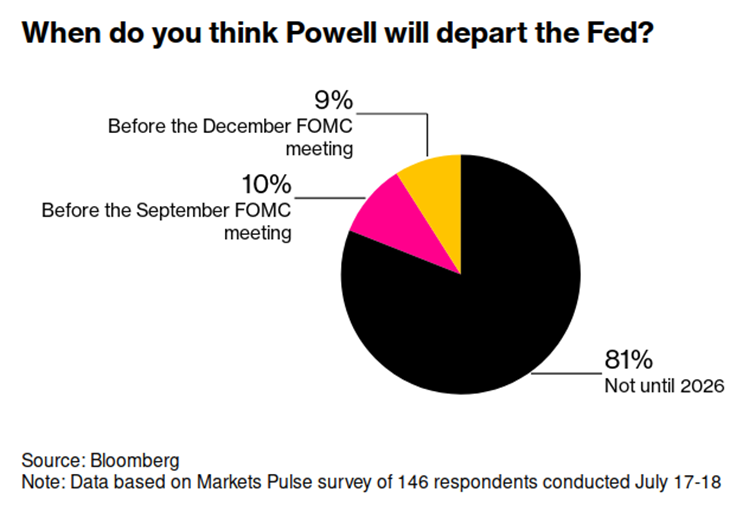

In this regard, each commodity rally has been explained by specific factors. For example, gold, which has been hitting highs for several weeks, has found an equilibrium point around $3,350/oz. “Although its role as a safe haven asset has slightly weakened due to a lower perception of risk, I still see several catalysts that could push it toward $3,500/oz by year-end. Among them are possible Fed rate cuts, likely starting in September; U.S. fiscal uncertainty tied to the ‘Big Beautiful Bill’ debate; continued central bank purchases (which I estimate at about 1,000 tons annually); and a greater tolerance for the opportunity cost of holding non-yielding gold in the face of rising sovereign risk,” explains Hottner.

From WisdomTree, they point to multiple macroeconomic risks supporting its valuation. Specifically, they cite trade uncertainty, debt trajectory, institutional quality, geopolitical risks, and ambiguous dollar policy.

“After its intraday high of $3,500/oz on April 22, 2025, gold has fluctuated between $3,180 and $3,400/oz. The lower end aligns with the 76.4% Fibonacci retracement level, and while our forecasts suggest a potential short-term break below this level, we anticipate strong support near the 61.8% level ($3,024/oz), paving the way for a rebound. For Q2 2026, we project that gold could reach $3,850/oz based on consensus macroeconomic data. We view the current period as a ‘loading spring’ phase, setting the stage for a strong upward move in gold prices,” says Nitesh Shah, head of commodities and macroeconomic research at WisdomTree.

The Vontobel expert also adds that, unlike gold, both silver and platinum have risen sharply, though more due to investment flows than strong fundamentals. “In the case of silver, the recent surge stems from growth in the solar sector, but there are regulations in China that could slow that momentum. As for platinum, the enthusiasm is fueled by shifting Chinese consumer preferences, although I believe prices may already be overextended,” she adds.

Industrial metals

For Carsten Menke, head of next generation research at Julius Baer, several factors also lie behind the price jump in iron and steel. “With prices significantly above their early summer lows, sentiment in the Chinese iron ore and steel markets appears to have shifted. One reason is the expectation of supply-side reforms in the steel industry, which cannot benefit both markets at the same time, as lower steel production implies reduced iron ore consumption,” says Menke.

It is worth noting that in 2024, China produced over 1 billion tons of steel—more than half of global output—of which it exported nearly 120 million tons, far more than any other country. According to Menke, sentiment in the Chinese iron ore and steel markets seems to have changed in recent weeks. “Prices have risen between 10% and 20% from their early summer lows. Since the structural overcapacity in the steel market is affecting global trade and tariffs, supply-side reforms in China would be essential to restore balance to the global market,” he explains.

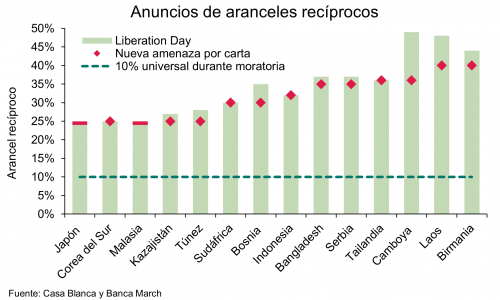

Copper also deserves mention, as it climbed back above $10,000 per ton in early July. In this case, Menke suggests what might be attributed to easing trade tensions and reduced recession risk is actually driven solely by tariffs.

“The expectation that the U.S. will impose tariffs on copper imports has caused a sudden increase in U.S. imports. This has turned a balanced market into a tight one. That said, copper will be restocked in the market at some point. We continue to project a market with sufficient supply this year, but we remain concerned about demand prospects due to U.S. importers’ early buying ahead of potential tariffs on China,” Menke concludes.

Oil and industrial metals

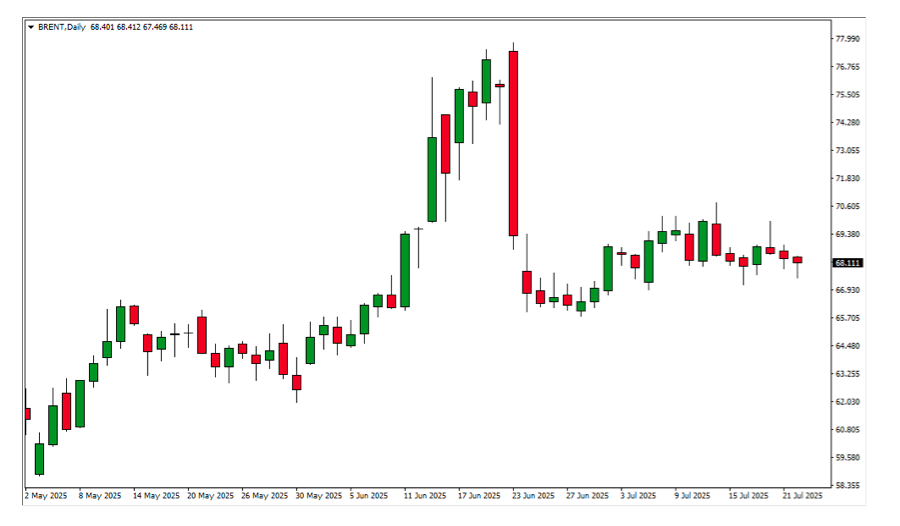

Finally, experts point out that oil has been at the center of significant volatility, with conflicts in the Middle East and Ukraine driving brief price spikes, particularly following Israeli attacks on Iranian facilities and direct U.S. involvement.

“For the second half of 2025, I anticipate a bearish scenario with expanding global supply: non-OPEC production continues to grow, with projects in Brazil, Guyana, Angola, the U.S., and Norway, and OPEC+ may reverse some of its cuts, adding 0.5 million barrels per day in September. Moreover, demand this year will be weaker than usual, leading to oversupply after the summer,” says Hottner.

Finally, the expert from Vontobel notes that, on the agricultural front, the first half of the year was relatively calm, but he sees the second half as presenting interesting opportunities and significant risks. “Record corn harvests in the U.S. and Argentina, along with possible trade realignments with China, will be key factors. Toward the end of 2025, the focus will shift to weather conditions in South America and regulatory decisions such as new biodiesel blending mandates under EPA (Environmental Protection Agency) rules in the U.S.,” he concludes.