Inflation on Target and Resilient Growth: Has the ECB Finished Its Job?

| By Amaya Uriarte | 0 Comentarios

International asset managers believe that the European Central Bank (ECB) has entered a new pause phase. In its meeting this week, the monetary institution kept rates unchanged and, despite offering few clues, indicated that it would take more time to assess economic developments in an international context it acknowledges as complex.

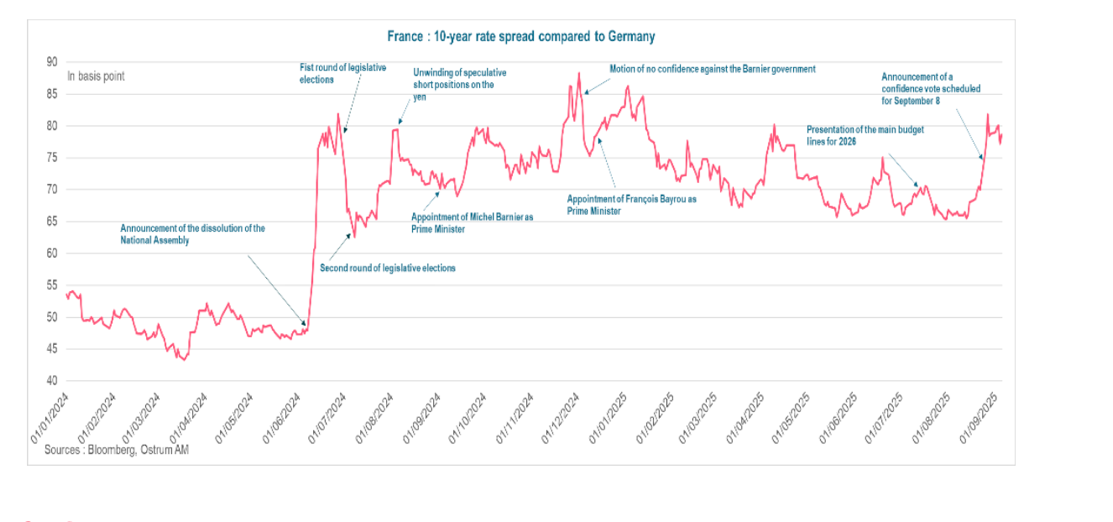

“President Lagarde reiterated that future monetary policy decisions will depend on data, while emphasizing that current rates are within the range the ECB considers neutral. Growth forecasts for 2025 were revised upward to 1.2%. Regarding the political situation in France, President Lagarde stated that it is not a matter for the ECB to comment on, while conveying the message that fiscal responsibility is extremely important,” summarized Felipe Villarroel, partner and portfolio manager at TwentyFour AM (a Vontobel boutique).

For Forest, it is significant that the interest rate gap with the Federal Reserve is expected to narrow in the coming months. “With signs of a weaker U.S. labor market, the Fed could cut rates twice this year. However, price pressures related to tariffs could resurface, leaving Jerome Powell caught between political pressure from President Trump and a shrinking margin for maneuver,” explains the CIO of Candriam.

Despite political instability, this September meeting gives the impression that the ECB has fulfilled its role. “At a time when free trade is faltering, political tensions are resurfacing, and the independence of the Federal Reserve is being questioned, the eurozone can count on a credible central bank. It has managed to navigate smoothly through the turbulent environment of recent months,” notes Raphaël Thuin, head of capital markets strategies at Tikehau Capital.

Has Its Job Finished?

For Luke Bartholomew, deputy chief economist at Aberdeen Investments, the most relevant question is whether the ECB has truly concluded its easing cycle or is merely pausing before implementing further cuts in the future. In his view, the economic forecasts seem broadly consistent with the idea that this easing cycle has come to an end.

“We continue to believe that the next move is more likely to be a rate hike rather than a cut, although this may still take time to materialize. Of course, a sharp rise in France’s financing costs could still destabilize the eurozone economy and force new stimulus measures. However, an explicit ECB intervention in the French debt market still seems distant,” says Bartholomew.

In the opinion of Nicolas Forest, CIO of Candriam, with interest rates already at neutral levels, the European Central Bank has largely achieved its immediate objective of containing inflation. Although he acknowledges that, in the current scenario, the ECB is keeping all options open, its next decisions will depend on whether incoming data continue to show moderate improvements or whether U.S. tariffs and the deterioration of the Chinese economy weigh more heavily on Europe.

Irene Lauro, eurozone economist at Schroders, also sees the ECB’s decision as confirmation of her view that the easing cycle has ended. “With declining trade uncertainty, the eurozone recovery will accelerate. The risks for the eurozone have shifted from trade uncertainty to political instability, with France now in the fiscal spotlight. But the resilience of the economy and the strengthening of domestic demand mean that the ECB can afford to maintain its monetary policy unchanged,” she argues.

When it comes to cuts, Sandra Rhouma, vice president and European economist on the fixed income team at AllianceBernstein, believes there may be one more cut before the end of the year, although the monetary institution will need “compelling evidence.” Rhouma argues that the ECB is in “a good position,” as President Lagarde often repeats, which also means they could and should apply further cuts when necessary.

“I believe the data at the December meeting will be convincing enough, but we must acknowledge that the ECB’s current reaction function increases the risk that no further cuts will occur this year. Particularly given that they continue to ignore signs of falling below their medium-term target, as reflected in their own forecasts,” she adds.

In this regard, Guy Stear, head of developed markets strategy at Amundi Investment Institute, adds that by lowering the inflation forecast for 2027 to below 2%, the ECB could be paving the way for a rate cut before the end of the year. “ECB President Christine Lagarde is optimistic about growth, but we are concerned that all efforts to reduce deficits outside Germany may end up hurting consumer demand,” explains Stear.

Implications for Investors

Markets interpreted Lagarde’s comments as hawkish, further reducing expectations for an additional rate cut in the future. Following these statements, a modest bear flattening of the Bund curve occurred. “Given positioning tensions, we cannot rule out further modest flattenings in the 5–30 year segment in the short term, although we suspect that, once a rate cut is completely ruled out, the curve will begin to steepen again. The balance of risks suggests that curves will remain steep or steepen further in the medium term,” notes Annalisa Piazza, fixed income research analyst at MFS Investment Management.

According to Forest, this environment points to a period of higher volatility but also of opportunities: European growth, together with supportive fiscal measures, could sustain certain segments of equities and credit, while the prospect of rate cuts in the U.S. would increase demand for high-quality bonds.

According to David Zahn, head of European fixed income at Franklin Templeton, following the ECB’s September meeting, the decision to keep rates at 2% reflects stable inflation amid signs of slowing growth. “We consider monetary policy to remain broadly neutral, which favors short-duration bonds and high-quality defensive equities. The financial sector could come under pressure if rate expectations remain subdued, while geopolitical and energy risks require close monitoring,” says Zahn.

Some firms believe that fixed income is quietly recalibrating. According to Thomas Ross, head of high yield at Janus Henderson, investor confidence should be supported not only by the ECB’s benign view on downside risks to the economy, but also by the possibility of a new cut to add further protection and consolidate a low-volatility environment. “In our view, yield-capture strategies—such as securitized credit, corporate credit, and multi-sector income strategies—should attract greater interest from investors,” says Ross.

The expert highlighted that the places of origin of ingredients such as austral hake or deep-sea grouper—“which is caught at 2,000 meters, or the famous smoked salmon (sourced from some of the most pristine waters in the world), smoked with native woods like lenga”—give them a unique and unfamiliar flavor, suited to the most discerning palates.

The expert highlighted that the places of origin of ingredients such as austral hake or deep-sea grouper—“which is caught at 2,000 meters, or the famous smoked salmon (sourced from some of the most pristine waters in the world), smoked with native woods like lenga”—give them a unique and unfamiliar flavor, suited to the most discerning palates.