AI: The Formula to Convert “At-Risk Customers” Into “Loyal Customers”

| By Amaya Uriarte | 0 Comentarios

Despite the imminent arrival of the so-called “generational wealth transfer,” which will bring a larger number of high-net-worth individuals (HNWIs) and fewer advisors to serve them, many wealth management firms are simply not prepared for success. According to the report “Capturing HNWI Loyalty Across Generations,” published by Capgemini, to ensure that private bankers can interact effectively with this new generation, firms must evolve rapidly on an organizational level but, above all, technologically.

“Wealth management executives who delay will face significant risk of losing both investors and talent to more agile competitors. The leading wealth management firms are adopting AI-based, industry-focused relationship management tools, as well as omnichannel experiences that eliminate manual processes, provide real-time guidance, and autonomously perform predefined tasks. By supporting their advisors and building loyalty among the next generation of HNWIs, these firms are positioning themselves to ensure long-term engagement and sustained business benefits,” the report’s authors state.

Signs of Impending Disruption in the Sector

With the global increase in the population of high-net-worth individuals (HNWIs), many wealth management firms are optimistic about expanding the population they aim to serve. In this context, the report asserts that “the great wealth transfer is also set to disrupt the wealth management sector by significantly straining, or even breaking, well-established loyalty ties.”

According to its analysis, private bankers now face the convergence of three significant trends related to HNWI loyalty. The first is a shift in investment preferences among the next generation of HNWIs. “Comprising Generation X, millennials, and Generation Z, this group expects hyper-personalized engagement. In fact, 81% of next-generation HNWIs plan to quickly leave their parents’ wealth management firm, driven by factors such as the lack of preferred digital channels (46%), lack of alternative investments (33%), and insufficient value-added services (25%),” it states.

Secondly, there will be an increase in the volume and diversity of HNWIs. The report indicates that as family wealth passes down through multiple successive generations, the number of clients to serve grows exponentially. Moreover, more than half (56%) of total wealth is expected to be transferred to women, who may have investment goals, styles, and priorities significantly different from those of men.

And thirdly, firms will face a changing landscape due to the imminent wave of retirements, which will leave an increasingly smaller number of experienced bankers. “Who will take their place? A stream of young, digital-native professionals who expect the workplace to evolve both technologically and culturally. In fact, they are already expressing such significant discontent that approximately one-fourth plan to switch wealth management firms or start their own in the near future,” the document states.

In other words, in the very short term, there will be more high-net-worth clients to serve, with a broader range of expectations for hyper-personalized services, while the supply of senior bankers will drastically decline.

The Value of Private Bankers

As for the importance of the banker in the loyalty-building process, our research also revealed that two-thirds of next-generation HNWIs consider the strength of a firm’s private banker team a key factor when choosing a wealth management provider. Sixty-two percent of next-generation HNWIs state they would follow their relationship manager if they moved to another firm, meaning loyalty is no longer based on the institutional ties felt by previous generations.

However, 56% state that their firms lack the necessary tools to meet the needs of next-generation HNWIs—namely: proactive information, personalized recommendations, and seamless communication across different channels. In light of the report’s findings, it is clear that to build loyalty among next-generation HNWIs, wealth management firms must strengthen their relationship management stance. This includes modernizing live and self-service technologies required to meet client expectations.

The Right Technology at the Right Time

The report notes that, as in many current situations, leveraging automation strategically is not about adopting technology for its own sake. According to its assessment, the key lies in understanding what next-generation HNWI clients expect from their wealth management firm and what tools private bankers need to earn their loyalty.

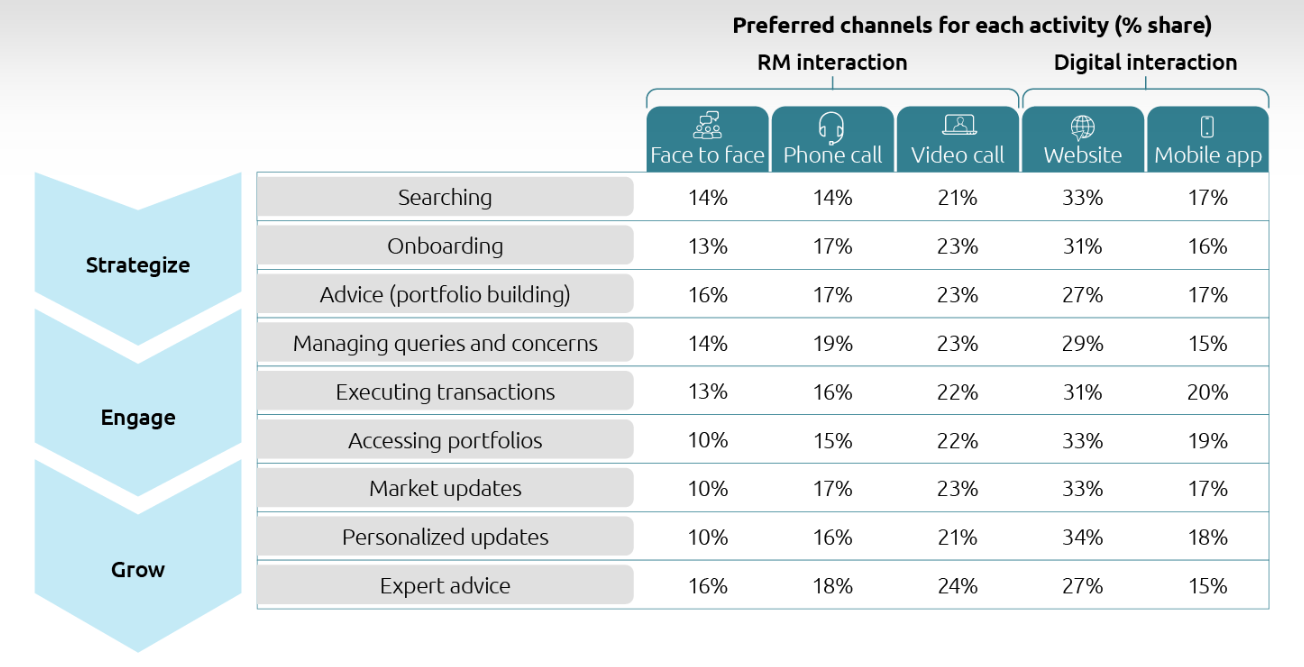

For example, despite the ubiquity of mobile apps, a surprising finding in the report was the greater interest of next-generation HNWIs in video calls and website interactions over mobile apps. In some types of interactions—such as making inquiries or addressing a concern—even traditional phone calls prevailed over apps.

“Less surprising was the decline in interest in face-to-face meetings, which generally received the lowest rating across all interaction types. The only exception was seeking expert advice, where face-to-face meetings ranked second to last—although only by a small margin,” the report concludes.