“In 2015 Feminism Is A Business Issue”

| By Alicia Miguel | 0 Comentarios

The future looks very bright for women in finance, says Barbara Stewart, CFA. Author of the Book “Rich Thinking 2015: Future of Women& Finance”, and guest speaker at CFA Spain “Future of women and Finance” Forum. Stewart, portfolio manager at Cumberland Private Wealth Management Inc. Toronto. Canada, explains in this interview with Funds Society that the financially confident woman is the number one target market and technology has levelled the playing field for women.

How do you see the future of women in finance, and in the asset management industry in particular?

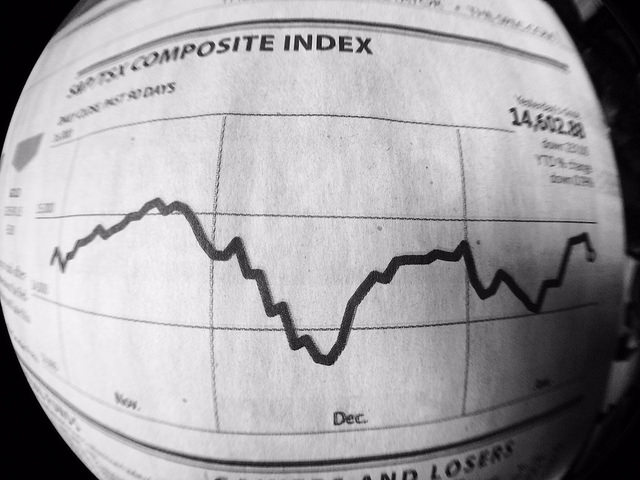

The future looks very bright for women in finance! Many studies now show that more women = more money and this is a very compelling equation for a still quite traditional investment industry. My research findings are clear that a) feminism makes good business sense, b) the financially confident woman is the number one target market, and c) technology has levelled the playing field for women. Women are huge users of social media and with respect to the asset management industry, – this is beginning to radically change the way we inform our clients about stocks and bonds, the way we find our clients, as well as the way we communicate with our clients.

Women presence is still poor in the investment industry … do you think it will grow over time? Will women take on positions of greater responsibility?

Because of the fact that we will have more and more financially confident women as clients, we will need more sophisticated advisors to work with them. My research has shown that women like to communicate in a language that makes them comfortable and they prefer to invest in causes and concerns that matter to them. The best advisor moving forward? A highly competent male or female advisor who uses a holistic approach and integrates the so-called feminine values of empathy and open communication. Many firms are attempting to attract female advisors because they are a natural fit for this role.

How these developments can benefit the financial and asset management industry?

These developments are great for the industry because once again, it has been proven that more women equals more money. Simply put, women are making more money, they are controlling more money and they are making most of the financial decisions in their families. Our industry needs to do a good job marketing to these financially confident woman – she is the future. If we market to these women properly (using their preferred method of communication and accurately reflecting their values when we suggest various investment alternatives) – we can capitalize on this opportunity to attract significant assets from this critical demographic.

What the advantages of diversity are for companies in the finance and the investment industry?

According to Dr. Ann Cavoukian, one of the ‘smart’ women that I interviewed for my white paper this year (Executive Director, Privacy and Big Data Institute, Ryerson University, Toronto, Canada) – “Feminism is not about saying no to makeup. It is about saying yes to academic, economic and social freedom for both men and women.” In 2015 feminism is a business issue. This type of open communication (through diversity) leads to a better functioning marketplace and a better functioning workplace. Progressive firms that embrace diversity currently have a competitive edge. Firms that “get it” have a But this won’t be the case for much longer. Soon ‘business feminism’ will be normal – just like using computers or using electricity.

How the role of women is as a customer of the financial industry? Is it an important target group? Are women needs different to those of men?

My research has shown that women prefer to learn about and/or hear about financial matters through either informal instruction (via social media/gamification/sharing platforms) or through real-life stories. This means that we need to be ultra-precise when communicating with or marketing to financially confident women. They prefer to invest in causes and concerns that matter to them so our job as advisors is to help them align investment ideas with their values. Most importantly, realize that women aren’t risk averse, they are risk aware. They may take longer to make an investment decision but they will do their homework and take calculated risks. Success with this number one target group will be all about better communication – in the way that they prefer to communicate. And if you make it meaningful to women, they will invest in your product or service, and they will do so with loyalty.

Every time there are more women in major positions: Mrs. Janet Yellen in the FED, Mrs. Christine Lagarde at the IMF… How do you think people perceive them because their women role? Do you think they are judged differently than men?

Actually no. I think there was a time when female role models were being judged differently than men but I don’t think that is still happening. Of course there will always be “unconscious bias” but ultimately it is results that count in the business world and as long as these highly visible women are producing results, well … it is becoming more and more accepted that they are truly top performers and we need them. The beauty of seeing more and more female role models is that it is self-perpetuating – it is becoming more mainstream to view women as effective leaders.

What is the role that women are called to play in the future of the financial industry in Spain, and worldwide?

We need women to act as excellent communicators and to enable the transformation of the industry. We need to restore trust and the best way to do this is through the integration of social media and marketing. One of my interviewees – a behavioural economist, Dr. Gemma Calvert (Founder of Neurosense, Singapore) said – “women may not trust the investment industry but they will trust each other”. The way forward is for smart women to share their positive stories about success in work and life … and inspire other girls and women to think “I can do that too!”

How the investment industry may become a better place for women?

The investment industry is the best place for a woman to work in my opinion. Why? Because you get rewarded for your results. So if you learn how to make money you will have not only financial independence but also the freedom to come and go as you please. And technology has changed everything. Women want to work from anywhere and now they are able to do just that. The role of an investment advisor can accommodate this need for flexibility so that women can continue to live their lives and structure their work schedules around their lives and competing responsibilities/interests.