“We Definitely See More Opportunities in European Equities and Particularly in Small and Mid Caps than Three Months Ago”

| By Alicia Miguel | 0 Comentarios

Thomas Angermann is a member of the Specialist Equities Team at UBS Global AM, based in Zurich. Specifically he is responsible for the management of a number of Pan European small and midcap mandates. In this interview with Funds Society, he explains why the growth potential currently offered by Small Caps is higher than the one that can be found for Large Caps.

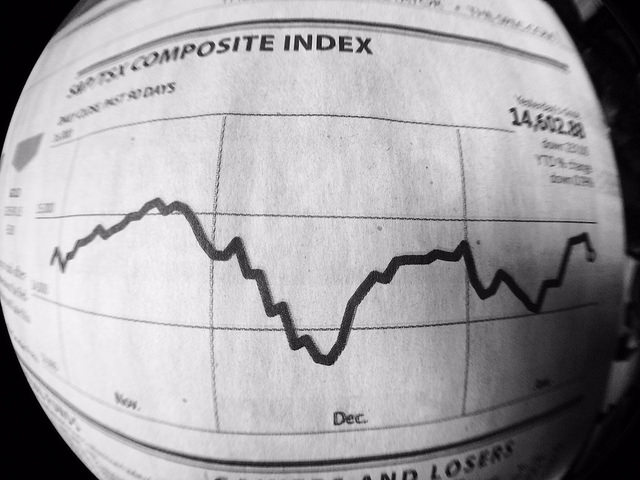

Do you think the current momentum is good for European Equities? Has the equity valuation improved after the market correction in August?

After the recent market correction the valuation for European equities looks interesting now. We definitely see more opportunities in European equities and particularly in Small and Mid caps than three months ago. We think the current correction is healthy as the market is pricing out the too high growth expectations.

Which will be the key factors for the revaluation? Which factor will have a greater importance: Profits, QE support or other macro factors?

Three main drivers should be mentioned. First, the potential earnings growth for the next year as well as the current expectations about this growth potential. Second factor, the Chinese economy, it seems we see first signs of stabilization, however we are still waiting for robust evidence on this. The adjustment from the pure investment driven economy of the past to a more balanced consumer driven economy of the future will take years. That will also create a lot of opportunities. The third factor is monetary policy by the central banks. We think they will stay accommodative but we do not count on any additional measures yet.

In general, what are the risks of short/medium tern correction in European stocks markets? In particular for Small Caps?

As before, three main risk drivers should be highlighted. The first risk we face are Emerging market turbulences. Specifically how the Emerging markets growth pattern will behave in the upcoming months and the level of volatility of EM currencies. We should keep an eye on how this will impact European export driven economies. The second driver is the behavior of the European consumer and to what extent it will remain supportive. A third risk factor would be given by central banks. However, as previously mentioned, we do not expect any upcoming change in their policies and it seems a first interest rate hike by the Fed is desired by the markets.

What extra value are Small Caps going to add vs. Large/Midcaps? Can Small Caps offer greater potential opportunities?

First of all the growth potential currently offered by Small Caps are higher than the one that can be found for Large Caps. Additionally Small Caps offer M&A opportunities, as in the current low growth environment larger companies might add growth by buying smaller companies. We expect that the M&A activity will increase, founding its main targets in the Small Caps universe rather than in the Large Cap world. A second factor is the daily volatility. Surprisingly during last months the volatility registered for Small Caps has often been lower than the one for Large Caps. However we will need further evidence of this pattern.

Is the SC sector affected anyway by general elections (such as the Spanish ones)?

Regarding elections, Small Caps sector is as much affected as the Large Caps sector is. We do not expect any remarkable long term impact coming from the Spanish political situation. However there might be short term effects.

Do you think that volatility will increase in the upcoming months? In this sense, which would be the consequences of a volatility increase regarding your investment style?

Since volatility has already been increased since end of last year with additional acceleration during August and September we do not expect further significant increases under current market conditions. However, in the case of a “Black-Swan-Event” (occurrence of something important which was not expected) we will see an further increase. Nevertheless we would not change our investment style and we would stick to our stock picking approach but would have an even closer look at our risk systems.