NewsMarkets

The Expert’s View

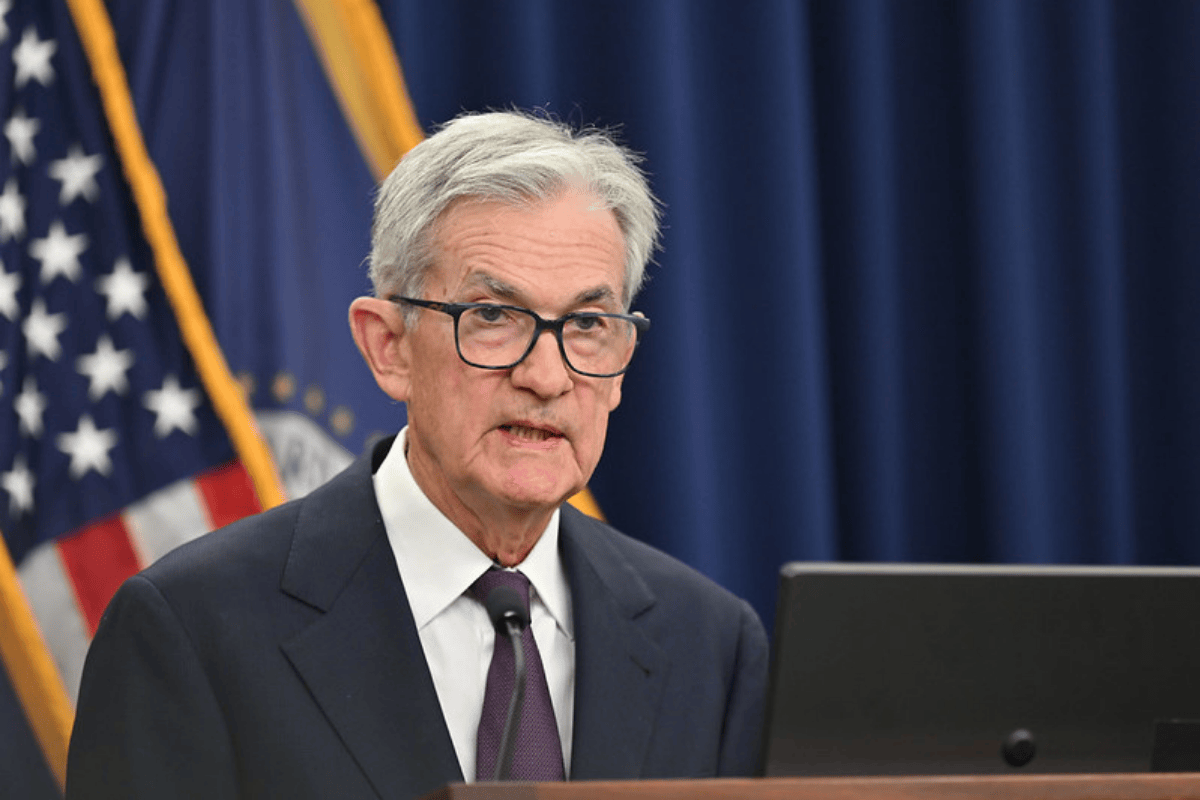

Labor Market in U.S.: Superficial Stability and Underlying Pressures

The year begins with few surprises on the macroeconomic front. The U.S. labor market remains in a gray area: hiring appears sluggish, yet there are no significant increases in layoffs. The December ADP private employment report came in below expectations (41,000 vs. the expected 50,000), although it confirms a trend of stability since mid-2025. For ...