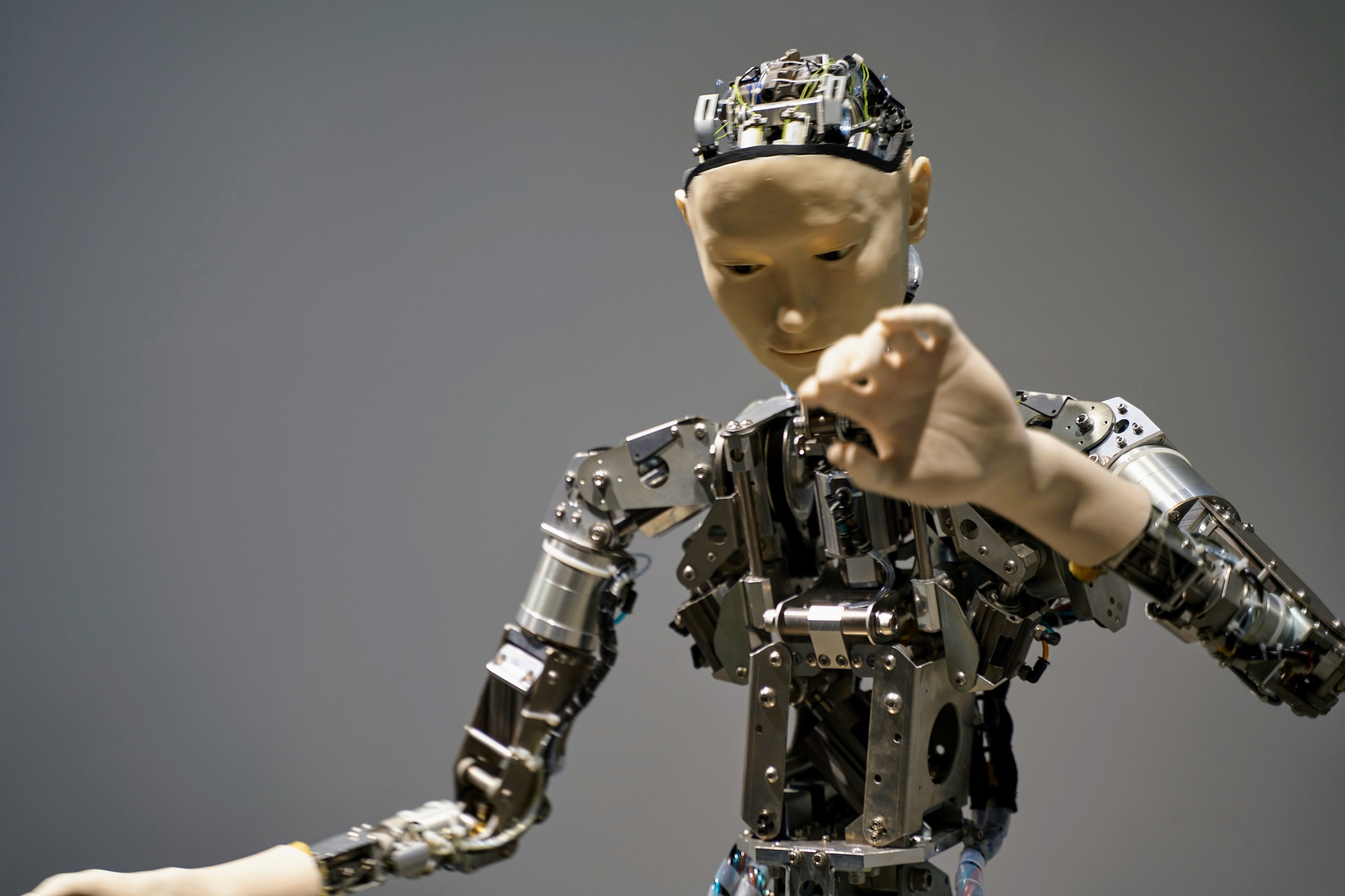

Ever since the first computers were designed, people have envisioned machines working to serve humanity. Many fundamental obstacles to that vision today have been overcome through innovation, creating a society where artificial intelligence (AI) is increasingly integral to our lives. For investors, the question now is how to position their portfolios to benefit from what many are calling the Fourth Industrial Revolution.

AI is using machines to understand, learn, and act on inputs from data being generated by an ever-growing number of digital devices, from smart watches to sensors monitoring livestock. AI finds patterns that humans can turn into insights, creating a feedback loop so machines can learn. What does this mean to investors? In our view, it means that businesses will be more productive and profitable.

This creates, in our view, a significant opportunity for investors. Advances in digital technology, including AI, have been so great lately that economist Tyler Cowen, author of The Great Stagnation, has said that total factor productivity (TFP) could reach record highs in 2021 after a decade of stagnating. Cowen is not alone seeing a bright future. A World Economic Forum report published in October wrote, “As the economy and job markets evolve, 97 million new roles will emerge… (largely) in fourth industrial revolution technology industries like artificial intelligence.” The report said that the most successful firms will be those that “reskill and upskill” workers to leverage AI and other digital advances.

Investors seeking to find potential winners can start by grouping AI companies into three categories; firms advancing AI technologies that can be sold as platforms and/or services; firms deploying AI to give them a competitive advantage; and, companies that are using AI to disrupt entire industries.

AI is fundamentally about making sense of large volumes of data, a challenge that naturally favors some data-intensive industries. For example, the Information Technology and Communications sectors have embraced AI to develop personalized services. Manufacturers use AI to advance factory automation and financial services firms use algorithms to develop new products. Some financial firms use AI to assess corporate Environmental, Social and Governance actions, using the technology to improve risk management and, potentially, the performance of portfolios.

Investors can also find AI innovators within various investment themes. Smart City projects use AI to create solutions for such challenges as reducing congestion and crime. Within the Internet of Things theme, innovative firms are adding more and more computing form factors to gather the data, adding devices in everything from refrigerators to farming irrigation systems and manufacturing supply chains.

In 2020, AI became more important as companies embraced digital transformation, using AI-enabled cloud solutions to better engage their customers, especially remotely. Part of this digital evolution has involved advances in cybersecurity. AI could be called the “arms merchant” of cybersecurity; helping create solutions to protect firms against cyberattacks and being used by hackers to find vulnerabilities. As more economic value comes online, firms advancing AI-enabled cybersecurity solutions should benefit.

AI is also increasingly important in the medical and pharmaceuticals sectors. That was evident in 2020 as AI technology rapidly sequenced the COVID-19 virus, facilitating an efficacious vaccine in a matter of months rather that the decade such an effort could otherwise have taken.

As AI becomes ubiquitous, the lines between sectors are blurring. Whether a certain firm is considered an automaker or a tech company may be a question of perspective. These blurring lines expand the opportunity set for investors that are willing to identify the firms that are making smart investments in AI to differentiate their products in ways that could facilitate a growing profits and market share.

The leadership of individual firms is also crucial. Investors should seek to identify the leaders with the courage to make the financial and cultural investment needed to leverage AI to gain market share, shift profits higher and to increase their share of overall industry profits.

Investors should monitor some key risks. There is a growing consensus that regulations may be needed to slow fake news and hate speech that can undermine democratic institutions. However, such regulations could benefit social networks if those new rules held people propagating hate speech, or fake news, legally responsible for the damages caused by their actions. Such rules, coupled with algorithms promoting reputable content, could ultimately improve social media for the common good.

Similarly, as data proliferates, privacy is another concern that may become even more acute as new technologies such as facial recognition become commonplace, suggesting a need for more rules.

Developing the appropriate legal framework should help the industry grow by removing a key risk to the outlook. Meanwhile, many questions remain: Who should be responsible when an intelligent medical X-ray machine produces an erroneous diagnosis—the radiologist, the hospital or the maker of the X-ray machine’s software? Similar legal issues must be resolved with self-driving cars, an area where progress has been much faster pace than I expected.

Beyond its investment potential, AI can help take the robot out of ourselves by eliminating all manner of mundane tasks, in the end, leaving investors with more time to enjoy the fruits of their labor.

Column by Sebastian Thomas, Lead Portfolio Manager for Global Artificial Intelligence at Allianz Global Investors