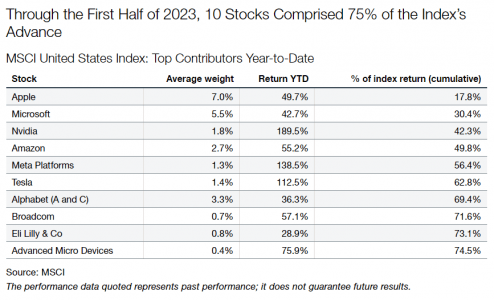

A few mega-cap stocks have driven market returns so far this year. Just ten companies have produced three-quarters of the return of the MSCI United States Index through the first half of 2023. This has led investors — generally those who missed owning these leaders — to complain about narrow “market breadth.” Implicit in this view is that more stocks should be producing positive returns. But is this intuition correct? Is the market’s narrow breadth a signal of trouble to come? Should we expect the softer names to eventually catch up?

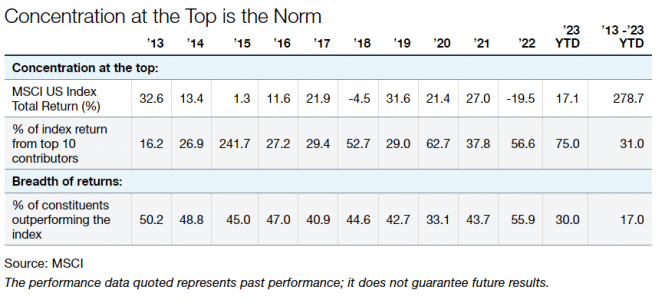

We compared the concentration of returns through the first six months of 2023 with the preceding ten years. As shown in the table below, 2023 has been more extreme than normal. This year, 75% of the market’s return was produced by just ten stocks. In most years, the top 10 stocks produce about a third of the market’s return.

But this historical pattern is still highly concentrated. To have 10 stocks — out of hundreds in the index — generating a third of the index return is not a broad market. It is a narrow market. To our mind, this suggests that expecting market “breadth” is generally a misguided assumption.

The table also illustrates the percent of constituents that outperform the index. In almost every year, less than half of stocks outperform the overall index. This year, the ratio is lower than normal at just 30%, another illustration of the higher-than-normal concentration. Importantly, over the entire sample period, the ratio is lower still at just 17%. That the success rate diminishes at longer horizons demonstrates the reduced chance of a stock sustaining outperformance over multiple years.

A large body of empirical work proves this point more rigorously. Academic researchers have analyzed decades of data in both the U.S. and international equity markets. Their work demonstrates that stock returns are very concentrated at long horizons. Hendrik Bessembinder, a finance professor at Arizona State University, found that just 4% of stocks produced all the net dollar wealth creation in US equity markets over the nearly century-long period from 1926 to 2019. The other 96% of stocks, in aggregate, added no value over their respective lifetimes.

Professor Bessembinder titles his article with a provocative question: “Do stocks outperform Treasury bills?” He shows that the answer is no. Four out of every seven stocks have lifetime buy-and-hold returns less than one-month Treasuries over matched timeframes. In other words, the median stock will underperform a risk-free bill over its life.

This contradicts our intuition about equities. How can the stock market deliver attractive returns, even if most stocks are duds? The answer is that market averages are driven by a small number of exceptional performers. Over time, these big winners grow into larger index weights and become the primary drivers of returns, while the losers shrink into irrelevance. In equity investing, you should not expect the average stock to deliver the average result.

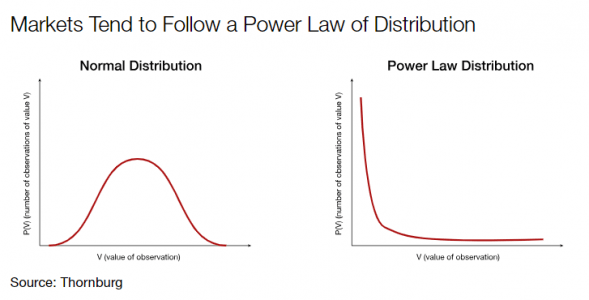

Stock markets follow a power law. In a power law distribution, the average result is pulled higher by a few positive outliers, while most results are far below average. This is distinct from the classic “bell curve” normal distribution that characterizes most randomly distributed variables. The charts below illustrate these two distribution functions.

For example, the height of American adult males is normally distributed around a mean of 5’9”. In a normal distribution, the median observation will be equivalent to the mean (or average). If you took a group of 100 men, arranged them in order of height, and then pulled out the man in the 50th position, he would probably be 5’9” tall. The median and the mean are the same.

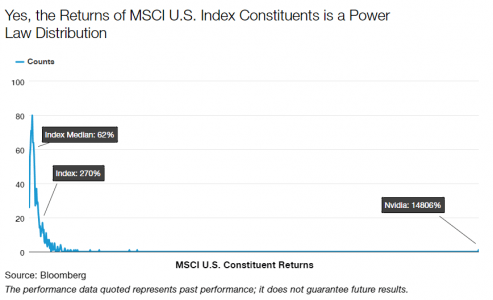

This does not hold true for stocks, particularly over longer horizons. Let’s return to the MSCI United States Index to see if it exhibits a power law distribution. Over the ten and half years of our analysis, the index delivered a total return of 13.5% annualized, or 278% cumulatively1. That’s the market average. There were 1,004 distinct stocks in the index over the period. The best was Nvidia Corp, which returned nearly 15,000% cumulatively. On the other side, there were several stocks roughly tied for worst that lost around 90% of their value, including First Republic Bank, Affirm Holdings, and SunEdison Inc. The median stock, or the one right in the middle of the list, was Eastman Chemical Co., which returned 62% cumulatively, or about 5% per year. As we should expect from a power law distribution, the median is not representative of the average result, but rather significantly worse than average. The average was pulled up by a very small number of positive outliers.

At Thornburg, we hunt for these outliers. Our portfolio managers and analysts search globally for exceptional companies that have the potential produce these positive results. This may come in the form of powerful growth that exceeds market expectations, or more consistent growth that compounds over time. Both types of companies populate the lists of top performing stocks. As active investors, we assemble concentrated portfolios of stocks with these characteristics, and aim to hold them for the long term to allow compounding to work.

While commentators are correct to observe that this year’s market is narrower than normal, market breadth is a myth. A few stocks drive most returns over time. Power laws are the rule, not the exception. It’s not just academics who have figured this out. As Warren Buffett acknowledged in his most recent letter to Berkshire Hathaway shareholders: “The lesson for investors: The weeds wither away in significance as the flowers bloom. Over time, it takes just a few winners to work wonders.”

Opinion piece by Nicholas Anderson, CFA, Portfolio Manager and Managing Director in Thornburg Investment Management.

Important Information

Investments carry risks, including possible loss of principal.

Any securities, sectors, or countries mentioned are for illustration purposes only. Holdings are subject to change. Under no circumstances does the information contained within represent a recommendation to buy or sell any security.

The views expressed are subject to change and do not necessarily reflect the views of Thornburg Investment Management, Inc. This information should not be relied upon as a recommendation or investment advice and is not intended to predict the performance of any investment or market.

Please see our glossary for a definition of terms.

This is not a solicitation or offer for any product or service. Nor is it a complete analysis of every material fact concerning any market, industry, or investment. Data has been obtained from sources considered reliable, but Thornburg makes no representations as to the completeness or accuracy of such information and has no obligation to provide updates or changes. Thornburg does not accept any responsibility and cannot be held liable for any person’s use of or reliance on the information and opinions contained herein.

This is directed to INVESTMENT PROFESSIONALS AND INSTITUTIONAL INVESTORS ONLY and is not intended for use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to the laws or regulations applicable to their place of citizenship, domicile or residence.

Thornburg is regulated by the U.S. Securities and Exchange Commission under U.S. laws which may differ materially from laws in other jurisdictions. Any entity or person forwarding this to other parties takes full responsibility for ensuring compliance with applicable securities laws in connection with its distribution.