The 2022-2023 global central bank rate hiking cycle has been uniquely challenging for fixed income investors. Most bond portfolios suffered their worst absolute return year in generations due to the rapidly rising interest rate environment, particularly for portfolios and product offerings which took a lot of interest rate risk in the form of longer duration. The most obvious example of this underperformance was in the bond market’s flagship index, the Bloomberg U.S. Aggregate Index (“Agg”), which lost 13.04% in 2022. The index entered last year with a hefty duration of 6.69 years but a yield-to-worst of only 1.75%. As a result, the index (and portfolios like it) could only generate a fraction of the income needed to offset the losses stemming from rising rates. Investors found similar drawdowns in their own fixed income portfolios, whether through offerings structured relative to the Agg benchmark or through direct passive exposure to the Agg itself.

Given the massive size of the fixed income market, at over $100 trillion globally, bond investors have a vast choice among many different types of sectors and securities. Indeed, the heterogeneity of the asset class is an appealing reason to take fixed income exposure in the first place. But despite the sector’s size and diversity, a fundamental tenet of fixed income investing is that each security in the universe really represents exposure to just one of three broad balance sheets: government, corporate, or consumer. There are instances of overlap – for example, a bond backed by a clothing retailer has some aspects of both corporate and consumer exposure. There can also be an overlap in balance sheet behavior; that is, the strength of the consumer can be positive for business performance, and vice versa. However, the balance sheets tend to behave independently of each other.

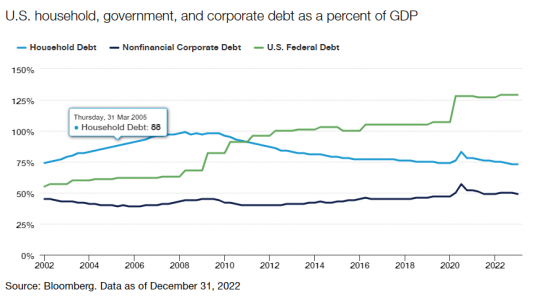

The chart above demonstrates this concept as it illustrates each balance sheet’s debt as a percentage of U.S. GDP over the past 20 years. Government balance sheet fundamentals in the U.S. and many developed markets have been deteriorating due to rising debt and deficits, which explains the consistently rising green line in the chart. Yet over the same period, most notably since the global financial crisis, the consumer balance sheet, as measured by household debt to GDP, has improved notably. Corporate debt as a percentage of GDP has trended modestly higher in the wake of historically low interest rates during the decade of the 2010s, but not to the same degree as the government balance sheet. The critical point is, given these different balance sheet trends, investors need to understand exposure to all three balance sheets, whether in the context of a single multi-sector portfolio or a group of different fixed income portfolios. This understanding is essential to determine if adequate exposure to the credit-sensitive balance sheets (corporate, consumer) can position a portfolio with a different and more effective diversification of risks.

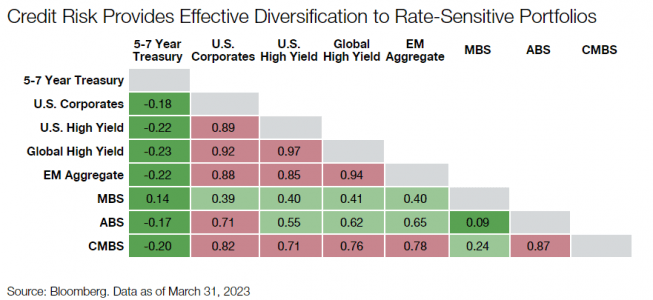

The diversification benefit of credit goes beyond the fundamental behavior of corporate and consumer balance sheets. It is evident in the performance correlation itself between rate-sensitive sectors and credit-sensitive sectors, such as investment-grade corporates, high yield, and various securitized markets. As seen below, we conducted an exercise comparing 10-year correlations between a range of fixed income asset classes. We use the Bloomberg U.S. Treasury 5-7 Year Index as a proxy for interest rate exposure and compare it to various credit-sensitive sectors, also using Bloomberg data. Total returns are used for the Treasury Index data, while excess returns – that is, stripping out a security’s duration effect and looking solely at its credit-driven return – are used for the credit sectors. As seen below, the diversification benefit of credit to rates is crystal clear, with an outright negative correlation of rates to every credit sector, whether corporate or consumer (i.e., household) driven. Credit shows to be a great complement to rates, and as such, we believe pairing credit with rates exposure in portfolio construction creates better diversification to fixed income portfolios.

One can also observe the correlation between the corporate credit sectors (i.e., U.S. Corporates versus U.S. High Yield) is very high. This is not surprising, given both sectors have exposure to the same corporate balance sheet. However, pairing corporates with securitized sectors (MBS, ABS, CMBS) creates diversification benefits, as seen in the light green. Intuitively, this makes sense because consumer balance sheet drivers – that is, housing market trends, unemployment and savings – behave independently of corporate balance sheet drivers (revenue, EBITDA, debt load, etc.). We believe this reveals the importance of building out credit exposure to include both balance sheets and utilizing managers who can pivot successfully between each based on relative value.

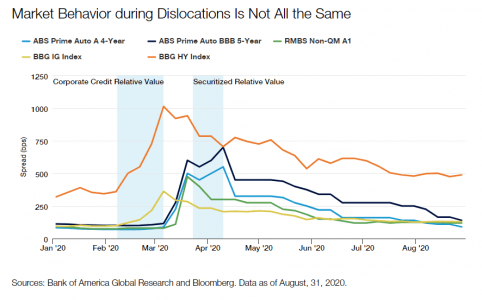

Given the different balance sheet drivers mentioned earlier, we strongly believe that active management is key to analyzing balance sheet behaviors. One can argue the merits of gaining exposure to rates through active or passive exposure, but we believe good credit selection should be an active exercise. In all parts of the market cycle, some credits will perform better than others, and even in market dislocations, credit sectors tend to sell off at different paces. This was most evident during the COVID crisis in 2020, when corporates vastly underperformed securitized sectors as the crisis intensified (see chart below). However, after the Fed announced a corporate credit facility meant to stabilize liquidity, corporate spreads began to recover while securitized sectors subsequently sold off. This shows the power of effective and nimble active management, which allows the ability to shift into credit sectors demonstrating superior relative value when they occur, and a better portfolio outcome versus choosing and investing in only one of the credit sectors.

We believe the concepts discussed in this paper strongly support credit-driven strategies as an effective complement to rates-driven strategies in broader fixed income portfolio construction. This allows for better fundamental diversification and exposure to sectors that have historically correlated negatively to rates. Further, many credit-driven sectors, like high yield, residential mortgages (RMBS), emerging markets, and commercial mortgage-backed securities (CMBS), have all or substantial parts that sit outside of the Bloomberg U.S. Aggregate Index, which again argues for the need to have greater flexibility. In conclusion, active management, which pursues credit-driven strategies, effectively complements interest rate strategies, broadens the opportunity set, and we believe delivers a better risk-adjusted return to fixed income portfolios over time.

Opinion tribune by Jeff Klingelhofer, co-head of investments and managing director at Thornburg IM, and Rob Costello, client portfolio manager.

Important Information