As spring blooms in the northern hemisphere, the green shoots of economic recovery appear to be emerging. This after months of stubborn inflation and banking sector turmoil.

Unfortunately, however, there aren’t yet enough of those green shoots to convince us to shift from the cautious stance we have maintained since the end of last year. Economic prospects are still highly uncertain, particularly in the developed world thanks in large part to sticky inflation.

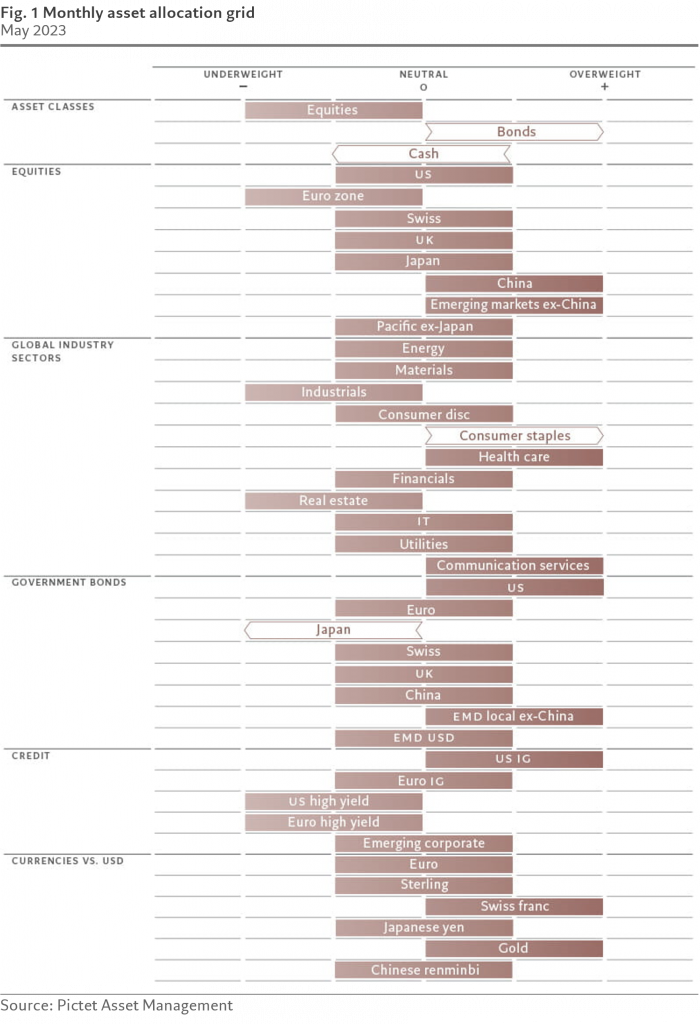

Moreover, corporate earnings estimates are being revised down, as we predicted. We continue to forecast flat earnings per share growth for 2023 in developed markets, which is now largely in line with consensus, but we believe expectations for the years to come are still too high. We therefore remain underweight developed market stocks and upgrade global bonds to overweight.

Our global business cycle indicators are still firmly in neutral territory; they are some way off from turning positive.

We still believe the US can avoid a recession, but its growth prospects aren’t especially bright in the medium term. GDP grew by just 1.1 per cent in the first quarter on an annualised basis – around half the pace that economists had expected.

There are some green shoots: our US lead indicator had shifted into positive territory for the first time in nearly a year, while housing activity, which tends to lead the economic cycle, has picked up from 10-year lows. But we believe that a definitive positive shift is still some way off given the lag in the transmission of tightening monetary policy, which has taken longer to work through the economy than in previous cycles. Consumption growth and non-residential investment will surely slow, while core inflation remains stubbornly high.

Our indicators for Europe are equally downbeat; we believe the region is several months behind the US in the cycle. Recent rate hikes won’t be felt in economic activity for another few months, although solid domestic demand should act as a buffer.

The picture is brighter for emerging markets. First quarter GDP data showed Chinese growth back near potential, fuelled by a rebound in private demand, especially in services. We expect excess savings – worth some RMB5 trillion – to be drawn down over the next two years, giving a significant boost to consumption.

Property markets also look healthier: construction has rebounded from September lows, floor space is increasing, and mortgage rates have fallen 150 basis points from their peak. China’s trade balance has also markedly improved, driven mainly by trade with the ASEAN economies. Our analysis shows that exports are now 63 per cent above pre-crisis levels, led by shipments of electric vehicles.

Our liquidity indicators are positive for emerging market assets but contain red flags for developed market equities. China’s central bank remains in easing mode, encouraging the flow of money and credit into the economy and thus creating supportive conditions for riskier assets.

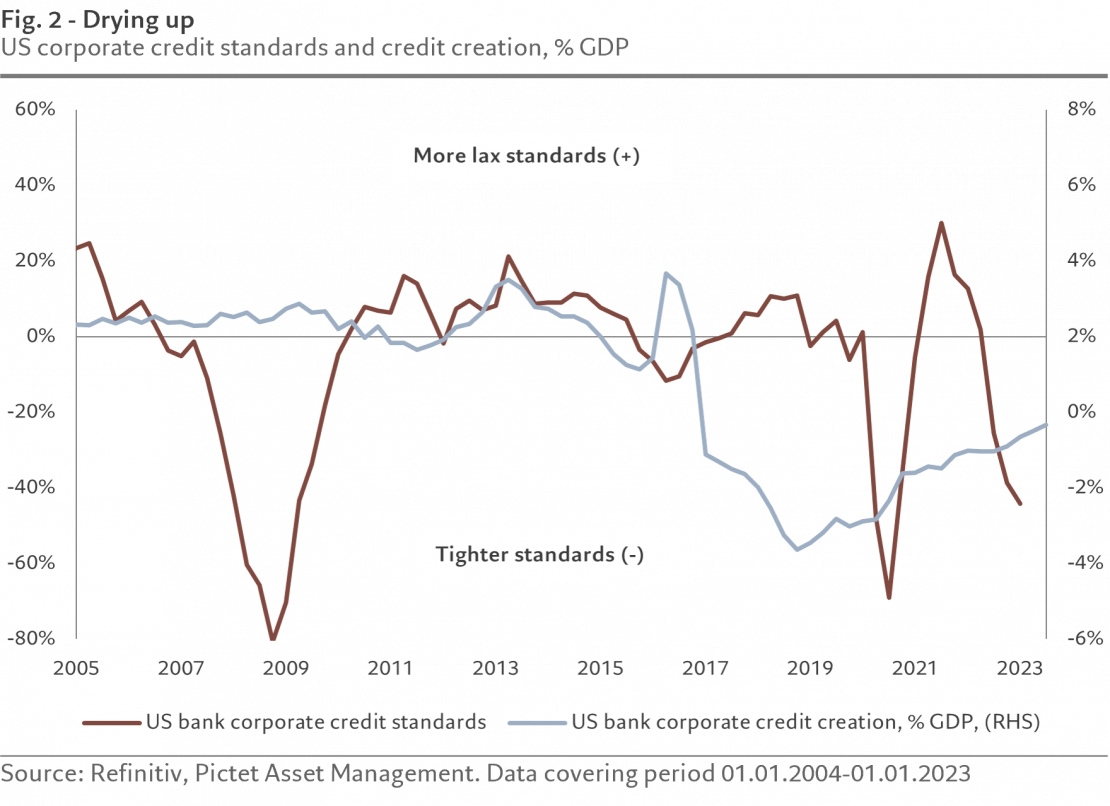

In contrast, the rate hikes delivered by US and European central banks are now starting to weigh heavily on the cost and availability of credit, causing a marked reduction in liquidity. With more tightening likely, conditions could worsen.Private liquidity – that provided by banks and other private sector lenders – was weakening even before the March bank failures and has now deteriorated further. Net interest margin pressures, tighter lending standards and the likely introduction of more stringent regulatory measures are curbing banks’ willingness to lend (see Fig. 2). Euro zone bank lending has come to a standstill, while in the US it’s slowed to just 1.5 per cent of GDP, compared to an average of 4 per cent in both regions in 2022.

We remain confident in the prospects for emerging market stocks and bonds but don’t share the same enthusiasm for developed market equities.

Opinion written by Luca Paolini, Pictet Asset Management’s Chief Strategist

Discover Pictet Asset Management’s macro and asset allocation views.

This material is for distribution to professional investors only. However it is not intended for distribution to any person or entity who is a citizen or resident of any locality, state, country or other jurisdiction where such distribution, publication, or use would be contrary to law or regulation.

The information and data presented in this document are not to be considered as an offer or sollicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information used in the preparation of this document is based upon sources believed to be reliable, but no representation or warranty is given as to the accuracy or completeness of those sources. Any opinion, estimate or forecast may be changed at any time without prior warning. Investors should read the prospectus or offering memorandum before investing in any Pictet managed funds. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Past performance is not a guide to future performance. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested.

This document has been issued in Switzerland by Pictet Asset Management SA and in the rest of the world by Pictet Asset Management (Europe) SA, and may not be reproduced or distributed, either in part or in full, without their prior authorisation.

For US investors, Shares sold in the United States or to US Persons will only be sold in private placements to accredited investors pursuant to exemptions from SEC registration under the Section 4(2) and Regulation D private placement exemptions under the 1933 Act and qualified clients as defined under the 1940 Act. The Shares of the Pictet funds have not been registered under the 1933 Act and may not, except in transactions which do not violate United States securities laws, be directly or indirectly offered or sold in the United States or to any US Person. The Management Fund Companies of the Pictet Group will not be registered under the 1940 Act.

Pictet Asset Management (USA) Corp (“Pictet AM USA Corp”) is responsible for effecting solicitation in the United States to promote the portfolio management services of Pictet Asset Management Limited (“Pictet AM Ltd”), Pictet Asset Management (Singapore) Pte Ltd (“PAM S”) and Pictet Asset Management SA (“Pictet AM SA”). Pictet AM (USA) Corp is registered as an SEC Investment Adviser and its activities are conducted in full compliance with SEC rules applicable to the marketing of affiliate entities as prescribed in the Adviser Act of 1940 ref.17CFR275.206(4)-3.