The COVID-19 pandemic has impacted us in numerous ways, setting off a cascade of dramatic changes to our lifestyles, and amid the unique circumstances of the lockdown environment, many turned to pets for companionship. The American Pet Products Association estimates that pet ownership increased from 56% of households in 1988, to 67% in 2019 and 70% post pandemic, mostly driven by millennials. Dogs comprise 57% of pet ownership, followed by cats at 27%.

Households across the U.S., Europe and Asia are shrinking due to a combination of lower birth rates, delayed marriages and overall rising costs of living and having children. In the U.S., for example, the average number of people per household dropped from an average of 3.5 in the 1960s to roughly 2.5 by 2020. As family formation has taken a back seat, and as many employees were told to work remotely during the pandemic, many millennials have chosen to have “fur babies” over children, especially during the COVID-19 pandemic. According to census data as of July 2019, millennials have overtaken baby boomers as the largest generation with 72 million members, and they experienced the highest increase in pet ownership among all age groups.

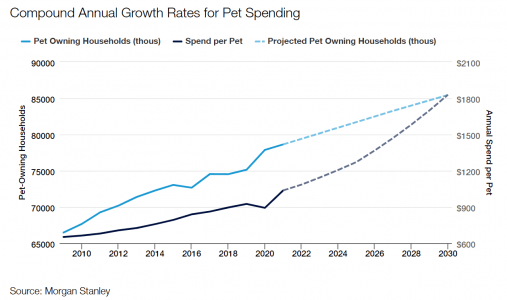

Millennials (born from 1981 to 1996), as well as Gen Z (1997 to 2013), are also the age groups that are most likely to consider their pets to be part of the family. Their desire to humanize their pets means they’re more willing than any other age group to spend a larger portion of their incomes on keeping their pets healthy and happy. More important, these two age groups are also expected to own roughly 60% of U.S. dogs by 2025, exceeding the pet ownership of the boomer generation. We believe this increase, and these age groups’ stronger attachment or “humanization” of their pets, will together provide a durable tailwind for the pet sector for many years to come. As seen below, Morgan Stanley predicts an acceleration to an 8% compound annual growth rate for U.S. pet expenditures by 2030, one of the largest rates of return in any retail segment.

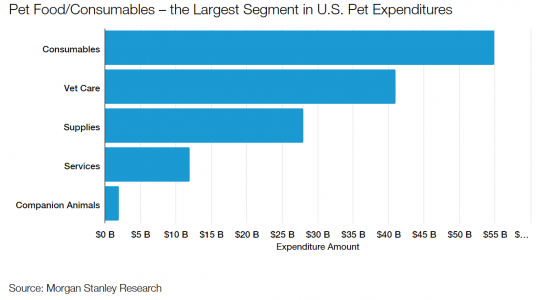

In addition, while emerging-markets countries such as India, Mexico, China and Brazil are currently lagging developed nations in pet ownership per capita, there is broad-based growth. In fact, according to a pet industry report by Bloomberg Intelligence, the global pet industry is expected to reach $493 billion by 2030, representing a drastic 54% increase from current levels. Although the U.S. will likely continue to be the largest market, emerging markets countries are also expected to deliver growth due to under-penetration of packaged dog food. Under-penetration and premiumization should continue to drive the largest consumables segment, while the basic need for pets to eat reduces cyclicality.

With a growing number of Americans regarding their pets as essentially a member of their family, the “pet humanization” trend has spawned an explosion of new businesses that focuses on providing better pet nutrition and care. Pet “parents,” especially in the developed world, have become increasingly educated about pet diets, and they are willing to devote more of their hard-earned money on premium, natural or branded pet foods. The “premiumization” of pet food has accelerated in popularity, particularly among millennials, who are more willing than other age groups to make financial trade-offs here and invest in their pets’ health.

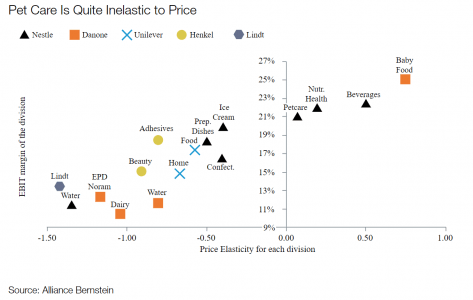

More to the point, U.S. millennial consumers are moving away from highly processed and lower-quality dry food (i.e., kibble) to pet foods that are minimally processed or so-called “raw” or “gently cooked” with human-grade ingredients. Gourmet-level dog and cat food is one of the fastest-growing areas in the pet food market due to its superior nutrition and lack of additives. Fresh pet food is believed to provide benefits like more energy, shinier coats, less stinky breath and healthier skin. Moreover, for consumers, cost seems to matter less and less in today’s landscape.

The premium pet food category appears to be one of the last areas where consumers are making “trade-down” decisions — that is, where they are willing to substitute for cheaper products — even despite high inflation eating away at household incomes. And once pet parents find high-quality foods that work for their pets, they’re unlikely to switch. As a result, pet food — and especially premium pet food — is proving to be one of the most resilient areas compared to other spending categories. As seen below, the price elasticity of the pet care category, which includes pet food, is almost as inelastic as those of baby food.

Lastly, adoption and acceleration of e-commerce have helped further bolster the pet food sector. Pet food e-commerce was already growing at a healthy pace before the pandemic, but digital paths to purchasing pet food have gained even more traction in recent years. Carrying home heavy boxes of dog food, or other pet products, like cat litter, isn’t appealing. And pet owners, especially those in the younger generations, are seeing the value of online shopping as well as direct and auto-shipping to their doorsteps. According to a 2021 report from Packaged Facts, pet food e-commerce will account for 55% of total U.S. pet food sales by 2025. That is up from approximately 30% today, above the 20% average for all U.S. retail.

The culture shift around pets has helped propel a rising demand for natural and premium pet goods. We believe the pet food industry is one of the most recession-resistant defensive plays, but also a structural growth story in the market.

Analysis by Mustafa Arikan, equity research analyst for Thornburg Investment Management.

Important Information

The views expressed are subject to change and do not necessarily reflect the views of Thornburg Investment Management, Inc. This information should not be relied upon as a recommendation or investment advice and is not intended to predict the performance of any investment or market.

This is not a solicitation or offer for any product or service. Nor is it a complete analysis of every material fact concerning any market, industry, or investment. Data has been obtained from sources considered reliable, but Thornburg makes no representations as to the completeness or accuracy of such information and has no obligation to provide updates or changes. Thornburg does not accept any responsibility and cannot be held liable for any person’s use of or reliance on the information and opinions contained herein.

Investments carry risks, including possible loss of principal.

Please see our glossary for a definition of terms.

Outside the United States

This is directed to INVESTMENT PROFESSIONALS AND INSTITUTIONAL INVESTORS ONLY and is not intended for use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to the laws or regulations applicable to their place of citizenship, domicile or residence.

Thornburg is regulated by the U.S. Securities and Exchange Commission under U.S. laws which may differ materially from laws in other jurisdictions. Any entity or person forwarding this to other parties takes full responsibility for ensuring compliance with applicable securities laws in connection with its distribution.