We can’t blame readers of the financial press for thinking that active investing is not worth the time and effort. They are often told that because stock prices capture all available information accurately, investors should abandon their pursuit of alpha, i.e., active investment performance, altogether.

It’s a compelling argument: passive investing is an inherently attractive proposition, especially since investors welcome low fees and greater transparency. However, it would be incorrect to say that active equity investing has lost its purpose.

A good proportion of active equity investment strategies become distinguished over time. Research shows that when investment managers stay true to their strongest convictions and avoid holding stocks simply to alter a portfolio’s tracking error, such approaches can be successful.[1]

All of this helps explain why Pictet Asset Management argues that allocating capital to thematic equities, characterized by their research-intensive, index-independent approach, presents a path to potentially higher returns.

The main objective of a thematic equity strategy is to invest in companies that benefit from structural forces that evolve independently of the economic cycle. In other words, it seeks to transform long-term megatrends, such as urbanization, globalization and climate change, into investment opportunities.

Implemented correctly, the thematic approach can offer investment managers a greater number of opportunities to generate alpha compared to conventional equity strategies. This is partly because it requires an in-depth understanding of complex economic and non-economic phenomena that require large-scale resources not available to all asset managers.

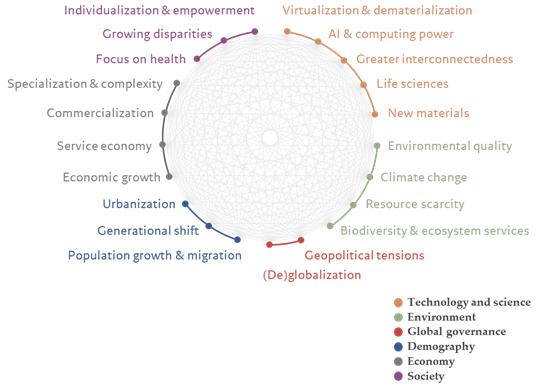

At Pictet Asset Management, our thematic teams have worked for many years with strategic consultancies, academics and business leaders to design a framework that tracks both the evolution and effects of 21 megatrends in the economy. Using this model, detailed below, we have identified 16 distinct investment universes comprised of companies with above-average growth prospects.

Pictet’s megatrends analytical framework

Source: Pictet Asset Management, 2024

Among these is robotics. Here, advances in artificial intelligence mean that robots are becoming part of everyday life, whether at home, in the office or in industrial plants.

Healthcare companies are also seeing their prospects improve thanks to powerful structural trends. On the one hand, technological progress promises to improve diagnostics and accelerate drug development. On the other hand, an increasingly long-lived population and growing middle classes in emerging markets are expected to drive demand for healthcare and diagnostic services in the coming years.

According to our forecasts, the returns of each of these two thematic universes could outperform the MSCI World index by 20% over the next five years.[2]

While thematic stocks can be a source of alpha, the analysis also allows us to conclude that they can serve as a complement to a passive equity allocation. According to our calculations, there are almost as many thematic stocks as there are companies represented in conventional equity indexes. This means that it is just as easy to diversify an equity portfolio with a thematic approach as with a traditional one benchmarked to a standard global equity index. In addition, the composition of a thematic equity portfolio bears little resemblance to more traditional global equity indexes.

This does not mean that the thematic approach is suitable for everyone. Those who invest over short investment horizons or who cannot tolerate significant deviations from benchmarks from time to time may find thematic stocks unsuitable. However, for investors willing to take a longer-term view, this approach offers the opportunity for superior equity returns.

Many investors consider active equity portfolio management to be expensive and unlikely to add value after costs. However, while simple math indicates that the average active investor should underperform, there are investment policies that can consistently add value over time.

We believe Pictet Asset Management ‘s active thematic equity strategies are among them, for several reasons:

- The design of thematic strategies incorporates a broader view of alpha, which goes beyond simply outperforming an index. Thematic investing takes a holistic perspective, starting with the selection of an appropriate and superior investment universe.

- We allow our investment teams complete freedom to select their stocks, eliminating “forced” or “uninformed” investment decisions.

- We focus on stock selection, which is generally more promising than sector/regional or market timing bets.

Guest column by Steve Freedman, Head of research and sustainability at Pictet Asset Management.

For more insights on opportunities within our Robotics fund, please click here.

[1] See, for example, https://www.aqr.com/Insights/Research/Alternative-Thinking/Active-and-Passive-Investing-The-Long-Run-Evidence.

[2] See Pictet Asset Management’s Secular Outlook 2024 for more details: https://am.pictet/es/globalwebsite/global-articles/2024/pictet-asset-management/secular-outlook

Disclaimer: This marketing material has been issued by Pictet Asset Management (Europe) SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services. Information used in the preparation of this document is based upon sources believed to be reliable, but no representation or warranty is given as to the accuracy or completeness of those sources. Any opinion, estimate or forecast may be changed at any time without prior warning. Investors should read the prospectus or offering memorandum before investing in any Pictet managed funds. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Past performance is not a guide to future performance. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested. Pictet Asset Management (USA) Corp (“Pictet AM USA Corp”) is responsible for effecting solicitation in the United States to promote the portfolio management services of Pictet Asset Management Limited (“Pictet AM Ltd”), Pictet Asset Management (Singapore) Pte Ltd (“PAM S”) and Pictet Asset Management SA (“Pictet AM SA”). Pictet AM (USA) Corp is registered as an SEC Investment Adviser and its activities are conducted in full compliance with SEC rules applicable to the marketing of affiliate entities as prescribed in the Adviser Act of 1940 ref.17CFR275.206(4)-3.