Sixty years ago, the first industrial robot started work in a car assembly line in the US state of New Jersey. Shaped as a giant heavy-lifting arm, it unloaded metal car parts from a die-cast press. Today, robots are no longer confined to the factory floor, they are increasingly part of our day-to-day lives.

There are some 3.5 million of them in the world [1]., capable of not only assembling your car but also of hoovering your house, delivering your shopping and even playing bingo with your granny. Yet the signs are the robotics industry has entered a new, more dynamic phase in its evolution.

Advances in technology, be that artificial intelligence (AI) or ever smaller and more powerful semiconductors, are paving the way for the development – and adoption – of a new breed of sophisticated machines. At the same time, labor shortages, an aging population and declining productivity are driving demand for automation.

For investors, this represents a very attractive opportunity that is underpinned by strong secular growth trends and goes beyond robots themselves. We anticipate these to be the five key themes that will drive the sector in the coming years.

1. Relocation and Shifting Production to Nearby Countries

Supply bottlenecks produced during the COVID-19 pandemic highlighted the dangers of relying on distant countries for manufacturing. Geopolitical tensions between the U.S. and China and the war in Ukraine added further pressure to global supply chains. As a result, governments and companies are increasingly interested in moving production to their home territories or at least to nearby countries, known as “re-shoring” and “near-shoring”. This should fuel demand for industrial robots to staff in these new factories, as well as for other automation equipment and software solutions. Some 41% per cent of US manufacturers are looking to increase automation, according to a recent survey by ABB Robotics [2].

The semiconductor industry is one of the key sectors targeted by the re-shoring trend, due to the increasingly vital nature of semiconductors and other related technologies, as well as national security concerns. Building semiconductor factories is a major focus of Washington’s USD 550 billion federal infrastructure spending package, and similar incentives have been approved accross several nations and economic unions.

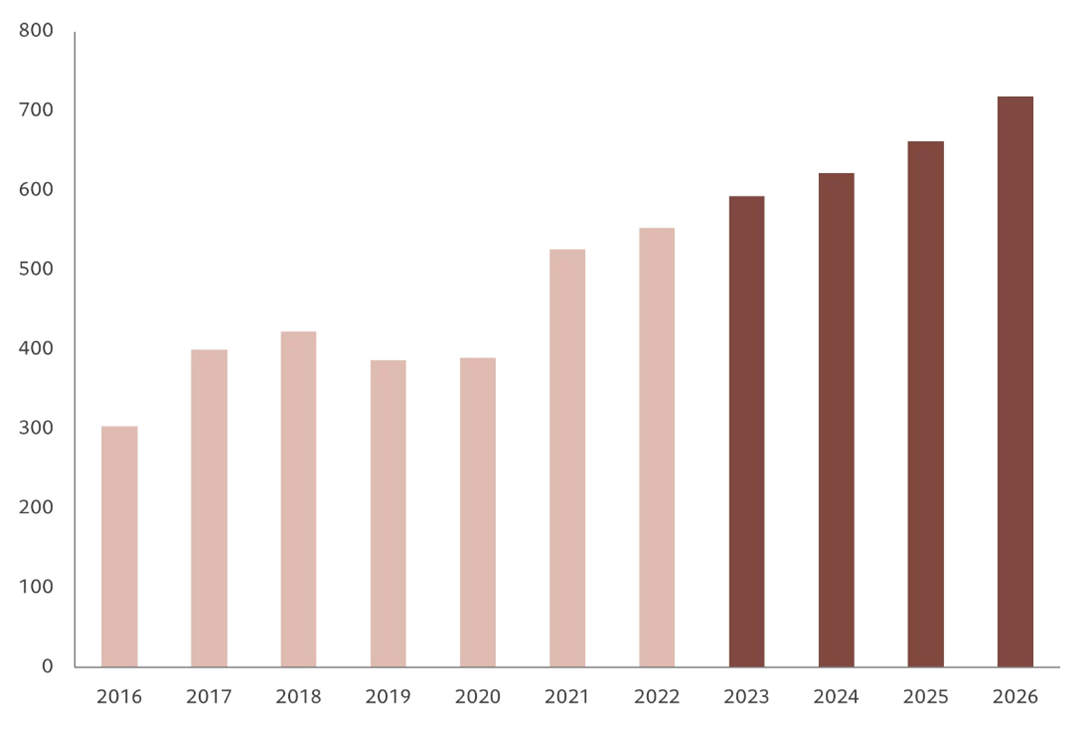

Fig. 1 – Global annual supply of industrial robots, ‘000 of units

Source: World Robotics, 2023. Data covering period 01.01.2016-31.12.2022; forecasts for 2023-2026.

2. Man plus machine: industrial cobots

Assembly-line robots may have been a staple of industry for a long time, but those that work autonomously while working closely with people are just starting to take off. The global market for cobots is expected to reach USD 6.8 billion in 2029, up from USD 1.2 billion in 2022, which equates to a compound annual growth rate (CAGR) of approximately 34%[3]. We see strong labour shortages, wage inflation, improving and cheaper technology boosting demand for this type of robotic tech. Cobots are proving particularly popular with small and medium sized enterprises (SMEs) and electric vehicle manufacturers, which itself is a major growth area as countries move to outlaw traditional cars to meet net zero targets.

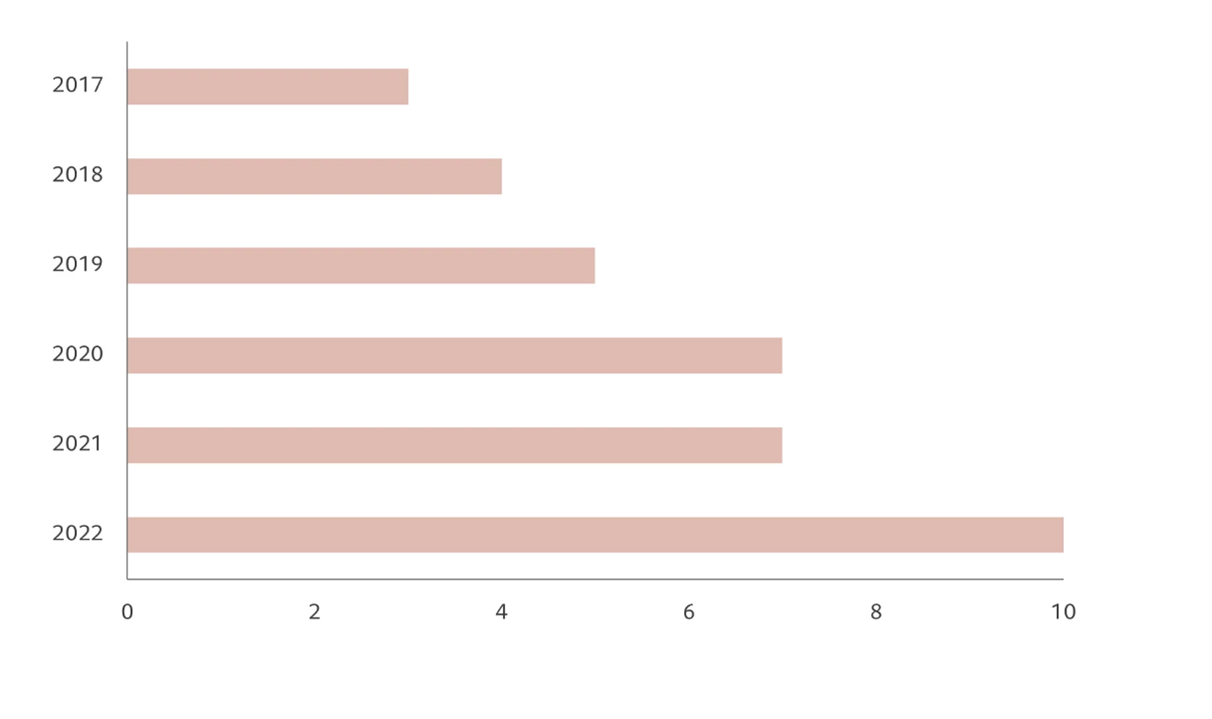

Fig. 2 – Cobots’ share in total industrial robot installations, %

Source: World Robotics, 2023. Data covering period 01.01.2017-31.12.2022.

3. Efficient software

The growth of automation – whether in the home or in industry – depends on software. Historically, industrial software operated on a buy, install and use-forever model. Today, it is increasingly moving to a software-as-a-service (SaaS) model, whereby companies pay a subscription fee to use the software, which is stored in the cloud or in a hybrid environment. The industrial software market could more than double to over USD 250 billion by 2027, representing a CAGR of 15%[4]. This should lead to efficiency gains throughout the process from product design and simulation, to sending the blueprint to the factory or manufacturing partner and optimising the supply chain. Cloud based solutions help reduce the cost and complexities of managing the software itself and also enable data centralisation. Data analytics on top of that is growing strongly as more and more data is generated. Business process automation is also growing in popularity, the process through which companies use software solutions to boost the productivity of white collar workers. Furthermore, advances in AI are enabling companies to use large amounts of data to improve operational efficiency.

4. AI and computation

As machines become increasingly sophisticated, they need more processing power to compute and process data. AI is particularly resource intensive, requiring vast amounts of data and processing power to create new content. That means more sophisticated semiconductors. Manufacturers of computing processors appear to be natural beneficiaries of the expansion of AI, but large language models (LLMs) also require other types of chips, such as those that boost memory capacity and bandwidth. Memory, compute and storage semiconductors account for the majority of semiconductor sales. Memory (“DRAM”) and storage (“NAND Flash”) chips are primarily used for storing data and instructions, while processing chips (such as the core “CPU” in a computer or a complementary accelerator chip like a “GPU”) are used for performing calculations and processing data in real time.

Also important in the semiconductor food chain are electronic design automation (EDA) companies, like Synopsys, who provide software solutions for the chip designers. The level of innovation and incorporation of AI into the software enable the chip designers to speed up the design phase and improve the power and compute efficiency. Furthermore advances in AI should boost the prospects of semiconductor equipment companies. They provide the chipmaking tools that produce smaller, faster, cheaper, more powerful and energy-efficient microchips. Semiconductor manufacturing plants (known as “fabs”) are some of the most highly automated factories in the world, and in turn require increasing usage of AI processes to improve yields and output.

5. Autonomous driving

Robots may have started out making cars, but today they are increasingly driving them. Fully driverless cars, lorries and buses, are still some years away from becoming viable for the mass market. Nevertheless, live trials are already in progress across the world, including in San Francisco, Beijing, Shanghai, and Phoenix. Alphabet-owned Waymo, for example, has notched up millions of miles on public roads (and billions more in simulation), and has been offering driverless rides to San Francisco residents for over a year. Autonomous vehicles are also already partly a reality through the inclusion of various aspects of advanced driver assistance (ADAS) technologies in the latest car models. As these become more common and more advanced, semiconductor demand should surge. By 2031, each car is expected to contain USD1,550 worth of semiconductors, up from just USD665 in 2021, according to research by Gartner.

AI is driving a new wave of innovation, revolutionizing robotics and automation technologies. With its ability to increase productivity, reduce costs and help solve problems related to global labor shortages, we believe robotics and automation will grow faster than the economy as a whole. This offers a very attractive thematic investment opportunity, both in the companies that manufacture the robots and in those that provide all the necessary elements, from semiconductors to software.

Guest column by Peter Lingen, Senior Investment Manager, Thematic Equities, at Pictet Asset Management

For more insights on opportunities within our Robotics fund, please click here.

References:

- https://ifr.org/ifr-press-releases/news/top-5-robot-trends-2023

- https://www.robotics247.com/article/robots_pave_way_reshoring_manufacturing

- https://www.marketsandmarkets.com/Market-Reports/collaborative-robot-market-194541294.html

- Gartner, 2023

Disclaimer: This marketing material has been issued by Pictet Asset Management (Europe) SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services. Information used in the preparation of this document is based upon sources believed to be reliable, but no representation or warranty is given as to the accuracy or completeness of those sources. Any opinion, estimate or forecast may be changed at any time without prior warning. Investors should read the prospectus or offering memorandum before investing in any Pictet managed funds. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Past performance is not a guide to future performance. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested. Pictet Asset Management (USA) Corp (“Pictet AM USA Corp”) is responsible for effecting solicitation in the United States to promote the portfolio management services of Pictet Asset Management Limited (“Pictet AM Ltd”), Pictet Asset Management (Singapore) Pte Ltd (“PAM S”) and Pictet Asset Management SA (“Pictet AM SA”). Pictet AM (USA) Corp is registered as an SEC Investment Adviser and its activities are conducted in full compliance with SEC rules applicable to the marketing of affiliate entities as prescribed in the Adviser Act of 1940 ref.17CFR275.206(4)-3.