For once, it has been quite a positive start to the new year – at least as far as the world economy is concerned. Slowing inflation appears to justify a pivot in monetary policy towards interest rate cuts, while growth has been resilient enough to suggest that the economy can avoid a hard landing.

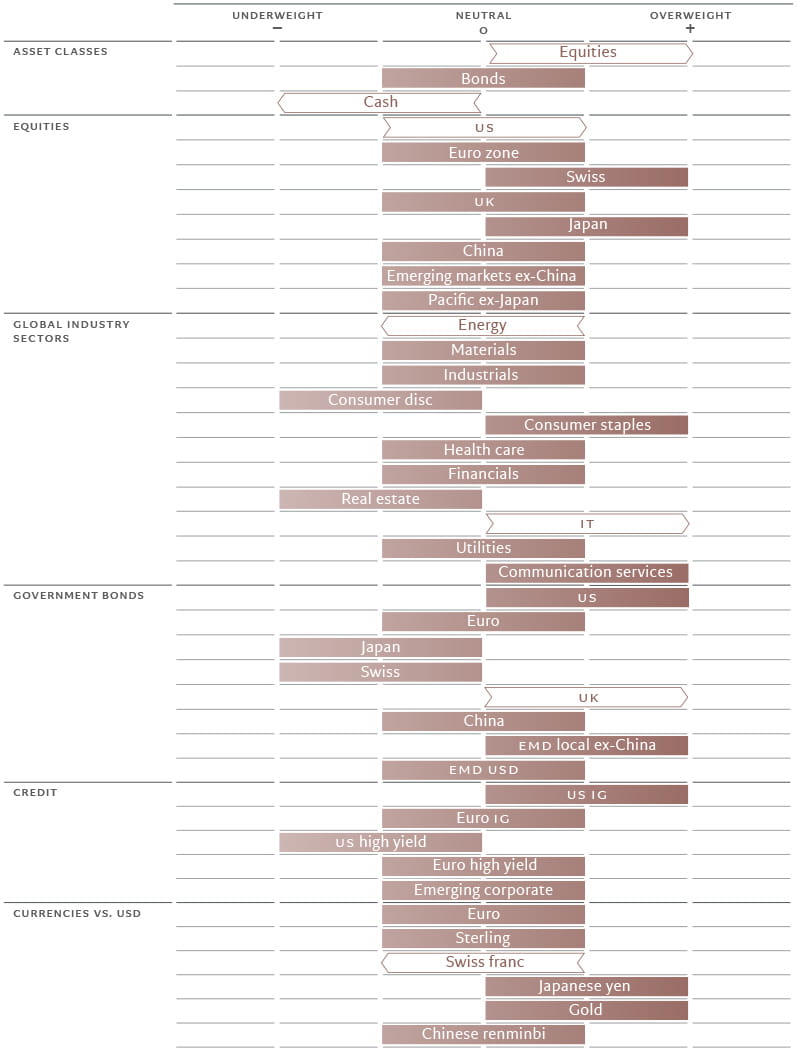

As long as this Goldilocks scenario holds, riskier assets should benefit. Therefore, we upgrade global equities to overweight, balancing this with an underweight in cash. As interest rate cuts start to come through, holding money in cash or equivalents will become increasingly unattractive. Our stance on bonds, meanwhile, remains neutral.

We view this allocation shift as a short-term move. Much like Goldilocks’s porridge won’t stay the perfect temperature for ever, we believe the global economy will eventually start to cool and bonds will regain the upper hand over equities.

Source: Pictet Asset Management

Indeed, our global leading indicator of business activity points to a likely slowdown going into the second half of the year. We expect growth in developed economies to total just 0.9 per cent for 2024 – roughly half the pace of the previous year.

Japan remains the only developed market with a positive score in our macro-economic model, with strong wage growth and potential rebound in global trade providing strong tailwinds.

The US economy is also holding up relatively well so far, which should boost its equity market in the near term. But survey data is increasingly gloomy, and we expect dynamics in the consumer sector and non-residential investment to deteriorate soon, prompting the US Federal Reserve to cut rates.

Growth in the euro zone, meanwhile, will likely be anaemic, albeit stable.

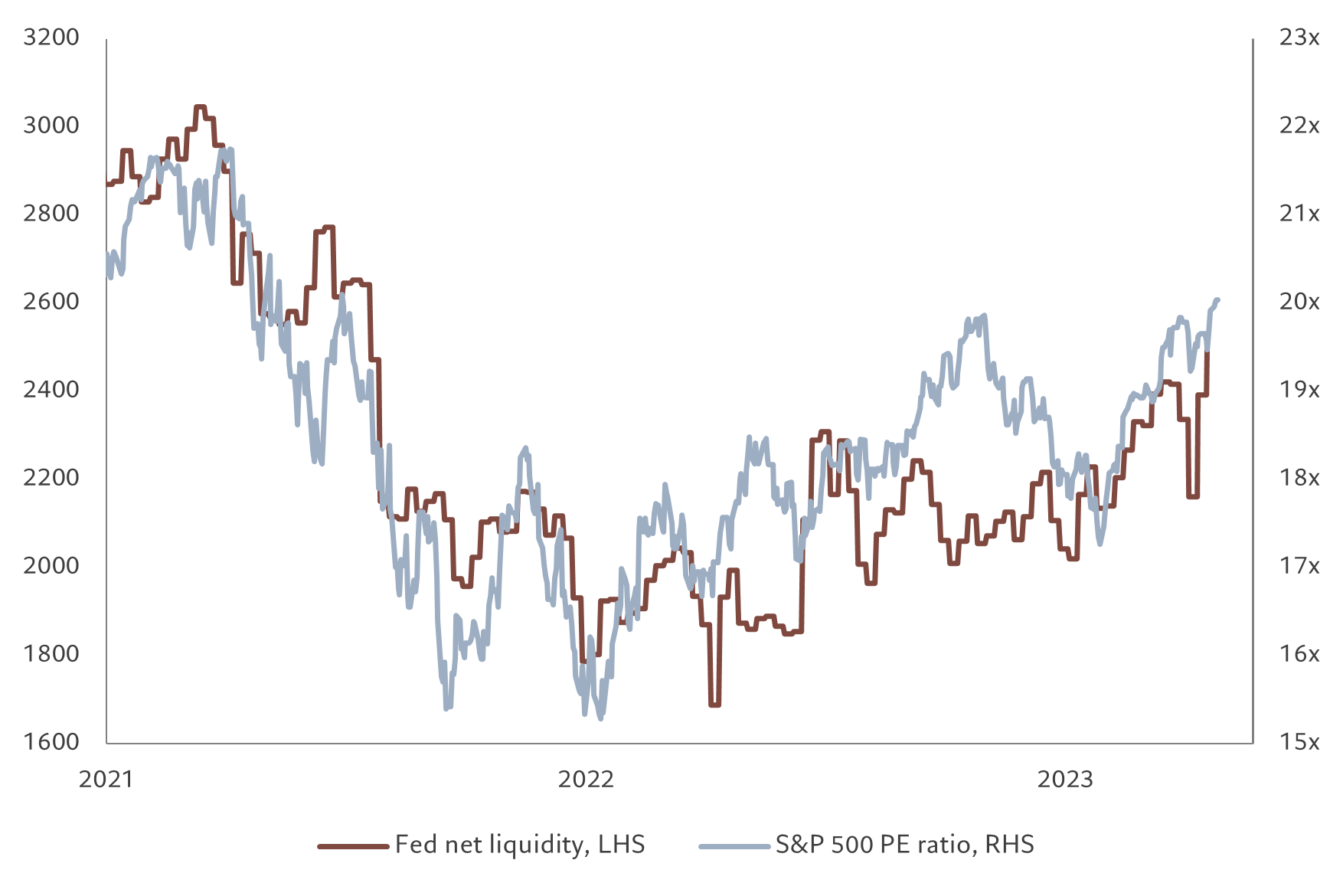

Our liquidity indicators show conditions will remain supportive for stocks, and US equities in particular, till the end of the first quarter. The Fed’s quantitative tightening programme has failed to make a dent, as it has been more than offset by financial institutions withdrawing their surplus cash parked with the central bank (see Fig. 2). This has helped risky assets outperform cash, restoring a degree of the ‘policy put’. Our analysis suggests that the increase in net liquidity – the additional amount of money the central bank provides the economy for investment and spending –is consistent with the S&P 500 grinding higher towards the 5,000 mark.

The situation is likely to change once the US Treasury shifts issuance to longer-dated bonds rather than T-bills, which we expect to occur the second quarter of 2024. This will result in a significant slowdown in the reduction of the Fed’s reverse repo facility , a net drain of the liquidity in the financial system and a likely increase in risk premia.

Fed net liquidity refers to the central bank’s injections or withdrawals of funds from the financial system. Source: Refinitiv DataStream, Pictet Asset Management. Data covering period 13.12.2019-23.01.2024

At that point, the stretched equity valuations will likely start to look unsustainable. US stocks appear expensive trading on 20 times their 12-month forward earnings – a level rarely sustained outside of the dotcom bubble. Improved earnings prospects offer some comfort, especially in the tech sector (and consequently for US), but the upside is limited given the lofty expectations that are priced in – consensus earnings per share growth for the US market is above 10 per cent against our forecasts of 4 per cent.

Our tactical preference for equities is also underpinned by positive technical signals, especially strong trends in US and Japan. Sentiment indicators have normalised from euphoria territory, while investor positioning shows a balance between call and put options, or between investors betting on a market rally versus those bracing for a rout.

Piece of opinion written by Luca Paolini, Pictet Asset Management’s Chief Strategist.

Discover Pictet Asset Management’s macro and asset allocation views here.

Disclaimer

This material is for distribution to professional investors only. However it is not intended for distribution to any person or entity who is a citizen or resident of any locality, state, country or other jurisdiction where such distribution, publication, or use would be contrary to law or regulation.

Information, opinions and estimates contained in this document reflect a judgement at the original date of publication and are subject to risks and uncertainties that could cause actual results to differ materially from those presented herein.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information used in the preparation of this document is based upon sources believed to be reliable, but no representation or warranty is given as to the accuracy or completeness of those sources. Any opinion, estimate or forecast may be changed at any time without prior warning. Investors should read the prospectus or offering memorandum before investing in any Pictet managed funds. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Past performance is not a guide to future performance. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested. This document has been issued in Switzerland by Pictet Asset Management SA and in the rest of the world by Pictet Asset Management (Europe) SA, and may not be reproduced or distributed, either in part or in full, without their prior authorisation.

For UK investors, the Pictet and Pictet Total Return umbrellas are domiciled in Luxembourg and are recognised collective investment schemes under section 264 of the Financial Services and Markets Act 2000. Swiss Pictet funds are only registered for distribution in Switzerland under the Swiss Fund Act, they are categorised in the United Kingdom as unregulated collective investment schemes. The Pictet group manages hedge funds, funds of hedge funds and funds of private equity funds which are not registered for public distribution within the European Union and are categorised in the United Kingdom as unregulated collective investment schemes. For Australian investors, Pictet Asset Management Limited (ARBN 121 228 957) is exempt from the requirement to hold an Australian financial services license, under the Corporations Act 2001.

For US investors, Shares sold in the United States or to US Persons will only be sold in private placements to accredited investors pursuant to exemptions from SEC registration under the Section 4(2) and Regulation D private placement exemptions under the 1933 Act and qualified clients as defined under the 1940 Act. The Shares of the Pictet funds have not been registered under the 1933 Act and may not, except in transactions which do not violate United States securities laws, be directly or indirectly offered or sold in the United States or to any US Person. The Management Fund Companies of the Pictet Group will not be registered under the 1940 Act. Pictet Asset Management (USA) Corp (“Pictet AM USA Corp”) is responsible for effecting solicitation in the United States to promote the portfolio management services of Pictet Asset Management Limited (“Pictet AM Ltd”), Pictet Asset Management (Singapore) Pte Ltd (“PAM S”) and Pictet Asset Management SA (“Pictet AM SA”). Pictet AM (USA) Corp is registered as an SEC Investment Adviser and its activities are conducted in full compliance with SEC rules applicable to the marketing of affiliate entities as prescribed in the Adviser Act of 1940 ref.17CFR275.206(4)-3. Pictet Asset Management Inc. (Pictet AM Inc) is responsible for effecting solicitation in Canada to promote the portfolio management services of Pictet Asset Management Limited (Pictet AM Ltd), Pictet Asset Management SA (Pictet AM SA) and Pictet Alternative Advisors (PAA).

In Canada, Pictet AM Inc is registered as an Exempt Market Dealer authorized to conduct marketing activities on behalf of Pictet AM Ltd, Pictet AM SA and PAA.