The global economic outlook is darkening again as tighter monetary policy around the world and surging energy prices continue to undermine consumer confidence and corporate earnings growth.

Major economies are flirting with a recession. Europe is feeling the chill more than most other regions as the soaring cost of living and energy shortages force consumers to tighten their belts, banks to slow lending and companies to delay capital spending plans.

All of this augurs badly for corporate earnings in the coming months.

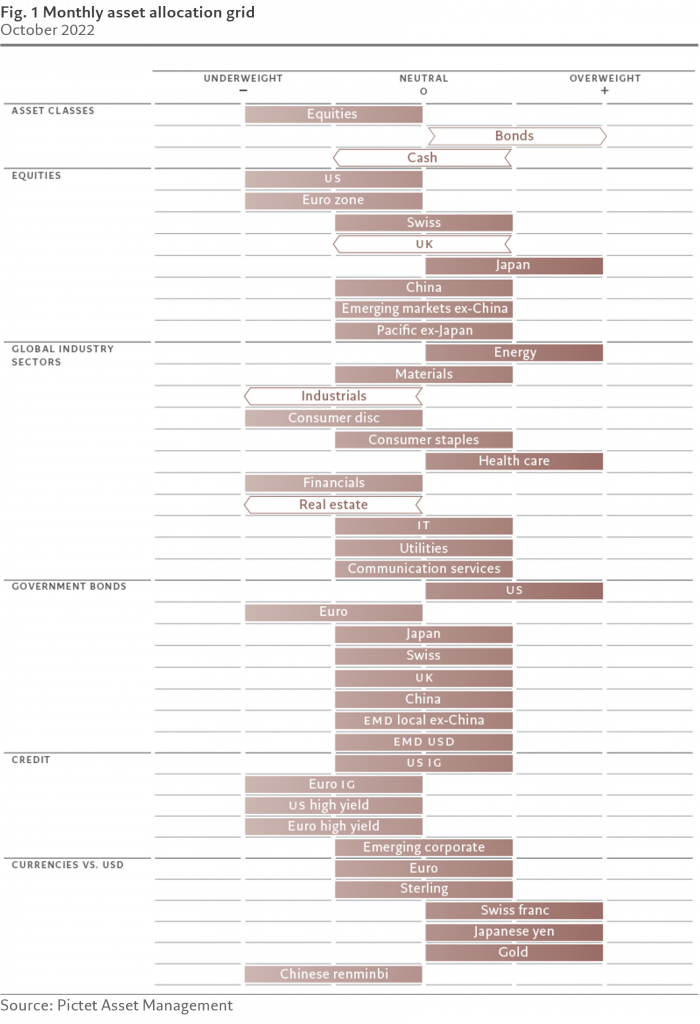

While the equity market sell-off this year has driven investor risk appetite to record lows – a point where stocks and other risky asset classes tend to stage a rebound – we see risks of a further correction. This is why we maintain our underweight position in equities.

We’re unlikely to change this stance until we see stabilisation in corporate earnings revisions, a steeper yield curve and a further cheapening of cyclical stocks.

By comparison, some areas of the bond market are beginning to look attractive, however, as yields are climbing to levels that are increasingly at odds with economic fundamentals. Headline inflation has likely peaked in the US, with inflation expectations also having slipped in recent months. The New York Federal Reserve’s monthly survey shows that consumers in August saw inflation at 5.75 per cent over the next 12 months, the lowest since October 2021. Against this backdrop, we upgrade bonds to overweight, with a preference for US Treasuries – a haven in times of turbulence. We also cut cash to neutral.

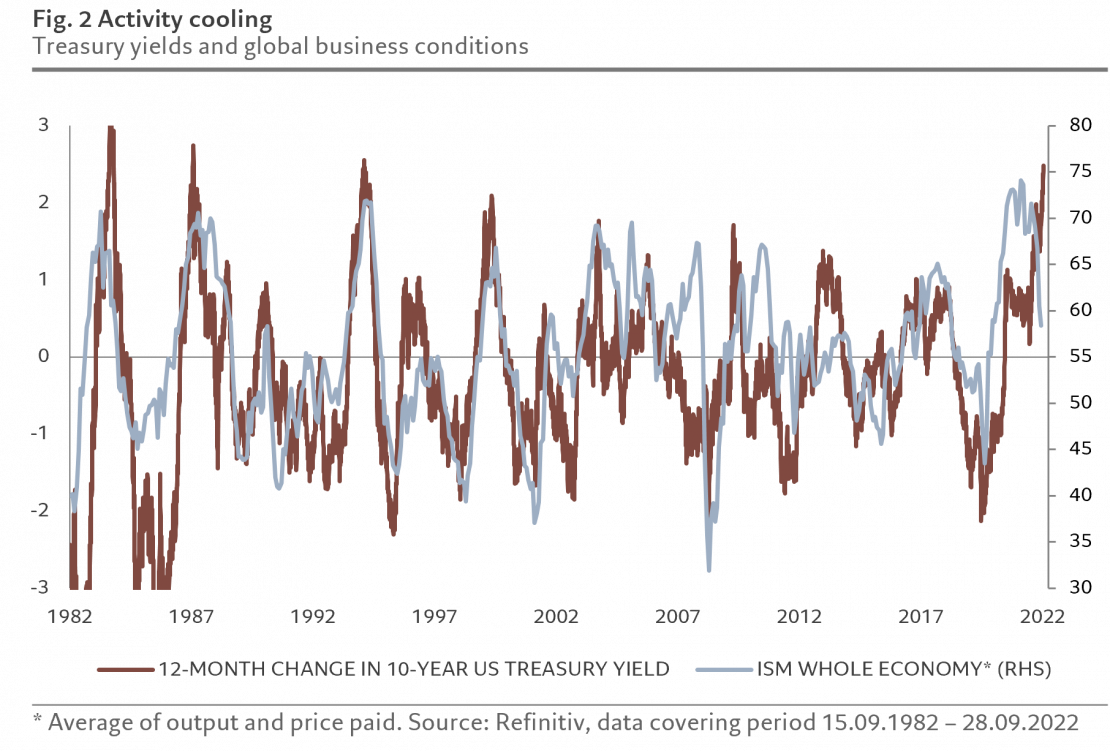

Our business cycle indicators show a clear slowdown in global economic growth. As Fig. 2 shows, rising borrowing costs tend to exact a heavy toll on global business conditions.

The outlook has deteriorated in the euro zone in particular, where consumer confidence has plunged to an all-time low and energy rationing poses further risk to industrial sectors. With the euro zone economy expected to contract towards the end of this year, we have cut our 2023 real GDP forecast to 0.2 per cent from 1 per cent.

The growth outlook is also weak in the US, although there are some positive signs that testify to the resilience of the world’s largest economy. The US labour market remains tight with jobless claims now trending down. Consumer confidence, meanwhile, has improved for the second consecutive month thanks to easing inflation worries.

That said, surveys also show companies remain reluctant to boost their capital spending while the housing market is confronting a slump in construction activity, pointing to a further 10 per cent decline in property prices over the next six months.

What’s more, typical mortgage payments as a proportion of income stand at their highest levels since the 1980s.

We’re becoming cautious on Japan’s economy whose leading indicators have slowed down. Manufacturing activity is contracting and weak global demand is pressuring the export sector.

The prospects for the UK economy remain weak, too.

The government’s plans to deliver the biggest tax cut since 1972 and ramp up borrowing at a time when the country’s consumer price index hovers close to a 40-year high has led investors to question the country’s fiscal credibility, giving rise to a sharp sell-off in sterling and gilts.

Consumer confidence stands at an all-time low with inflation-adjusted wages expected to contract 5 per cent. We expect the UK economy to fall into recession from the fourth quarter of this year with full-year growth to be at zero next year.

Our liquidity indicators show tighter conditions in major economies, especially in the US and UK, as central banks continue to reverse pandemic-era monetary stimulus.

At the same time, bank credit, which has until recently partially offset the effect of central bank tightening, is finally slowing down, in line with leading indications from credit standards.

China is the only country showing easier liquidity. The People’s Bank of China is lowering funding costs and offering targeted easing measures to revive credit demand.

Our valuation model backs up our positive stance on bonds.

Global bond yields are now at the highest since mid-2011 following a recent sell-off.

Equities are on the verge of becoming cheap for the first time since April 2020 after a 9-per cent decline in world stocks in September alone – which was driven entirely by a contraction in earnings multiples.

As a result, the global 12-month price earnings ratio has fallen to 13 times, below the low seen in June.

What is more, the pace of contraction is consistent with a sell-off typically seen during a recession.

Our models suggest a rebound in multiples of 5-10 per cent over the next 12 months, assuming that 10-year yield on US Treasury Inflation Protected Securities (TIPS) falls to 0.75 per cent.

Our 2022 global earnings growth forecast, meanwhile, stands at 2 per cent, significantly below market consensus.

Within equities, we’re becoming more cautious on cyclical sectors that are growth-sensitive, such as industrials and real estate.

Our technical indicators show investor risk appetite close to record low levels, with equity funds losing USD25 billion in flows in the past four weeks.

While a technical rebound cannot be ruled out at this depressed sentiment level, our negative trend score suggests taking an underweight equity position over our investment horizon.

Opinion written by Luca Paolini, Pictet Asset Management’s Chief Strategist

Discover Pictet Asset Management’s macro and asset allocation views.

Information, opinions, and estimates contained in this document reflect a judgment at the original date of publication and are subject to risks and uncertainties that could cause actual results to differ materially from those presented herein.

Important notes

This material is for distribution to professional investors only. However, it is not intended for distribution to any person or entity who is a citizen or resident of any locality, state, country or other jurisdiction where such distribution, publication, or use would be contrary to law or regulation.

The information and data presented in this document are not to be considered as an offer or sollicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information used in the preparation of this document is based upon sources believed to be reliable, but no representation or warranty is given as to the accuracy or completeness of those sources. Any opinion, estimate or forecast may be changed at any time without prior warning. Investors should read the prospectus or offering memorandum before investing in any Pictet managed funds. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Past performance is not a guide to future performance. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested.

This document has been issued in Switzerland by Pictet Asset Management SA and in the rest of the world by Pictet Asset Management (Europe) SA, and may not be reproduced or distributed, either in part or in full, without their prior authorisation.

For US investors, Shares sold in the United States or to US Persons will only be sold in private placements to accredited investors pursuant to exemptions from SEC registration under the Section 4(2) and Regulation D private placement exemptions under the 1933 Act and qualified clients as defined under the 1940 Act. The Shares of the Pictet funds have not been registered under the 1933 Act and may not, except in transactions which do not violate United States securities laws, be directly or indirectly offered or sold in the United States or to any US Person. The Management Fund Companies of the Pictet Group will not be registered under the 1940 Act.

Pictet Asset Management (USA) Corp (“Pictet AM USA Corp”) is responsible for effecting solicitation in the United States to promote the portfolio management services of Pictet Asset Management Limited (“Pictet AM Ltd”), Pictet Asset Management (Singapore) Pte Ltd (“PAM S”) and Pictet Asset Management SA (“Pictet AM SA”). Pictet AM (USA) Corp is registered as an SEC Investment Adviser and its activities are conducted in full compliance with SEC rules applicable to the marketing of affiliate entities as prescribed in the Adviser Act of 1940 ref.17CFR275.206(4)-3.

Pictet Asset Management Inc. (Pictet AM Inc) is responsible for effecting solicitation in Canada to promote the portfolio management services of Pictet Asset Management Limited (Pictet AM Ltd) and Pictet Asset Management SA (Pictet AM SA).

In Canada Pictet AM Inc is registered as Portfolio Manager authorized to conduct marketing activities on behalf of Pictet AM Ltd and Pictet AM SA.