The Covid-19 pandemic exposed the strengths – and the weaknesses – of health systems around the world. The Pictet-Health Thematic Advisory Board has identified five lessons that the industry can learn from the experience, which open up new opportunities for both businesses and investors.

- Embrace the benefits of digital

In the first few months of the pandemic, tele-health appointments surged to 78 times their pre-Covid levels, accounting for almost a third of outpatient visits. Although in-person visits have resumed with the lifting of restrictions, digital appointments are still around 38 times more prevalent than before the pandemic, suggesting that tele-medicine is very much here to stay.

Remote psychiatry is experiencing especially strong growth, with around half of all consultations now digital. Advisory Board members also highlighted the value and convenience of tele-health for follow-up appointments and reviews of test results.

According to consultancy McKinsey, in the US alone, as much as USD250 billion of current healthcare spending could be shifted to virtual or near virtual care. The advantages include the possibility of getting closer to the patient, particularly in areas where traditional health provision is lacking, as well as significant cost savings and even benefits to the environment due to the reduced need for journeys. (In the UK, for example, NHS estimates that use of its app services has eliminated 22,000 car journeys each month.3)

However, for tele-health to maximise its growth potential, significant investment in digital infrastructure is necessary.

Beyond tele-health, the pandemic also highlighted the importance of machine learning and AI in tackling health problems. After all, it was data scientists– rather than epidemiologists – who were responsible for crunching data from 2.5 million app users to identify the loss of your sense of smell and taste as key Covid symptoms.

By centralising and unifying health records, there is the potential to better monitor and anticipate problems, both at the level of individual patients and whole regions where extra resources may be needed.

As well as playing a key part in diagnostics, Advisory Board members expect that data will be key to future drug development and clinical trial design. However, barriers to entry are high. Companies with scale and therefore access to large datasets (such as claims data for big insurance providers) are at an advantage. Many of the new digital health companies that have recently listed via initial public offerings still need to prove that their business models can reach that scale and turn a profit.

- Prevention can be better than cure

With Covid proving particularly problematic for people with underlying health conditions (known as comorbidities), society has become more attuned to the need to embrace healthier lifestyles.

A more balanced, less highly-processed diet, doing more exercise, spending time in less polluted environments and reconnecting with nature are becoming more popular among both young and old.

All of which means the health industry should see growth in demand for healthy foods, personal care and hygiene, and services linked to healthy lifestyles.

- Don’t underestimate need for hospitals and nurses

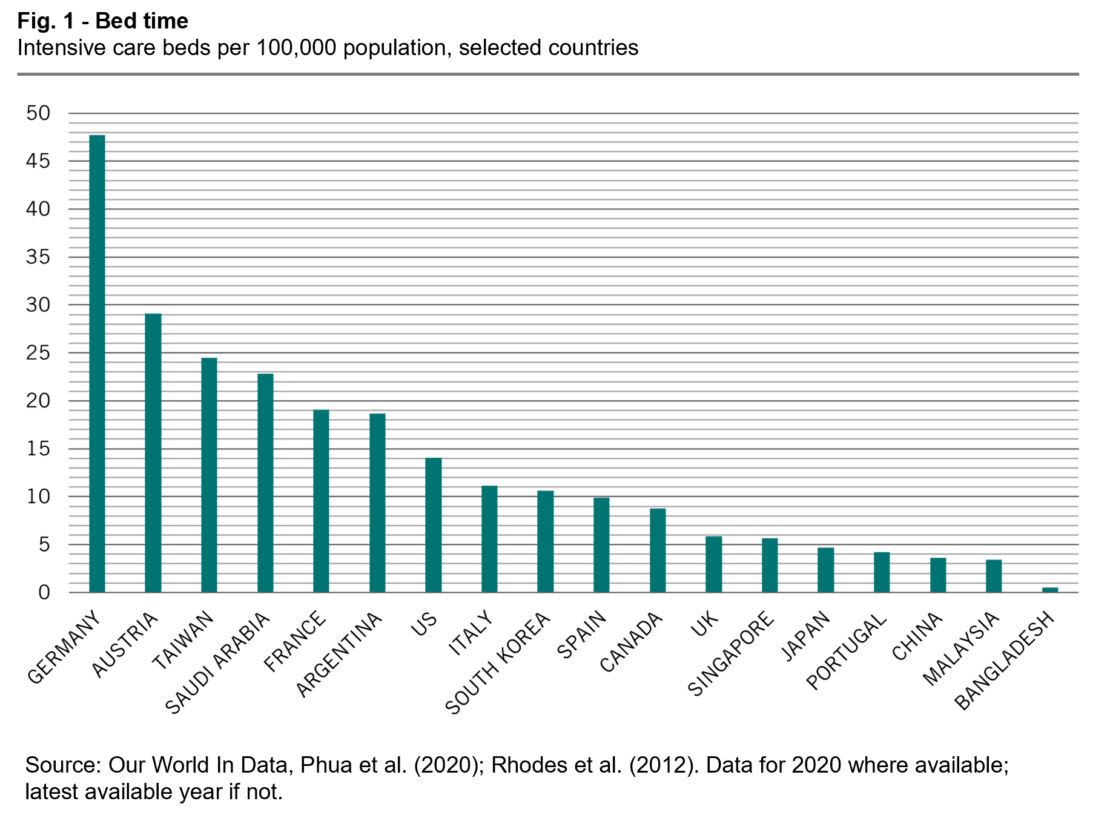

The pandemic also brought into sharp relief the importance of having enough physical resources – be that doctors, nurses or intensive care beds. It highlighted great disparities in capacity, even within the developed world.

While Germany averages 48 intensive care unit (ICU) beds per 100,000 population, the US has 14 and Japan has fewer than five (see Fig. 1). There are similar disparities in numbers of doctors and nurses too. Within, Europe, for example, Norway scores relatively high on both counts, while Portugal has some of the lowest numbers, according to data from the European Observatory on Health Systems and Policies.

In the first wave of the pandemic, countries with more extensive hospital provision – such as Austria and Germany – performed much better, Advisory Board members noted. Could the pandemic spell the end of the trend of downsizing hospitals – and even lead to the construction of new ones?

Of course, hospitals need staff, and that is another major problem. Nursing is seen increasingly as an unattractive job, offering low pay and low social recognition. This needs to change. In the US, around a third of nurses are planning to leave their posts in direct patient care; in Europe similar trends are at play. Well-funded community care provision could help fill some of the gaps.

Data can help here, too. If data analysis predicts that there will be fewer nurses, that gives you the opportunity to better prepare and address the problem.

- Private and public must work together

Another key lesson was that health clearly needs more investment – politicians have realised that without a functioning health system a country cannot have a functioning economy. Yet, there is a limit to how much of that money can come from the public purse, particularly as government debt levels are already elevated and as economic growth is slowing. Indeed, research by Advisory Board members shows that historically government health spending has tended to decrease after a crisis.

Fortunately, the pandemic provided a template of how businesses, governments and academics can work together towards a common goal – particularly in the development of vaccines. However, it also exposed some potential problems and shortcomings, as highlighted by the scandals over unsuitable personal protective equipment (PPE) and an ineffective “track and trace” system in the UK.

- Supply chains are crucial

Supply chains are a major challenge for the health industry. The Covid-related interruptions to global trade highlighted the problem, and the current surge in inflation has only served to underscore the importance of stock levels and supply chains.

Even med-tech is not immune to supply issues, as illustrated by recent problems in the procurement of semiconductors, which are essential components of connected devices and implants.

A major re-think is due and is already underway. Firms across the health industry are looking to increased the flexibility and responsiveness of their supply chains – which can often be achieved by harnessing high quality data and using new technologies. As part of this effort, many companies are also broadening the range of suppliers they use and, in some cases switching manufacturing plants to home soil (onshoring) or to countries nearby (near-shoring), both of which reduce reliance on lengthy supply chains.

Finally, the pandemic highlighted the need to adopt an integrated approach to health (the “One Health” concept) beyond human health due to its inter-dependencies with animal and ecosystem health. This may help decrease the incidence of future zoonotic events, as well as improving the quality of the food we eat and the air we breathe.

Opinion written by Lydia Haueter, Senior Investment Manager for Pictet Asset Management’s Thematic Equities team.

Discover more about Pictet Asset Management’s expertise in thematic investing.

Information, opinions, and estimates contained in this document reflect a judgment at the original date of publication and are subject to risks and uncertainties that could cause actual results to differ materially from those presented herein.

Important notes

This material is for distribution to professional investors only. However, it is not intended for distribution to any person or entity who is a citizen or resident of any locality, state, country or other jurisdiction where such distribution, publication, or use would be contrary to law or regulation.

The information and data presented in this document are not to be considered as an offer or sollicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information used in the preparation of this document is based upon sources believed to be reliable, but no representation or warranty is given as to the accuracy or completeness of those sources. Any opinion, estimate or forecast may be changed at any time without prior warning. Investors should read the prospectus or offering memorandum before investing in any Pictet managed funds. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Past performance is not a guide to future performance. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested.

This document has been issued in Switzerland by Pictet Asset Management SA and in the rest of the world by Pictet Asset Management (Europe) SA, and may not be reproduced or distributed, either in part or in full, without their prior authorisation.

For US investors, Shares sold in the United States or to US Persons will only be sold in private placements to accredited investors pursuant to exemptions from SEC registration under the Section 4(2) and Regulation D private placement exemptions under the 1933 Act and qualified clients as defined under the 1940 Act. The Shares of the Pictet funds have not been registered under the 1933 Act and may not, except in transactions which do not violate United States securities laws, be directly or indirectly offered or sold in the United States or to any US Person. The Management Fund Companies of the Pictet Group will not be registered under the 1940 Act.

Pictet Asset Management (USA) Corp (“Pictet AM USA Corp”) is responsible for effecting solicitation in the United States to promote the portfolio management services of Pictet Asset Management Limited (“Pictet AM Ltd”), Pictet Asset Management (Singapore) Pte Ltd (“PAM S”) and Pictet Asset Management SA (“Pictet AM SA”). Pictet AM (USA) Corp is registered as an SEC Investment Adviser and its activities are conducted in full compliance with SEC rules applicable to the marketing of affiliate entities as prescribed in the Adviser Act of 1940 ref.17CFR275.206(4)-3.

Pictet Asset Management Inc. (Pictet AM Inc) is responsible for effecting solicitation in Canada to promote the portfolio management services of Pictet Asset Management Limited (Pictet AM Ltd) and Pictet Asset Management SA (Pictet AM SA).

In Canada Pictet AM Inc is registered as Portfolio Manager authorized to conduct marketing activities on behalf of Pictet AM Ltd and Pictet AM SA.