China’s re-opening has failed to deliver a market rally, US banking sector remains jittery and inflation is proving sticky. We extend our already cautious stance by shifting more positions to neutral.

Asset allocation: never mind the debt ceiling

The Unites States debt ceiling has filled column inches, but throughout, the markets have been sanguine that a compromise would be struck, limiting the scope for any relief rally in equities.

More pertinent, however, are questions over the direction of the global economy, with the US’s outlook worsening in recent weeks, China’s post-Covid performance starting to disappoint and Germany wobbling. And as inflation fails to fall as fast as anticipated, investors are reconsidering how quickly central bankers might be prepared to ease monetary policy or how soon rates might peak. That’s one reason equities failed to respond more positively to what was a strong first quarter earnings season – the recent past might have been good, but the future’s looking increasingly uncertain.

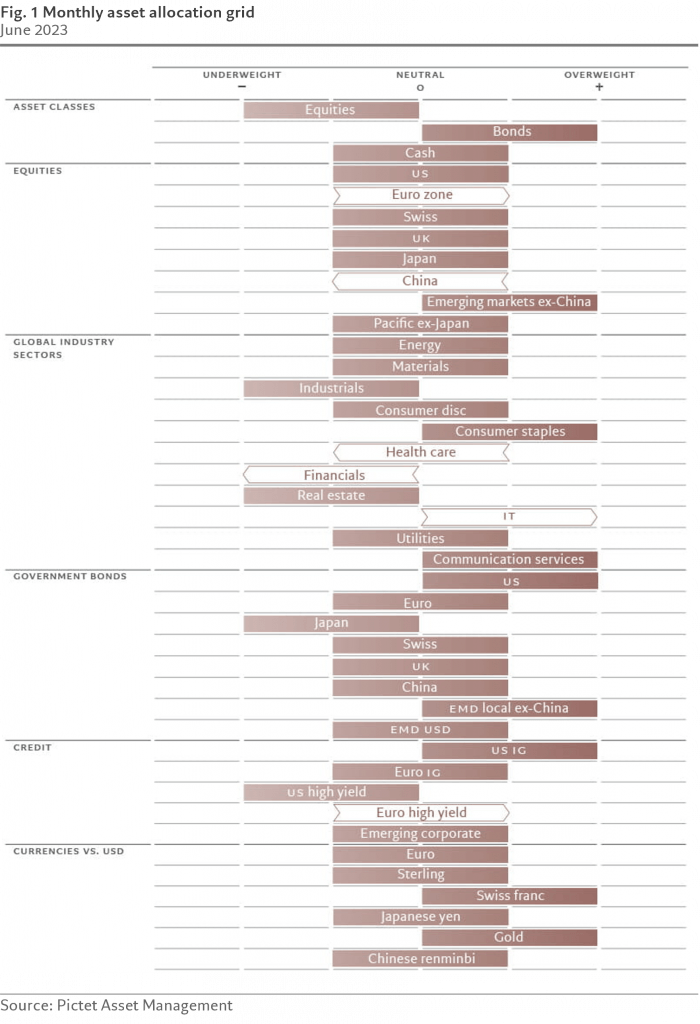

As a result, we remain cautious in our general asset allocation, with an overweight on bonds and underweight on equities.

Our globalbusiness cycle indicators show signs of softening momentum in developed markets, but with emerging markets still registering positive growth. We also detect a growing divergence within developed economies.

The US Federal Reserve’s dramatic series of rate hikes since the start of last year finally seem to be taking a bite out of the US economy. US consumers are responding by increasing their precautionary savings, though the stock of excess savings and relatively low household leverage ratios suggest that while growth will dip below potential, the US shouldn’t slide into recession.

By contrast euro zone growth is picking up – though even here the signals aren’t all positive. The economy continues to be two paced with a persistent gap between the more buoyant services and a contracting manufacturing sector, according to sentiment indicators, despite German unfilled orders remaining well above trend.

Overall, the euro zone’s trade balance has rebounded following the energy shock triggered by Russia’s invasion of Ukraine which should add to deflationary trends. Meanwhile, Japan is in its own virtuous economic cycle, with GDP growing solidly thanks to healthy domestic demand. The Bank of Japan, might, however, start to temper this if, as we expect, it winds up its ultra-accommodative monetary stance.

We remain positive on the Chinese economy as post-pandemic pent-up demand is significant and mortgage rates are falling. However, the timing of the recovery appears somewhat uncertain with April activity data clearly weaker than expected. Retail sales are running at 12 per cent below trend, and the real estate sector still struggling.

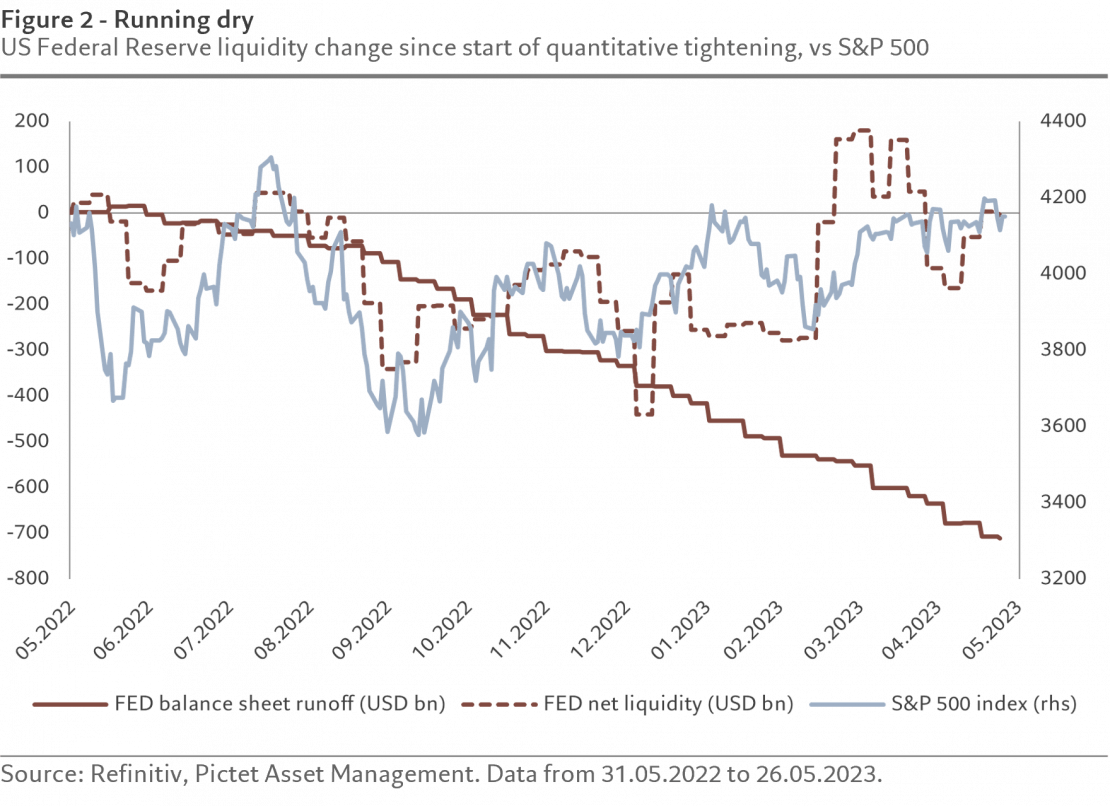

Our liquidity indicators show a desynchronised global cycle, with liquidity contracting in developed economies and expanding in the emerging world. But even in the developed markets, the contraction is less severe than it was at the start of the year, amid moderating inflationary pressures and – in the case of the US – the Treasury in essence injecting liquidity by drawing down its cash pile and the Fed providing emergency assistance to the financial sector.

Though the Fed retains a hawkish bias, we think it’s now on pause. That, however, won’t necessarily improve liquidity conditions – falling inflation means real rates are going up. At the same time, once the debt ceiling drama is resolved, the Treasury could be expected to rebuild its balances. That will also represent a liquidity squeeze (see Fig. 2). Still, the market is ambitious in its expectations for rates – 170 basis points of cuts over the next 18 months.

Our valuation metrics show that most asset classes are priced in broadly neutral territory – though the dispersion of valuation and yields for major asset classes is abnormally low, suggesting an under-pricing of market risk. Emerging market equities look cheap, broadly because of weakness in Chinese equities. Meanwhile, the gains of the past month have taken Japanese equities from cheap to neutral.

Overall, equity multiples have limited upside over the next 12 months on our model. The US market’s multiple is 15 per cent above our medium-term fair value, though falling inflation could cause it to overshoot further in the short term. We see corporate earnings staying flat in US and Europe this year, though there’s scope for upside surprises in emerging markets.

Our overall technical signal remains positive for equities, with momentum firming further in the Japanese and Swiss markets. Seasonality turned negative for European and UK equities, however. Generally, sentiment indicators are neutral, except for Japanese equities, which now look overbought. The bond score was unchanged at neutral, with the US Treasury market upgraded to neutral.

Most investor surveys point to weakening risk appetite, with fund managers stating their bond allocation is at a 14-year high. Equity outflows accelerated during the month, mostly driven by the US. At the same time, money market and government bond flows remained strong.

Opinion written by Luca Paolini, Pictet Asset Management’s Chief Strategist.

Discover Pictet Asset Management’s macro and asset allocation views.