Just as the markets had started taking the Ukraine-Russian war in their stride, the latest grim developments in the Middle East remind investors of how quickly geopolitical crisis can boil up. The conflict in Gaza comes at a point when economies are looking vulnerable.

The United States is in our view at the cusp of slowing significantly as US Federal Reserve rate hikes of the past year feed through to consumers. And though the Chinese economy looks like it has troughed, sentiment there remains depressed. Elsewhere, Europe’s resurgence is slow in coming. As a consequence we remain neutral equities. Valuations for stocks may be more palatable following the market’s recent pull-back and corporate earnings look resilient for now, but muted economic growth means there’s no compelling case to buy.

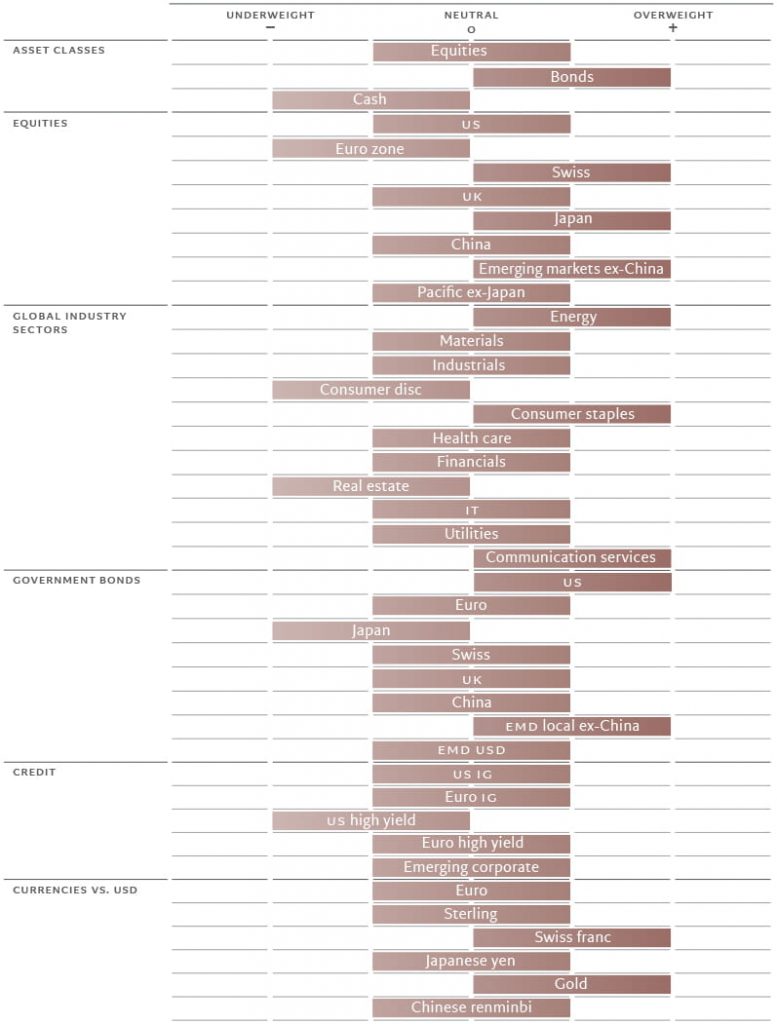

Our defensive stance is reinforced by our overweight in bonds.

Fixed income markets have suffered significant upheaval this year and the prospect of a surge in government bond supply is a growing worry given substantial public sector deficits, particularly in the US. Yet with bonds offering the most attractive yields for many years – they hit 5 per cent on 10-year US Treasuries, while real yields are at multi-decade highs – and a likely slowdown in both growth and inflation, we continue to hold an overweight in fixed income.

Source: Pictet Asset Management

Our business cycle indicators show that while emerging market economies remain resilient, developed markets are slowing. Within developed markets, the euro zone has better prospects than the US, although both are growing below potential. Over the short-term, the stickiness of inflation remains a concern, with headline price pressures having picked up. And should the conflict between Hamas and Israel expand beyond that immediate region, oil prices would respond. But we think overall that disinflationary forces hold sway, driven by subdued growth and easing supply chain pressures.

We expect the US economy to slow to well below potential and this year’s current rate of rate of expansion of 1.9 per cent. That’s mostly because we expect consumption to be muted as American households work through the savings surplus they built up during Covid. The euro zone is also subdued, with countries dependent on manufacturing faring especially badly. But that should improve with China’s slow recovery.

Japan remains the one bright spot in the developed world: we see it as the only major developed economy growing above potential in 2024. Consumer spending is strong, while governance reforms across the corporate sector are helping attract foreign capital.

Liquidity conditions continue to diverge across the world, with the US and Europe tightening and Japan witnessing the opposite (for now); China continues to offer modest stimulus.

In the US, higher real rates are proving a drag on loan-making. Also inhibiting the flow of credit is a pick up in the pace of quantitative tightening by the Fed and an increase in issuance of US government securities to cover the country’s significant budget deficit. Net US bond issuance is likely to come to USD300-500bn per quarter for the current quarter and quarters to come, compared to less than USD200bn during the previous quarter. Debt servicing costs will further add to the upward pressure.

Elsewhere, China’s flirtation with deflation could prompt Chinese authorities into taking a more aggressive monetary stance. Meanwhile in Japan, there are signs that a move towards tightening is imminent, though timing is a question.

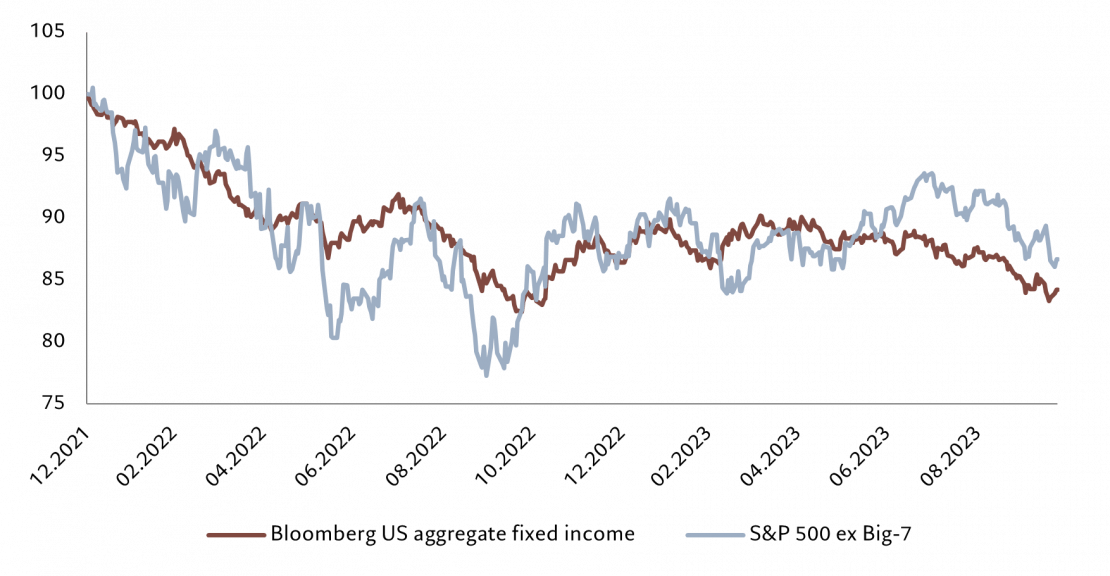

*Top 7 by current market cap: AAPL, MSFT, AMZN, GOOG, NVDA, META, TSLA.

Source: Refinitiv, MSCI, IBES, Pictet Asset Management. Data covering period 31.12.2021 to 25.10.2023.

Our valuation metrics clearly favour bonds over equities, not least because of a recent jump in yields. US equity price-earnings (PE) multiples remain above our model estimate. The 12-month price to earnings (PE) ratio for the market is 12 per cent above our secular fair value forecast of 16 times. The ‘Magnificent 7’ tech stocks that had been dominating the equity market’s performance, weakened somewhat, but are still on a rich forward PE of 28 times, which represents an 80 per cent premium to the rest of the market. But the rest of the market has tracked developments in bond yields (see Fig. 2).

Relative to bonds, equities are very expensive in the US. For the first time since 2001, stocks’ 12-month earnings yield is below the Fed funds rate and the gap between the earnings yield and the real bond yield is below 2 per cent. This has only happened four times in the past half-century.

Our technical indicators show weakening trends for equities, led by declining momentum in Japan and a deterioration in the euro zone. Seasonality remains favourable for the market over the next month, however. The bond trend has also deteriorated. Sentiment remains weak, suggesting oversold conditions for eurozone and Chinese equities. Within fixed income, high yield credit and emerging market hard currency bonds also look oversold.

Piece of opinion written by Luca Paolini, Pictet Asset Management’s Chief Strategist.

Discover Pictet Asset Management’s macro and asset allocation views here.

Disclaimer

This material is for distribution to professional investors only. However it is not intended for distribution to any person or entity who is a citizen or resident of any locality, state, country or other jurisdiction where such distribution, publication, or use would be contrary to law or regulation.

Information, opinions and estimates contained in this document reflect a judgement at the original date of publication and are subject to risks and uncertainties that could cause actual results to differ materially from those presented herein.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information used in the preparation of this document is based upon sources believed to be reliable, but no representation or warranty is given as to the accuracy or completeness of those sources. Any opinion, estimate or forecast may be changed at any time without prior warning. Investors should read the prospectus or offering memorandum before investing in any Pictet managed funds. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Past performance is not a guide to future performance. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested. This document has been issued in Switzerland by Pictet Asset Management SA and in the rest of the world by Pictet Asset Management (Europe) SA, and may not be reproduced or distributed, either in part or in full, without their prior authorisation.

For UK investors, the Pictet and Pictet Total Return umbrellas are domiciled in Luxembourg and are recognised collective investment schemes under section 264 of the Financial Services and Markets Act 2000. Swiss Pictet funds are only registered for distribution in Switzerland under the Swiss Fund Act, they are categorised in the United Kingdom as unregulated collective investment schemes. The Pictet group manages hedge funds, funds of hedge funds and funds of private equity funds which are not registered for public distribution within the European Union and are categorised in the United Kingdom as unregulated collective investment schemes. For Australian investors, Pictet Asset Management Limited (ARBN 121 228 957) is exempt from the requirement to hold an Australian financial services license, under the Corporations Act 2001.

For US investors, Shares sold in the United States or to US Persons will only be sold in private placements to accredited investors pursuant to exemptions from SEC registration under the Section 4(2) and Regulation D private placement exemptions under the 1933 Act and qualified clients as defined under the 1940 Act. The Shares of the Pictet funds have not been registered under the 1933 Act and may not, except in transactions which do not violate United States securities laws, be directly or indirectly offered or sold in the United States or to any US Person. The Management Fund Companies of the Pictet Group will not be registered under the 1940 Act. Pictet Asset Management (USA) Corp (“Pictet AM USA Corp”) is responsible for effecting solicitation in the United States to promote the portfolio management services of Pictet Asset Management Limited (“Pictet AM Ltd”), Pictet Asset Management (Singapore) Pte Ltd (“PAM S”) and Pictet Asset Management SA (“Pictet AM SA”). Pictet AM (USA) Corp is registered as an SEC Investment Adviser and its activities are conducted in full compliance with SEC rules applicable to the marketing of affiliate entities as prescribed in the Adviser Act of 1940 ref.17CFR275.206(4)-3. Pictet Asset Management Inc. (Pictet AM Inc) is responsible for effecting solicitation in Canada to promote the portfolio management services of Pictet Asset Management Limited (Pictet AM Ltd), Pictet Asset Management SA (Pictet AM SA) and Pictet Alternative Advisors (PAA).

In Canada, Pictet AM Inc is registered as an Exempt Market Dealer authorized to conduct marketing activities on behalf of Pictet AM Ltd, Pictet AM SA and PAA.