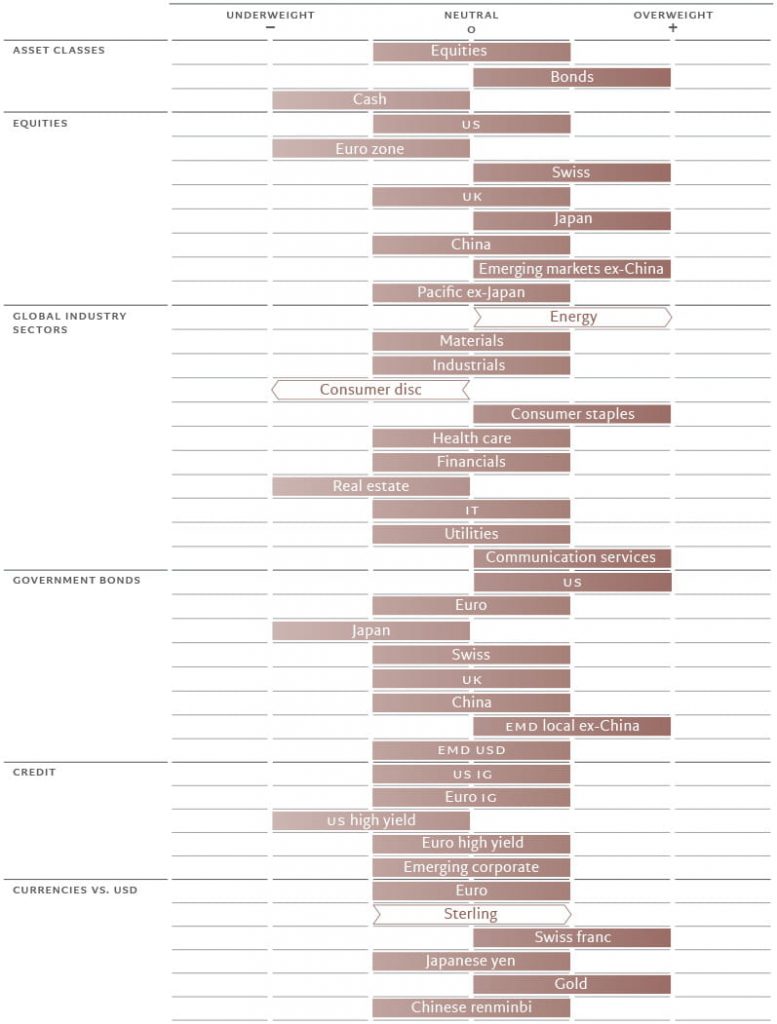

In the face of economic uncertainty and stubborn inflation, we continue to favour bonds over equities.

Asset allocation: looming economic slowdown casts shadow over stocks

The outlook for most major developed economies remains uncertain.

Economic growth in the US is likely to turn anaemic and stay below its long-term trend, while Europe is not expected to recover anytime soon.

We expect earnings growth of US companies to contract more than 2 per cent next year, in stark contrast to the estimates of analysts who forecast growth of as much as 10 per cent.

Also concerning is that developed central banks are poised to withdraw more liquidity from the financial system at a time when inflationary pressure is building once more.

With economic conditions unfavourable in much of the developed world, we retain a neutral stance on equities and an overweight on bonds; we are also underweight cash.

Source: Pictet Asset Management

Our business cycle analysis indicates the US economy is in a delicate state.

Industry surveys point to a drop in services consumption, which represents 70 per cent of economic activity in the country, while non-residential investment is also likely to fall because of high interest rates and a tight labour market.

All of this should weigh on the world economy, which we expect to grow just 0.5 per cent year on year next year, well below its pre-pandemic trend. Europe also remains weak as the economy feels the chill from tightening monetary policy and our leading indicator and consumer confidence are weakening.

In contrast, Japan is going from strength to strength.

We expect the world’s third largest economy to grow at 1.5 per cent next year, above potential and driven by strong exports. We expect higher private consumption in the coming months, and a sustained pick up in wage growth should prompt the Bank of Japan (BoJ) to end its negative interest rate policy.

China is showing early signs of an economic recovery. Consumption appears to have stabilised in the short term, leaving plenty of scope for improvement given retail sales remain 16 per cent below trend at a time when household deposits are 20 per cent above trend.

A recovery in the property sector is a missing piece of puzzle that would bolster consumer confidence.

Growth in the rest of the emerging world is likely to accelerate into next year, comfortably outpacing that of developed peers.

Our liquidity indicators support our neutral stance on equities.

Developed market central banks, apart from Japan, continue to withdraw liquidity from the financial system, even as they approach the end of their interest rate hike campaigns.

Liquidity conditions are likely to remain tight as inflation could well prove stickier than previously thought – not least because of a spike in oil and food prices.

In the US, a pick-up in government bond issuance expected in the coming months should also add to the liquidity squeeze.

Liquidity remains ample in Japan, however, as monetary policy there is accommodative, underpinning the flow of money and credit.

The beginning of an interest rate cut cycle in some parts of emerging markets should be positive for liquidity conditions there. Our valuation score supports our preference for bonds over equities.

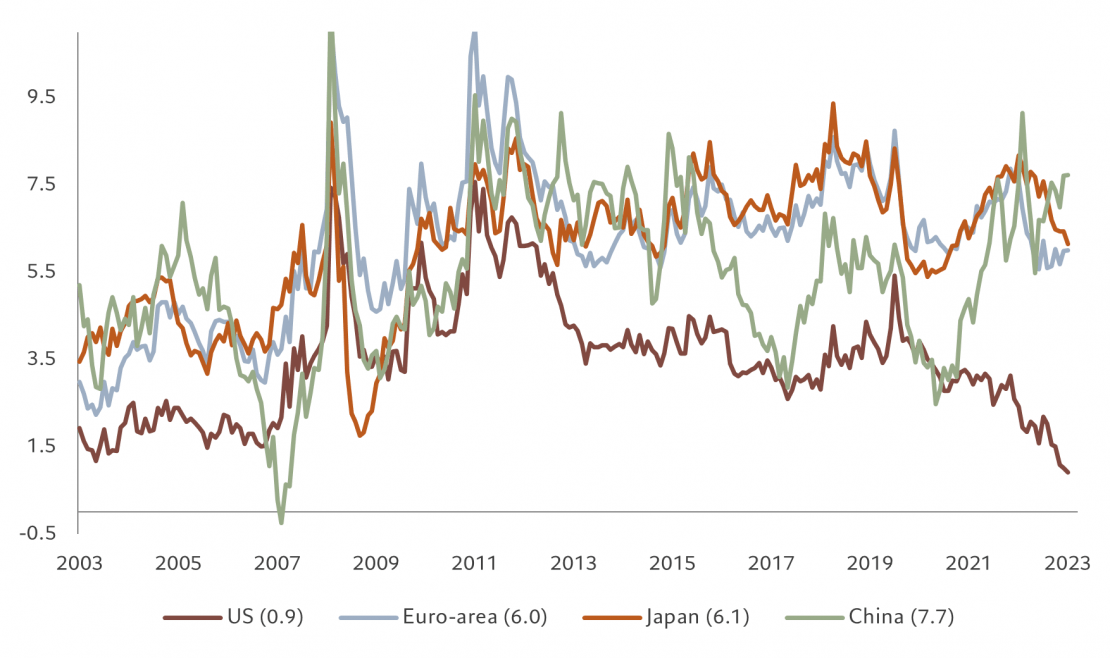

The US equity risk premium – or extra return investors get over risk-free rate — has fallen to 3.4 per cent, the lowest in more than 20 years (see Fig. 2).

Source: Refinitiv, data covering period 26.09.2003 – 26.09.2023

On comparison, offering a 10-year yield of more than 4.5 per cent, US bonds look particularly attractive.

Our technical indicators support our neutral stance on equities.

Investor sentiment and positioning indicators show that equities are falling out of favour, but they are not quite depressed enough to give us a contrarian buy signal.

Piece of opinion written by Luca Paolini, Pictet Asset Management’s Chief Strategist.

Discover Pictet Asset Management’s macro and asset allocation views here.

Information, opinions and estimates contained in this document reflect a judgement at the original date of publication and are subject to risks and uncertainties that could cause actual results to differ materially from those presented herein.