The key trends to look out for in science, technology and sustainability over the next 12 months – and beyond:

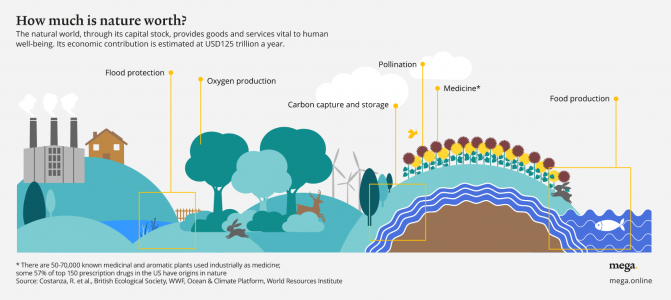

1. Protecting biodiversity

The world is waking up to the fact that protecting biodiversity is just as important for our survival on Earth as halting global warming. At the UN COP 15 summit in Montreal in December 2022, governments signed a ground-breaking deal to halt biodiversity loss by 2030. To achieve this, we will need to harness new and existing technologies to embed more sustainable practices across industries such as agriculture, forestry, IT, fishery, materials, real estate, consumer discretionary and staples, utilities and pharmaceuticals. Following COP 15, the financial sector is expected to increasingly contribute to this transition. The OECD estimates that investments aimed at protecting biodiversity stand at less than USD100 billion a year – a paltry sum, particularly when compared with what climate change attracts (USD632 billion). Expect that gap to slowly start closing in 2023.

2. High-tech cars

New technology brings disruption and opportunities to almost every industry. The auto sector is no exception. Electric vehicles are becoming ever more popular – not least thanks to the recent surge in petrol prices. 2023 will see new launches from many manufacturers, including Tesla’s iconic-looking pick-up truck. Five years from now, one in four new cars sold is expected to be fully electric.1 That, in turn, will fuel demand for batteries and semi-conductors. Automation is the other key tech shift in the car industry. While fully automous vehicles are still largely the stuff of science fiction, the latest models are offering ever more advanced automation features, backed by ever more complex software. China’s Baidu is even planning to launch a car with a detachable steering wheel. According to Goldman Sachs, the average length of software code per vehicle has doubled to 200 million lines in 2020, and is forecast to reach as high as 650 million lines by 2025, presenting a big growth opportunity for the tech sector.2

3. Computing at the edge

The rise of 5G and advances in AI have opened up a new era of data storage. Edge computing uses augmented reality and machine learning to analyse data at or near the place where it is gathered, or “on the edge”. It then takes advantage of super-fast transfers made possible by 5G to send that data to the cloud. When 6G comes, the process will be even faster. One of the key benefits of such an approach is low latency, which in turn opens the door to the development of new devices and applications which rely on minimal delays. Farms, for example, are starting to embrace edge-enabled ground and air sensors to monitor water and chemicals for optimal crop yields. Edge technology can benefit the environment, as it has lower carbon footprint compared to processing data on the cloud. It also creates new cybersecurity challenges and demand for solutions to address them.

4. Power of the circle

From metals and fossil fuels, to animals and crops, we are consuming a year’s worth of the Earth’s resources in just eight months, which is clearly not sustainable in the long run. The answer is to make the most of what we’ve got and make it last for as long as possible. The circular economy concept ideally envisages a world without waste – a loop whereby resources are used and reused for as long as possible. The emphasis is on creating products that are long-lasting and easy to take apart, repair, refurbish and re-assemble to make other products. The approach also involves making greater use of organic materials (such as wood in construction) that are part of a natural loop. Circular design can be applied both to consumer goods and to industry, and it’s a huge opportunity – the circular economy could unlock up to USD4.5 trillion of additional economic output, according to Accenture.3 Governments are increasingly on board. Circular economy is a key part of Europe’s Green Deal initiative, with targets for 2023 including legislation for substantiating green claims made by companies and measures to reduce the impact of microplastic pollution on the environment.4

5. Drug engineering

Drug development is notoriously slow and costly, with low chances of success. But that may be all about to change thanks to advanced computing. In one of the most exciting recent developments in the healthcare industry, DeepMind, Alphabet’s AI unit, succeeded in developing technology that can be used to predict the shape of any protein in the human body. The breakthrough potentially paves the way for much faster, cheaper and more efficient drug discovery – something Alphabet and others are now working on. Over the next decade, the market could be worth some USD50 billion, according to Morgan Stanley. 5

6. Battle against obesity

The prevalence of obesity in the world has tripled since 1975,6 and it is now responsible for some 3 million deaths a year. Covid increased awareness of how excess weight can make people susceptible to other diseases. There is growing momentum – from governments and individuals – to tackle the problem, which coincides with the development of new treatments. One potentially promising new weight loss drug has recently been approved for use in the US; another one is expected to get the green light in 2023. The global obesity treatment market could top USD54 billion by 2030 from just USD2.4 billion in 2022, according to Morgan Stanley. Insurers are slowly becoming more willing to cover obesity treatment, and there is also a growing appetite from the public to pay out of pocket where such coverage is not available.

7. Learning for life

Demographic and technological change have deeply impacted society. As a result, learning is no longer the mainstay of school. A growing number of countries are embracing lifelong learning as a means to cope with the challenges associated with longer-living populations. The pandemic prompted many people to reconsider their lives and their jobs. Labour shortages in some industries have created opportunities for new workers to step in. At the same time, improved work/life balances – with working from home saving commuting hours – have opened the door for people to take up new hobbies. Growing acceptance of online learning has made studying more accessible. It shouldn’t be a surprise that 2023 has been pronounced the “European Year of Skills”, with extra investment in training and a drive to get more women into science and technology.

Opinion written by Stephen Freedman, Head of Research and Sustainability for Pictet Asset Management’s Thematic Equities as well as Chair of the Thematic Advisory Boards

Discover more about Pictet Asset Management’s expertise in thematic investing

Notes

[1] https://www.alixpartners.com/industries/automotive-industrial/

[2] https://www.goldmansachs.com/insights/pages/software-is-taking-over-the-auto-industry.html

[3] https://newsroom.accenture.com/news/the-circular-economy-could-unlock-4-5-trillion-of-economic-growth-finds-new-book-by-accenture.htm

[4] https://environment.ec.europa.eu/strategy/circular-economy-action-plan_en

[5] https://www.morganstanley.com/ideas/ai-drug-discovery

[6] https://www.who.int/news-room/fact-sheets/detail/obesity-and-overweight

Information, opinions, and estimates contained in this document reflect a judgment at the original date of publication and are subject to risks and uncertainties that could cause actual results to differ materially from those presented herein.

Important notes

This material is for distribution to professional investors only. However, it is not intended for distribution to any person or entity who is a citizen or resident of any locality, state, country or other jurisdiction where such distribution, publication, or use would be contrary to law or regulation.

The information and data presented in this document are not to be considered as an offer or sollicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information used in the preparation of this document is based upon sources believed to be reliable, but no representation or warranty is given as to the accuracy or completeness of those sources. Any opinion, estimate or forecast may be changed at any time without prior warning. Investors should read the prospectus or offering memorandum before investing in any Pictet managed funds. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Past performance is not a guide to future performance. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested.

This document has been issued in Switzerland by Pictet Asset Management SA and in the rest of the world by Pictet Asset Management (Europe) SA, and may not be reproduced or distributed, either in part or in full, without their prior authorisation.

For US investors, Shares sold in the United States or to US Persons will only be sold in private placements to accredited investors pursuant to exemptions from SEC registration under the Section 4(2) and Regulation D private placement exemptions under the 1933 Act and qualified clients as defined under the 1940 Act. The Shares of the Pictet funds have not been registered under the 1933 Act and may not, except in transactions which do not violate United States securities laws, be directly or indirectly offered or sold in the United States or to any US Person. The Management Fund Companies of the Pictet Group will not be registered under the 1940 Act.

Pictet Asset Management (USA) Corp (“Pictet AM USA Corp”) is responsible for effecting solicitation in the United States to promote the portfolio management services of Pictet Asset Management Limited (“Pictet AM Ltd”), Pictet Asset Management (Singapore) Pte Ltd (“PAM S”) and Pictet Asset Management SA (“Pictet AM SA”). Pictet AM (USA) Corp is registered as an SEC Investment Adviser and its activities are conducted in full compliance with SEC rules applicable to the marketing of affiliate entities as prescribed in the Adviser Act of 1940 ref.17CFR275.206(4)-3.

Pictet Asset Management Inc. (Pictet AM Inc) is responsible for effecting solicitation in Canada to promote the portfolio management services of Pictet Asset Management Limited (Pictet AM Ltd) and Pictet Asset Management SA (Pictet AM SA).

In Canada Pictet AM Inc is registered as Portfolio Manager authorized to conduct marketing activities on behalf of Pictet AM Ltd and Pictet AM SA.