As many as 140 countries and hundreds of companies around the world have joined the race to achieve net zero emissions, halt global warming and avert a climate crisis.

However, limiting temperature rises to 1.5C by 2100 – the cornerstone of the Paris Climate Agreement signed six years ago – remains a distant hope.

Current projections, based on policies already in place, show the world will be 2.7C warmer than it is today.1

And even in the best-case scenario, which takes into account all the net zero pledges and promises, average temperatures are on course to rise by 1.8C.

The problem with net zero pledges as they stand is that not every industry can decarbonise at this pace.

“Net zero” is achieved when greenhouse gases pumped into the air are offset by removing the same amount of carbon from the atmosphere by other means.

To hit this goal by the middle of this century, every sector of the economy must reduce its greenhouse gas emissions.

Yet for industries such as agriculture, aviation, shipping and cement production, that is unrealistic. Their emissions are likely to remain high for decades. The same is true for large parts of the developing world. China and India will also not achieve net zero before 2060 and 2070, respectively, under their current targets.

This is where negative emissions technologies (NET), or methods to remove carbon from the atmosphere, could make a real difference.

According to Advisory Board members of Pictet AM’s Timber and Global Environmental Opportunities strategies, scientists and governments increasingly see NET as vital to achieving net zero goals.

Already, companies such as software giant Microsoft and re-insurer Swiss Re are using NETs to remove CO2 gases.

New and innovative NETs such as direct air capture are attractive as they can be more efficient and can reduce the operating costs of removing carbon. This means they could potentially be deployed on a far wider scale.

Go negative, be positive

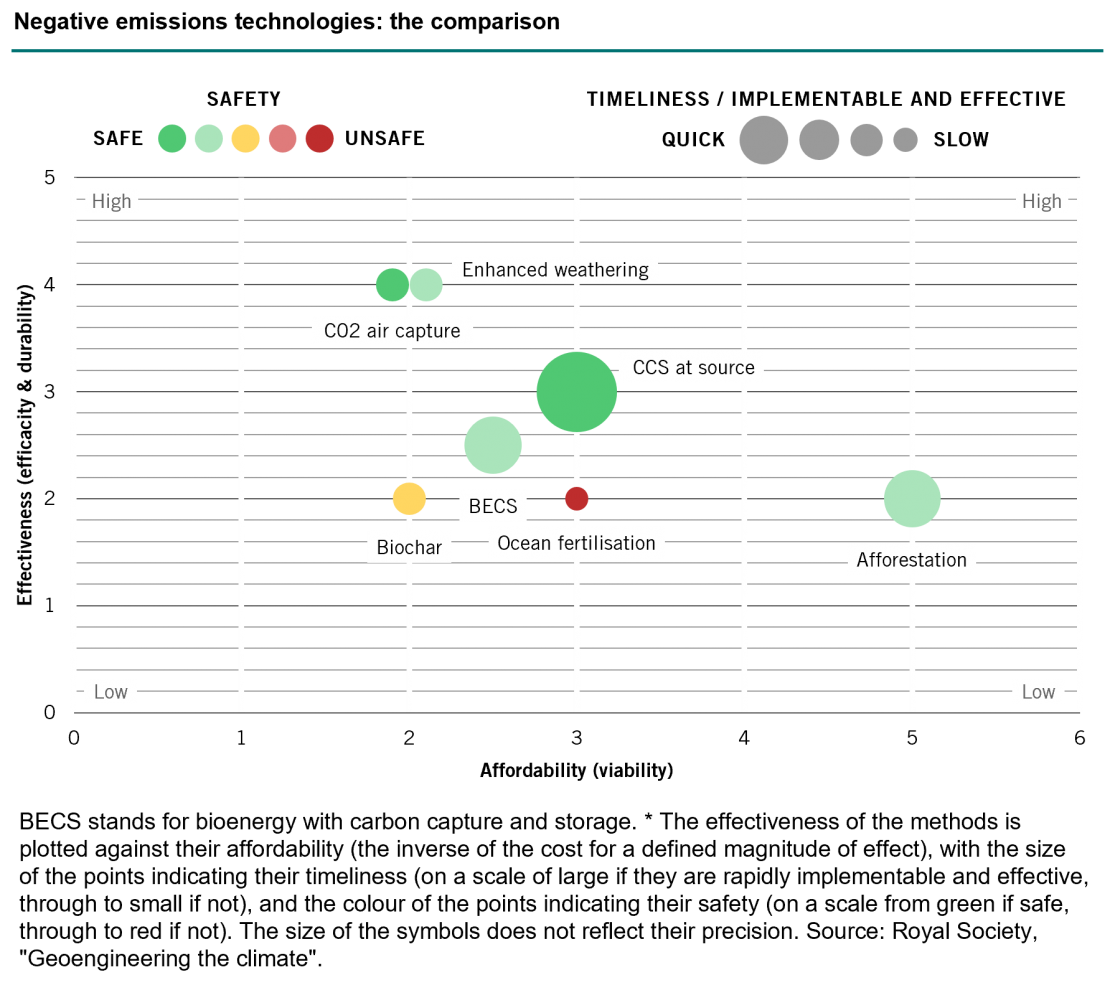

There are various ways to achieve negative emissions. But each solution comes with its own limitations, whether that is in terms of its effectiveness, durability and affordability.

Established NET methods such as the planting of trees rely on photosynthesis to absorb and lock in greenhouse gas, while emerging technologies such as carbon capture and storage (CCS) and enhanced weathering use chemistry to do much the same thing.

Afforestation is considered the most affordable method of removing CO2 from the atmosphere. At the same time, however, it scores less well on efficacy than other methods because it can take time for a newly planted forest to grow; its durability, meanwhile, hinges on the longevity of the forest itself. On the other hand, direct air capture technologies may be effective on installation but are currently very costly to implement.

While businesses have an array of NET options to choose from, our Advisory Board members say that relying on just one technology may be less effective than a using a combination of different methods. In other words, using a portfolio of NETs can deliver a better overall outcome than deploying a single system in isolation (see Figure). The combinations will, naturally, vary by industry and by company.

For example, Microsoft looks to forestry for 85 per cent of its projected carbon removal, but also uses soil, bio-energy, bioc-char and direct air capture.2

Aiming to eliminate all its historic emissions since its founding in 1975, the Seattle-based firm has already purchased the removal of 1.3 million tonnes of carbon across 26 projects around the world.

Price of going negative

Surprisingly, it is the fossil fuel industry that is perhaps best equipped to harness NET. That’s because some 90 per cent of its scientific, technological and engineering expertise is transferrable to the development of CCS technology.3

For other heavy emission industries such as agriculture or fashion, however, carbon removal technology is difficult to deploy at scale.

For these sectors, our experts say, a better solution could be the voluntary carbon market. This fledgling scheme, which operates outside regulated markets such as Europe’s Emissions Trading System, allows companies to offset their carbon emissions through the voluntary (as opposed to mandated) purchase of carbon removal credits.

The voluntary market is currently worth USD400 million but is expected to grow to as much as USD480 billion by 2050.4 This would equate to a drawdown of as much as 3.6 gigatonnes of CO2 equivalent (CO2e) a year, just under a fifth of the amount required by the Paris Accord.

Currently, the average voluntary carbon market price stands at around USD4-5 per tonne of CO2e. But industry estimates suggest could rise to as much as USD140 by 2050.5

In the short term at least, voluntary carbon market activities will be concentrated in land-based carbon-reduction tech, including afforestation, reforestation and improved forest management, which is both low cost and ready to implement. Over time, our Advisory Board members say, the market will expand to cover other emerging technologies, such as CCS.

But for the voluntary carbon market to take off, greater transparency is required. Not least in how offsets work.

For example, companies who buy carbon removal credits generated from afforestation should not expect to be able to apply the offsets immediately. In such cases, their use needs to somehow reflect the time lag between the point at which the carbon is released into the atmosphere to when it will be removed from a forest.

“The world should use NETs as part of a broader portfolio of carbon-reduction measures designed to place the economy on a more sustainable footing.”

No getting out of jail

For all the excitement around carbon offsetting, its expansion brings into sharp relief a thorny philosophical issue. If offsetting becomes the carbon-reduction tool of choice, it will do little to eradicate the activities that cause emissions in the first place.

Our Advisory Board members say NETs should not serve as some kind of “get out of jail free” card that allows polluters to avoid or delay efforts to cut emissions in the first place.

Rather, they say, NETs should instead form part of a broader portfolio of carbon-reduction measures designed to place the economy on a more sustainable footing.

Opinion written by Steve Freedman, Head of Research and Sustainability for Pictet Asset Management’s Thematic Equities as well as Chair of the Thematic Advisory Boards.

Discover more about Pictet Asset Management’s expertise in thematic investing.

Notes:

(1) Climate Action Tracker

(2) https://www.microsoft.com/en-us/corporate-responsibility/sustainability/carbon-removal-program

(3) McKinsey

(4) https://www.ucl.ac.uk/global-governance/news/2021/jan/reforming-global-voluntary-market-carbon-offsets

(5) UCL/Trove and McKinsey

Information, opinions, and estimates contained in this document reflect a judgment at the original date of publication and are subject to risks and uncertainties that could cause actual results to differ materially from those presented herein.

Important notes

This material is for distribution to professional investors only. However, it is not intended for distribution to any person or entity who is a citizen or resident of any locality, state, country or other jurisdiction where such distribution, publication, or use would be contrary to law or regulation.

The information and data presented in this document are not to be considered as an offer or sollicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information used in the preparation of this document is based upon sources believed to be reliable, but no representation or warranty is given as to the accuracy or completeness of those sources. Any opinion, estimate or forecast may be changed at any time without prior warning. Investors should read the prospectus or offering memorandum before investing in any Pictet managed funds. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Past performance is not a guide to future performance. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested.

This document has been issued in Switzerland by Pictet Asset Management SA and in the rest of the world by Pictet Asset Management (Europe) SA, and may not be reproduced or distributed, either in part or in full, without their prior authorisation.

For US investors, Shares sold in the United States or to US Persons will only be sold in private placements to accredited investors pursuant to exemptions from SEC registration under the Section 4(2) and Regulation D private placement exemptions under the 1933 Act and qualified clients as defined under the 1940 Act. The Shares of the Pictet funds have not been registered under the 1933 Act and may not, except in transactions which do not violate United States securities laws, be directly or indirectly offered or sold in the United States or to any US Person. The Management Fund Companies of the Pictet Group will not be registered under the 1940 Act.

Pictet Asset Management (USA) Corp (“Pictet AM USA Corp”) is responsible for effecting solicitation in the United States to promote the portfolio management services of Pictet Asset Management Limited (“Pictet AM Ltd”), Pictet Asset Management (Singapore) Pte Ltd (“PAM S”) and Pictet Asset Management SA (“Pictet AM SA”). Pictet AM (USA) Corp is registered as an SEC Investment Adviser and its activities are conducted in full compliance with SEC rules applicable to the marketing of affiliate entities as prescribed in the Adviser Act of 1940 ref.17CFR275.206(4)-3.

Pictet Asset Management Inc. (Pictet AM Inc) is responsible for effecting solicitation in Canada to promote the portfolio management services of Pictet Asset Management Limited (Pictet AM Ltd) and Pictet Asset Management SA (Pictet AM SA).

In Canada Pictet AM Inc is registered as Portfolio Manager authorized to conduct marketing activities on behalf of Pictet AM Ltd and Pictet AM SA.