An oil supply shock could be a threat to the markets in mid-2014. A rise in the global price of oil would cut spending and hurt profits. If there is no quick solution, this could be a summer of market discontent.

The sudden and successful advance of Sunni militants from the Islamic State of Iraq and Syria (ISIS) into northern and western Iraq has captured our attention and raised some concern. There is no ignoring the risks to the markets from this rapidly developing situation. The most important bargaining chip — or weapon — in such a situation is a country’s biggest economic asset. For Iraq, that asset is its oil.

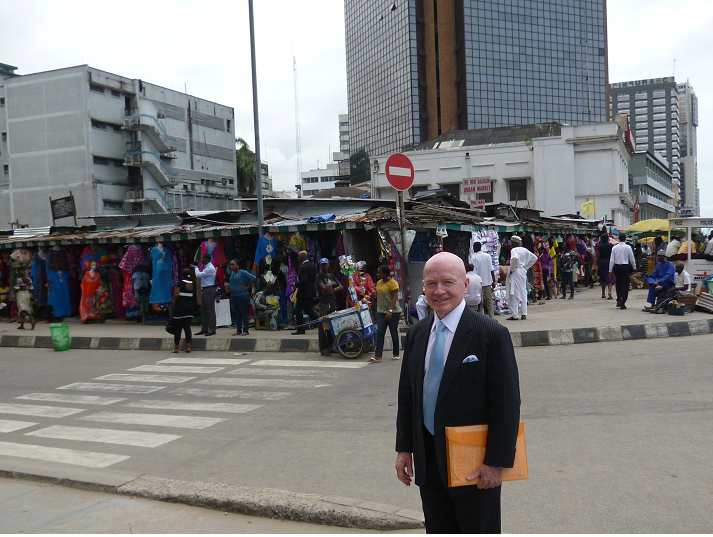

Flying back to Boston from Dubai last Friday, I was far from reassured as I thought over the six days I had just spent in the Persian Gulf region. While there, I asked everyone I could about the prospect for upheavals in the flow of oil and political power.

The consensus I heard was that the ISIS fighters have signaled their intention to use oil to further their cause — meaning that the price of oil is likely to rise in the near term. In fact, we’ve already seen evidence of price fluctuations in the spot and futures markets.

In the longer run, any new Iraqi government — whether hostile to the west or not — will eventually need to keep the oil flowing out to keep the money coming in. But in the meantime, even if the rebels fail to take over southeastern Iraq and the oil-exporting terminals on the Persian Gulf, there is still the chance of an escalation in the conflict and a further disruption in the flow of Iraqi oil.

I have consistently held out that the business cycle matters to investors. Rising energy costs would put the forward growth of the US economy directly at risk — especially if those costs rose above 7% or 8% of disposable income. And this could happen in the next couple of months for reasons unrelated to increasing demand.

As I have maintained throughout this business cycle, the United States holds an enviable position among its peers. The eurozone is heavily dependent on both oil from the Middle East and natural gas from Russia, another area of geopolitical concern. Since the Fukushima nuclear disaster in March 2011, Japan has imported nearly 100% of the fossil fuels needed to generate power.

Oil is relatively cheap in the US because domestic production has been rising, though still not enough for independence from imports. The reality remains that an oil price spike would threaten the buying power of US consumers and companies alike. And with 40% of S&P 500 profits coming from international sources, the US equity market’s ability to boost sales and earnings in the coming months could also be at risk.

Right now, I fail to see a quick solution, and so I fear a summer of market discontent might lie ahead.

By Fórmate a Fondo

By Fórmate a Fondo