The CONSAR announced a modification to the investment regime of the AFOREs: the limit for investing in structured instruments (alternative assets) will increase from 20% to 30% (press release). This expansion is subject to the conditions that will be established in the Circular Única Financiera (CUF), which is still pending publication.

Although the market remains on hold awaiting these guidelines, it is worth reviewing how AFOREs’ preferences have evolved over the past three years.

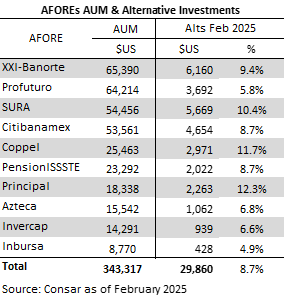

At the end of February, the assets under management of the AFOREs amounted to 343.317 billion dollars, of which 29.860 billion (8.7%) were invested in structured instruments, both local and international, at market value.

Of that total, internal estimates suggest that 4.3% corresponds to local investments (CKDs) and 4.4% to international ones (CERPIs). Considering that by regulation at least 10% of the CERPIs’ portfolio must be invested in Mexico, at least 0.4% of that 4.4% also has a national component, bringing the total proportion of local investment to 4.7% and international investment to 4%.

Now, if instead of market value we consider committed capital, the picture changes, and investment in structured products rises to 19.9% of total assets, which is a level very close to the regulatory limit. Of that percentage, 42% corresponds to CKDs (local investments) and 58% to CERPIs, consolidating the portfolio’s tilt toward international vehicles.

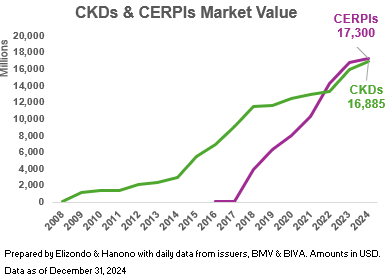

At market value, local investments stood at 16.885 billion dollars, while international investments reached 17.300 billion dollars as of the end of December, marking 2022 as the point when the market value of CERPIs began to surpass that of CKDs.

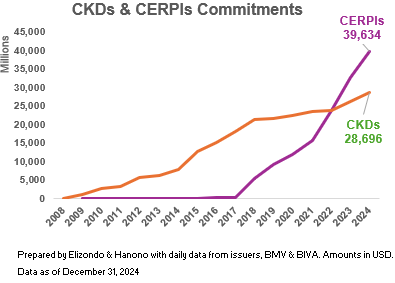

However, when reviewing the commitments of each, there are differences that favor international investments: 39.634 billion dollars in CERPIs vs 26.696 billion dollars in CKDs.

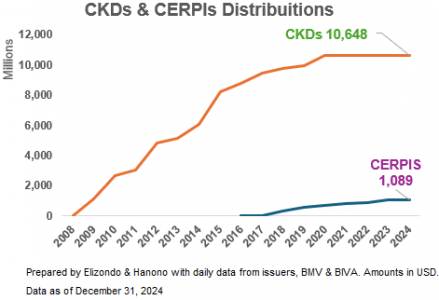

The age of the CKDs (2009) reflects a favorable trend in distributions, which as of the end of December 2024 stands at 10.648 billion dollars, while in the case of the CERPIs (2016 and international in 2018), it barely reaches 1.089 billion dollars.

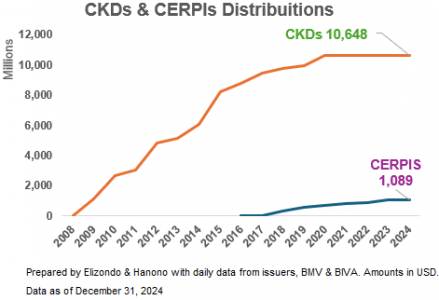

In the last three years, new placements have favored CERPIs over CKDs in both number of funds (155 out of 161) and committed capital (82% of the total issued between the two).

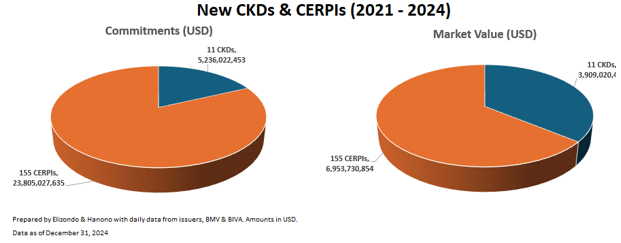

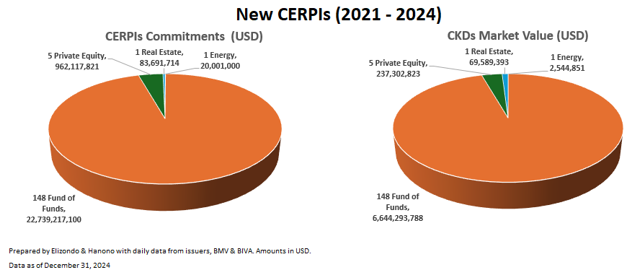

The new CERPI issuances have been allocated to fund of funds and feeder funds of the AFOREs, with an amount totaling 22.739 billion dollars, which represents 96% of the committed capital. These investments have gradually allowed the AFOREs to invest in international funds between 2021 and 2024.

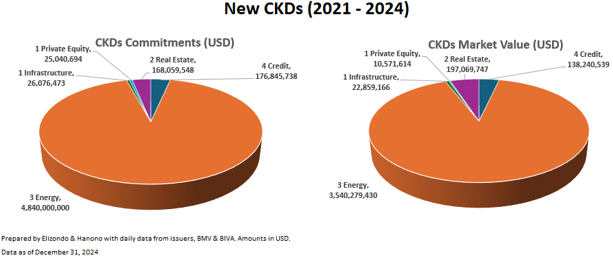

From the CKD issuances, commitments have been channeled primarily to the energy sector (92%), private credit (3%), and real estate (3%).

The new limit on alternatives (structured products) represents more than just a percentage increase—it is a silent warning for the local market. If CKDs fail to adapt to an environment where efficiency, diversification, and results are a priority, they risk falling behind compared to vehicles that are much more aligned with the AFOREs’ global vision.