As rates have shifted higher, high yield is now living up to its name.

Since 2008, there have been relatively few opportunities to invest in high yield at yields above 8%. Many investors who allocated to the asset class during these times, benefited from double-digit total returns over the subsequent one-, three- and five-year periods.

Since 2008, the average annualized forward return for the Bloomberg US Corporate High Yield index ranged from approximately 11% to over 18% when the starting yield to worst was higher than 8%. The results are similar for the global high yield market.

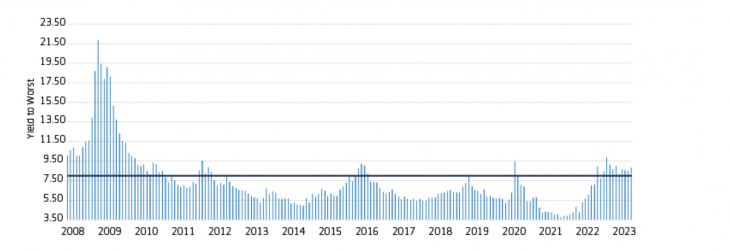

Exhibit 1: Yields above 8% are relatively rare, and can present above-average total return potential

Yield to worst for the Bloomberg US Corporate High Yield Index

Exhibit 1: Past results are not a reliable indicator of future performance. Source: Aegon AM and Bloomberg. Based on monthly Bloomberg. US Corporate High Yield Index data from January 1, 2008 to May 31, 2023. One-, three- and five-year returns are based on the forward annualized index return for months where the starting yield to worst was above 8%. Three-and five-year returns based on 44 months and 43 months, respectively, that had starting yields of more than 8%. Data is provided for illustrative purposes only. Indices do not reflect the performance of an actual investment. It is not possible to invest directly in an index, which also does not take into account trading commissions and costs. All investments contain risk and may lose value.

Assessing spreads and future return potential

While all-in yields are attractive, spreads remain around historical averages, leaving many investors grappling with the right time to increase their high yield allocation. Given the macro uncertainty, it is unlikely that we will see sustained spread tightening in the near term, although relatively tight market technicals can exert positive pressure.

Although spreads could be biased toward widening in the short term, we expect this could be more contained than during previous downturns given the higher-quality composition of the high yield market today relative to prior downturns.

Previous recessions have resulted in spreads widening above the 800 to 1,000 basis-point (bps) level. However, many of these periods were also during times of much lower risk-free rates. For example, the spread widening witnessed during 2020 occurred when rates were at historically low levels.

As a recession becomes more imminent, it is feasible that spread widening is more contained to around 600 to 700 bps given the higher-quality composition of the market and the solid fundamental starting point. Additionally, periods of spread widening could be short-lived, depending on the macro backdrop.

We believe that the majority of the Federal Reserve’s rate hikes have already occurred and that when the economy turns, rates are likely to decline, which could help offset some of the spread widening.

Additionally, after massive outflows from the high yield asset class in 2022, we may well witness a wave of inflows as opportunities arise and investors shift toward overweight, which could in turn provide supportive technicals and potentially result in swift spread tightening.

While it can be challenging to time the bottom or top of the market, we believe current yields can provide appealing long-term total return potential. In addition, we expect dislocations to emerge, presenting opportunities to capitalize on bouts of spread widening.

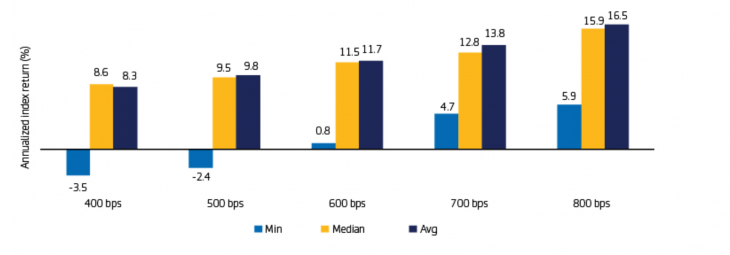

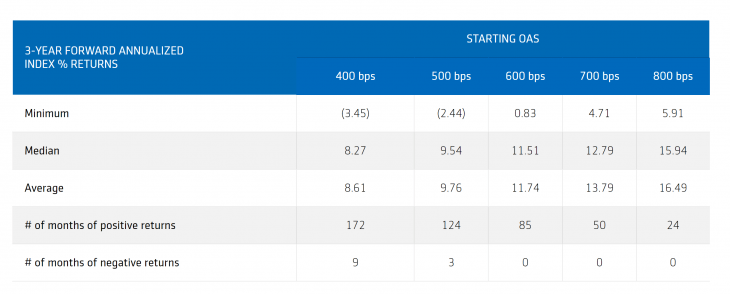

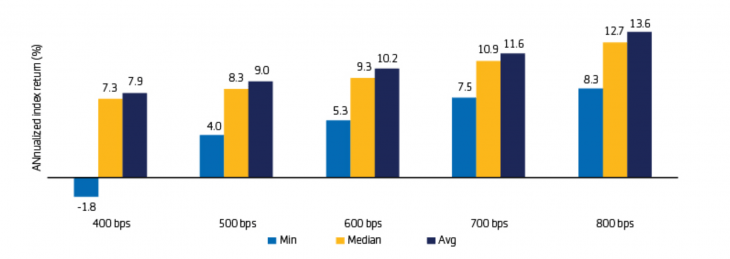

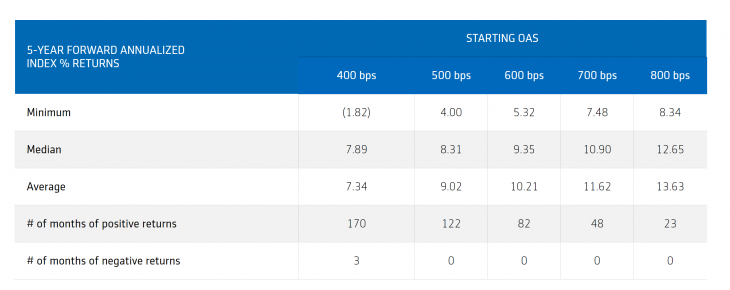

As shown below, the high yield index has historically generated average returns over 7% during the subsequent three- and five-year periods based on a starting OAS of 400 to 800 bps. The results are similar for US and global high yield indices.

Exhibit 2: 3-year forward high yield index returns based on starting OAS

Bloomberg US Corporate High Yield Index (monthly data from January 1994 through May 2023)

Exhibit 3: 5-year forward high yield index returns based on starting OAS

Bloomberg US Corporate High Yield Index (monthly data from January 1994 through May 2023)

Exhibit 3: Past results are not a reliable indicator of future performance. Source: Aegon AM and Bloomberg. Based on monthly Bloomberg US Corporate High Yield Index data from January 31, 1994 – May 31, 2023. The 3- and 5-year returns are based on the forward annualized index return for months where the starting OAS was at or above the level shown. Data is provided for illustrative purposes only. Indices do not reflect the performance of an actual investment. It is not possible to invest directly in an index, which also does not take into account trading commissions and costs. All investments contain risk and may lose value.

Time in the market, not timing the market

Overall, we believe yields around 8% can present attractive opportunities for long-term investors. Depending on your appetite for volatility, this may not be the environment to stretch for unnecessary risk in lower-quality CCC bonds, particularly when there are interesting opportunities to generate solid returns in higher-quality high yield bonds.

In this environment, we think there is a case to be made for long-term investors to consider gradual increases to high yield in an effort to capitalize on attractive yields, provided they can weather some short-term market swings. Spread widening may present opportunities to further increase allocations, however timing the bottom or top of the market can be challenging. After all, it is time in the market, not timing the market, that matters in high yield.

Over the long term, high yield has tended to deliver competitive risk-adjusted returns compared to many other fixed income assets, and even equities. As such, we believe the structural case for high yield remains very much intact. And throughout the remainder of the year, we expect high yield has the potential to generate attractive carry and solid coupon-like returns.

Article written by Kevin Bakker, CFA and Co-head of US High Yield; Ben Miller, CFA and Co-head of US High Yield; Thomas Hanson, CFA and Head of Europe High Yield; and Mark Benbow, Investment Manager. All of them of Aegon Asset Management.

Disclosures

Unless otherwise noted, the information in this document has been derived from sources believed to be accurate at the time of publication.

This material is provided by Aegon Asset Management (Aegon AM) as general information and is intended exclusively for institutional, qualified, and wholesale investors, as well as professional clients (as defined by local laws and regulation) and other Aegon AM stakeholders.

This document is for informational purposes only in connection with the marketing and advertising of products and services, and is not investment research, advice or a recommendation. It shall not constitute an offer to sell or the solicitation to buy any investment nor shall any offer of products or services be made to any person in any jurisdiction where unlawful or unauthorized. Any opinions, estimates, or forecasts expressed are the current views of the author(s) at the time of publication and are subject to change without notice. The research taken into account in this document may or may not have been used for or be consistent with all Aegon AM investment strategies. References to securities, asset classes and financial markets are included for illustrative purposes only and should not be relied upon to assist or inform the making of any investment decisions. It has not been prepared in accordance with any legal requirements designed to promote the independence of investment research, and may have been acted upon by Aegon AM and Aegon AM staff for their own purposes.

The information contained in this material does not take into account any investor’s investment objectives, particular needs, or financial situation. It should not be considered a comprehensive statement on any matter and should not be relied upon as such. Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to any particular investor. Reliance upon information in this material is at the sole discretion of the recipient. Investors should consult their investment professional prior to making an investment decision. Aegon AM is under no obligation, expressed or implied, to update the information contained herein. Neither Aegon AM nor any of its affiliated entities are undertaking to provide impartial investment advice or give advice in a fiduciary capacity for purposes of any applicable US federal or state law or regulation. By receiving this communication, you agree with the intended purpose described above.

Past performance is not a guide to future performance. All investments contain risk and may lose value. This document contains “forward-looking statements” which are based on Aegon AM’s beliefs, as well as on a number of assumptions concerning future events, based on information currently available. These statements involve certain risks, uncertainties and assumptions which are difficult to predict. Consequently, such statements cannot be guarantees of future performance, and actual outcomes and returns may differ materially from statements set forth herein.

Investments in high yield bonds may be subject to greater volatility than fixed income alternatives, including loss of principal and interest, as a result of the higher likelihood of default. The value of these securities may also decline when interest rates increase.

The following Aegon affiliates are collectively referred to herein as Aegon Asset Management: Aegon USA Investment Management, LLC (Aegon AM US), Aegon USA Realty Advisors, LLC (Aegon RA), Aegon Asset Management UK plc (Aegon AM UK), and Aegon Investment Management B.V. (Aegon AM NL). Each of these Aegon Asset Management entities is a wholly owned subsidiary of Aegon N.V. In addition, Aegon Private Fund Management (Shanghai) Co, Ltd., a partially owned affiliate, may also conduct certain business activities under the Aegon Asset Management brand.

Aegon AM UK is authorised and regulated by the Financial Conduct Authority (FRN: 144267) and is additionally a registered investment adviser with the United States (US) Securities and Exchange Commission (SEC). Aegon AM US and Aegon RA are both US SEC registered investment advisers. Aegon AM NL is registered with the Netherlands Authority for the Financial Markets as a licensed fund management company and on the basis of its fund management license is also authorized to provide individual portfolio management and advisory services in certain jurisdictions. Aegon AM NL has also entered into a participating affiliate arrangement with Aegon AM US. Aegon Private Fund Management (Shanghai) Co., Ltd is regulated by the China Securities Regulatory Commission (CSRC) and the Asset Management Association of China (AMAC) for Qualified Investors only.

©2023 Aegon Asset Management. All rights reserved.

AdTrax: 5785090.1GBL