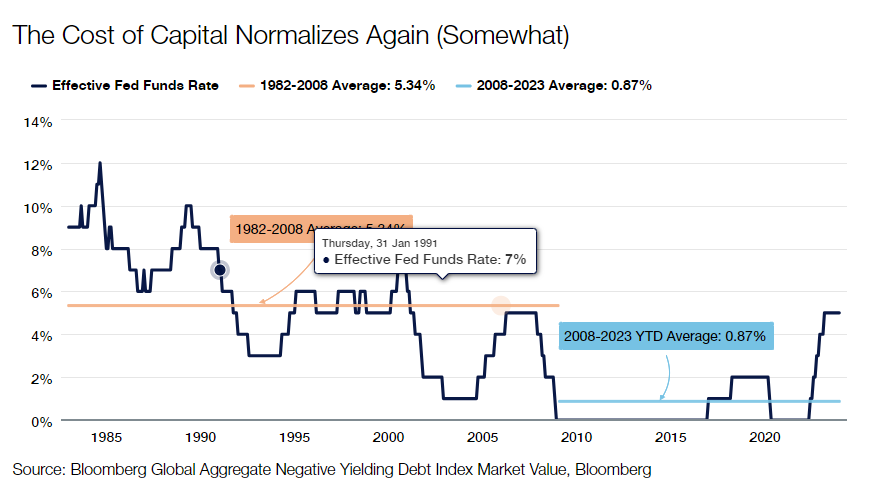

The past two years of navigating fixed income markets have come down to what we call the end of low-interest rate alchemy, during which previously low rates and cheap cost of capital helped pull demand forward and prop up asset markets. The Fed’s zero interest rate policy encouraged many consumers, companies and the federal government to borrow and, in the case of the latter two, notably increase their debt loads as a percentage of GDP.

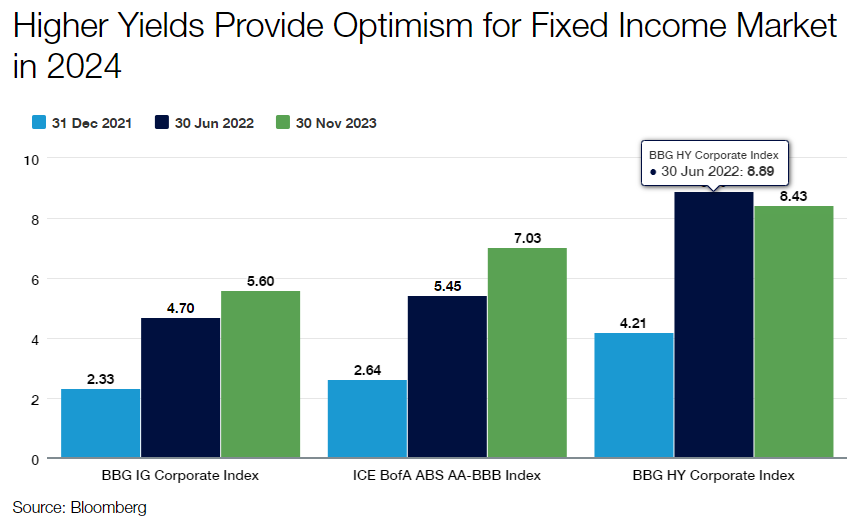

But 2022 and most of 2023 saw a sharp reset, with the Fed focusing squarely on taming inflation and sharply raising the cost of capital. This hawkish Fed policy led to the painful fixed income returns of 2022 but set the stage for a rebound in late 2023 that gave investors optimism about the kind of returns the fixed income asset class can deliver going forward.

Though trending down, inflation continues to be the Fed’s primary challenge, and the main question for 2024 is how much the Fed will turn its attention again to growth risks, and to what extent they deliver cuts to promote maximum employment. Those of us who predicted a recession in 2023 have been eating a bit of humble pie as the U.S. and developed economies in the European Union and Japan have so far defied expectations and continued to expand at a reasonably healthy pace.

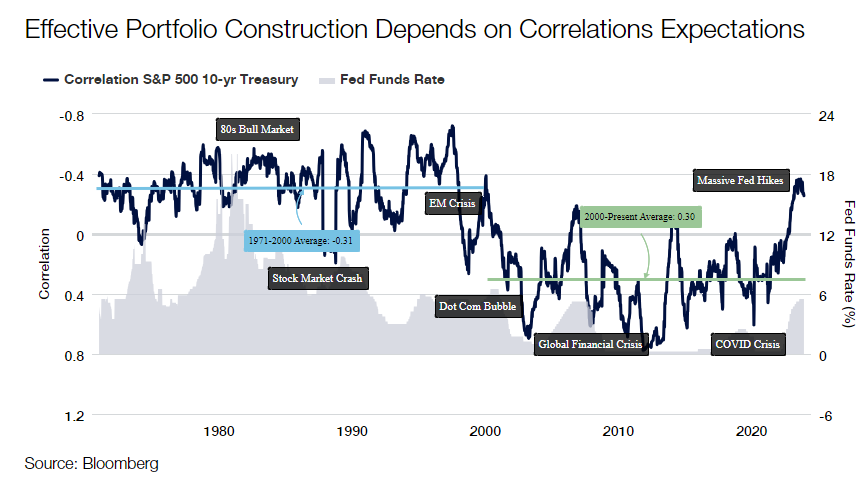

That said, we believe the current yield levels and the rally we experienced late in the year signal that painful fixed income returns are behind us. The Fed hiking cycle is essentially over, and the question is how many cuts the Fed will deliver in 2024. While the economy is likely to continue to slow, and inflation returns closer to ‘target,’ we believe the Fed will deliver cuts but will not be overly aggressive without a significant pullback in economic activity, causing rates to stay higher than the market currently expects. Given this backdrop, in 2024, we expect fixed income to return to its more familiar past playbook: find ways of generating high income levels, all while protecting from the recession tail. If we experience a recession, fixed income can and should act as a ballast and provide negative or low correlations with risk assets. And that is the basis for our 2024 global fixed income outlook.

We believe a recession, albeit a modest one, will likely become the adverse macro event that restores normalcy to the fixed income markets this year. We made this same forecast a year ago, but the Fed’s aggressive tightening since March 2022 should eventually tip the economy into at least a mild contraction. The aggressive rate hiking of the past two years takes time to work through macroeconomic multiplier effects. Still, we are finally seeing that happen in an increasingly alarming fashion across balance sheets.

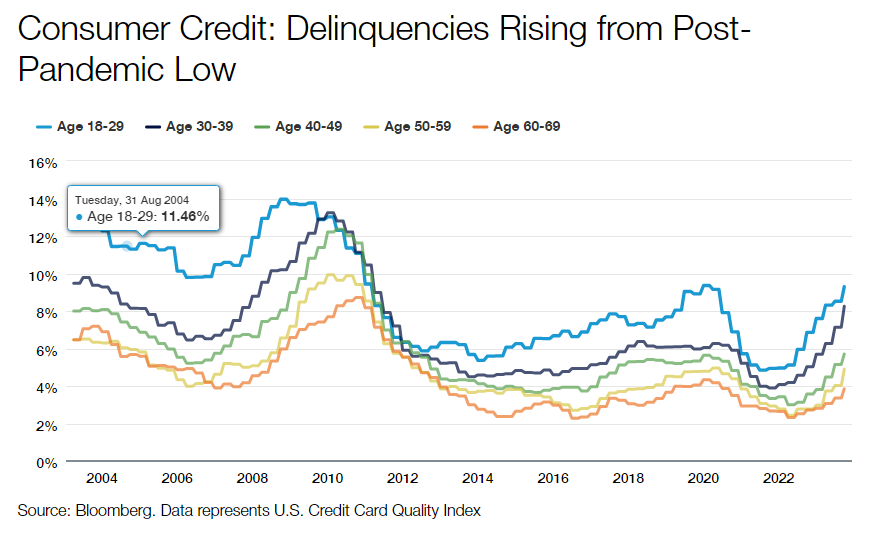

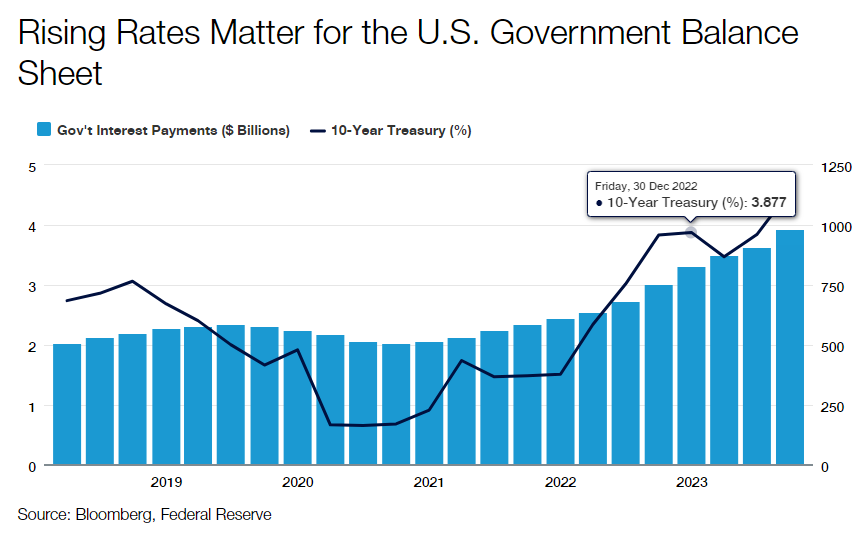

We typically see delinquencies and defaults on credit cards and auto loans in a recessionary environment. That’s happening. Home sales would slow dramatically and decline to multi-year lows. That’s happening. Consumer confidence would weaken. That’s happening. Interest coverage ratios would decline. That’s happening. Companies would require increased returns on investment for capital spending projects to cover the additional borrowing costs. That is also happening. Within government, we see sharp increases in the price of servicing debt. At the state and local government levels, we are beginning to see shortfalls in expected revenue growth that, in some cases, are leading to emerging budget shortfalls in current and future fiscal years.

All these things are finally happening as we expected a year or more ago. But the impact, regardless of the timing, is the same: the increased likelihood of a recession. The delayed timing aspect is primarily due to the strength of the consumer and labor market. But those strengths are fraying, and as that is likely to continue, a recession in 2024 is quite likely. We expect it will force the Fed to cut interest rates and launch a new easing cycle.

After December’s Fed meeting, markets priced in a series of rate cuts in anticipation of a dovish Fed next year. However, the Fed believes cuts they may deliver in 2024 do not serve as accommodative policy per se but rather to relieve the economy of rate levels it deems in restrictive territory.

Inflation was the driver behind the Fed’s massive tightening cycle of 2022-2023, and inflation will put the brakes on any aggressive easing cycle in 2024 and into 2025. The Fed has made it clear that its 2% inflation target has not changed, and with core inflation currently running at about twice that level, the central bank has to worry about how long inflation will remain above its target. Unless the expected recession is a genuine shock, we cannot expect the Fed to respond aggressively.

What keeps inflation from slowing to 2% given that it has slowed appreciably from its recent multi-generational peak? It all comes back to the stubbornly strong labor market, wage growth, and the wage pressures already built within the system.

The Fed’s approach to monetary policy suggests it will be comfortable waiting for inflation to slow to target and, to address growth risks, cutting rates to lower levels but still in somewhat restrictive territory. Since we don’t anticipate an actual shock-to-the-system type of recession in 2024, the Fed’s actions should signal to investors that ‘this is the business cycle, not an emergency, and this is what we’ve been trying to accomplish through the normalization of interest rates.’

Given this macro backdrop, we expect negative or low correlations with risk assets to reemerge. In other words, with the normalization of interest rates, it’s reasonable to expect the recent sharp reversion to negative correlations between fixed income and equity performance to continue even as the economy slips into recession. During the 30 years from 1971 through 2000, the correlation between stocks and bonds was -0.31. That correlation flipped to +0.30 from 2000 through today, even considering that correlations normalized back to about -0.25 in recent months.

When we look at valuations heading into 2024, we ask ourselves whether or not we are compensated for risk and an unexpected, perhaps tail, event. As the new year gets underway, we are not. But income generation is the best it’s been in 15 years, and focusing on removing potential volatility from portfolios will be the name of the game. These are interesting returns at current yields, even in an unchanged world. In fact, in the case of high yield corporates, they are equity-like returns, which is remarkable, especially since yields in that space were roughly 4% not so long ago.

Generally, we like less cyclical credits and, therefore, underexposed to a likely recession. Such acyclically oriented sectors include insurance, healthcare and utilities. As mentioned, although overall yields are attractive in the investment-grade and high yield corporate space, valuations in both sectors give us pause to add further exposure.

We continue to monitor weaker consumer trends. Excess savings have come down, and consumption is beginning to soften. In response, our positioning within securitized credit is in higher-rated senior bonds, which tend to behave with less volatility versus more credit-sensitive securities in the mortgage and asset-backed space. Consistent with this view, we find Agency mortgage-backed securities (MBS) attractive, with the potential to outperform should rates fall and mortgage refinancings pick up.

Opinion article by Jeff Klingelhofer, CFA, Co-Head of Investments and Managing Director at Thornburg Investment Management.

Important Information

Investments carry risks, including possible loss of principal.

The views expressed are subject to change and do not necessarily reflect the views of Thornburg Investment Management, Inc. This information should not be relied upon as a recommendation or investment advice and is not intended to predict the performance of any investment or market.

Please see our glossary for a definition of terms.

This is not a solicitation or offer for any product or service. Nor is it a complete analysis of every material fact concerning any market, industry, or investment. Data has been obtained from sources considered reliable, but Thornburg makes no representations as to the completeness or accuracy of such information and has no obligation to provide updates or changes. Thornburg does not accept any responsibility and cannot be held liable for any person’s use of or reliance on the information and opinions contained herein.

This is directed to INVESTMENT PROFESSIONALS AND INSTITUTIONAL INVESTORS ONLY and is not intended for use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to the laws or regulations applicable to their place of citizenship, domicile or residence.

Thornburg is regulated by the U.S. Securities and Exchange Commission under U.S. laws which may differ materially from laws in other jurisdictions. Any entity or person forwarding this to other parties takes full responsibility for ensuring compliance with applicable securities laws in connection with its distribution.