Despite predictions by many market participants, including us, that the relative setup for international equities was favorable entering 2023, the U.S. looks set to turn in outperformance versus the majority of other developed and emerging markets. However, we note that many indicators that led us to last year’s prediction remain stretched and that the MSCI EAFE Index has outperformed the S&P 500 since markets began rebounding in October 2022.

The primary driver of U.S. index returns in 2023 was the emergence of AI as a significant market driver and the resulting charge of the Magnificent Seven: Apple, Amazon, Alphabet, NVIDIA, Meta, Microsoft, and Tesla. As of mid-December, the Magnificent Seven had contributed about two-thirds of the S&P 500’s roughly 25% return, and the S&P’s remaining 493 stocks about one-third. As of mid-December, the top 10 stocks in the S&P 500 made up one-third of the index, a new high for the period of U.S. outperformance. The comparable numbers for the MSCI EAFE and ACWI ex USA indices are approximately 15% and 11%, respectively.

The Magnificent Seven began 2023 with a price-to-earnings ratio of about 20x and are wrapping up the year with a PE in line with their long-term average of about 28x. In other words, these companies began 2023 at a steep discount, which has been closed. Of their year-to-date return, more than half derived from the increase in their PE ratio and the remainder from robust earnings growth anchored in the explosion of interest and adoption of AI.

Heading into a new year, we see a disagreement between the U.S. equity and fixed income markets. As of late 2023, U.S. equities are priced at approximately 20 times earnings, which is 33% more expensive than the historical average of about 15 times earnings. Moreover, the financial markets anticipate earnings growth of about 12% this year. In other words, optimistic equity investors are willing to pay above-average valuations in anticipation of above-average growth.

However, the fixed income market is pricing in about 125 basis points of Fed easing in 2024 in anticipation of slower economic growth and perhaps the delayed recession many thought was possible in 2023. Market expectations for rate cuts were boosted in mid-December due to the dovishness surrounding 2023’s final FOMC meeting.

We find it difficult to reconcile these two outcomes: a robust economy supporting solid earnings growth and expensive valuations, but not an easier monetary policy. Or you have a weakening economy and likely recession that supports about 125 bps of Fed rate cuts but not robust earnings growth and historically expensive valuations. You can’t have it both ways.

This dichotomy, equity markets calling for growth and fixed income markets for recession, needs to be resolved, and investors may want to seek active equity returns until this situation settles. Given the mixed messaging from markets, we believe that quality and cash flow will be key for equities, and we favor businesses with durable models and the ability to navigate an environment with elevated levels of uncertainty and recession risk. Additionally, we believe active managers may be more agile in adapting to change through the coming year as financial markets rectify this bifurcation of expectations.

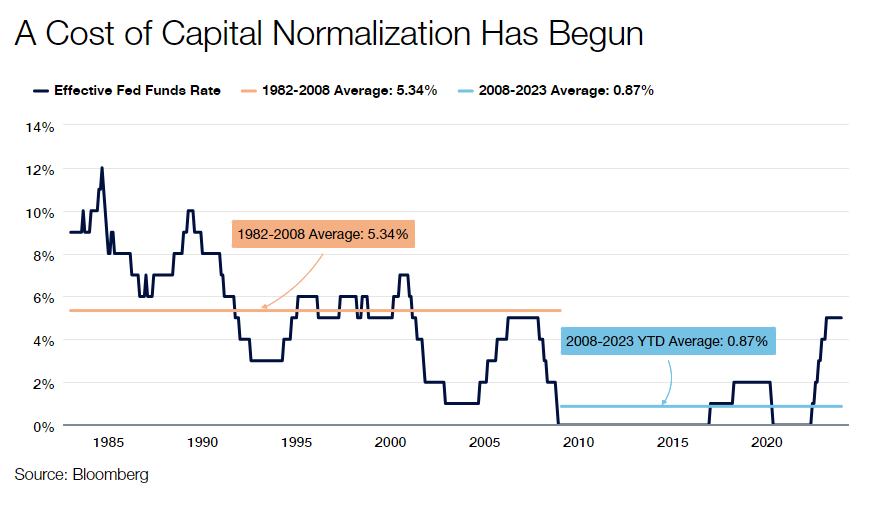

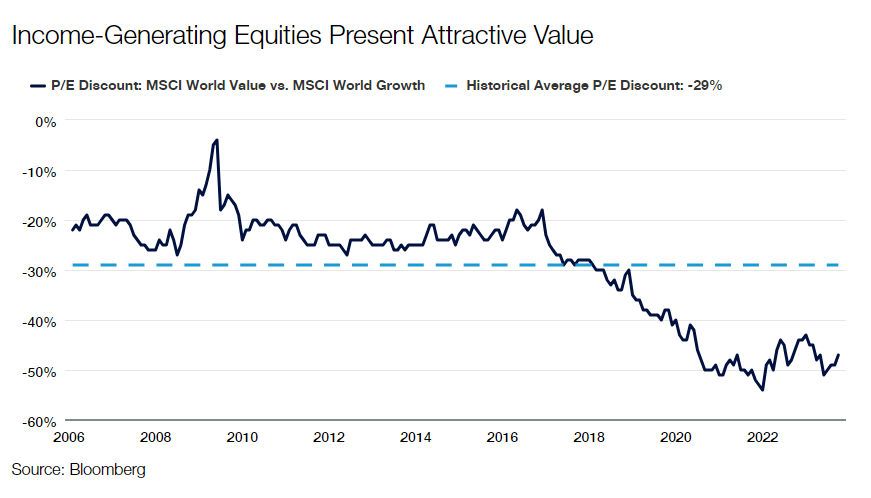

As the growth vs. recession situation resolves, and markets continue to digest a more normalized cost of capital (see the illustration above), we expect more modest returns for equity investors and an environment that may favor steadier income-generating stocks. While inexpensive capital of the past decade was a tailwind for companies with less cash flow today, but higher potential growth rates, the rapid rise in rates that began in March 2022 should support more mature companies with consistent cash flow profiles, strong moats and the ability to self-fund future growth. If this plays out as we expect, income will likely play an even more significant role than usual in total equity returns.

Investors are just emerging from a period of devastating inflation and performance in fixed income, and equity income portfolios that have produced growing income streams may be an excellent hedge against stubborn inflationary pressures in the U.S. and overseas. With fixed income markets still struggling in 2023, equity income has emerged as an attractive opportunity for investors, and we believe it offers attractive relative value and the opportunity to deflect any volatility stemming from the standoff between growth and a slowdown or even recession.

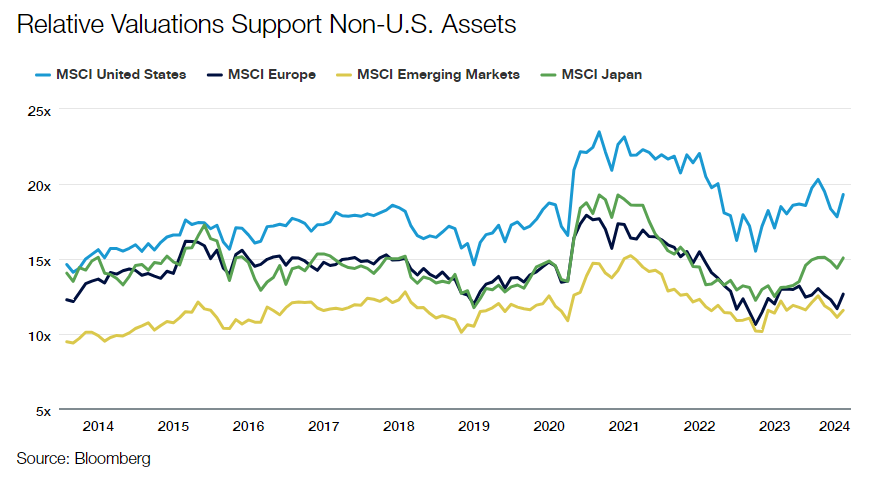

U.S. equities have outperformed international equities for much of the last 15-plus years. But we know from history that relative performance between U.S. and non-U.S. markets is cyclical.

At the end of last year, we noted several factors that in past markets (notably in the early 2000s) had led to a turn in international vs. U.S. performance. While that didn’t happen in 2023 due primarily to the catalyst of AI and the performance of the Magnificent Seven, we note that those factors are still present and at stretched levels:

- Relative Valuations: The MSCI ACWI ex USA Index trades at a 33% 1-year forward P/E discount to the S&P 500, near the widest levels of more than 15 years of U.S. outperformance. While research has shown that although valuation differentials may have a low correlation to short-term returns, they have an increasing impact the longer the holding period.

- The U.S. Dollar: The dollar is a significant factor in the relative performance of international equities, contributing about 40% of international outperformance in 2002-2007 and half of its underperformance since then. The U.S. Dollar Index (DXY) sits at its highest level since late 2002, around the last time international began to outperform the U.S.

- Market Concentration and Breadth: As noted above, just seven stocks contributed roughly two-thirds of U.S. performance in 2023, and the top 10 stocks now constitute 32% of the S&P 500. The comparable numbers for the ACWI ex USA Index are about 20% of the total return from the top seven stocks and 11% of the market cap in the top 10 companies.

While we can’t time a turn in relative performance, we think it makes a strong case for rebalancing by U.S. investors who hold roughly 14% of their equity portfolio in international companies versus a 38% weight in the MSCI ACWI Index.

While value has outperformed in international year to date as opposed to the U.S., where growth has outperformed due to AI and the impact of the Magnificent Seven, there is no shortage of interesting Growth and Value investment themes outside the U.S. In AI, many leading “picks and shovels” investments are outside the U.S.—companies such as Taiwan Semiconductor and SK Hynix and semiconductor equipment makers ASML, BE Semiconductor Industries, and Disco. In the booming market for weight loss medications, Ozempic manufacturer Novo Nordisk’s headquarters are located in Denmark.

We like these names because we don’t have to select the “winners” but focus on the firms providing the tools all players need in the AI revolution. We believe many of the best firms and most attractive valuations are outside the U.S.

Opinion piece by Ben Kirby, CFA Co-Head of Investments and Managing Director at Thornburg Investment Management

Important Information