Issuers on the brink of investment grade, as well as high-yield issuers, continue to face significant challenges in securing financing. Debt markets are slowly reopening for European commercial real estate companies, but investor confidence has yet to recover to pre-2022 levels due to high leverage, significant capital investment, and concerns over the governance of some issuers.

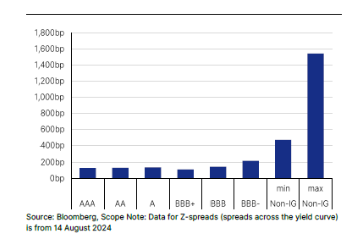

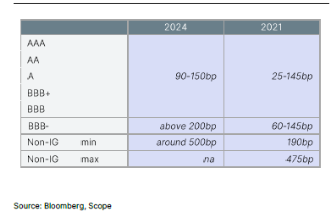

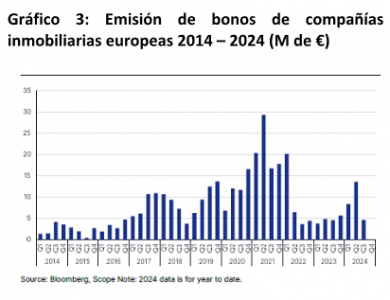

Only companies with a strong BBB credit rating or higher have access to the most liquid debt capital markets. Falling bond yields and tightening spreads may provide capital market-based financing competitive with secured bank loans. For these issuers, spreads on new issues range from 90 to 150 basis points, close to the 25-145 basis point range in 2021 (Charts 1, 2), the year when debt issuance in the capital markets for real estate companies reached its peak (Chart 3).

For companies at the investment grade threshold—rated BBB—the fear of a downgrade translates into much wider spreads. New issue spreads exceed 200 basis points, in stark contrast to the 60 to 145 basis points range in 2021.

Although we believe prices have bottomed out in some property segments, investor nervousness also points to the risk of further declines in property values at the riskiest end of the European commercial real estate market. Banks’ appetite for financing less attractive commercial properties remains limited, exposing real estate managers to a negative feedback loop. The sale of distressed assets could call into question current valuations and act as a catalyst for balance sheet restructuring. Additionally, possible sales of open-end real estate funds to offset cash outflows will test market resilience.

Non-Investment Grade Issuers Continue to Face Tough Financing Challenges

Spreads are even wider for issuers below investment grade and companies with governance concerns.

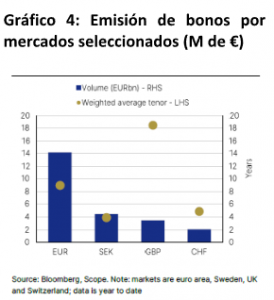

In practice, debt capital markets do not offer them a financing source to avoid potential covenant breaches and support interest coverage ratios. Smaller European capital markets, like the Swedish market, only offer loan borrowers shorter-term credit (Chart 4), providing little relief to an industry burdened by debt.

The Risk of Further Declines in Property Valuations Looms Over the Sector

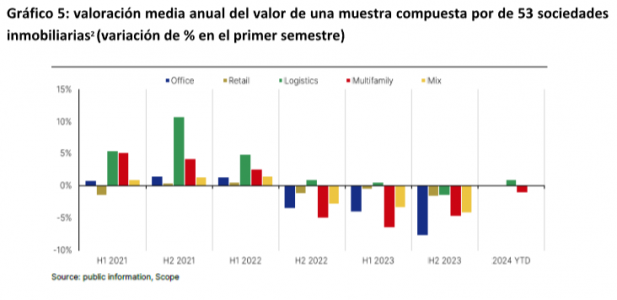

Investor caution also reflects the considerable risk that further devaluation of real estate assets remains. Corrections in prime real estate assets (retail and office), as well as residential and logistics properties in general, are nearing the bottom (Chart 5). However, prices of non-prime assets and those requiring heavy investments—such as modernization, environmental compliance, and conversion to meet structural changes in demand—continue to decline.

Open-end real estate funds, which are experiencing large cash outflows, could exert additional downward pressure on valuations if they begin to divest less attractive properties from their portfolios to gain liquidity. So far, funds have avoided doing this to maintain the net asset values of their assets. For example, if a substantial portion of the properties—such as part of the €128 billion in investments held by German open-ended funds—were to hit the market, we would witness further devaluation of real estate assets.

A More Abrupt Shift in Interest Rates Offers the Possibility of Greater Relief

European real estate companies would clearly benefit, like any indebted sector, from a more abrupt shift in the interest rate cycle if fears of recession and stagnating growth lead to looser monetary policy in Europe and the U.S. Currently, we foresee a continued, cautious reduction in interest rates, with a single 0.25 basis point cut from the ECB and the Federal Reserve in the second half of the year.

Underlying interest rates have dropped sharply due to recession fears in the U.S. If weaker growth prospects and slow economic growth in the U.K. and the EU materialize, quicker rate cuts could provide a funding opportunity for companies with structurally solid portfolios, low leverage, and no governance issues. In general, we expect few short-term issuances from smaller real estate companies (gross asset value below €2 billion) in the eurobond market.

The benchmark bonds these companies issued to take advantage of the market’s low financing costs in the decade before 2022 have left many with the headache of refinancing them at much higher rates today, if they can.

Banks Continue to Support the Sector… Up to a Point

Banks have become more cautious and selective but are still lending to the sector. They are willing to renew existing financing for properties or real estate portfolios with solid operational performance and are even willing to grant new loans if the collateral is firm and commitments are strict. Loan margins for secured loans have increased to 60-230 basis points, depending on property type, ultimate ownership, leverage, and, most importantly, location. Thus, bank financing may be a more reasonable alternative for weaker creditors than capital markets-based financing.

However, bank financing has its limits. Banks have not only tightened loan guarantees but have also focused more on the composition of their loan portfolios with respect to maximum exposure to a sector, individual issuers, and/or properties without good energy efficiency certifications or other eco-building ratings. Secondly, high-leverage transactions are no longer viable, meaning that if a borrower has financing problems, they may need to turn to grey debt markets at much higher costs.

Bank loans can only cover a marginal portion of bond refinancing due to mature, leaving issuers with lower investment grades and non-investment grades under pressure to restructure their assets or liabilities—most likely at a high cost for both shareholders and debt holders.

European real estate companies as a whole have weathered the worst of the recent financing crisis, but the credit outlook for many companies remains highly uncertain.