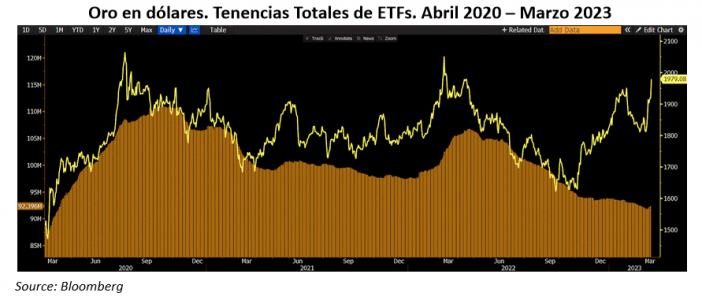

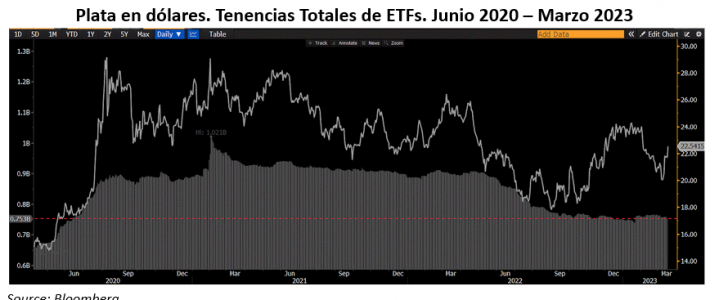

This bearish cycle is the first major test for precious metals ETFs, whose holdings skyrocketed in 2020, fell two years diagonally, rebounded in 2022, and have been falling almost unabated for 10 months. So far, the test is not satisfactory. Even with the price rally between October and January, and now in March, investors seem skeptical and tend to further reduce the investment.

Gold investments go up and down like a roller coaster

ETFs that track the trajectory of gold and silver rose to prominence in the mid-2000s and grew to absorb the majority of production. Holdings of GLD, IAU and others (histogram) reached 83 million ounces (M) −about 157,3 billion dollars (B) − in 2012 due to the tremendous rise in price to $1.895 from $377 (line); from there they fell 45% to 46M in 2015 due to the collapse of the metal, also 45%; they recovered to 69M in 2016 and continued to grow to 111,4M in 2020, in the midst of the pandemic. The enchantment began to reverse. The prolonged reduction stopped in January 2022, around 98M. From there the brilliance reappeared, intensified by the outbreak of the Russia-Ukraine war that pushed the price back to the all-time high of $2.000 (white line). And since May the global investment descends like a roller coaster due to the Fed’s monetary policy, a true factor of price variation. The slide appeared to slow at 94M in October, as gold returned to the range it had been in before the Covid era, but continued at a less pronounced pace. As of March 10, the fall sharpened to 91,8M, −166.2 B−, 17% below the highest peak and 14% below the last year high, although 7 days later they were 92,4M −around 182,3 B−.

Managers (or retail investors) did not react in November-December to the price improvement to $1.950, the threshold of the highest peak: holdings fell beyond the level they were in September-October, when the metal was trading at the lowest rank in almost four years. Instead, they did react to the dip to $1.836 in February, reducing holdings to April 2020 levels.

Silver holdings: two-year stability distorted by the Fed

SLV, SIVR and others (grey histogram) increased their silver positions to 504M −24,4 B− in 2011, when the price skyrocketed to $48.50. By 2015 they had reduced them by 13% in response to the decline of 72% of the metal to $13.90, to stabilize them in the following 8 years around 550M and increase them, due to the monetary frenzy, by 75%, to 896M, between 2019 and 2020, when the price went up to $29 (white line). Investments stabilized between August and December of that initial year of the pandemic to suddenly rise vertically, up to 1.02B in February 2021, due to the call on Reddit to “squeeze” the metal. Since then they have decreased. See the precipitation from May. Last January, global investment fell 28% from the peak and 19% from the 2022 high to 739M, June 2020 levels. As of March 17, it recovered to 752,8M −15,4 B−, reducing the drop to 26% and 17%, respectively.

The decline in holdings, completed just two months ago, was the result of the price falling from $26. An ounce bottomed out at $17.60, from where it began to improve, although the decline in holdings did not abate. As in the case of gold, managers or investors were indifferent to the rise to $24 between October and December and even hurried selling until holdings fell to 739M, levels at the start of the pandemic, in June 2020. But they saw something come out to buy in January raising assets to 764M even as the rally petered out. What is interesting, unlike in the case of gold, is that the selling was stopped even though the white metal fell back to $20,60.

First serious test for gold and silver ETFs

Holdings already influence the direction of prices. The only precedent for the reaction of managers and/or investors to monetary tightening and the free fall of gold and silver, is that of 2011-2015, which may not be useful to infer how they will continue to act now. The disenchantment with gold, which is widely used for hoarding and ornamentation, is relevant. Regardless of the differences in attitude towards one metal and the other, one thing is clear: Holdings are back to numbers of three years ago and may be further reduced. Although prices are higher than then, precious metals do not hedge money from the loss of purchasing power and that the fundamental factors (production, demand, use in solar panels and vehicles, etc.), do not affect the prices. And the outlook is clearly not rosy. Continued selling suggests investors do not expect prices to return to high levels. The rallies seem to be used to sell, not to restore positions. Although the possible softening of the Fed due to fears of a new banking crisis is priced in, (gold rebound to around $1.970, silver around $22,50), pessimism is more permeable.

Column by Arturo Rueda