Duration is a measure of how sensitive the value of a bond (or a portfolio) is to changes in yields. If yields fall – all things remaining equal – a bond with a higher duration should experience a higher total return than a shorter duration bond. Equally, they should fall more in value in percentage terms when yields rise.

A cruel quirk of fixed income assets is that the more expensive they get (the lower the yield) the riskier they become, as their duration risk rises. This created the ingredients for the perfect post-pandemic storm that struck the bond market, causing it to have one its worst years on record in 2022.

Nothing lasts forever, though. Various factors have emerged that favour taking risk. So the question for investors is: if not now, when?

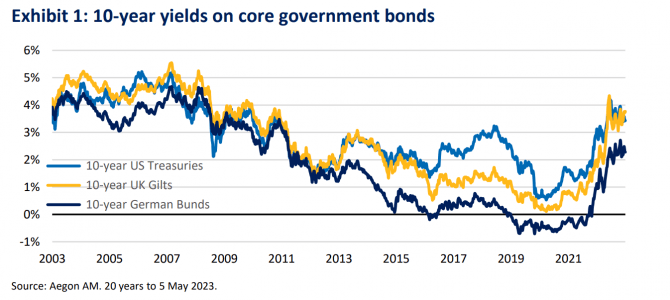

As Exhibit 1 shows, government bond markets have experienced an extreme repricing since their yield lows of 2020. Since then, 10-year UK Gilt and US Treasury yields increased by almost 450 bps, with 10-year yields in Germany rising by around 350 bps over the same period. This repricing was necessary to reflect the macroeconomic backdrop of the time, and in many markets pushed yields to their highest levels since the financial crisis.

The opportunity to buy ‘risk-free’ assets at yields around 4% is not to be sniffed, especially after years of investors being forced into taking ever more risk to achieve any sort of yield or income. As a key cornerstone for any investment decision, government bond market valuations are compelling again, creating a solid foundation for future total returns.

Another support for improved valuations is that duration can again act as a risk-off hedge. With a higher starting point than in recent years, yields now have room to fall in a flight-toquality situation. We saw this when the US regional banking stresses emerged in March, and then again when First Republic failed in early May. With duration acting as a stabilising factor again, this adds to its attraction at a time of macroeconomic uncertainty.

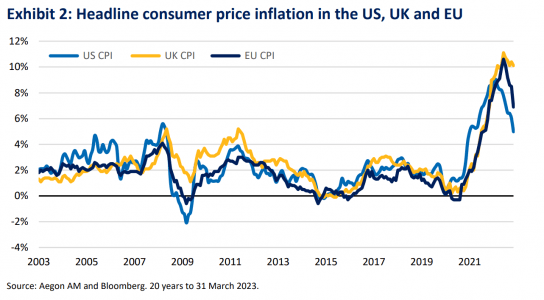

The unprecedented fiscal and monetary stimulus in response to the Covid-19 crisis drove the initial sell-off in government bonds. There followed a jump in commodity prices in 2022, which saw inflation reach multi-generational highs, with central banks increasing interest rates aggressively in response.

We are now seeing this in reverse. After peaking in the summer of 2022, US Consumer Price Inflation (CPI) has fallen steadily from over 9% to less than 5%. As Exhibit 2 shows, headline inflation in both the UK and Europe peaked in October 2022, with prices in Europe already falling sharply. In the UK, we expect the more modest falls so far will give way to sharper declines in the coming months.

On the growth side, the picture is similar. Economic activity is slowing, with forwardlooking indicators and survey data highlighting that risks are skewed to the downside around the consensus view of a ‘managed slowdown’. Some recent data releases have stood out:

• German GDP slipping into negative territory in Q1, alongside a collapse in European lending.

• The sharp fall in UK mortgages, with net lending falling to zero in March.

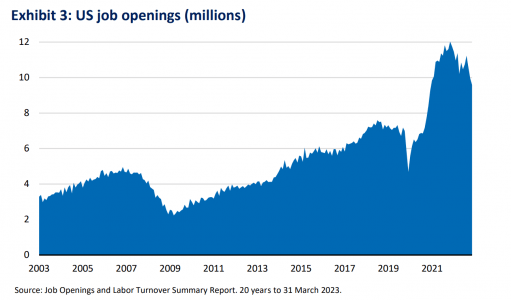

• Cracks emerging in the US labour market, with the rise in weekly jobless claims and the fall in job openings, as measured by the US JOLTS report.

None of this feels consistent with the need for government bond yields to be higher. Instead, it increasingly supports the case for yields to be lower.

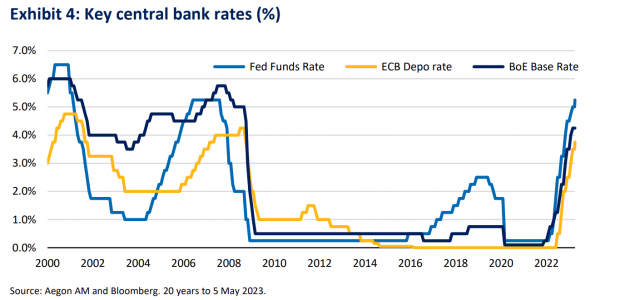

Falling inflation, weaker forward-looking data and tensions in the financial system all point to central bank rates not needing to move much higher. We believe we are now entering the end game for the hiking cycle of the major central banks. After almost 18 months of global rate hikes that were kicked off by the Bank of England, the lagged impact of monetary tightening is now starting to bite: the arguments against hikes and in favour of a ‘pause’ are growing.

For investors in bonds with any duration risk, this is a crucial development. Central banks reaching their terminal rate helps to put a ceiling on yields, reducing the downside risk to holding bonds. The debate over whether to favour a short duration vs. long duration stance has become more clear-cut, with conviction now higher on the need for additional interest-rate risk.

The focus will then shift to how long central banks can keep rates on hold. Given the current macroeconomic outlook, the balance of risks would be biased towards interest rates being reduced rather than increased after they pause. Again, this would be supportive for duration risk.

After the fall-out of the great-repricing of 2021-22, investors now no longer need to fear duration risk. With the risk of higher yields now much diminished – replaced with the potential for lower yields – and government bonds acting more like a ‘risk-off’ hedge again, the benefits to investors of embracing duration risk within their fixed income allocations are clear.

Of course, nothing ever moves in a straight line. The need to actively manage duration will continue to be key – both in terms of overall level of risk and which markets to get our duration from. But our starting point is to hold more rather than less duration risk.

Piece of opinion written by Colin Finlayson, Investment Manager, Fixed Income at Aegon Asset Management.

Disclosures

This material is provided by Aegon Asset Management (Aegon AM) as general information and is intended exclusively for

institutional and wholesale investors, as well as professional clients (as defined by local laws and regulation) and other Aegon AM

stakeholders.

This document is for informational purposes only in connection with the marketing and advertising of products and services, and

is not investment research, advice or a recommendation. It shall not constitute an offer to sell or the solicitation to buy any

investment nor shall any offer of products or services be made to any person in any jurisdiction where unlawful or unauthorized.

Any opinions, estimates, or forecasts expressed are the current views of the author(s) at the time of publication and are subject

to change without notice. The research taken into account in this document may or may not have been used for or be consistent

with all Aegon AM investment strategies. References to securities, asset classes and financial markets are included for illustrative

purposes only and should not be relied upon to assist or inform the making of any investment decisions. It has not been prepared

in accordance with any legal requirements designed to promote the independence of investment research, and may have been

acted upon by Aegon AM and Aegon AM staff for their own purposes.

The information contained in this material does not take into account any investor’s investment objectives, particular needs, or

financial situation. It should not be considered a comprehensive statement on any matter and should not be relied upon as such.

Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or

strategy is suitable or appropriate to any particular investor. Reliance upon information in this material is at the sole discretion of

the recipient. Investors should consult their investment professional prior to making an investment decision. Aegon Asset

Management is under no obligation, expressed or implied, to update the information contained herein. Neither Aegon Asset

Management nor any of its affiliated entities are undertaking to provide impartial investment advice or give advice in a fiduciary

capacity for purposes of any applicable US federal or state law or regulation. By receiving this communication, you agree with

the intended purpose described above.

Past performance is not a guide to future performance. All investments contain risk and may lose value. This document contains

“forward-looking statements” which are based on Aegon AM’s beliefs, as well as on a number of assumptions concerning future

events, based on information currently available. These statements involve certain risks, uncertainties and assumptions which

are difficult to predict. Consequently, such statements cannot be guarantees of future performance, and actual outcomes and

returns may differ materially from statements set forth herein.

The following Aegon affiliates are collectively referred to herein as Aegon Asset Management: Aegon USA Investment

Management, LLC (Aegon AM US), Aegon USA Realty Advisors, LLC (Aegon RA), Aegon Asset Management UK plc (Aegon AM UK), and Aegon Investment Management B.V. (Aegon AM NL). Each of these Aegon Asset Management entities is a wholly owned

subsidiary of Aegon N.V. In addition, Aegon Private Fund Management (Shanghai) Co., a partially owned affiliate, may also

conduct certain business activities under the Aegon Asset Management brand.

Aegon AM UK is authorised and regulated by the Financial Conduct Authority (FRN: 144267) and is additionally a registered

investment adviser with the United States (US) Securities and Exchange Commission (SEC). Aegon AM US and Aegon RA are both

US SEC registered investment advisers.

Aegon AM NL is registered with the Netherlands Authority for the Financial Markets as a licensed fund management company

and on the basis of its fund management license is also authorized to provide individual portfolio management and advisory

services in certain jurisdictions. Aegon AM NL has also entered into a participating affiliate arrangement with Aegon AM US.

Aegon Private Fund Management (Shanghai) Co., Ltd is regulated by the China Securities Regulatory Commission (CSRC) and the

Asset Management Association of China (AMAC) for Qualified Investors only; ©2022 Aegon Asset Management or its affiliates.

All rights reserved.

AdTrax: 5691266.1. | Expiry: 31 May 2025