The U.S. equity market rallied sharply in January but ended slightly lower for March and the first quarter after an overdue high-volatility spike selloff during early February and a recovery rally into mid-March, followed by a month-end dip with the S&P 500 Index closing nearly 10% off its 2018 highs.

The U.S. Federal Reserve’s gradual liquidity reduction and rising policy rate, plus the prospect for the same from the ECB, have weighed on stock prices. However, the U.S. Treasury yield curve flattened as note and bond yields declined toward the end of March while stocks retreated. The main drivers for rising stock prices continue to be lower corporate taxes and higher profits.

Global merger and acquisition activity accelerated to a record $1.2 trillion in the first quarter of this year following the passage of U.S. tax reform and a boost from the catalyst of shareholder activists. CEOs are initiating major transactions sparked by excess cash and the goal of growing the top and bottom line. Industry consolidation deals are heating up as scarce targets ignite bidding wars. Uncertainty over Trump trade policy and regulatory hurdles are deal headwinds.

Duelling trade tariffs between the U.S. and China have increased tensions between the two countries. Widening spreads on a mark-to-market basis, not broken deals, were the culprit driving performance in March. Merger arbitrage spreads widened in reaction to these factors, allowing us to deploy additional capital opportunistically. These opportunities would lead us to expect to earn potentially higher returns when deals in the portfolio close.

We believe the recent widening of spreads and the increase in deal risk premiums present an attractive opportunity to add to and initiate positions with the potential to earn greater returns. We continue to find attractive opportunities investing in announced mergers and expect future deal activity will provide further prospects to generate returns non-correlated to the market.

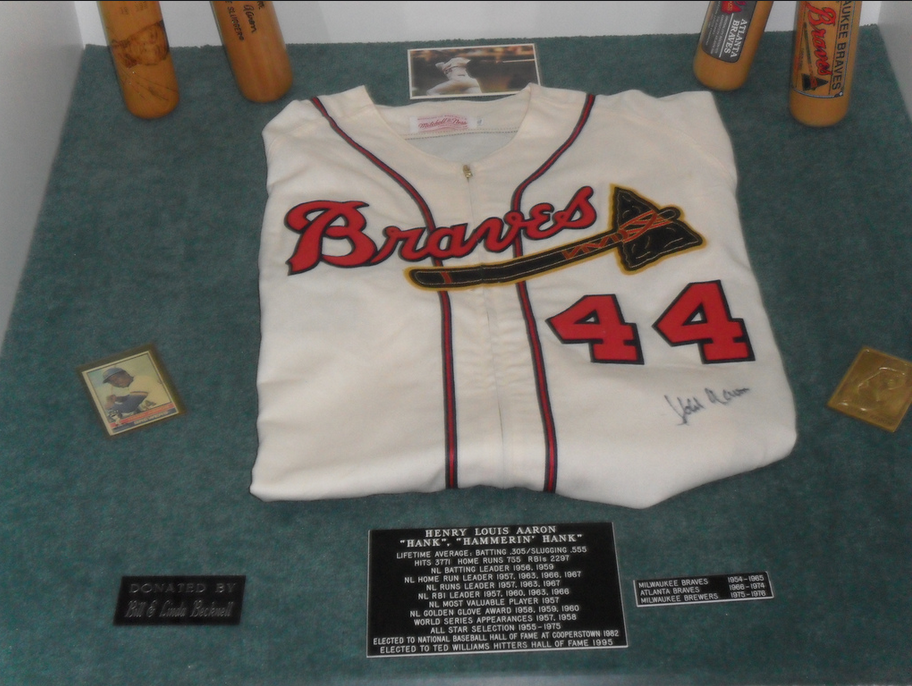

Play Ball! On the long only side The Atlanta Braves were founded in 1871 and are the oldest continuously operating professional sports franchise in America. The Liberty Braves Group (BATRA) moved to the new 41.5K seat SunTrust Park, Cobb County from Atlanta in February 2017. Liberty Media Corporation recapitalized the Atlanta Braves as a tracking stock in April 2016 along with Liberty SiriusXM and Liberty Formula One. Assets include the Atlanta Braves Major League Baseball club and stadium and the Battery real estate project. The Battery Atlanta is a 46 acre mixed-use development with residential and commercial property that feeds off the stadium (16 acres) on 82 acres with initial completion in 2018 and 20 acres for further development. Sports franchise valuations continue to mature, the opportunity to be an owner is an expensive endeavor, The Liberty Braves Group gives you an opportunity to part of the inner circle and own a piece of a MLB team at an attractive value.

Rising uncertainties may keep the stock market on edge but corporate profit growth, aggressive corporate stock buy backs, and deals should provide a cushion for any selloffs.

Column by Gabelli Funds, written by Michael Gabelli

To access our proprietary value investment methodology, and dedicated merger arbitrage portfolio we offer the following UCITS Funds in each discipline:

GAMCO MERGER ARBITRAGE

GAMCO Merger Arbitrage UCITS Fund, launched in October 2011, is an open-end fund incorporated in Luxembourg and compliant with UCITS regulation. The team, dedicated strategy, and record dates back to 1985. The objective of the GAMCO Merger Arbitrage Fund is to achieve long-term capital growth by investing primarily in announced equity merger and acquisition transactions while maintaining a diversified portfolio. The Fund utilizes a highly specialized investment approach designed principally to profit from the successful completion of proposed mergers, takeovers, tender offers, leveraged buyouts and other types of corporate reorganizations. Analyzes and continuously monitors each pending transaction for potential risk, including: regulatory, terms, financing, and shareholder approval.

Merger investments are a highly liquid, non-market correlated, proven and consistent alternative to traditional fixed income and equity securities. Merger returns are dependent on deal spreads. Deal spreads are a function of time, deal risk premium, and interest rates. Returns are thus correlated to interest rate changes over the medium term and not the broader equity market. The prospect of rising rates would imply higher returns on mergers as spreads widen to compensate arbitrageurs. As bond markets decline (interest rates rise), merger returns should improve as capital allocation decisions adjust to the changes in the costs of capital.

Broad Market volatility can lead to widening of spreads in merger positions, coupled with our well-researched merger portfolios, offer the potential for enhanced IRRs through dynamic position sizing. Daily price volatility fluctuations coupled with less proprietary capital (the Volcker rule) in the U.S. have contributed to improving merger spreads and thus, overall returns. Thus our fund is well positioned as a cash substitute or fixed income alternative.

Our objectives are to compound and preserve wealth over time, while remaining non-correlated to the broad global markets. We created our first dedicated merger fund 32 years ago. Since then, our merger performance has grown client assets at an annualized rate of approximately 10.7% gross and 7.6% net since 1985. Today, we manage assets on behalf of institutional and high net worth clients globally in a variety of fund structures and mandates.

Class I USD – LU0687944552

Class I EUR – LU0687944396

Class A USD – LU0687943745

Class A EUR – LU0687943661

Class R USD – LU1453360825

Class R EUR – LU1453361476

GAMCO ALL CAP VALUE

The GAMCO All Cap Value UCITS Fund launched in May, 2015 utilizes Gabelli’s its proprietary PMV with a Catalyst™ investment methodology, which has been in place since 1977. The Fund seeks absolute returns through event driven value investing. Our methodology centers around fundamental, research-driven, value based investing with a focus on asset values, cash flows and identifiable catalysts to maximize returns independent of market direction. The fund draws on the experience of its global portfolio team and 35+ value research analysts.

GAMCO is an active, bottom-up, value investor, and seeks to achieve real capital appreciation (relative to inflation) over the long term regardless of market cycles. Our value-oriented stock selection process is based on the fundamental investment principles first articulated in 1934 by Graham and Dodd, the founders of modern security analysis, and further augmented by Mario Gabelli in 1977 with his introduction of the concepts of Private Market Value (PMV) with a Catalyst™ into equity analysis. PMV with a Catalyst™ is our unique research methodology that focuses on individual stock selection by identifying firms selling below intrinsic value with a reasonable probability of realizing their PMV’s which we define as the price a strategic or financial acquirer would be willing to pay for the entire enterprise. The fundamental valuation factors utilized to evaluate securities prior to inclusion/exclusion into the portfolio, our research driven approach views fundamental analysis as a three pronged approach: free cash flow (earnings before, interest, taxes, depreciation and amortization, or EBITDA, minus the capital expenditures necessary to grow/maintain the business); earnings per share trends; and private market value (PMV), which encompasses on and off balance sheet assets and liabilities. Our team arrives at a PMV valuation by a rigorous assessment of fundamentals from publicly available information and judgement gained from meeting management, covering all size companies globally and our comprehensive, accumulated knowledge of a variety of sectors. We then identify businesses for the portfolio possessing the proper margin of safety and research variables from our deep research universe.

Class I USD – LU1216601648

Class I EUR – LU1216601564

Class A USD – LU1216600913

Class A EUR – LU1216600673

Class R USD – LU1453359900

Class R EUR – LU1453360155