The outlook for US small-capitalisation stocks looks better now than it has for several years. The main reasons include the US interest rate cutting cycle (small caps tend to benefit); attractive valuations; and continued reshoring and merger & acquisition trends.

Falling interest rates and small caps

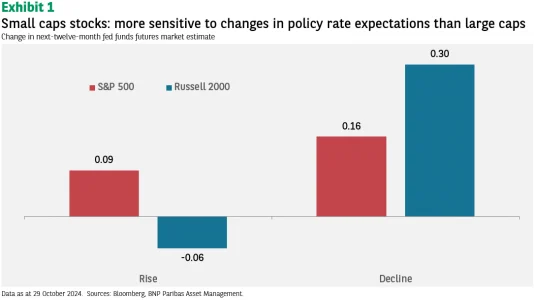

The US Federal Reserve (the Fed) began its dovish pivot in September and continued its loosening of monetary policy in November. As you can see in Exhibit 1, the stock market performance of small caps has been correlated to the change in policy rate expectations over the last 12 months. When Fed policy rate expectations turn more dovish, small caps outperform.

This phenomenon is likely a function of the cost of debt falling more for small-cap companies as they typically have a higher proportion of variable rate debt than larger-cap companies. Falling policy rates should also boost management confidence, reduce the cost of capital, and support merger & acquisition (M&A) activity heading into 2025.

Small-cap valuations – Attractive

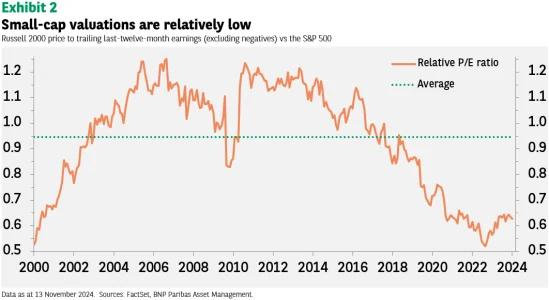

Price/earnings ratios for small caps have recovered from the lows and are now near their long-run average of 17 times (excluding companies with negative earnings). Relative to large-cap indices, small-cap P/E multiples look relatively low; they are currently 11% below average (see Exhibit 2).

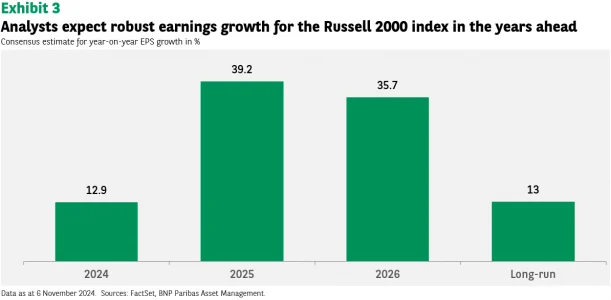

We expect earnings to drive the next leg higher for small-cap share prices. Analysts are looking for robust earnings growth: 15% this year, and by over 30% in 2025 and 2026. That is ahead of the long run rate of 13% growth (see Exhibit 3).

While earnings forecasts are often optimistic, we believe that with a soft or no landing ahead for the US economy, they are not wildly off the mark. If the higher earnings growth rates are realised, valuations should improve.

Mega-cap tech’s lead expected to narrow

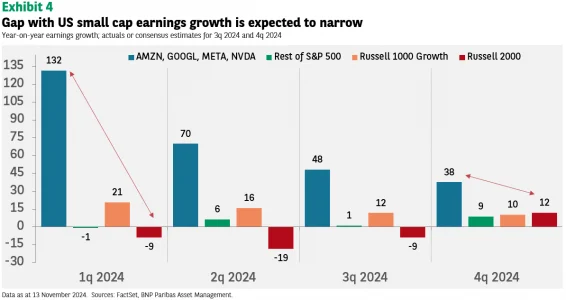

Four big tech companies (Amazon, Google, Meta and Nvidia1) have generated the bulk of recent earnings growth on the US market. This has driven the outperformance of the tech-heavy NASDAQ 100, the small-cap Russell 1000 Growth and, to a lesser degree, the broad S&P500.

Earnings for the big four grew by 70% year-on-year in the second quarter of 2024, compared to just 6% for the remaining 496 companies in the S&P500. That gap is forecast to narrow (see Exhibit 4) and if it does, so should the gap in stock market performance.

Tailwinds for small caps in 2025

For decades after China’s admission to the World Trade Organisation (WTO) in 2001, US companies were focused on outsourcing production to lower-cost nations to improve profits. Industrial production stagnated in the US, while it rose sharply in China.

We see potential for that trend to reverse in the coming years. During the pandemic, having supply chains and manufacturing far from home created difficulties for US firms and many are looking to ‘re-shore’ production.

Rising geopolitical tensions and protectionism are other catalysts, abetted by the financial support from the federal government’s CHIPS Act and the Infrastructure Investment and Jobs Act.

We believe a multi-year cycle of capital expenditure driven by re-shoring initiatives lies ahead. US small caps should benefit from this trend as they are more levered to domestic investment and economic cycles.

Information technology spending on datacentres — which are a key part of the infrastructure supporting the artificial intelligence (AI) ‘arms race’ — is boosting not only sales of advanced graphic processing units (GPUs), but also revenues at many lesser-known hardware, software, industrial, materials and even utility companies.

This capex is funded largely by the profits of other tech companies that are spending to grow their business, rather than hoarding cash or boosting earnings per share (EPS) via share buybacks.

M&A is another potential tailwind for small caps.

With lower interest rates easing the burden of debt, uncertainty fading over the outlook for the economy, and political uncertainty lower now that the US election is behind us, deal flow should improve. Strategic buyers are always evaluating opportunities for innovation or disruption and may now be better able to implement their plans.

Conclusion

We see a number of tailwinds for smaller US companies emerging as the Fed pivots to monetary easing, earnings recover, and valuation dislocations normalise. These market inflections could be further supported by trends in onshoring and re-shoring, and a resumption of M&A activity.

Column by Geoff Dailey, Head for the US Equity team at BNP Paribas Asset Management, Chris Fay, Portfolio Manager on the US and Global Thematic Equities team and Vincent Nichols, Senior Investment Specialist for the US and Global Thematic Equities team

[1] Mentioned for illustrative purposes only. This is not a recommendation to buy or sell securities. BNP Paribas Asset Management may or may not hold positions in these stocks.

Disclaimer

Please note that articles may contain technical language. For this reason, they may not be suitable for readers without professional investment experience. Any views expressed here are those of the author as of the date of publication, are based on available information, and are subject to change without notice. Individual portfolio management teams may hold different views and may take different investment decisions for different clients. This document does not constitute investment advice. The value of investments and the income they generate may go down as well as up and it is possible that investors will not recover their initial outlay. Past performance is no guarantee for future returns. Investing in emerging markets, or specialised or restricted sectors is likely to be subject to a higher-than-average volatility due to a high degree of concentration, greater uncertainty because less information is available, there is less liquidity or due to greater sensitivity to changes in market conditions (social, political and economic conditions). Some emerging markets offer less security than the majority of international developed markets. For this reason, services for portfolio transactions, liquidation and conservation on behalf of funds invested in emerging markets may carry greater risk.