Almost exactly three years ago, I penned an article titled ‘The Dividend Dilemma’. It was the depths of the Covid-induced market selloff; companies were cutting or suspending dividends left, right and center; and analysts were predicting big cuts to global dividends from which they would take years to recover. I anticipated a fall of around 30%.

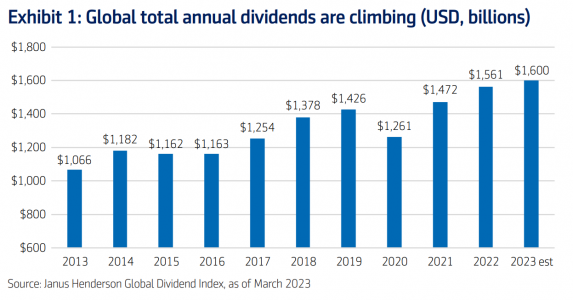

Yet for all the cataclysmic predictions, payouts took just one year to bounce back. 2021 was a record-setting year for global dividends at $1.47 trillion, a mark that was bettered in 2022 at $1.56 trillion and is forecasted to be exceeded yet again in 2023 at an estimated $1.60 trillion (see Exhibit 1).

We have now gone from the dividend dilemma to the dividend deluge. With 2022 also setting a record for share buyback authorizations, the picture is clear – companies are returning record amounts of capital to shareholders.

The volatility we saw across asset classes last year served as a reminder that dividends are typically much less variable than earnings and can provide an important source of total return in challenging markets. Dividends also have a solid track record of keeping pace with inflation and while annual growth wasn’t quite the low double digit level that we saw inflation hit at its peak, there was less erosion in real terms than we saw in payouts from most other asset classes.

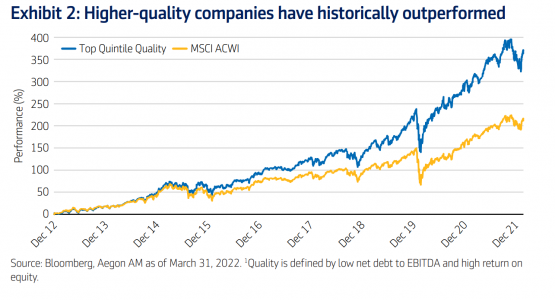

So where does this leave us now? Deep value areas of the market, characterized by companies with lower-quality earnings and high debt levels had their day in the sun last year. Such rallies tend to be sharp but also short-lived, which played out in the first quarter of this year as we saw momentum fade abruptly. Investors are likely questioning whether such companies can continue to be successful in a slowing growth (or recessionary) environment. In addition, with interest rates looking like they will be higher for longer, indebted companies will likely see more of their cashflow eaten up by interest payments, rather than being available to distribute to

shareholders.

In contrast to the riskier, deep-value end of the market, we believe a focus on ‘quality’ dividend paying companies, those with strong balance sheets and high returns on equity, can be a powerful factor over time. As shown in Exhibit 2, the top quintile of companies, based on quality1 within the MSCI All Country World Index, has significantly outperformed the wider market over time.

This quality approach will, we believe, be especially important if the harsher economic conditions that many expect come to fruition. Indeed, despite the uncertainty in the market right now, over two-thirds of the companies within a representative global equity income portfolio have increased their dividends in the first quarter of 2023.

These increases suggest companies are generating plentiful free cash flow, and returning it to shareholders is signaling, what we believe is, a healthy confidence in their financial situation.

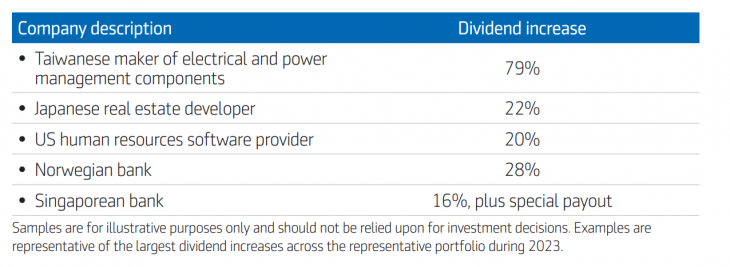

A few examples of high dividend increases include:

What is striking about these examples is not only the magnitude of the increases but also the diversity of the companies involved, on both a geographical and sectoral basis, which implies broad-based strength.

All of this suggests we may be in a golden period for dividend investing. Companies are returning record amounts of capital to shareholders and are doing so while recording payout ratios that are below long-term averages, meaning these dividends should remain even in the face of slowing growth.

Dividend strategies themselves tend to come into their own in more choppy market environments, where income streams become an even more crucial part of total returns and a lower beta approach may offer some protection from volatility. This serves to highlight the excellent shape of global dividends and should provide equity income investors with significant opportunities – despite volatility, they remain well positioned in the market.

Piece of opinion by Mark Peden, Investment Manager of Aegon Asset Management.

This material is provided by Aegon Asset Management (Aegon AM) as general information and is intended exclusively for institutional and wholesale investors, as well as professional clients (as defined by local laws and regulation) and other Aegon AM stakeholders.

This document is for informational purposes only in connection with the marketing and advertising of products and services, and is not investment research, advice or a recommendation.

It shall not constitute an offer to sell or the solicitation to buy any investment nor shall any offer of products or services be made to any person in any jurisdiction where unlawful or unauthorized. Any opinions, estimates, or forecasts expressed are the current views of the author(s) at the time of publication and are subject to change without notice. The research taken into account in this document may or may not have been used for or be consistent with all Aegon AM investment strategies. References to securities, asset classes and financial markets are included for illustrative purposes only and should not be relied upon to assist or inform the making of any investment decisions. It has not been prepared in accordance with any legal requirements designed to promote the independence of investment research, and may have been acted upon by Aegon AM and Aegon AM staff for their own purposes.

The information contained in this material does not take into account any investor’s investment objectives, particular needs, or financial situation. It should not be considered a comprehensive statement on any matter and should not be relied upon as such. Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to any particular investor. Reliance upon information in this material is at the sole discretion of the recipient. Investors should consult their investment professional prior to making an investment decision. Aegon Asset Management is under no obligation, expressed or implied, to update the information contained herein. Neither Aegon Asset Management nor any of its affiliated entities are undertaking to provide impartial investment advice or give advice in a fiduciary capacity for purposes of any applicable US federal or state law or regulation. By receiving this communication, you agree with the intended purpose described above.

Past performance is not a guide to future performance. All investments contain risk and may lose value. This document contains “forward-looking statements” which are based on Aegon AM’s beliefs, as well as on a number of assumptions concerning future events, based on information currently available. These statements involve certain risks, uncertainties and assumptions which are difficult to predict. Consequently, such statements cannot be guarantees of future performance, and actual outcomes and returns may differ materially from statements set forth herein.

The following Aegon affiliates are collectively referred to herein as Aegon Asset Management: Aegon USA Investment Management, LLC (Aegon AM US), Aegon USA Realty Advisors, LLC (Aegon RA), Aegon Asset Management UK plc (Aegon AM UK), and Aegon Investment Management B.V. (Aegon AM NL). Each of these Aegon Asset Management entities is a wholly owned subsidiary of Aegon N.V. In addition, Aegon Private Fund Management (Shanghai) Co., a partially owned affiliate, may also conduct certain business activities under the Aegon Asset Management brand.

Aegon AM UK is authorised and regulated by the Financial Conduct Authority (FRN: 144267) and is additionally a registered investment adviser with the United States (US) Securities and Exchange Commission (SEC). Aegon AM US and Aegon RA are both US SEC registered investment advisers.

Aegon AM NL is registered with the Netherlands Authority for the Financial Markets as a licensed fund management company and on the basis of its fund management license is also authorized to provide individual portfolio management and advisory services in certain jurisdictions. Aegon AM NL has also entered into a participating affiliate arrangement with Aegon AM US. Aegon Private Fund Management (Shanghai) Co., Ltd is regulated by the China Securities Regulatory Commission (CSRC) and the Asset Management Association of China (AMAC) for Qualified Investors only; ©2023 Aegon Asset Management or its affiliates. All rights reserved.

Adtrax: 5640856.1GBL

By Fórmate a Fondo

By Fórmate a Fondo