Challenging economic conditions are setting the stage for an interesting year ahead. As the economy slows and the cycle ages, companies will likely face financial headwinds. Although firms are entering the year with solid balance sheets, can high yield issuers weather a downturn?

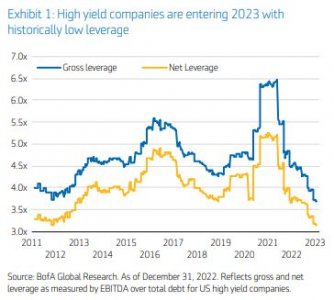

Solid fundamental starting point- while caution is warranted, we think many high yield companies are well-positioned to navigate a downturn given the solid fundamental starting point. In recent years, high yield companies diligently improved their balance sheets, resulting in the lowest leverage levels in more than a decade (Exhibit 1) and the highest interest coverage ratios in recent history. This fundamental improvement is further evidenced by the ongoing upgrade momentum with rising stars outpacing fallen angels. In addition, the credit quality composition of the market has improved, with the high yield market now being over 50% BBs and roughly 10% in CCCs and below. For context, prior to the great financial crisis, the high yield market included more than 20% in CCCs and below.

Heading into 2023, the global macroeconomic environment remains extremely uncertain. Higher and potentially rising interest rates, persistent inflation, elevated geopolitical risk, tight energy markets and the effects of an uncertain reopening in China are just a few of the top-of-mind worries.

These risks may well lead to further slowing of the US and developed market economies and create financial headwinds for many high yield companies. With a potential recession risk looming on the horizon, high yield companies will likely be facing slowing consumer demand and cutbacks in business investments—both of which could lead to declining revenues. Margins may contract as earnings come under pressure in the slowing economy. In addition, interest coverage ratios are likely to decline as coupon rates reset higher and interest costs increase, especially for issuers with floating rate loans. As a result, we believe fundamental improvement has peaked for many high yield companies.

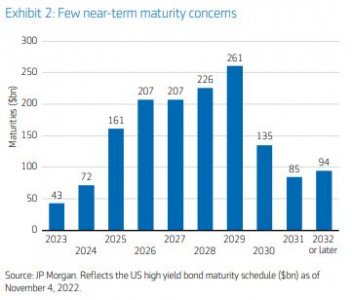

Despite the cloudy macro outlook, we believe most high yield companies are well-positioned to navigate a slowdown. Balance sheets are generally in decent shape and credit metrics are not stretched for most companies. Additionally, there is no immediate maturity wall that presents a refinancing challenge to companies (Exhibit 2) and overall liquidity levels are good. During the year ahead, we expect that the high yield market will present compelling opportunities to invest in companies with attractive risk-return characteristics.

Tribune by Kevin Bakker, CFA and Ben Miller, CFA, co-heads of US High Yield at Aegon Asset Management.

Read more insights from the experts at Aegon Asset Management.

Unless otherwise noted, the information in this document has been derived from sources believed to be accurate at the time of publication. This material is provided by Aegon Asset Management (Aegon AM) as general information and is intended exclusively for institutional and wholesale investors, as well as professional clients (as defined by local laws and regulation) and other Aegon AM stakeholders.

This document is for informational purposes only in connection with the marketing and advertising of products and services, and is not investment research, advice or a recommendation. It shall not constitute an offer to sell or the solicitation to buy any investment nor shall any offer of products or services be made to any person in any jurisdiction where unlawful or unauthorized. Any opinions, estimates, or forecasts expressed are the current views of the author(s) at the time of publication and are subject to change without notice. The research taken into account in this document may or may not have been used for or be consistent with all Aegon AM investment strategies.

References to securities, asset classes and financial markets are included for illustrative purposes only and should not be relied upon to assist or inform the making of any investment decisions. It has not been prepared in accordance with any legal requirements designed to promote the independence of investment research, and may have been acted upon by Aegon AM and Aegon AM staff for their own purposes.

The information contained in this material does not take into account any investor’s investment objectives, particular needs, or financial situation. It should not be considered a comprehensive statement on any matter and should not be relied upon as such. Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to any particular investor. Reliance upon information in this material is at the sole discretion of the recipient. Investors should consult their investment professional prior to making an investment decision. Aegon Asset Management is under no obligation, expressed or implied, to update the information contained herein. Neither Aegon Asset Management nor any of its affiliated entities are undertaking to provide impartial investment advice or give advice in a fiduciary capacity for purposes of any applicable US federal or state law or regulation. By receiving this communication, you agree with the intended purpose described above.

Past performance is not a guide to future performance. All investments contain risk and may lose value. This document contains “forward-looking statements” which are based on Aegon AM’s beliefs, as well as on a number of assumptions concerning future events, based on information currently available. These statements involve certain risks, uncertainties and assumptions which are difficult to predict. Consequently, such statements cannot be guarantees of future performance, and actual outcomes and returns may differ materially from statements set forth herein.

Investments in high yield bonds may be subject to greater volatility than fixed income alternatives, including loss of principal and interest, as a result of the higher likelihood of default. The value of these securities may also decline when interest rates increase. The following Aegon affiliates are collectively referred to herein as Aegon Asset Management: Aegon USA Investment Management, LLC (Aegon AM US), Aegon USA Realty Advisors, LLC (Aegon RA), Aegon Asset Management UK plc (Aegon AM UK), and Aegon Investment Management B.V. (Aegon AM NL). Each of these Aegon Asset Management entities is a wholly owned subsidiary of Aegon N.V. In addition, Aegon Private Fund Management (Shanghai) Co., a partially owned affiliate, may also conduct certain business activities under the Aegon Asset Management brand.

Aegon AM UK is authorised and regulated by the Financial Conduct Authority (FRN: 144267) and is additionally a registered investment adviser with the United States (US) Securities and Exchange Commission (SEC). Aegon AM US and Aegon RA are both US SEC registered investment advisers. Aegon AM NL is registered with the Netherlands Authority for the Financial Markets as a licensed fund management company and on the basis of its fund management license is also authorized to provide individual portfolio management and advisory services in certain jurisdictions. Aegon AM NL has also entered into a participating affiliate arrangement with Aegon AM US. Aegon Private Fund Management (Shanghai) Co., Ltd is regulated by the China Securities Regulatory Commission (CSRC) and the Asset Management Association of China (AMAC) for Qualified Investors only.

©2023 Aegon Asset Management or its affiliates. All rights reserved.

Adtrax: 5425390.1GBL

Authors of the article:

object(WP_Post)#22207 (24) {

["ID"]=>

int(207734)

["post_author"]=>

string(2) "19"

["post_date"]=>

string(19) "2023-02-20 10:36:26"

["post_date_gmt"]=>

string(19) "2023-02-20 09:36:26"

["post_content"]=>

string(686) "

Kevin Bakker, CFA, is co-head of US high yield and a senior portfolio manager responsible for US and global high yield portfolio management at Aegon Asset Management. Prior to his current role, he was a public fixed income research analyst covering high yield and investment grade corporate securities. Prior to joining the firm, Kevin was employed by Archer Daniels Midland in various roles within their commodities trading division. He has been in the industry since and started with the firm in 2003. Kevin received his BA from Loras College and his MBA from the University of Iowa. He is a CFA® charterholder.

"

["post_title"]=>

string(12) "Kevin Bakker"

["post_excerpt"]=>

string(0) ""

["post_status"]=>

string(7) "publish"

["comment_status"]=>

string(6) "closed"

["ping_status"]=>

string(6) "closed"

["post_password"]=>

string(0) ""

["post_name"]=>

string(12) "kevin-bakker"

["to_ping"]=>

string(0) ""

["pinged"]=>

string(0) ""

["post_modified"]=>

string(19) "2023-02-21 20:50:50"

["post_modified_gmt"]=>

string(19) "2023-02-21 19:50:50"

["post_content_filtered"]=>

string(0) ""

["post_parent"]=>

int(0)

["guid"]=>

string(61) "https://www.fundssociety.com/?post_type=profile&p=207734"

["menu_order"]=>

int(0)

["post_type"]=>

string(7) "profile"

["post_mime_type"]=>

string(0) ""

["comment_count"]=>

string(1) "0"

["filter"]=>

string(3) "raw"

}

Kevin Bakker, CFA, is co-head of US high yield and a senior portfolio manager responsible for US and global high yield portfolio management at Aegon Asset Management. Prior to his current role, he was a public fixed income research analyst covering high yield and investment grade corporate securities. Prior to joining the firm, Kevin was employed by Archer Daniels Midland in various roles within their commodities trading division. He has been in the industry since and started with the firm in 2003. Kevin received his BA from Loras College and his MBA from the University of Iowa. He is a CFA® charterholder.

object(WP_Post)#22203 (24) {

["ID"]=>

int(207740)

["post_author"]=>

string(2) "19"

["post_date"]=>

string(19) "2023-02-20 10:43:48"

["post_date_gmt"]=>

string(19) "2023-02-20 09:43:48"

["post_content"]=>

string(601) "

Ben Miller, CFA, is co-head of US high yield and a senior portfolio manager responsible for US and global high yield portfolio management at Aegon Asset Management. Prior to his current role, Ben held various investment responsibilities ranging from private placement analyst to public fixed income research analyst. He has been in the industry since and started with the firm and its affiliates in 1993. Ben received his BA from the University of Northern Iowa and his MBA from the University of Iowa. He is a CFA® charterholder.

"

["post_title"]=>

string(10) "Ben Miller"

["post_excerpt"]=>

string(0) ""

["post_status"]=>

string(7) "publish"

["comment_status"]=>

string(6) "closed"

["ping_status"]=>

string(6) "closed"

["post_password"]=>

string(0) ""

["post_name"]=>

string(10) "ben-miller"

["to_ping"]=>

string(0) ""

["pinged"]=>

string(0) ""

["post_modified"]=>

string(19) "2023-02-21 21:21:43"

["post_modified_gmt"]=>

string(19) "2023-02-21 20:21:43"

["post_content_filtered"]=>

string(0) ""

["post_parent"]=>

int(0)

["guid"]=>

string(61) "https://www.fundssociety.com/?post_type=profile&p=207740"

["menu_order"]=>

int(0)

["post_type"]=>

string(7) "profile"

["post_mime_type"]=>

string(0) ""

["comment_count"]=>

string(1) "0"

["filter"]=>

string(3) "raw"

}

Ben Miller, CFA, is co-head of US high yield and a senior portfolio manager responsible for US and global high yield portfolio management at Aegon Asset Management. Prior to his current role, Ben held various investment responsibilities ranging from private placement analyst to public fixed income research analyst. He has been in the industry since and started with the firm and its affiliates in 1993. Ben received his BA from the University of Northern Iowa and his MBA from the University of Iowa. He is a CFA® charterholder.

object(WP_Post)#22201 (24) {

["ID"]=>

int(208706)

["post_author"]=>

string(2) "17"

["post_date"]=>

string(19) "2023-03-02 17:56:19"

["post_date_gmt"]=>

string(19) "2023-03-02 16:56:19"

["post_content"]=>

string(640) "

Thomas Hanson, CFA, head of europe high yield, is a member of the Global Leveraged Finance team at Aegon Asset Management. Prior to his current role, Thomas worked for Janus Henderson Investors, where he was manager of a number of high yield bond funds. Before that, Thomas worked for Aerion and Lazard Asset Management in a variety of analysis and portfolio management roles. He has been in the industry since 2000 and started with the firm in 2019. Thomas has a BA (Joint Hons) in French and Management Studies from the University of Reading. He is a CFA charterholder.

"

["post_title"]=>

string(13) "Thomas Hanson"

["post_excerpt"]=>

string(0) ""

["post_status"]=>

string(7) "publish"

["comment_status"]=>

string(6) "closed"

["ping_status"]=>

string(6) "closed"

["post_password"]=>

string(0) ""

["post_name"]=>

string(13) "thomas-hanson"

["to_ping"]=>

string(0) ""

["pinged"]=>

string(0) ""

["post_modified"]=>

string(19) "2023-03-02 17:56:20"

["post_modified_gmt"]=>

string(19) "2023-03-02 16:56:20"

["post_content_filtered"]=>

string(0) ""

["post_parent"]=>

int(0)

["guid"]=>

string(61) "https://www.fundssociety.com/?post_type=profile&p=208706"

["menu_order"]=>

int(0)

["post_type"]=>

string(7) "profile"

["post_mime_type"]=>

string(0) ""

["comment_count"]=>

string(1) "0"

["filter"]=>

string(3) "raw"

}

Thomas Hanson, CFA, head of europe high yield, is a member of the Global Leveraged Finance team at Aegon Asset Management. Prior to his current role, Thomas worked for Janus Henderson Investors, where he was manager of a number of high yield bond funds. Before that, Thomas worked for Aerion and Lazard Asset Management in a variety of analysis and portfolio management roles. He has been in the industry since 2000 and started with the firm in 2019. Thomas has a BA (Joint Hons) in French and Management Studies from the University of Reading. He is a CFA charterholder.

object(WP_Post)#22199 (24) {

["ID"]=>

int(208703)

["post_author"]=>

string(2) "17"

["post_date"]=>

string(19) "2023-03-02 17:54:26"

["post_date_gmt"]=>

string(19) "2023-03-02 16:54:26"

["post_content"]=>

string(649) "

Mark Benbow, Investment Manager, is a member of the Global Leveraged Finance team at Aegon Asset Management. He specialises in high yield bonds and co-manages the global high yield bond funds. Prior to his current role, Mark worked for Scottish Widows Investment Partnership, where he was an analyst on the global equities team. Previous to this he worked at Morgan Stanley as a Financial Analyst. He has been in the industry since 2008 and started with the firm in 2015. Mark holds a first-class honours degree in Management and Economics and a Masters in Investment and Finance.

"

["post_title"]=>

string(11) "Mark Benbow"

["post_excerpt"]=>

string(0) ""

["post_status"]=>

string(7) "publish"

["comment_status"]=>

string(6) "closed"

["ping_status"]=>

string(6) "closed"

["post_password"]=>

string(0) ""

["post_name"]=>

string(11) "mark-benbow"

["to_ping"]=>

string(0) ""

["pinged"]=>

string(0) ""

["post_modified"]=>

string(19) "2023-03-02 19:05:01"

["post_modified_gmt"]=>

string(19) "2023-03-02 18:05:01"

["post_content_filtered"]=>

string(0) ""

["post_parent"]=>

int(0)

["guid"]=>

string(61) "https://www.fundssociety.com/?post_type=profile&p=208703"

["menu_order"]=>

int(0)

["post_type"]=>

string(7) "profile"

["post_mime_type"]=>

string(0) ""

["comment_count"]=>

string(1) "0"

["filter"]=>

string(3) "raw"

}

Mark Benbow, Investment Manager, is a member of the Global Leveraged Finance team at Aegon Asset Management. He specialises in high yield bonds and co-manages the global high yield bond funds. Prior to his current role, Mark worked for Scottish Widows Investment Partnership, where he was an analyst on the global equities team. Previous to this he worked at Morgan Stanley as a Financial Analyst. He has been in the industry since 2008 and started with the firm in 2015. Mark holds a first-class honours degree in Management and Economics and a Masters in Investment and Finance.

By Fórmate a Fondo

By Fórmate a Fondo