For investors, determining their asset allocation this year will be especially challenging. One of the main uncertainties is whether the new president of the United States, Donald Trump, will raise export tariffs and potentially spark a trade war.

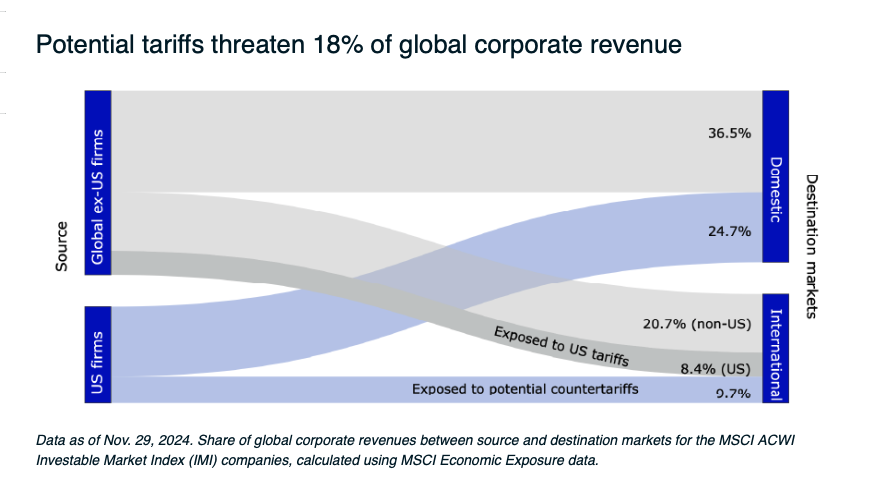

Abhishek Gupta, Executive Director of MSCI Research, analyzes the situation with data from his firm and explains in a report that “nearly 40% of global corporate revenues are generated in international markets, and 18% may be at risk due to the tariffs proposed by the U.S. and potential counter-tariffs. Furthermore, the risk was evenly split between non-U.S. companies selling in the United States (8.4%) and U.S. companies selling internationally (9.7%).”

Tariff Risk by Country and Sector

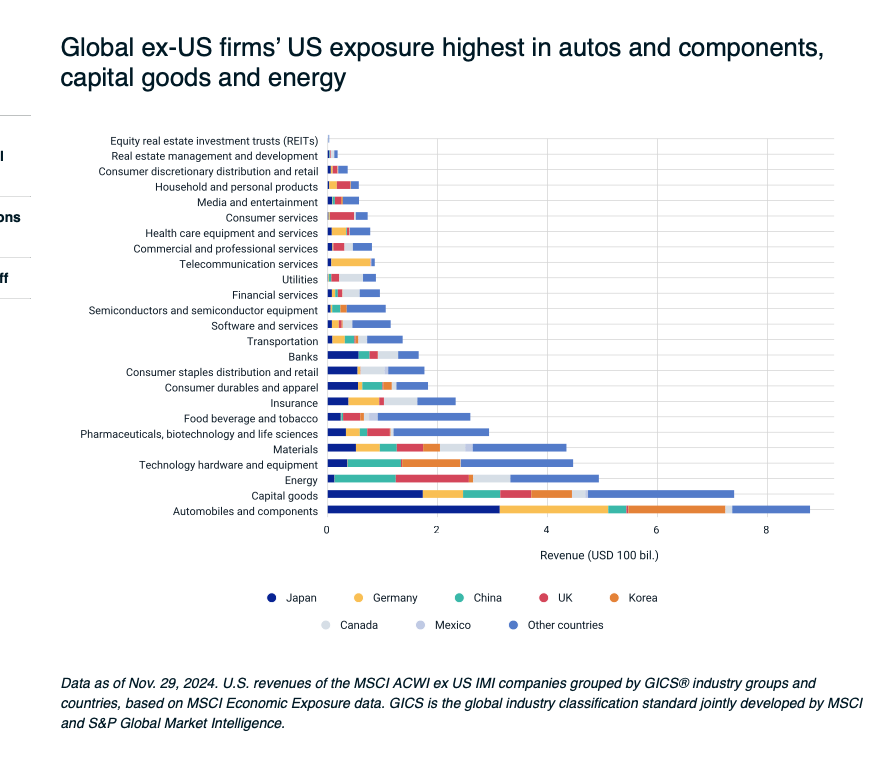

Japan, Germany, the United Kingdom, China, and Canada are the top five countries (by revenue in U.S. dollars) that sell in the U.S. market. Among them, Japanese, German, and Korean automakers dominate automobile and component imports, while Chinese, U.K., and Canadian companies lead energy imports.

Capital goods and materials also make up a substantial portion of total U.S. imports, but these are more fragmented among exporting nations. Other industries, such as pharmaceuticals, food and beverages, and durable consumer goods, have accounted for a smaller share of total U.S. imports but could be at risk due to their dependence on U.S. demand.

Beyond revenue exposure, the location of a company’s production facilities can add another layer of risk. For example, several Japanese automakers produce vehicles in Mexico. Higher U.S. tariffs on Mexican imports could have a disproportionate impact on these companies compared to those that manufacture in Japan.

The following heat map analysis combines data from MSCI Economic Exposure and MSCI GeoSpatial Asset Intelligence to highlight the number of companies economically tied to the United States (defined as deriving more than 10% of their revenue from the U.S.) that have production facilities in Canada, Mexico, or China—all of which could be subject to higher tariffs.

Approximately 390 non-U.S. companies meet these criteria (of which 90 are Canadian, Mexican, or Chinese companies). Japanese companies appear to be the most exposed, with 91 at risk, including 28 in the capital goods industry and 18 in the automotive sector. Many European companies may also be at risk due to overlapping revenue dependencies and production locations.