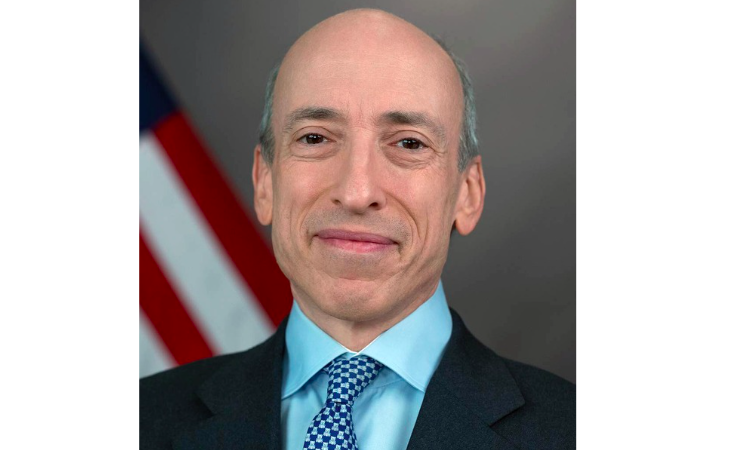

The Securities and Exchange Commission (SEC) announced that its Chair, Gary Gensler, will step down on January 20, 2025. Gensler began his term on April 17, 2021, immediately following the GameStop market events, and “led the agency through a robust regulatory agenda to enhance the efficiency, resilience, and integrity of U.S. capital markets,” the SEC stated in its announcement.

During his tenure, Gensler oversaw high-profile cases to hold violators accountable and return billions to harmed investors, the regulator added. “The SEC is an extraordinary agency. Its staff and the Commission are singularly focused on protecting investors, facilitating capital formation, and ensuring markets work for both investors and issuers. The staff are true public servants. It has been an honor to work with them on behalf of everyday Americans to ensure that our capital markets remain the best in the world,” said Gensler.

Treasury Markets

The SEC highlighted key achievements during Gensler’s leadership, including fundamental improvements in the $28 trillion U.S. Treasury markets. To reduce costs and risks, the SEC implemented rules to promote central clearing and limit exemptions for intermediaries from registering with the national securities association. These reforms aim to lower risk and increase efficiency across U.S. capital markets.

Equity Markets

Under Gensler, the SEC introduced the first significant updates to the $55 trillion U.S. equity markets in nearly 20 years. These updates included modernizing the National Market System, enabling tighter spreads and lower fees for more efficient trading. Other improvements included reducing the settlement cycle to one day, benefiting investors by reducing market risk. Additionally, the SEC updated intermediary execution quality reporting requirements, making equity markets more efficient for investors.

Resilience

The SEC adopted changes to Form PF, the confidential reporting form for certain private fund investment advisers registered with the SEC. The revised rules require large hedge fund and private equity fund advisers to file timely updates on specific events.

In collaboration with the Commodity Futures Trading Commission (CFTC), the SEC also amended Form PF to enhance the quality of information received from all filers. These changes, effective next year, aim to improve regulatory oversight. The SEC also reformed money market fund regulations, making these funds more resilient, liquid, and transparent, even during periods of stress.

Corporate Governance

To boost trust in capital markets, the SEC introduced corporate governance reforms under Gensler’s leadership. These included updates on insider trading rules, executive clawback provisions tied to erroneous financial statements, and enhanced disclosure of executive compensation relative to performance.

The agency also adopted rules enabling shareholders to vote for their preferred board candidates using universal proxy cards in contested director elections. Additionally, the SEC implemented rules requiring timely disclosures from entities acquiring more than a 5% stake in a company.

Enforcement and Compliance

The SEC’s Divisions of Enforcement and Examinations, comprising about half the agency, remained active during Gensler’s tenure. The SEC received over 145,000 tips, complaints, and referrals and awarded approximately $1.5 billion to whistleblowers. It initiated more than 2,700 enforcement actions, resulting in $21 billion in penalties and disgorgement orders. Between fiscal years 2021 and 2024, the agency returned more than $2.7 billion to harmed investors.

Through inspections of investment advisers, funds, and broker-dealers, the SEC recovered over $250 million for investors. The Division of Examinations also improved communication with registrants, sharing timely priorities and observations while collaborating proactively with industry participants and other regulators.

Under Gensler, the SEC continued Jay Clayton’s work to protect cryptocurrency investors. During his term, the agency took action against crypto intermediaries for fraud, wash trading, registration violations, and other misconduct. In its most recent fiscal year, 18% of SEC tips, complaints, and referrals were related to cryptocurrencies, even though these markets represent less than 1% of U.S. capital markets. Courts consistently upheld the SEC’s authority to enforce securities laws, regardless of the form of the securities being offered, the statement concluded.